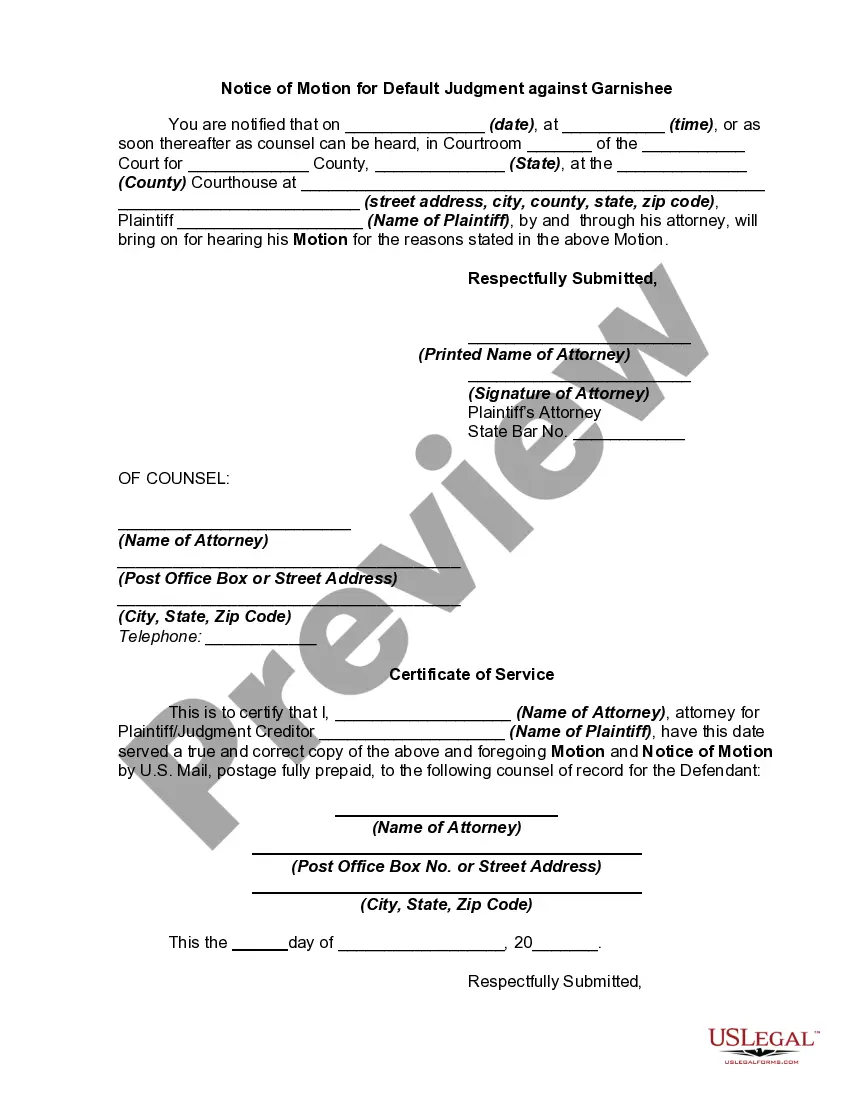

Are you presently within a position the place you need to have documents for possibly organization or specific reasons just about every day time? There are plenty of legal papers templates available on the Internet, but locating ones you can depend on isn`t effortless. US Legal Forms offers a huge number of type templates, much like the Tennessee Motion for Default Judgment against Garnishee, which can be published to satisfy state and federal requirements.

When you are currently informed about US Legal Forms site and possess a free account, merely log in. Afterward, you may download the Tennessee Motion for Default Judgment against Garnishee web template.

Unless you come with an profile and want to begin using US Legal Forms, abide by these steps:

- Obtain the type you need and ensure it is to the proper area/region.

- Utilize the Preview button to check the shape.

- See the information to actually have chosen the appropriate type.

- In case the type isn`t what you`re trying to find, make use of the Look for discipline to discover the type that meets your requirements and requirements.

- Once you discover the proper type, click Get now.

- Select the costs prepare you want, submit the desired details to generate your account, and pay for the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a convenient file structure and download your duplicate.

Locate all the papers templates you have purchased in the My Forms menu. You can aquire a more duplicate of Tennessee Motion for Default Judgment against Garnishee whenever, if needed. Just select the essential type to download or produce the papers web template.

Use US Legal Forms, by far the most comprehensive selection of legal varieties, to save lots of some time and prevent blunders. The services offers appropriately created legal papers templates that you can use for a variety of reasons. Produce a free account on US Legal Forms and start producing your lifestyle a little easier.