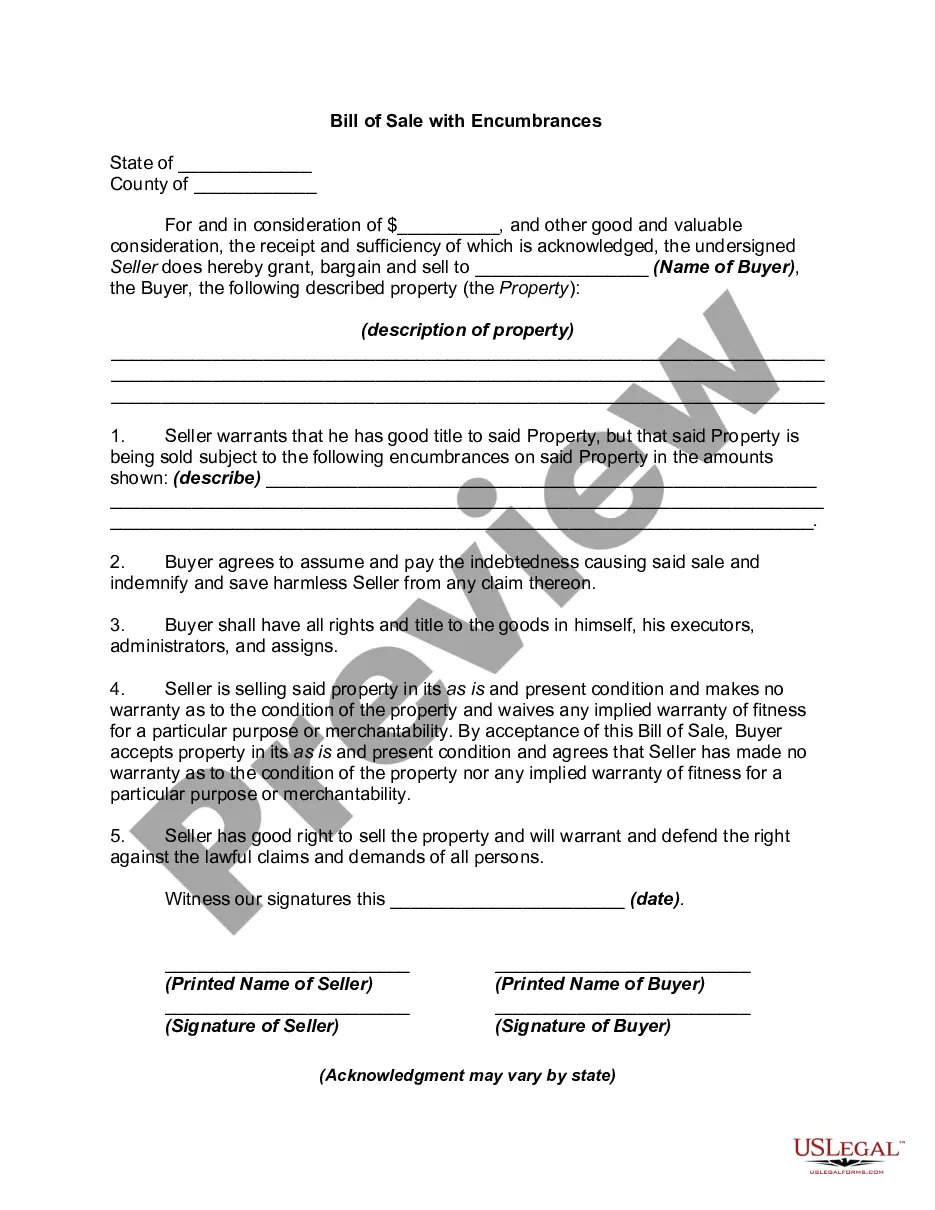

A Bill of Sale with encumbrances means that whatever product is being sold has some sort of lien, mortgage, or monies owing, and the Buyer is agreeing that they will take on these obligations upon purchase.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Tennessee Bill of Sale with Encumbrances: Explained in Detail In Tennessee, a Bill of Sale with Encumbrances is a legal document that facilitates the transfer of ownership rights of a property or asset from one party to another. This document not only acknowledges the sale but also discloses any existing encumbrances or liens affecting the property. It is crucial to understand the key aspects of a Tennessee Bill of Sale with Encumbrances, ensuring a transparent and legally binding transaction. Key Elements of a Tennessee Bill of Sale with Encumbrances: 1. Parties involved: The Bill of Sale with Encumbrances identifies the buyer (purchaser) and the seller (transferor), stating their full legal names, contact information, and addresses. It is important to provide accurate details to avoid any confusion or disputes in the future. 2. Asset or Property Description: The document should clearly describe the asset or property being sold, including specific details such as make, model, year (in case of vehicles), serial numbers (if applicable), and any other identifying features. This description ensures clarity and prevents any ambiguity about the item being transferred. 3. Sale Consideration: The Bill of Sale must state the agreed-upon purchase price or consideration for the asset. It is essential to record the exact amount, ensuring both parties are in agreement. Additionally, if any part of the sale consideration is paid at a later date or through installments, those terms should be explicitly mentioned. 4. Encumbrances or Liens: One of the primary purposes of the Tennessee Bill of Sale with Encumbrances is to disclose any existing liens or encumbrances on the property. This includes mortgages, outstanding loans, judgments, or any other claims against the asset. Full details of each encumbrance, including the name of the creditor, amount owed, and any relevant account numbers, should be clearly listed in the document. 5. Seller's Representation and Warranty: The seller typically provides a representation that they are the rightful owner of the property, free from any undisclosed liens or encumbrances. This representation acts as a warranty, assuring the buyer that they will obtain clear ownership upon completion of the transaction. Types of Tennessee Bills of Sale with Encumbrances: While the underlying elements remain the same, Tennessee recognizes different types of Bills of Sale based on the asset category. Common types include: 1. Tennessee Vehicle Bill of Sale with Encumbrances: Used specifically for documenting the sale of a motor vehicle, this type of Bill of Sale includes all the essential elements mentioned above. It also captures vehicle-specific details such as VIN (Vehicle Identification Number), license plate number, and odometer reading. 2. Tennessee Real Estate Bill of Sale with Encumbrances: For the sale of real property, such as land, houses, or commercial buildings, this type of Bill of Sale is utilized. It includes detailed descriptions of the property, survey information, and any encumbrances placed against it. 3. Tennessee Business Bill of Sale with Encumbrances: When buying or selling a business, this specific type of Bill of Sale helps transfer ownership rights. It includes provisions related to the sale of business assets, equipment, inventory, and any encumbrances affecting the business. By familiarizing yourself with the essential components and variations of a Tennessee Bill of Sale with Encumbrances, you can ensure a smooth and legally robust transaction. Always consult with a qualified legal professional to draft or review this document, ensuring compliance with Tennessee state laws and individual circumstances.Tennessee Bill of Sale with Encumbrances: Explained in Detail In Tennessee, a Bill of Sale with Encumbrances is a legal document that facilitates the transfer of ownership rights of a property or asset from one party to another. This document not only acknowledges the sale but also discloses any existing encumbrances or liens affecting the property. It is crucial to understand the key aspects of a Tennessee Bill of Sale with Encumbrances, ensuring a transparent and legally binding transaction. Key Elements of a Tennessee Bill of Sale with Encumbrances: 1. Parties involved: The Bill of Sale with Encumbrances identifies the buyer (purchaser) and the seller (transferor), stating their full legal names, contact information, and addresses. It is important to provide accurate details to avoid any confusion or disputes in the future. 2. Asset or Property Description: The document should clearly describe the asset or property being sold, including specific details such as make, model, year (in case of vehicles), serial numbers (if applicable), and any other identifying features. This description ensures clarity and prevents any ambiguity about the item being transferred. 3. Sale Consideration: The Bill of Sale must state the agreed-upon purchase price or consideration for the asset. It is essential to record the exact amount, ensuring both parties are in agreement. Additionally, if any part of the sale consideration is paid at a later date or through installments, those terms should be explicitly mentioned. 4. Encumbrances or Liens: One of the primary purposes of the Tennessee Bill of Sale with Encumbrances is to disclose any existing liens or encumbrances on the property. This includes mortgages, outstanding loans, judgments, or any other claims against the asset. Full details of each encumbrance, including the name of the creditor, amount owed, and any relevant account numbers, should be clearly listed in the document. 5. Seller's Representation and Warranty: The seller typically provides a representation that they are the rightful owner of the property, free from any undisclosed liens or encumbrances. This representation acts as a warranty, assuring the buyer that they will obtain clear ownership upon completion of the transaction. Types of Tennessee Bills of Sale with Encumbrances: While the underlying elements remain the same, Tennessee recognizes different types of Bills of Sale based on the asset category. Common types include: 1. Tennessee Vehicle Bill of Sale with Encumbrances: Used specifically for documenting the sale of a motor vehicle, this type of Bill of Sale includes all the essential elements mentioned above. It also captures vehicle-specific details such as VIN (Vehicle Identification Number), license plate number, and odometer reading. 2. Tennessee Real Estate Bill of Sale with Encumbrances: For the sale of real property, such as land, houses, or commercial buildings, this type of Bill of Sale is utilized. It includes detailed descriptions of the property, survey information, and any encumbrances placed against it. 3. Tennessee Business Bill of Sale with Encumbrances: When buying or selling a business, this specific type of Bill of Sale helps transfer ownership rights. It includes provisions related to the sale of business assets, equipment, inventory, and any encumbrances affecting the business. By familiarizing yourself with the essential components and variations of a Tennessee Bill of Sale with Encumbrances, you can ensure a smooth and legally robust transaction. Always consult with a qualified legal professional to draft or review this document, ensuring compliance with Tennessee state laws and individual circumstances.