Tennessee Cash Disbursements Journal

Description

How to fill out Cash Disbursements Journal?

If you require to compile, obtain, or print authentic document templates, utilize US Legal Forms, the largest assortment of legal forms accessible online.

Take advantage of the site's straightforward and user-friendly search function to locate the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you require, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Tennessee Cash Disbursements Journal in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and then click the Download button to obtain the Tennessee Cash Disbursements Journal.

- You can also access forms you've previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's contents. Be sure to read the description.

- Step 3. If you are not satisfied with the template, utilize the Search field at the top of the screen to find alternative versions of the legal form.

Form popularity

FAQ

A cash disbursement journal is a method of recording all cash flows for your business. Many entrepreneurs start out their small business spending and receiving cash payments. Unlike credit card payments, there is not an automatic system recording each transaction.

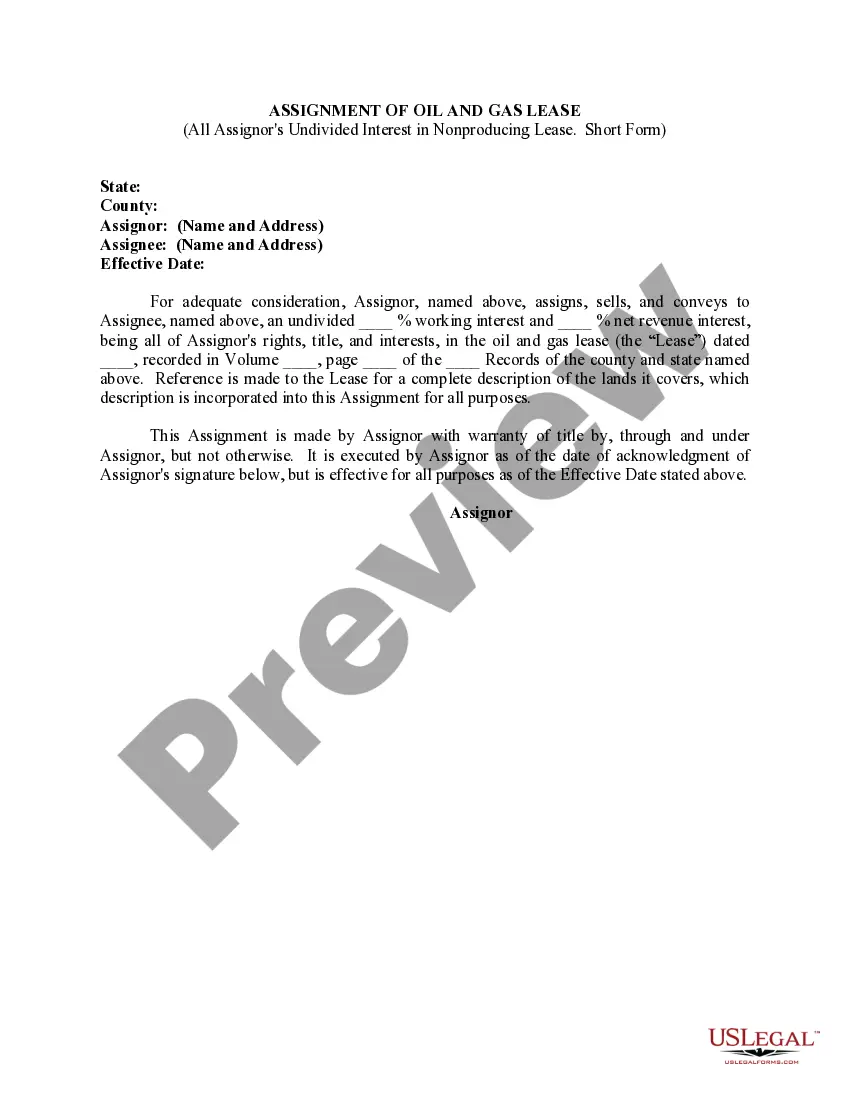

For example, cash disbursed to pay bills is credited to the Cash account (which goes down in value) and is debited to the account from which the bill or loan is paid, such as Accounts Payable.

A cash disbursements journal is summarized at the end of the period, usually a month. The total cash outflow is then posted to the general ledger, along with the total cash inflow (which can be derived from the cash receipts journal).

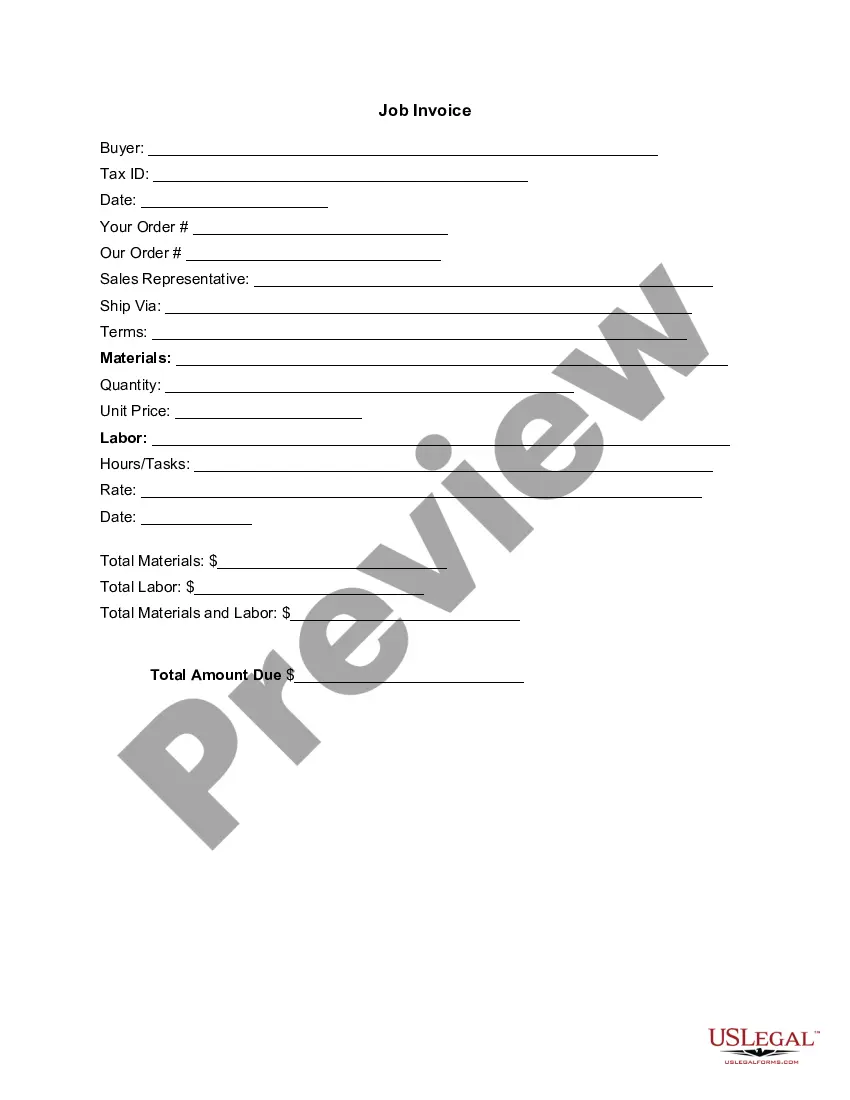

The cash disbursements journal (or cash payments journal) is an accounting form used to record all cash outflows. Some examples of outflows are accounts payable, materials payable, and operating expenses, as well as all cash purchases and disbursements to a petty cash fund.

Key Takeaways. A cash disbursement journal is a record of a company's internal accounts that itemizes all financial expenditures made with cash or cash equivalents. A cash disbursement journal is done before payments are posted to the general ledger and is used in creating a general ledger.

An entry for a disbursement includes the date, the payee name, the amount debited or credited, the payment method, and the purpose of the payment. The overall cash balance of the business is then adjusted to account for the disbursement.

A cash disbursement journal is done before payments are posted to the general ledger and is used in creating a general ledger. The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information.

A cash disbursements journal is summarized at the end of the period, usually a month. The total cash outflow is then posted to the general ledger, along with the total cash inflow (which can be derived from the cash receipts journal).

Create a Cash Disbursements Journal reportFrom the QuickBooks Reports menu, select Custom Reports then click Transaction Detail.Enter the appropriate date range.In the Columns box, check off the following columns:Click the Total by drop-down and select an appropriate criteria like Payee, Account or Month.More items...

In accounting terms, a disbursement, also called a cash disbursement or cash payment, refers to a wide range of payment types made in a specific period, including interest payments on loans and operating expenses. It can refer to cash payments, electronic fund transfers, checks and other forms of payment.