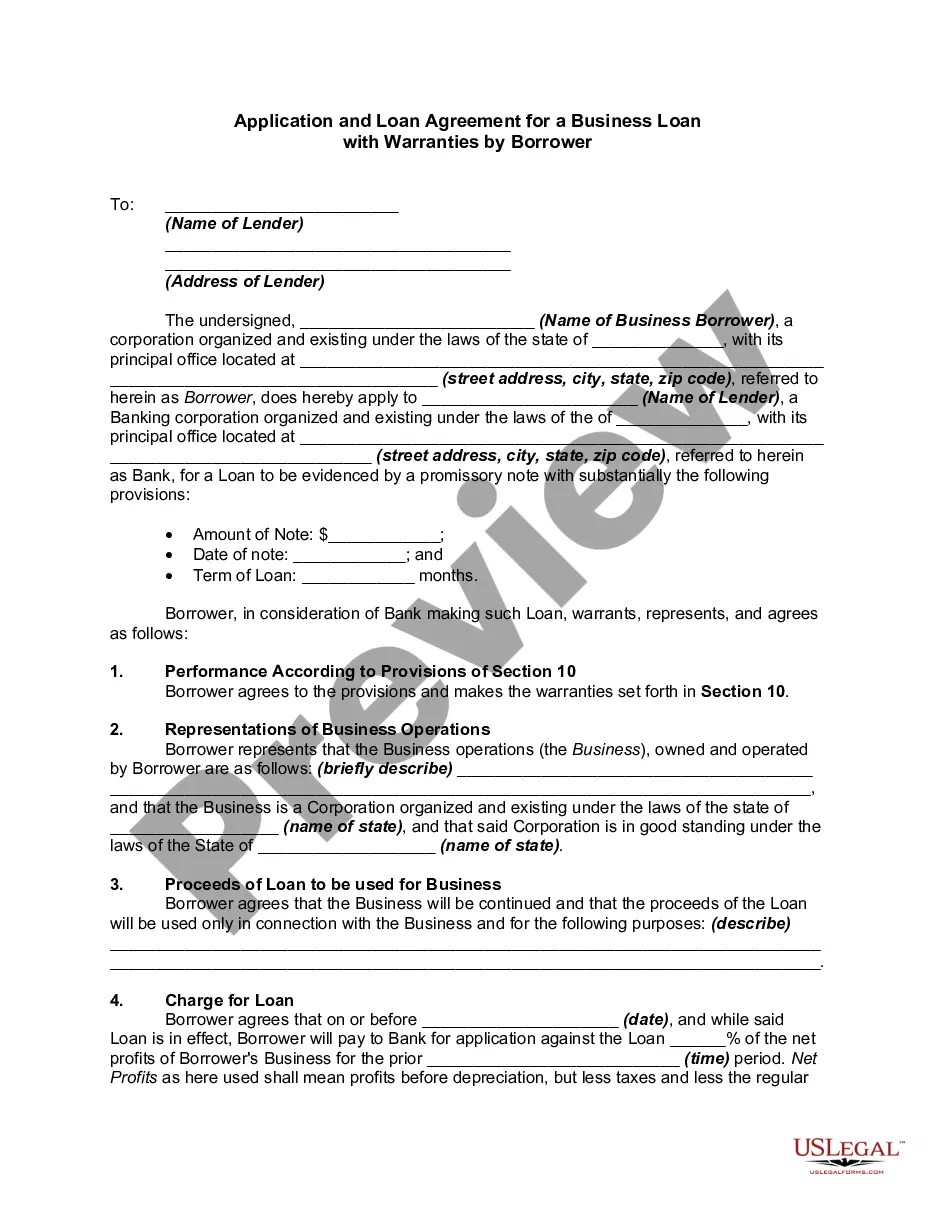

As a general matter, a loan by a bank is the borrowing of money by a person or entity who promises to return it on or before a specific date, with interest, or who pledges collateral as security for the loan and promises to redeem it at a specific later date. Loans are usually made on the basis of applications, together with financial statements submitted by the applicants.

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

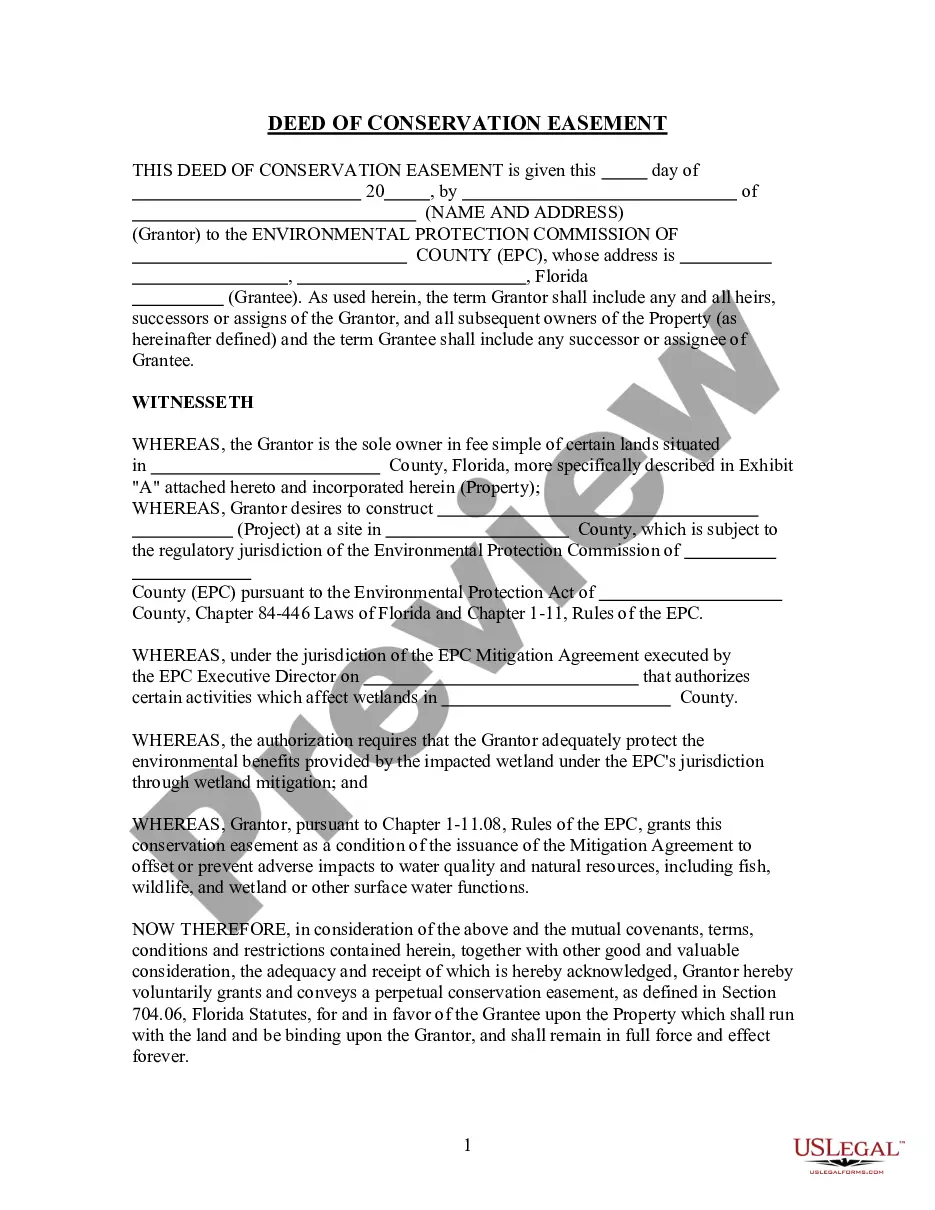

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

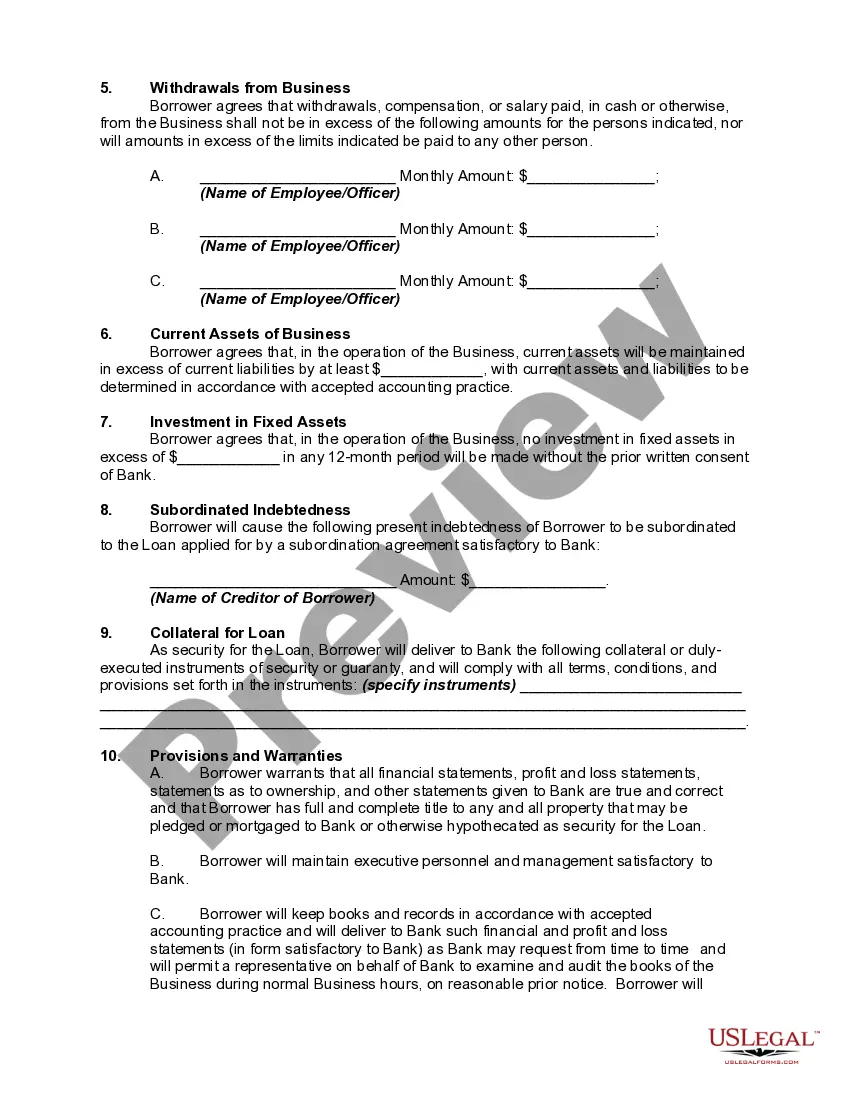

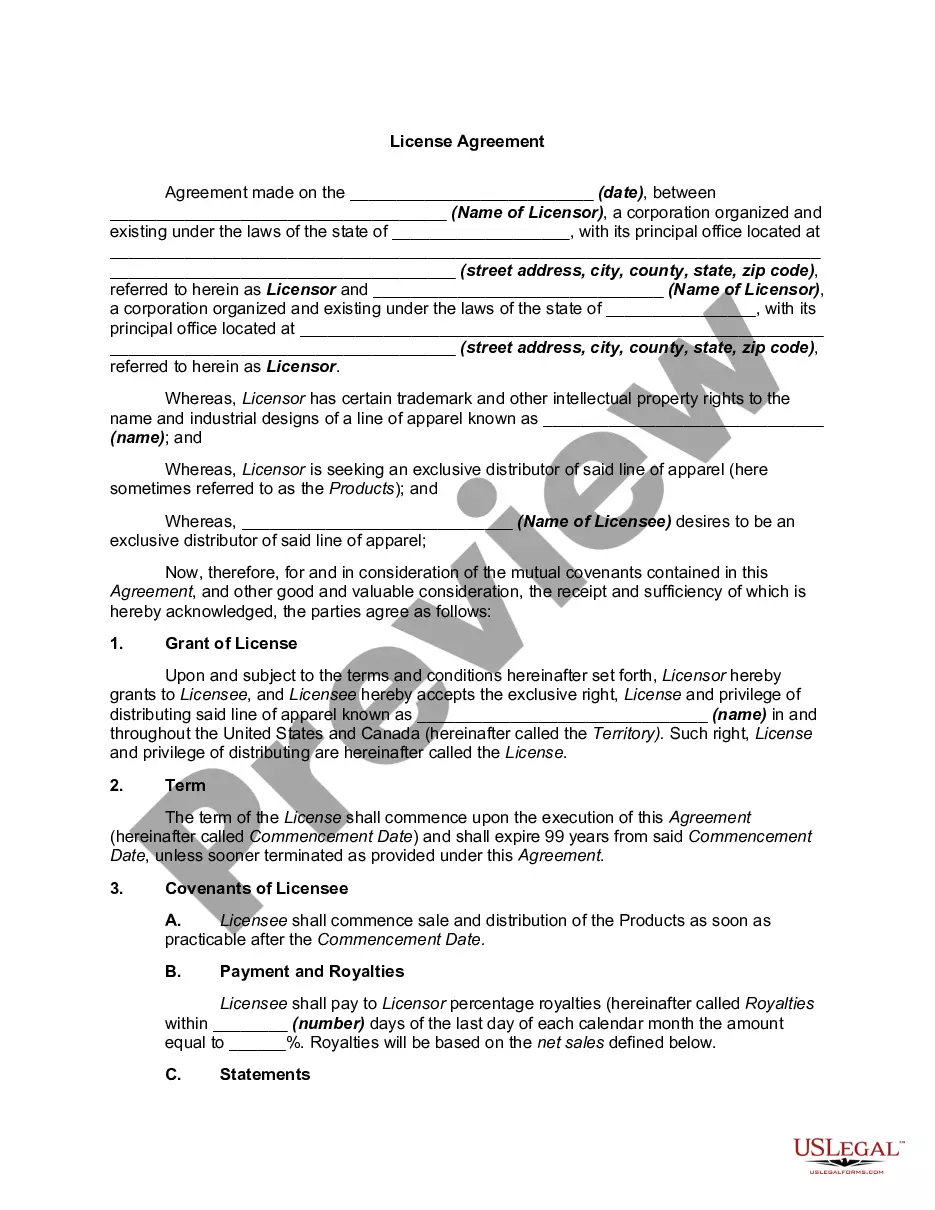

Title: Tennessee Application and Loan Agreement for a Business Loan with Warranties by Borrower Keywords: Tennessee, application, loan agreement, business loan, warranties, borrower, types Description: The Tennessee Application and Loan Agreement for a Business Loan with Warranties by Borrower is a comprehensive legal document required for businesses in Tennessee applying for a loan. This agreement outlines the terms and conditions of the loan, while also providing certain warranties and assurances by the borrower to the lender. There are various types of Tennessee Application and Loan Agreements for a Business Loan with Warranties by Borrower, each tailored to specific situations: 1. General Business Loan Agreement: This agreement is commonly used by businesses seeking a loan in Tennessee. It covers a wide range of industries and loan purposes, providing a standard set of terms and warranties that borrowers must adhere to. 2. Small Business Administration (SBA) Loan Agreement: For smaller businesses, especially those applying for loans backed by the Small Business Administration, this agreement is necessary. It includes additional provisions required by the SBA, offering more protection and specific guidelines for borrowers. 3. Start-Up Loan Agreement: Designed specifically for fledgling businesses, this agreement addresses the unique circumstances and risks associated with start-ups. It may require additional warranties, financial statements, or projections to assess the viability of the business. 4. Equipment Loan Agreement: When a business seeks a loan exclusively for equipment purchase or leasing purposes, this agreement becomes applicable. It includes warranties related to the equipment's condition, maintenance, and usage, ensuring the lender's investment is protected. 5. Real Estate Loan Agreement: For businesses seeking funds to purchase or develop commercial properties in Tennessee, this more complex agreement is required. It involves detailed warranties related to property value, insurance, and adherence to zoning regulations. Key components found in all the Tennessee Application and Loan Agreements for a Business Loan with Warranties by Borrower include: — Borrower Information: Identifying details of the borrower, including its legal name, address, contact details, and business structure (e.g., sole proprietorship, partnership, or corporation). — Loan Details: Precise terms of the loan, such as the loan amount, interest rate, repayment schedule, and any specific conditions or covenants. — Warranties by Borrower: Assurances made by the borrower to the lender, covering aspects like the accuracy of provided information, absence of pending litigation, compliance with laws, financial solvency, and maintaining appropriate insurance coverage. — Collateral: Identification of any collateral pledged by the borrower to secure the loan, such as real estate, equipment, or accounts receivable. — Default and Remedies: Procedures and consequences in the event of borrower default, including the lender's rights to initiate legal actions or seize collateral for repayment. The Tennessee Application and Loan Agreement for a Business Loan with Warranties by Borrower plays a vital role in establishing the legal framework and expectations between a lender and borrower. With its various types catering to different loan purposes, it ensures clarity, transparency, and protection for both parties involved in a business loan transaction in Tennessee.Title: Tennessee Application and Loan Agreement for a Business Loan with Warranties by Borrower Keywords: Tennessee, application, loan agreement, business loan, warranties, borrower, types Description: The Tennessee Application and Loan Agreement for a Business Loan with Warranties by Borrower is a comprehensive legal document required for businesses in Tennessee applying for a loan. This agreement outlines the terms and conditions of the loan, while also providing certain warranties and assurances by the borrower to the lender. There are various types of Tennessee Application and Loan Agreements for a Business Loan with Warranties by Borrower, each tailored to specific situations: 1. General Business Loan Agreement: This agreement is commonly used by businesses seeking a loan in Tennessee. It covers a wide range of industries and loan purposes, providing a standard set of terms and warranties that borrowers must adhere to. 2. Small Business Administration (SBA) Loan Agreement: For smaller businesses, especially those applying for loans backed by the Small Business Administration, this agreement is necessary. It includes additional provisions required by the SBA, offering more protection and specific guidelines for borrowers. 3. Start-Up Loan Agreement: Designed specifically for fledgling businesses, this agreement addresses the unique circumstances and risks associated with start-ups. It may require additional warranties, financial statements, or projections to assess the viability of the business. 4. Equipment Loan Agreement: When a business seeks a loan exclusively for equipment purchase or leasing purposes, this agreement becomes applicable. It includes warranties related to the equipment's condition, maintenance, and usage, ensuring the lender's investment is protected. 5. Real Estate Loan Agreement: For businesses seeking funds to purchase or develop commercial properties in Tennessee, this more complex agreement is required. It involves detailed warranties related to property value, insurance, and adherence to zoning regulations. Key components found in all the Tennessee Application and Loan Agreements for a Business Loan with Warranties by Borrower include: — Borrower Information: Identifying details of the borrower, including its legal name, address, contact details, and business structure (e.g., sole proprietorship, partnership, or corporation). — Loan Details: Precise terms of the loan, such as the loan amount, interest rate, repayment schedule, and any specific conditions or covenants. — Warranties by Borrower: Assurances made by the borrower to the lender, covering aspects like the accuracy of provided information, absence of pending litigation, compliance with laws, financial solvency, and maintaining appropriate insurance coverage. — Collateral: Identification of any collateral pledged by the borrower to secure the loan, such as real estate, equipment, or accounts receivable. — Default and Remedies: Procedures and consequences in the event of borrower default, including the lender's rights to initiate legal actions or seize collateral for repayment. The Tennessee Application and Loan Agreement for a Business Loan with Warranties by Borrower plays a vital role in establishing the legal framework and expectations between a lender and borrower. With its various types catering to different loan purposes, it ensures clarity, transparency, and protection for both parties involved in a business loan transaction in Tennessee.