Tennessee Lease of Recreation or Athletic Equipment

Description

Article 2A of the UCC governs any transaction, regardless of its form, that creates a lease of personal property. Article 2A has been adopted, in different forms, by the majority of states, but it does not apply retroactively to transactions that occurred prior to the effective date of its adoption in a particular jurisdiction.

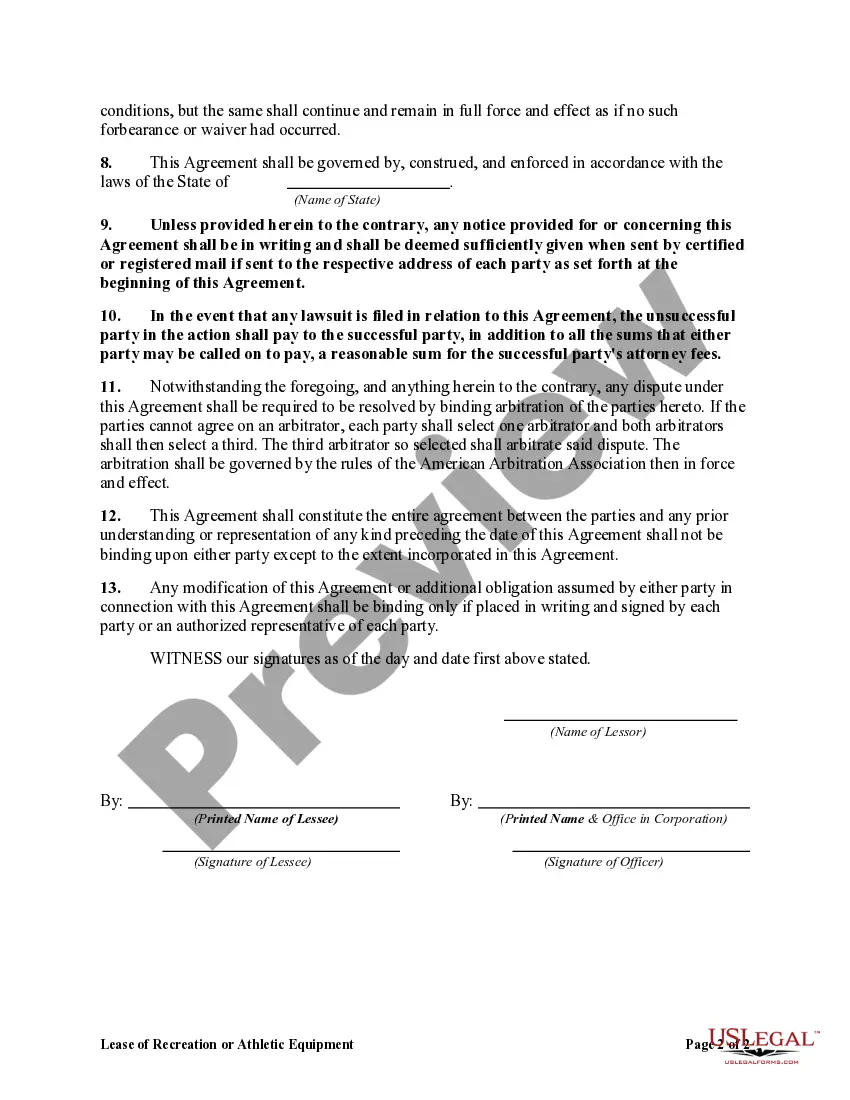

How to fill out Lease Of Recreation Or Athletic Equipment?

You might spend several hours online looking for the legal document template that meets the federal and state criteria you require.

US Legal Forms offers a vast array of legal documents that are reviewed by experts.

You can easily download or print the Tennessee Lease of Recreation or Athletic Equipment from our platform.

If available, use the Preview option to browse through the document template as well. If you wish to find another version of the form, utilize the Search field to locate the template that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- Then, you can complete, modify, print, or sign the Tennessee Lease of Recreation or Athletic Equipment.

- Every legal document template you obtain is yours permanently.

- To get another copy of a purchased form, go to the My documents tab and click the relevant option.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, verify that you have selected the correct document template for your chosen region/area.

- Review the form description to ensure you have chosen the right type.

Form popularity

FAQ

Starting a recreational rental business is an exciting venture that begins with market research and understanding customer needs. After establishing a solid business plan, consider specializing in items like bikes, kayaks, or sports equipment, utilizing a Tennessee Lease of Recreation or Athletic Equipment to facilitate your operations. Additionally, ensure you promote your offerings through local advertising and online platforms to attract customers.

The most profitable rental business often revolves around high-demand items, such as recreational or athletic equipment, which has become increasingly popular. The growing trend in outdoor activities and fitness can make a Tennessee Lease of Recreation or Athletic Equipment a lucrative option. To maximize profits, focus on quality inventory and excellent customer service, building a loyal clientele base.

In many cases, you do need a license to rent out recreational equipment in Tennessee. While requirements can vary by location, it's crucial to comply with state regulations to avoid any legal issues. Utilizing a Tennessee Lease of Recreation or Athletic Equipment is an excellent way to ensure you're operating within the guidelines and protecting your business.

Germantown, TN, boasts several beautiful parks, providing residents and visitors ample opportunities for outdoor activities. These parks often feature amenities like walking trails, playgrounds, and sports fields, enhancing recreational enjoyment. If you want to rent out recreational or athletic equipment in these parks, you may consider a Tennessee Lease of Recreation or Athletic Equipment.

In Tennessee, most professional services are not subject to sales tax, with a few exceptions, like certain construction-related services. If your professional activity involves the Tennessee Lease of Recreation or Athletic Equipment, it is wise to consult state guidelines to confirm tax implications. Being aware of tax liabilities can help in maintaining compliance and planning budgets effectively.

Tennessee does not impose sales tax on specific items, such as prescription medications, certain food products, and state government supplies. It’s essential to consider how the Tennessee Lease of Recreation or Athletic Equipment might fit into these categories. Understanding these non-taxable items can help you make informed decisions about spending.

In Tennessee, restocking fees may be subject to sales tax depending on the context of the transaction. When dealing with returns related to Tennessee Lease of Recreation or Athletic Equipment, clarity on how fees are applied can prevent unexpected charges. Businesses should ensure proper documentation and understanding to align with state tax laws.

Tennessee sales tax exemption applies to various categories, including certain services and tangible goods used for business purposes. For instance, transactions related to the Tennessee Lease of Recreation or Athletic Equipment can often fall under this exemption. To ensure compliance, reviewing detailed state regulations is recommended, as they evolve over time.

Examples of tax-exempt items in Tennessee include machinery used in manufacturing, certain nonprofit purchases, and specific educational materials. Additionally, entities that engage in Tennessee Lease of Recreation or Athletic Equipment may qualify for exemption under particular guidelines. Identifying these exemptions is essential for businesses to optimize their financial outcomes.

Tennessee has specific items that are not subject to sales tax, such as certain food items, medical devices, and some services. This includes specific agreements, like the Tennessee Lease of Recreation or Athletic Equipment, which can provide tax-exempt benefits under certain conditions. Understanding what is exempt enables better financial planning when engaging in transactions.