Tennessee Customer Invoice

Description

How to fill out Customer Invoice?

Are you presently in a role that requires documents for both work or personal purposes almost every day.

There are many legal document templates available online, but finding ones you can trust isn't straightforward.

US Legal Forms offers thousands of form templates, including the Tennessee Customer Invoice, which can be tailored to meet state and federal regulations.

Once you find the correct form, click Buy now.

Choose the payment plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Tennessee Customer Invoice template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct region/county.

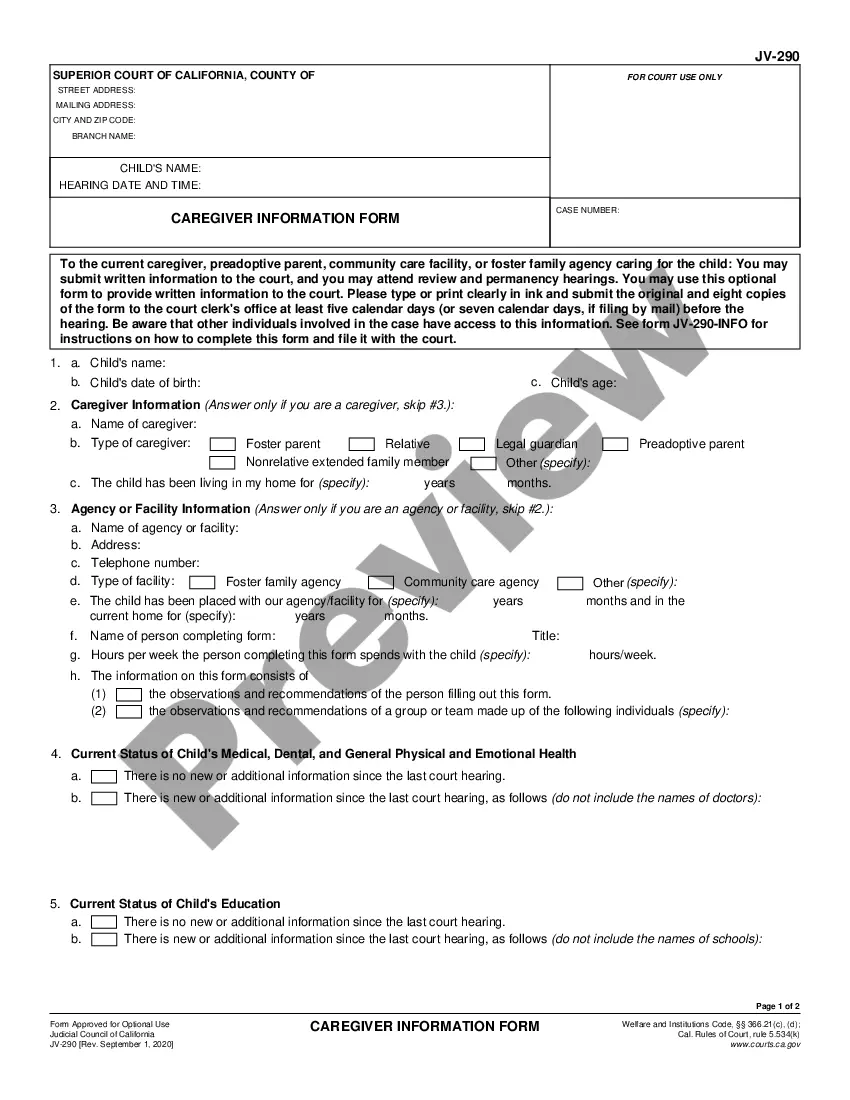

- Utilize the Review button to inspect the form.

- Check the details to confirm that you have selected the accurate form.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs and preferences.

Form popularity

FAQ

A customer invoice is issued to clients for products or services rendered, while a vendor invoice is received from suppliers for goods or services provided to your business. The Tennessee Customer Invoice focuses on sales transactions and payment requests, whereas the vendor invoice pertains to expenses incurred by your business. Understanding these differences is important for maintaining accurate accounts payable and receivable, which is crucial for sound financial management.

A customer invoice is a detailed document that outlines the goods or services provided to a customer, along with the amounts owed. It typically includes information such as the transaction date, item descriptions, quantities, prices, and payment terms. The Tennessee Customer Invoice acts as a legal record of the sale, providing both parties clarity on the financial aspects of the transaction. It is crucial for effective financial management.

Invoicing is necessary for most businesses to maintain clear financial records. A Tennessee Customer Invoice not only helps in tracking sales but also aids in tax preparation and compliance. Regular invoicing ensures that your business stays organized, and it helps prevent disputes related to payments or services rendered. Therefore, using invoices is an essential part of sound business management.

Yes, customers generally need an invoice for their purchases. A Tennessee Customer Invoice serves as an official record of the transaction, allowing customers to track their expenses and manage their budgets effectively. It also promotes transparency in business dealings, ensuring all parties understand the transaction details. Including an invoice is a best practice that benefits both the buyer and seller.

Filling out a simple Tennessee Customer Invoice involves keeping it straightforward. Start with your business information, add the customer's details, and include a brief description of the services or products. Finally, list the total amount due, payment terms, and kindly remind the customer of the due date.

A good sentence for your Tennessee Customer Invoice might be, 'Please find the invoice for the services rendered and the total amount due by due date.' This sentence communicates professionalism and clarity, helping ensure your customers understand their responsibilities. Always keep the tone polite yet firm, encouraging timely payment.

Filling out the invoice details on a Tennessee Customer Invoice involves specifying your business name and contact information, as well as the customer's name and address. Clearly describe each product or service, including quantities and unit prices. You should also add terms of payment and due date, making it easy for customers to understand their obligations.

When preparing a tax invoice statement as a Tennessee Customer Invoice, include all your business details, including your tax identification number. Be sure to list the items or services provided, their quantities, and the applicable tax rates. Make it clear how much tax is applied to the total, as this is crucial for record-keeping and compliance.

To fill out a Tennessee Customer Invoice statement, start by entering your business details at the top, including your name, address, and contact information. Next, include the customer's information, specify the date, and assign an invoice number for easy tracking. Lastly, clearly describe the services or products provided, add the costs, and calculate the total amount due.

Yes, in Tennessee, you can file your federal taxes without needing to file any state income tax return since it does not exist. However, businesses must consider other tax types like franchise and sales tax. A well-maintained Tennessee Customer Invoice ensures that you meet your obligations efficiently.