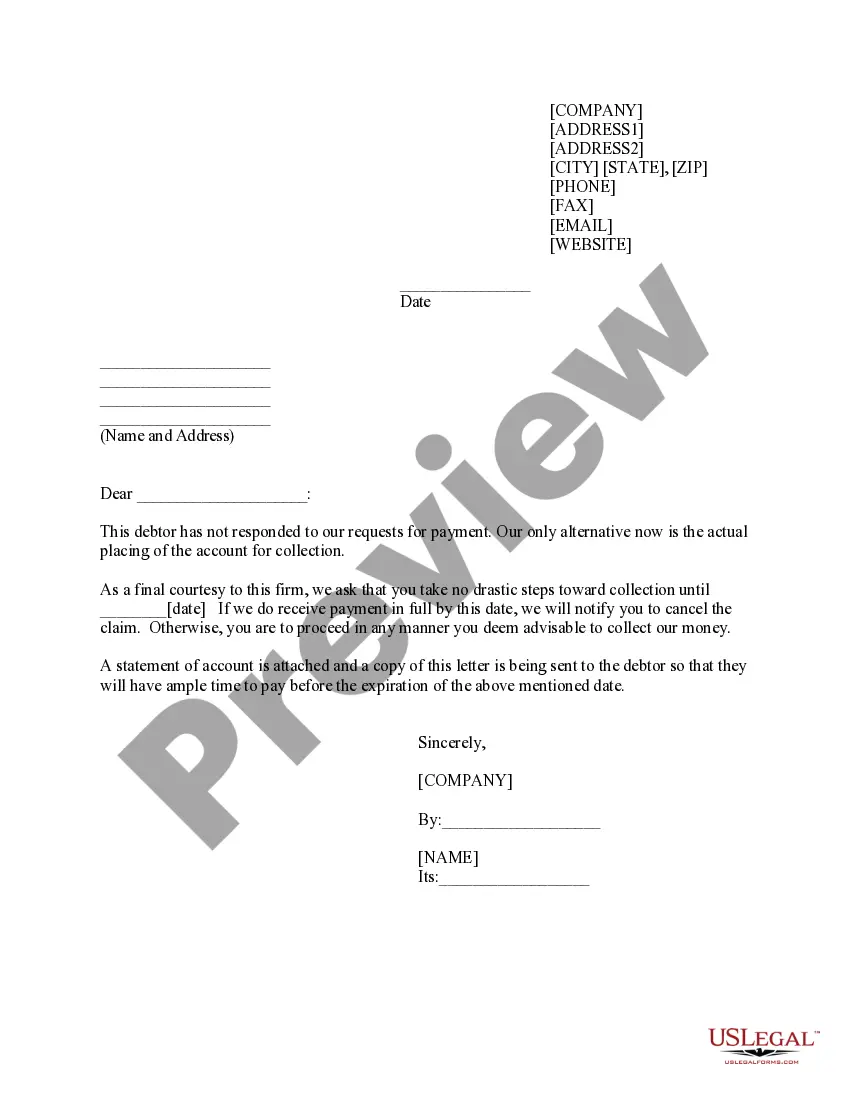

Tennessee Sample Letter for Collection - Referral of Account to Collection Agency

Description

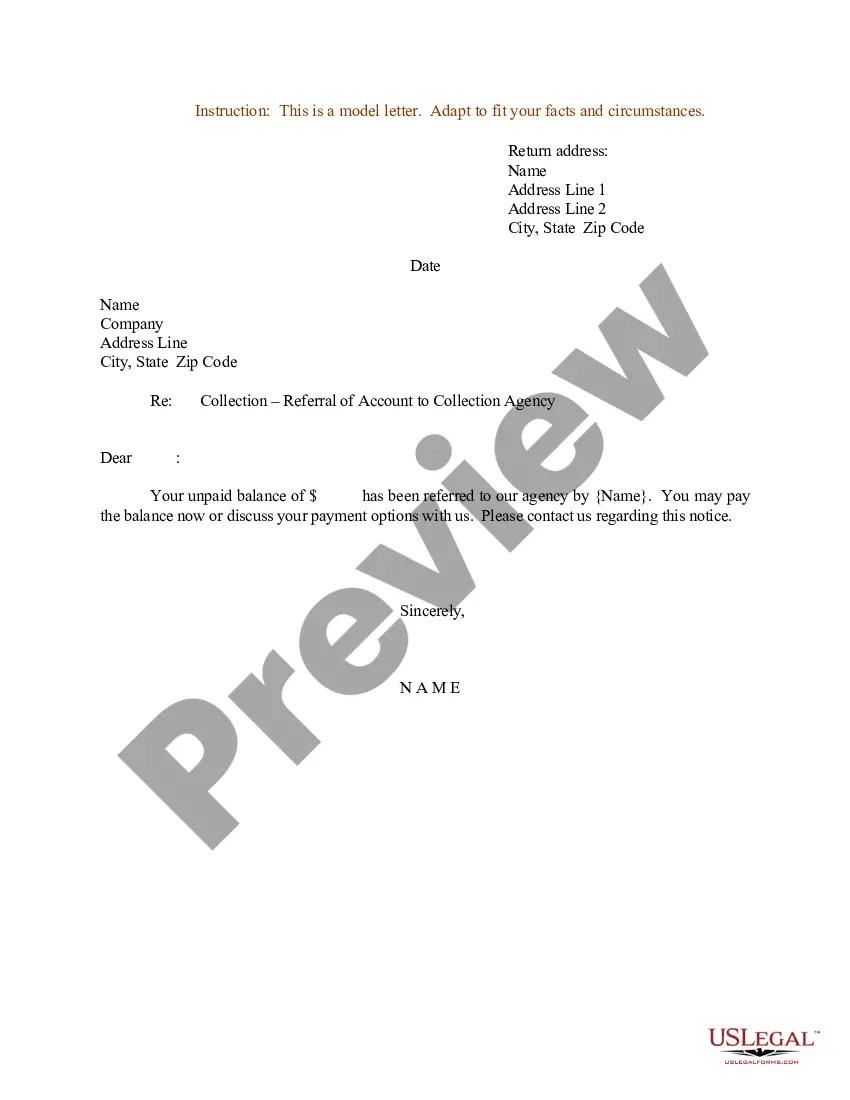

How to fill out Sample Letter For Collection - Referral Of Account To Collection Agency?

Finding the correct sanctioned document template can be quite challenging.

Indeed, there are numerous formats available online, but how do you locate the authorized document you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are straightforward instructions you should follow: First, ensure you have selected the right document for your location/region.

You can view the form via the Preview button and read the document description to confirm it is suitable for you.

- The platform offers a vast selection of templates, including the Tennessee Sample Letter for Collection - Referral of Account to Collection Agency, suitable for business and personal purposes.

- All of the documents are verified by experts and meet federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Tennessee Sample Letter for Collection - Referral of Account to Collection Agency.

- Use your account to search through the legal documents you have previously purchased.

- Navigate to the My documents tab of your account to get another copy of the document you need.

Form popularity

FAQ

A referral to a collection agency is the process where a creditor transfers the responsibility of collecting a debt to a third-party agency. This step usually follows unsuccessful attempts by the creditor to obtain payment directly. Utilizing a Tennessee Sample Letter for Collection - Referral of Account to Collection Agency can highlight important details regarding your obligations and how to formally handle this situation.

When you are referred to debt collection, the agency will typically reach out to you via phone, mail, or email to demand payment. They may engage in negotiation to settle the debt, but if you don’t respond, they may take further actions, including reporting the debt to credit bureaus. Having a Tennessee Sample Letter for Collection - Referral of Account to Collection Agency can help you navigate this process and understand your rights.

A referral to a collections agency means that your unpaid debt is sent to a specialized company that focuses on recovering outstanding amounts. These agencies have the expertise and resources to pursue collection more aggressively than the original creditor. You can access a Tennessee Sample Letter for Collection - Referral of Account to Collection Agency to find guidance on how this referral process works and its implications.

When an account is referred to collections, it indicates that the original creditor has decided to hand over your unpaid debt to a collection agency. This process usually occurs after several attempts to collect the debt have failed, which means the creditor no longer wishes to pursue the matter themselves. Using a Tennessee Sample Letter for Collection - Referral of Account to Collection Agency can help you understand the formalities involved in this process.

A reasonable offer to settle a debt usually ranges from 30% to 70% of the total amount owed, depending on your financial situation and the creditor's willingness to negotiate. Consider your budget and how much you can realistically afford. Researching comparable offers can equip you better for discussions, and the Tennessee Sample Letter for Collection - Referral of Account to Collection Agency can serve as a baseline for your proposals.

An example of a letter of collection typically includes a header, date, recipient address, and a clear subject line. The letter body should state the debt details, including amount and payment instructions, while maintaining a polite tone. You can find examples through resources like the Tennessee Sample Letter for Collection - Referral of Account to Collection Agency to ensure you’ve covered all essential elements.

Writing an effective collection letter involves being concise, clear, and direct. Begin with a courteous greeting and explicitly state your purpose. Detail the debt amount, provide payment options, and outline any consequences of non-payment. Following a sample such as the Tennessee Sample Letter for Collection - Referral of Account to Collection Agency can help you format your letter correctly.

In a collection letter, begin with a respectful address to the recipient and state the purpose of your communication. Include details about the debt, such as the amount owed, the due date, and any relevant account information. It’s crucial to explain the next steps if the debt remains unpaid, guiding them on how to contact you. A well-structured letter can align with the Tennessee Sample Letter for Collection - Referral of Account to Collection Agency for optimal results.

When writing a good collection email, maintain a professional tone, and directly address the recipient by name. Clearly outline the nature of the debt, including the amount and the original creditor. Provide instructions on how they can resolve the debt or contact you for further discussion. Utilizing the Tennessee Sample Letter for Collection - Referral of Account to Collection Agency can help ensure your email covers all necessary points effectively.

To write a full and final settlement letter, start by stating your intent to settle the debt for a specific amount. Clearly mention the debt details, including the account number, amount owed, and any related information. Finally, express your desire for the company to accept this offer to prevent further collection actions. Consider using a template like the Tennessee Sample Letter for Collection - Referral of Account to Collection Agency for guidance.