Title: Tennessee Checklist — Health and Disability Insurance: A Comprehensive Overview Introduction: Tennessee Checklist — Health and Disability Insurance is an essential tool for individuals residing in Tennessee to ensure they have the necessary insurance coverage to safeguard their health and financial well-being. This comprehensive checklist covers various aspects of health and disability insurance, helping residents make informed decisions and obtain the most suitable coverage. Here, we provide a detailed description of the key elements to consider when examining health and disability insurance options in Tennessee. Keywords: Tennessee checklist, health insurance, disability insurance, coverage, insurance options, residents. 1. Importance of Health and Disability Insurance: In Tennessee, having adequate health and disability insurance is crucial to protect oneself and loved ones from unexpected medical expenses and income loss due to disability. These insurance policies offer financial security and peace of mind during challenging times. 2. Health Insurance Coverage: a. Individual Health Insurance: This type of insurance covers an individual and offers medical benefits such as doctor visits, hospital stays, prescription medications, and preventive care. b. Employer-Sponsored Health Insurance: Many employers in Tennessee provide health insurance plans for their employees. This coverage is often more affordable and may include additional benefits like dental, vision, and wellness programs. c. Medicaid: A government-funded program that provides health insurance coverage to low-income individuals and families in Tennessee. Eligibility is based on income and other criteria. d. Medicare: A federal health insurance program primarily catering to individuals aged 65 and above. It also covers younger individuals with certain disabilities. 3. Disability Insurance Coverage: a. Short-term Disability Insurance: This policy provides temporary income replacement when individuals are unable to work due to a covered illness, injury, or pregnancy-related condition. b. Long-term Disability Insurance: Designed to provide income replacement for an extended period (often years or even until retirement), long-term disability insurance offers coverage if one becomes unable to work for an extended duration. 4. Key Considerations while Choosing Insurance: a. Coverage Limitations: Understand the specific benefits, deductibles, co-payments, and limitations associated with each insurance policy. b. Network Coverage: Evaluate whether the insurance plan includes desired healthcare providers, hospitals, and specialists within its network. c. Premiums and Affordability: Consider the monthly premiums and ensure they fit within your budget, while still offering adequate coverage. d. Prescription Medications: Assess whether the insurance plan covers the prescription drugs you require and if there are any limitations or additional costs. e. Pre-Existing Conditions: Determine if the insurance policy covers pre-existing medical conditions and any waiting periods for coverage. f. Additional Benefits: Explore any additional benefits offered by the insurance plans, such as wellness programs, telehealth services, mental health coverage, or alternative therapies. Conclusion: Tennessee Checklist — Health and Disability Insurance serves as an invaluable resource for individuals residing in Tennessee. Understanding the different insurance options available, such as individual health insurance, employer-sponsored plans, Medicaid, and Medicare, empowers residents to make informed decisions about their coverage needs. Additionally, considering the various aspects of disability insurance, including short-term and long-term policies, ensures comprehensive financial protection. Evaluate the key considerations mentioned above to select insurance plans that offer optimal coverage, affordability, and peace of mind for your healthcare and disability needs in Tennessee. Keywords: Tennessee checklist, health insurance, disability insurance, coverage options, affordable insurance, healthcare providers, prescription medications, pre-existing conditions, additional benefits in insurance plans.

Tennessee Checklist - Health and Disability Insurance

Description

How to fill out Tennessee Checklist - Health And Disability Insurance?

Are you inside a position where you need paperwork for both enterprise or specific uses almost every time? There are plenty of lawful document layouts accessible on the Internet, but getting versions you can depend on isn`t effortless. US Legal Forms gives a huge number of kind layouts, much like the Tennessee Checklist - Health and Disability Insurance, that happen to be created in order to meet state and federal specifications.

When you are presently acquainted with US Legal Forms internet site and also have an account, merely log in. After that, you may download the Tennessee Checklist - Health and Disability Insurance format.

Unless you provide an bank account and need to begin to use US Legal Forms, follow these steps:

- Obtain the kind you want and make sure it is for the proper metropolis/county.

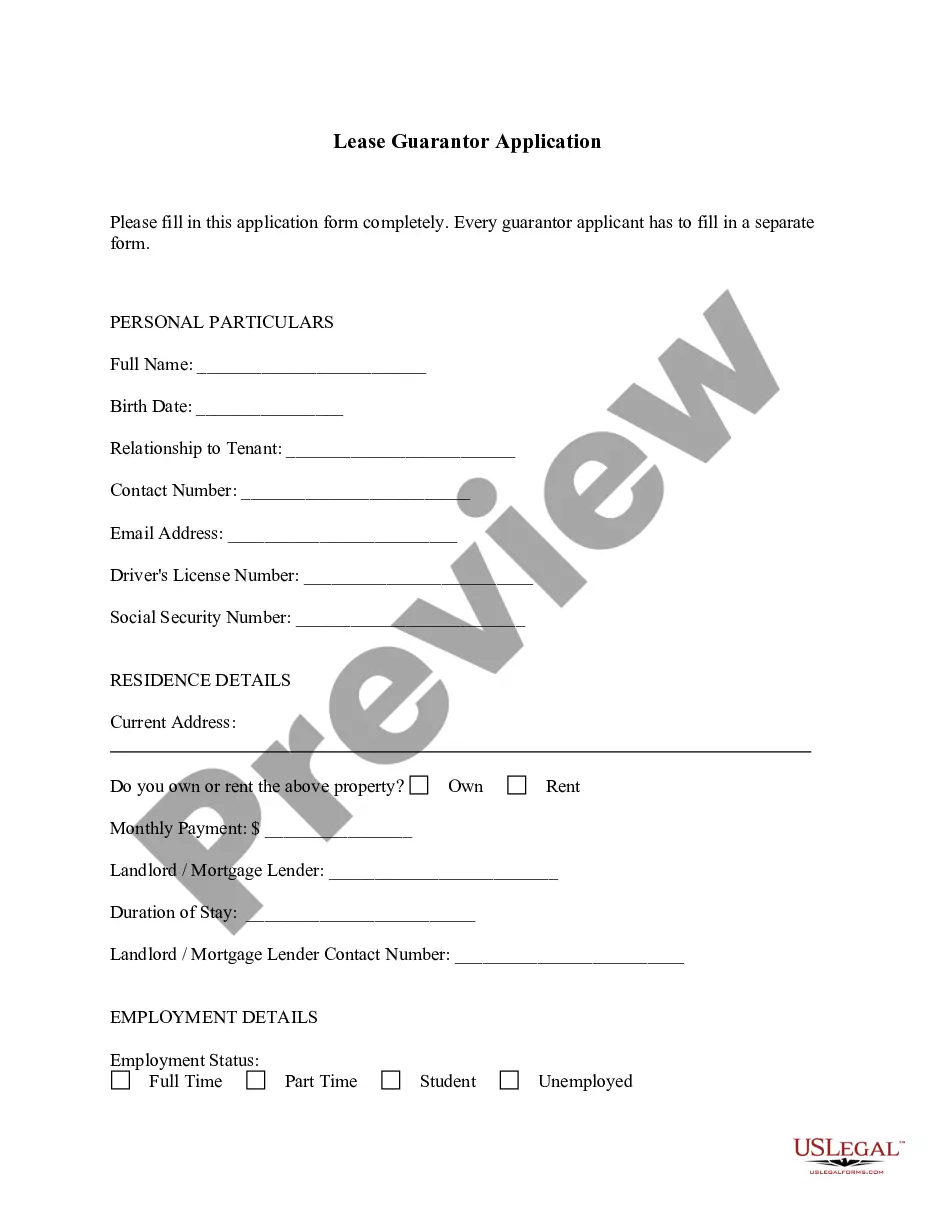

- Utilize the Preview key to examine the shape.

- Browse the explanation to actually have selected the appropriate kind.

- When the kind isn`t what you`re seeking, take advantage of the Look for industry to find the kind that meets your requirements and specifications.

- Once you obtain the proper kind, click Buy now.

- Pick the rates plan you want, complete the specified details to generate your account, and buy an order with your PayPal or charge card.

- Choose a hassle-free file formatting and download your backup.

Find all of the document layouts you might have bought in the My Forms food selection. You may get a extra backup of Tennessee Checklist - Health and Disability Insurance whenever, if required. Just go through the necessary kind to download or print out the document format.

Use US Legal Forms, by far the most substantial collection of lawful varieties, in order to save efforts and prevent errors. The support gives expertly made lawful document layouts that you can use for an array of uses. Create an account on US Legal Forms and commence making your life easier.