Title: Understanding Tennessee Assignment of Rents by Lessor: Types and Detailed Description Introduction: The Tennessee Assignment of Rents by Lessor is a legal agreement that allows a lessor (landlord) to assign their rights to receive rental income from a property to another party. This arrangement provides a unique way for lessors to secure a loan or protect their interests in cases of default by the lessee. This article provides a detailed description of the Tennessee Assignment of Rents by Lessor, highlighting its types and key features. 1. Overview of Tennessee Assignment of Rents by Lessor: The Tennessee Assignment of Rents by Lessor is a legally binding document that transfers the right to collect rental income from a property from the lessor to another entity, typically a lender or mortgagee. It is a crucial tool used to secure loans while allowing lenders to have an additional source of repayment. 2. Types of Tennessee Assignment of Rents by Lessor: a) Absolute Assignment of Rents: An absolute assignment of rents is a complete transfer of the lessor's right to collect rental income. In this arrangement, the lender assumes full control over the collection and use of rental revenue generated from the property. It provides the lender with increased security as they can directly manage the income to satisfy any outstanding debt. b) Security Assignment of Rents: A security assignment of rents provides the lender with a security interest in the rental income, but the lessor retains the right to continue collecting the rents. In case of a default, the lender can then step in and take over the collection of rental payments. This type allows the lessor to maintain some control while providing additional protection to the lender. 3. Key Features and Benefits: a) Security for Lenders: The Assignment of Rents by Lessor acts as a valuable security measure for lenders by offering an alternative repayment source. In cases where the lessee defaults on their mortgage, the lender can step in to ensure uninterrupted income flow, which can help offset any outstanding loan balance. b) Enhanced Borrowing Capacity: By assigning the rents to the lender, lessors can increase their borrowing capacity. The assignment can be seen as an additional asset, improving their creditworthiness and allowing for the potential to obtain better terms on loans or lines of credit. c) Streamlined Debt Recovery: In the event of default, an assigned rent agreement empowers the lender to directly collect rental income from tenants, ensuring a more efficient recovery process. This feature minimizes the need for legal intervention and reduces the time and expenses associated with traditional foreclosure methods. d) Safeguarding Interests: Assigning rents helps protect the lessor's interest in ensuring continuity and stability in the income stream. It mitigates risks such as tenant bankruptcy or lease terminations that could leave the lessor struggling to meet their loan obligations. Conclusion: The Tennessee Assignment of Rents by Lessor is a powerful legal tool that benefits both lessors and lenders involved in property transactions. By allowing the lessor to assign rental income rights to the lender, it creates a safety net for lenders and enhances the financial position of lessors. Whether through absolute or security assignments, this arrangement helps facilitate more secure lending practices while offering various advantages to both parties involved.

Tennessee Assignment of Rents by Lessor

Description

How to fill out Tennessee Assignment Of Rents By Lessor?

US Legal Forms - among the largest libraries of lawful types in the USA - provides a variety of lawful file themes it is possible to down load or produce. Making use of the web site, you can find a huge number of types for enterprise and specific purposes, sorted by categories, states, or search phrases.You can get the latest models of types like the Tennessee Assignment of Rents by Lessor within minutes.

If you already have a membership, log in and down load Tennessee Assignment of Rents by Lessor from the US Legal Forms catalogue. The Down load button will appear on each and every form you perspective. You have accessibility to all earlier downloaded types within the My Forms tab of your own bank account.

If you want to use US Legal Forms for the first time, here are easy instructions to obtain began:

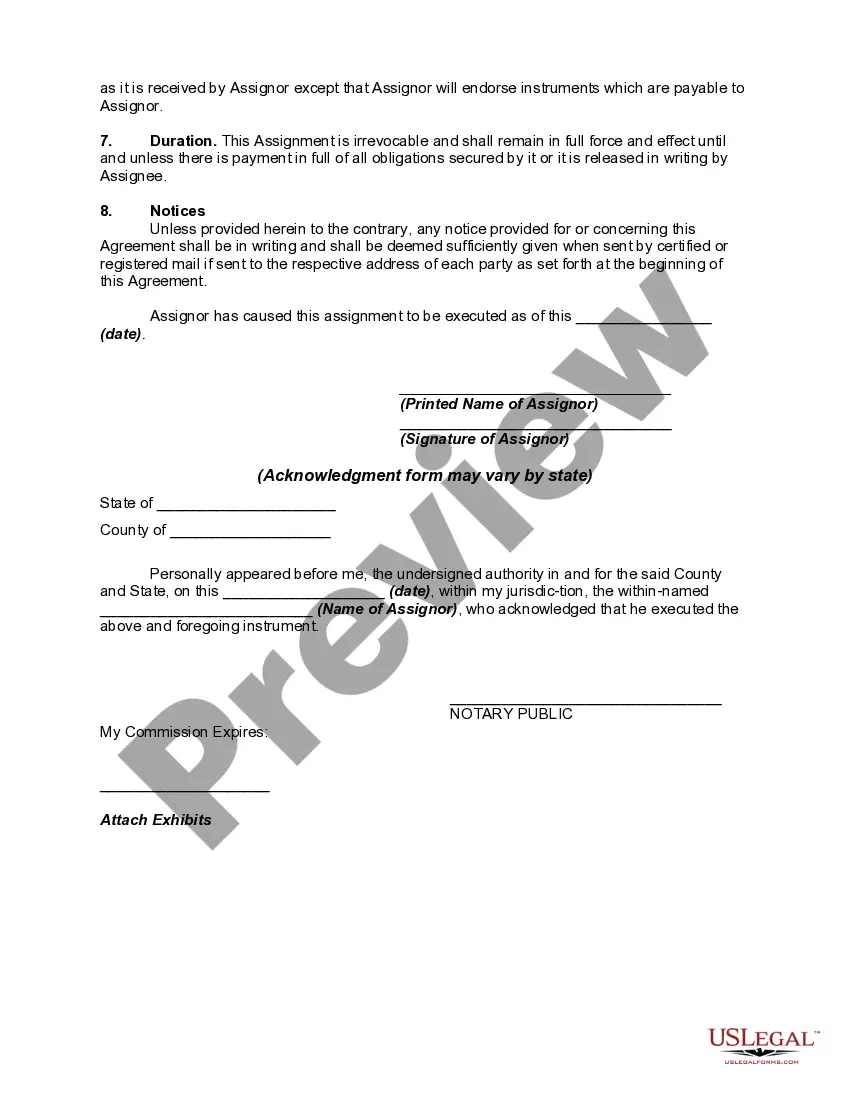

- Make sure you have picked the correct form for the city/region. Select the Preview button to analyze the form`s articles. Read the form description to ensure that you have selected the proper form.

- If the form does not match your requirements, use the Look for area towards the top of the monitor to obtain the one which does.

- If you are content with the form, affirm your option by clicking on the Buy now button. Then, choose the rates strategy you want and supply your accreditations to sign up for an bank account.

- Process the deal. Make use of charge card or PayPal bank account to finish the deal.

- Pick the formatting and down load the form on your gadget.

- Make changes. Fill up, edit and produce and indication the downloaded Tennessee Assignment of Rents by Lessor.

Each web template you put into your bank account does not have an expiration time and is the one you have eternally. So, if you would like down load or produce one more backup, just visit the My Forms area and then click about the form you will need.

Gain access to the Tennessee Assignment of Rents by Lessor with US Legal Forms, one of the most extensive catalogue of lawful file themes. Use a huge number of skilled and express-particular themes that meet up with your business or specific demands and requirements.