A receiver is a person authorized to take custody of another's property in a receivership and to apply and use it for certain purposes. Receivers are either court receivers or non-court receivers.

Appointment of a receiver may be by agreement of the debtor and his or her creditors. The receiver takes custody of the property, business, rents and profits of an insolvent person or entity, or a party whose property is in dispute.

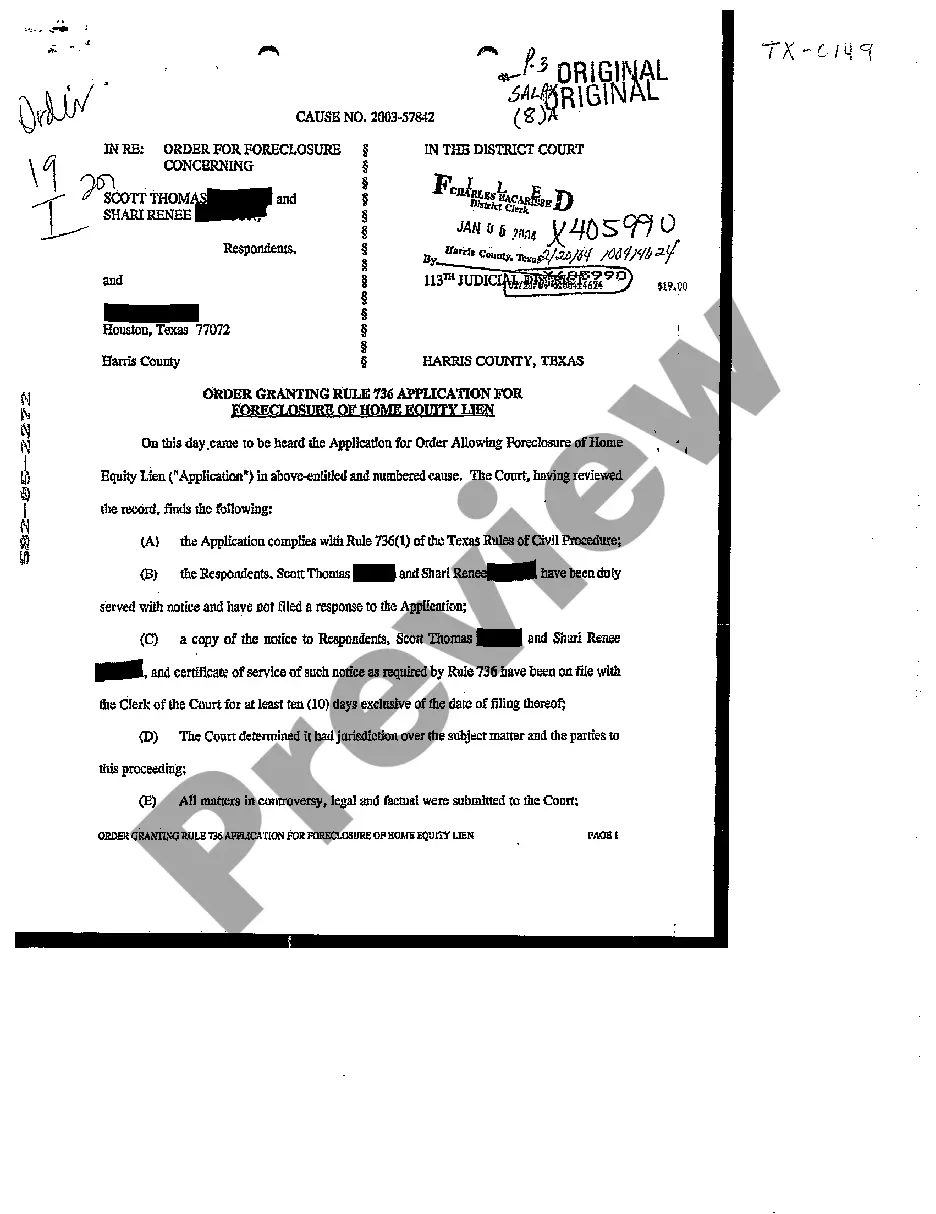

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Title: Tennessee Agreement between Creditors and Debtor for Appointment of Receiver: A Comprehensive Guide Introduction: The Tennessee Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions under which a receiver is appointed to manage and dispose of a debtor's assets. This agreement plays a crucial role in facilitating debt collection and ensuring fair treatment for both creditors and debtors. In Tennessee, there are various types of agreements specific to different situations and entities involved. This comprehensive guide will provide insight into the purpose, key components, and types of Tennessee Agreements between Creditors and Debtors for Appointment of Receivers. Key Components of the Agreement: 1. Parties Involved: The agreement identifies and includes the creditor(s), debtor(s), and the receiver. Each party's name, address, and contact information are essential for legal purposes. 2. Recitals: This section sets out the background and context of the agreement, highlighting the reasons necessitating the appointment of a receiver and the consent of the debtor and creditors. 3. Appointment of Receiver: Here, the agreement specifies the appointment of a receiver, including their name, qualifications, and responsibilities. It may also outline any specific powers conferred upon the receiver. 4. Receivership Duties and Powers: This section enumerates the receiver's duties and powers, which typically include managing and preserving the debtor's assets, collecting receivables, selling assets, or distributing proceeds to the creditors in a fair and orderly manner. 5. Payment of Expenses: The agreement states how the expenses related to the receivership will be borne, whether by the debtor or the creditors, and defines the process for reimbursement. 6. Reporting and Accounting: This component outlines the receiver's obligation to provide regular reports to the creditors, detailing financial statements, collections, and distribution of funds according to the court's guidance. Types of Tennessee Agreements between Creditors and Debtors for Appointment of Receivers: 1. General Agreement for Appointment of Receiver: This is the standard agreement used when creditors come to an agreement with the debtor to seek the appointment of a receiver to manage the debtor's assets. 2. Voluntary Agreement for Appointment of Receiver: This type of agreement is entered into consensually by both the debtor and creditors, without requiring a court order. It demonstrates a cooperative approach to resolving financial issues. 3. Involuntary Agreement for Appointment of Receiver: In some cases, creditors may file a court petition seeking the appointment of a receiver against the debtor's wishes. This agreement further outlines the terms and conditions under which the receiver will operate. Conclusion: The Tennessee Agreement between Creditors and Debtor for Appointment of Receiver is an essential legal document that ensures fairness and transparency in the management and distribution of a debtor's assets. By understanding the key components and nuances involved in different types of agreements, creditors and debtors can navigate the complexities of debt collection more effectively. Seeking professional legal advice is crucial to ensure compliance with Tennessee laws and maximize the likelihood of a successful outcome for all parties involved.Title: Tennessee Agreement between Creditors and Debtor for Appointment of Receiver: A Comprehensive Guide Introduction: The Tennessee Agreement between Creditors and Debtor for Appointment of Receiver is a legal document that outlines the terms and conditions under which a receiver is appointed to manage and dispose of a debtor's assets. This agreement plays a crucial role in facilitating debt collection and ensuring fair treatment for both creditors and debtors. In Tennessee, there are various types of agreements specific to different situations and entities involved. This comprehensive guide will provide insight into the purpose, key components, and types of Tennessee Agreements between Creditors and Debtors for Appointment of Receivers. Key Components of the Agreement: 1. Parties Involved: The agreement identifies and includes the creditor(s), debtor(s), and the receiver. Each party's name, address, and contact information are essential for legal purposes. 2. Recitals: This section sets out the background and context of the agreement, highlighting the reasons necessitating the appointment of a receiver and the consent of the debtor and creditors. 3. Appointment of Receiver: Here, the agreement specifies the appointment of a receiver, including their name, qualifications, and responsibilities. It may also outline any specific powers conferred upon the receiver. 4. Receivership Duties and Powers: This section enumerates the receiver's duties and powers, which typically include managing and preserving the debtor's assets, collecting receivables, selling assets, or distributing proceeds to the creditors in a fair and orderly manner. 5. Payment of Expenses: The agreement states how the expenses related to the receivership will be borne, whether by the debtor or the creditors, and defines the process for reimbursement. 6. Reporting and Accounting: This component outlines the receiver's obligation to provide regular reports to the creditors, detailing financial statements, collections, and distribution of funds according to the court's guidance. Types of Tennessee Agreements between Creditors and Debtors for Appointment of Receivers: 1. General Agreement for Appointment of Receiver: This is the standard agreement used when creditors come to an agreement with the debtor to seek the appointment of a receiver to manage the debtor's assets. 2. Voluntary Agreement for Appointment of Receiver: This type of agreement is entered into consensually by both the debtor and creditors, without requiring a court order. It demonstrates a cooperative approach to resolving financial issues. 3. Involuntary Agreement for Appointment of Receiver: In some cases, creditors may file a court petition seeking the appointment of a receiver against the debtor's wishes. This agreement further outlines the terms and conditions under which the receiver will operate. Conclusion: The Tennessee Agreement between Creditors and Debtor for Appointment of Receiver is an essential legal document that ensures fairness and transparency in the management and distribution of a debtor's assets. By understanding the key components and nuances involved in different types of agreements, creditors and debtors can navigate the complexities of debt collection more effectively. Seeking professional legal advice is crucial to ensure compliance with Tennessee laws and maximize the likelihood of a successful outcome for all parties involved.