Tennessee Invoice Template for Farmer: Streamlining Farm Business Operations Keywords: Tennessee, invoice template, farmer, agricultural billing, farm business, streamline operations, agricultural invoicing, payment tracking, accurate record keeping, tax compliance, professional invoices. Description: A Tennessee Invoice Template for Farmers is a pre-designed document that allows farmers in Tennessee to create professional and accurate invoices for their agricultural business operations. These templates serve as effective tools to streamline farm business operations, ensuring payment tracking, accurate record keeping, and tax compliance. Tennessee's farmers require an efficient invoicing system to seamlessly bill their customers for agricultural products and services provided. Traditional pen-and-paper methods are time-consuming and prone to errors. With the help of invoice templates designed specifically for farmers in Tennessee, the billing process becomes more streamlined, organized, and professional. These templates are customizable to cater to the individual needs of different types of farmers in Tennessee. Some specific types of Tennessee Invoice Templates for Farmers include: 1. Produce Invoice Template: This template is tailored for farmers who primarily grow and sell fruits, vegetables, or crops. It includes relevant fields such as product description, quantity, unit price, total amount, and any applicable discounts or taxes. 2. Livestock Invoice Template: For farmers engaged in livestock farming, this template facilitates billing for livestock sales, breeding services, or other livestock-related transactions. It allows them to itemize the type of livestock, quantity, price per unit, and any additional charges specific to the livestock industry. 3. Equipment Rental Invoice Template: Farmers offering equipment rental services to other farmers or contractors can use this template to generate invoices. It includes fields for recording equipment details, rental duration, rental charges, and any applicable terms and conditions. Key Features and Benefits: — Easy customization: These templates can be easily customized with the farmer's business logo, address, contact information, and any specific details required to reflect the professionalism of the farmer's brand. — Simplified invoicing process: The templates come with pre-set fields to easily input product or service descriptions, quantity, prices, discounts, taxes, and other necessary billing information. — Accuratrecorkeepingng: By using these templates, farmers can generate detailed and organized invoices, ensuring accurate record keeping of transactions. This is particularly beneficial during audits or when tracking outstanding payments. — Tax compliance: These templates include sections for tax identification numbers, tax rates, and subtotal calculations, helping farmers comply with Tennessee tax regulations. — Professional appearance: By utilizing a well-designed template, farmers can create invoices that project a professional image of their business, facilitating trust and prompt payment from clients. In conclusion, a Tennessee Invoice Template for Farmers is an essential tool for agricultural businesses in Tennessee. Whether selling produce, livestock, or offering equipment rental services, these customizable templates help streamline billing processes, maintain accurate records, and ensure tax compliance. By utilizing these templates, farmers can focus more on their core operations while maintaining professionalism in their financial transactions.

Tennessee Invoice Template for Farmer

Description

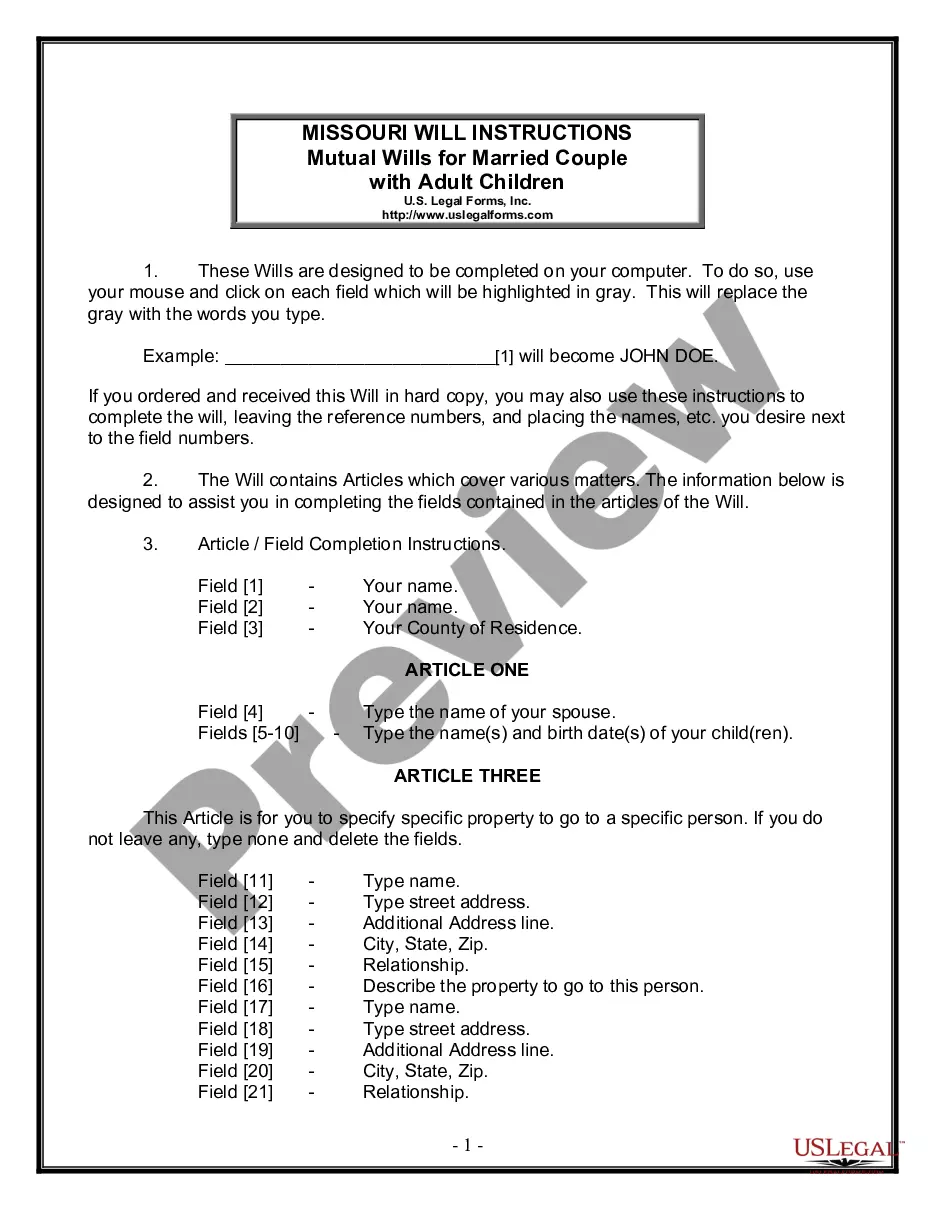

How to fill out Tennessee Invoice Template For Farmer?

US Legal Forms - one of the largest collections of authentic forms in the USA - offers a broad selection of legitimate document templates you can download or create.

By using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Tennessee Invoice Template for Farmer within minutes.

Read the form description to confirm you have picked the right form.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you have a subscription, Log In and download the Tennessee Invoice Template for Farmer from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents tab in your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you begin.

- Ensure you have chosen the correct form for your city/state.

- Click on the Preview button to review the form's content.

Form popularity

FAQ

Finding an invoice template in Word is straightforward. You can open Word, go to the templates section, and search for 'invoice.' Alternatively, using a Tennessee Invoice Template for Farmer can streamline the process, as you can start with a professional design ready to be customized. This way, you save time and effort, allowing you to focus more on your farming activities.

Creating your own invoice template is definitely possible and can be quite beneficial. You can start with a Tennessee Invoice Template for Farmer, which provides an ideal framework for your invoices. This approach allows you to personalize the template according to your branding while ensuring all critical details are covered.

Yes, you can create your own commercial invoice, and it's quite manageable. By using a Tennessee Invoice Template for Farmer, you have a solid foundation to work from, ensuring you include essential information. Customization allows you to tweak the template according to your specific business needs while maintaining a professional appearance.

A commercial invoice typically includes important information such as the seller and buyer's details, descriptions of the goods or services provided, and payment terms. For farmers, using a Tennessee Invoice Template for Farmer can simplify this process. It ensures that all necessary elements are included, making it easier for you to keep your records straight and your transactions clear.

Yes, it is completely legal to create your own invoice as long as it complies with relevant regulations. Ensure that your invoice includes all necessary details, such as itemized services, your business information, and payment terms. Using a Tennessee Invoice Template for Farmer can help you meet those legal requirements with ease.

To create your own invoice, start by choosing a format that works for you. You can write one from scratch or use an online template. A Tennessee Invoice Template for Farmer can streamline this task, providing you with a reliable structure that meets all legal requirements.

When writing an invoice for gardening, list your services, such as lawn care or landscape design, along with corresponding prices. Providing clear descriptions helps your clients understand the services offered. Using a Tennessee Invoice Template for Farmer can ensure that your gardening invoices are professional and easy to read.

Yes, there are many invoice templates available in Excel that you can customize to fit your needs. Specifically, a Tennessee Invoice Template for Farmer can guide you in structuring your invoices effectively. Utilize this template to ensure all the necessary information is included.

Yes, creating an invoice yourself is entirely possible and often necessary for freelancers and farmers. A Tennessee Invoice Template for Farmer can provide you with a structured format, helping you include the essential details while saving time and effort.

Creating an invoice in Excel generally provides more flexibility and functionality, especially for calculations. Word, however, can be suitable for simpler invoices. A Tennessee Invoice Template for Farmer crafted in Excel allows for easy edits and adjustments as your farm services evolve.

Interesting Questions

More info

You can see the full set with different income and cost ranges. You can edit the monthly ranges and create additional ranges based on the number of items you produce or buy. Furthermore, you can also add a monthly range for an item if you already own it. The template is flexible to produce all kinds of income and expenses and is made by professionals at a great price. The invoice template is designed to produce all the necessary and necessary items for your business every month. You can easily convert the template to your own design using our template converter. Your business will be able to show the total number of hours worked. Your employees will earn the total number of paychecks, including overtime. Your suppliers will receive the maximum number of items. You will have full access to all required information of each employee in a neat manner. You can see a detailed overview every time you update with the updated data.