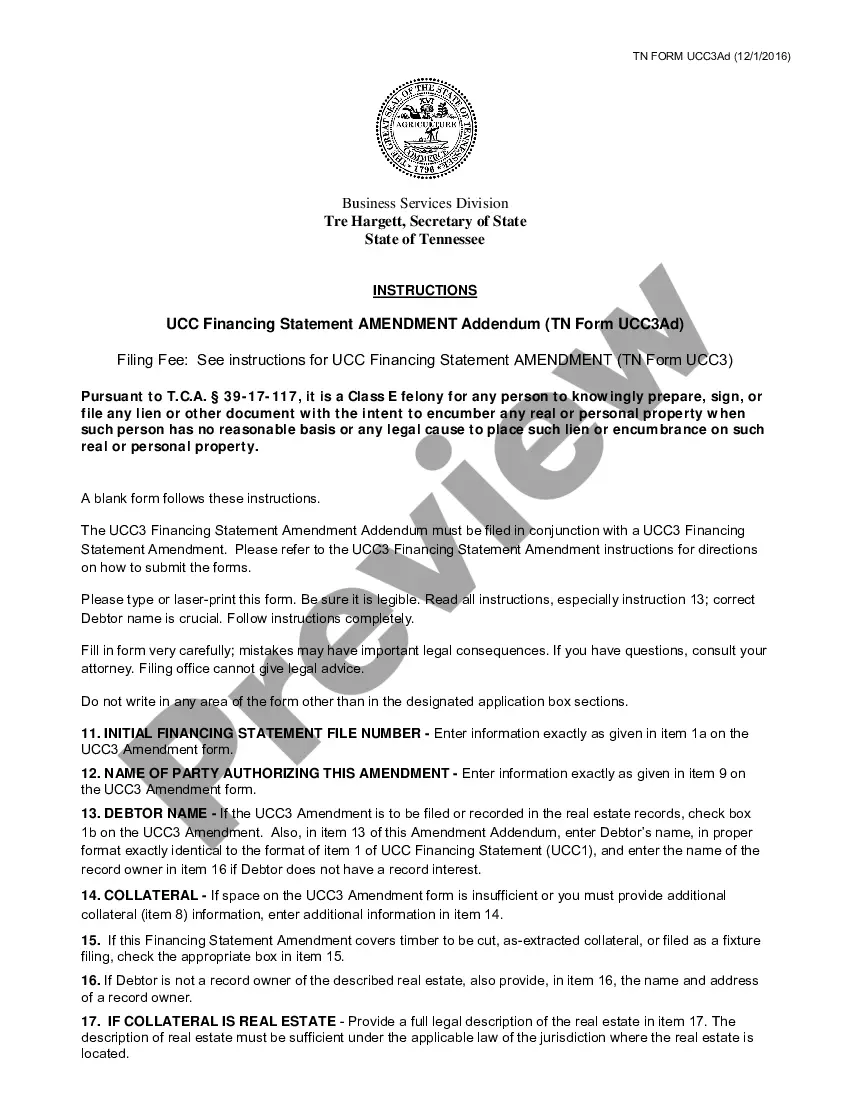

Title: Understanding Tennessee Notice of Default on Promissory Note Installment: Types and Overview Introduction: In Tennessee, a Notice of Default on Promissory Note Installment serves as an important legal document notifying borrowers of their failure to meet the agreed installment payments on a promissory note. This detailed description aims to shed light on the concept of Notice of Default, its purpose, and any potential types that may exist in the state of Tennessee. 1. Definition and Purpose: A Notice of Default on Promissory Note Installment is a formal written notice sent to borrowers who have fallen behind or failed to make their installment payments as stipulated in a promissory note. The primary purpose of this notice is to inform the borrower about their default status and the consequences that may follow if the arbitrage is not resolved promptly. 2. Key Elements: — Identification of Parties: The notice should clearly state the names of the lender (or creditor) and borrower (or debtor). — Promissory Note Details: The notice must include relevant information about the promissory note, such as the principal amount, interest rate, installment due dates, and overall payment schedule. — Default Notification: It should explicitly mention that the borrower has defaulted on their installment payment(s). — Cure Period: The notice should provide a reasonable period during which the borrower can cure the default by making the overdue payment(s) and any additional charges or penalties. — Consequences: A Notice of Default typically outlines the legal actions that the lender can initiate if the borrower fails to resolve the default within the cure period. These consequences may include foreclosure, repossession, or legal action seeking recovery of the debt. 3. Types of Tennessee Notice of Default on Promissory Note Installment: a) Residential Mortgage Default Notice: Specifically applicable to default situations involving residential mortgage loans. b) Commercial Loan Default Notice: Pertains to default scenarios associated with commercial loans used for business purposes. c) Installment Loan Default Notice: Covers default situations for various types of installment loans, such as car loans, personal loans, or equipment financing. Conclusion: A Tennessee Notice of Default on Promissory Note Installment plays a crucial role in establishing communication between lenders and borrowers when installment payments are not made according to the terms of a promissory note. It is essential for borrowers to understand the implications of receiving such a notice and take immediate action to resolve the default before further legal consequences arise.

Tennessee Notice of Default on Promissory Note Installment

Description

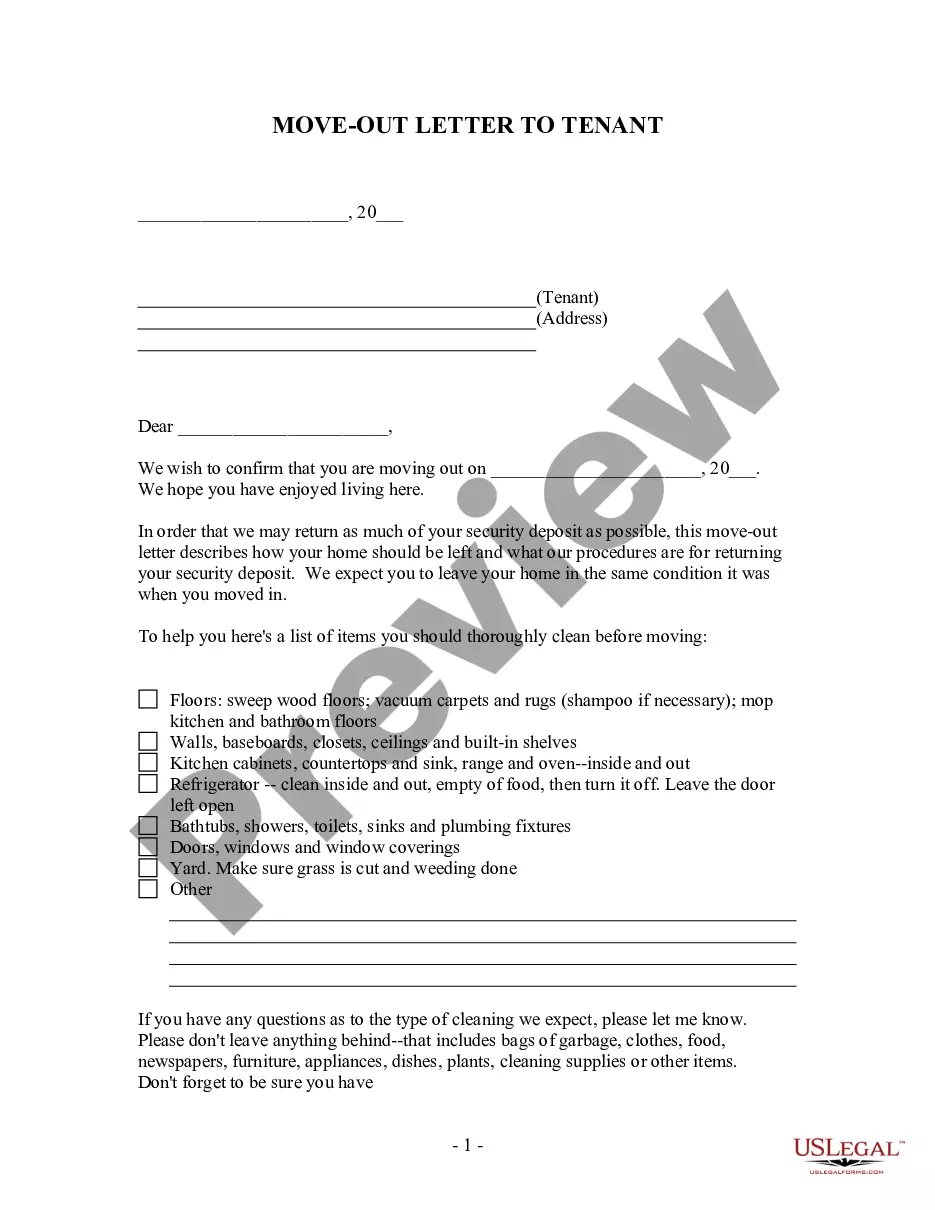

How to fill out Tennessee Notice Of Default On Promissory Note Installment?

You can spend hours on the Internet attempting to find the lawful papers template that meets the federal and state demands you want. US Legal Forms supplies 1000s of lawful types which can be analyzed by experts. You can actually obtain or print out the Tennessee Notice of Default on Promissory Note Installment from our service.

If you currently have a US Legal Forms accounts, it is possible to log in and click on the Acquire switch. Next, it is possible to total, change, print out, or sign the Tennessee Notice of Default on Promissory Note Installment. Every lawful papers template you get is your own for a long time. To obtain one more backup of any obtained type, go to the My Forms tab and click on the related switch.

If you use the US Legal Forms web site the first time, follow the straightforward directions under:

- Initial, make certain you have selected the best papers template for the state/city of your choice. See the type information to make sure you have picked the proper type. If offered, make use of the Preview switch to search throughout the papers template at the same time.

- If you wish to discover one more model in the type, make use of the Search field to discover the template that fits your needs and demands.

- Upon having discovered the template you desire, click on Purchase now to proceed.

- Pick the rates strategy you desire, enter your qualifications, and sign up for an account on US Legal Forms.

- Complete the purchase. You can use your bank card or PayPal accounts to pay for the lawful type.

- Pick the file format in the papers and obtain it to your device.

- Make modifications to your papers if required. You can total, change and sign and print out Tennessee Notice of Default on Promissory Note Installment.

Acquire and print out 1000s of papers web templates making use of the US Legal Forms web site, that provides the largest collection of lawful types. Use specialist and status-distinct web templates to take on your business or individual requirements.

Form popularity

FAQ

Only makers and acceptors (drawees that promise to pay when the instrument is presented) are subject to primary liability. The maker of a promissory note promises to pay the note. An acceptor is a drawee that promises to pay an instrument when it is presented later for payment.

A demand promissory note is a legally binding document between a borrower and a lender. With this agreement, the borrower promises to repay a debt at any time that is "demanded" by the lender. Once a lender has demanded repayment, the borrower must repay the debt or loan immediately.

3. Demand For Payment on Demand Promissory Note InstructionsWrite in a deadline by which you must receive full payment. This deadline may be provided in the terms of the note itself.Consider sending your demand by registered mail.If the deadline you established has passed, do not be afraid to contact a lawyer.

A promissory note may include a default on secured debt as part of the agreement. This means that if the borrower fails to pay under the agreed-upon terms of the promissory note, then the lender can take the secured debt as a form of payment.

The debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

Circumstances for Release of a Promissory NoteThe debt owed on a promissory note either can be paid off, or the noteholder can forgive the debt even if it has not been fully paid. In either case, a release of promissory note needs to be signed by the noteholder.

When payment is requested, a time period will be given for repayment. A promissory note, in contrast, can have the option for payment to be 'on demand' or at a specified date. A demand note is not required to show cause notice to be given to a borrower who is delinquent, unlike a mortgage loan.

What Happens When a Promissory Note Is Not Paid? Promissory notes are legally binding documents. Someone who fails to repay a loan detailed in a promissory note can lose an asset that secures the loan, such as a home, or face other actions.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.