Title: Tennessee Sample Letter for Note and Deed of Trust for Real Estate Financing Introduction: When engaging in real estate financing transactions in Tennessee, it’s crucial to have an accurate and legally binding documentation process. One essential component of this process is the Tennessee Sample Letter for Note and Deed of Trust. The Note and Deed of Trust are vital documents that outline the terms, conditions, and legal rights and responsibilities of the parties involved in the transaction. In Tennessee, there are different types of Note and Deed of Trust, such as fixed-rate mortgages, adjustable-rate mortgages, and balloon mortgages, each serving specific purposes according to the borrower's needs. Sample Letter for Note and Deed of Trust: [Your Name] [Your Address] [City, State, ZIP] [Date] [Recipient's Name] [Recipient's Address] [City, State, ZIP] Subject: Tennessee Sample Letter for Note and Deed of Trust Dear [Recipient’s Name], I am writing to present you with the Tennessee Sample Letter for Note and Deed of Trust for the financing transaction related to the property located at [Property Address]. This letter documents the terms and conditions agreed upon between the borrower and the lender, hereby referred to as the parties. For the purpose of real estate financing, the parties have entered into a legally binding agreement, and the terms are delineated as follows: 1. Note: The Note is a legal document that outlines the borrower's promise to repay the loan and the terms of repayment. It includes details such as the loan amount, interest rate, repayment schedule, late payment penalties, and any additional terms agreed upon between the parties. 2. Deed of Trust: The Deed of Trust is a legal document that serves as collateral for the loan. It establishes a lien on the property, ensuring that if the borrower defaults on the loan, the lender has the right to foreclose and sell the property to recover the outstanding debt. The Deed of Trust also includes details regarding the trustee, beneficiary, and any applicable provisions according to Tennessee state law. Types of Tennessee Sample Letter for Note and Deed of Trust: 1. Fixed-Rate Mortgage: A fixed-rate mortgage is a loan agreement where the interest rate remains the same throughout the loan term. This type of loan offers stability and predictable monthly payments, ideal for borrowers who prefer a consistent budget. 2. Adjustable-Rate Mortgage: An adjustable-rate mortgage is a loan agreement where the interest rate fluctuates based on market conditions. The initial interest rate is typically lower than fixed-rate mortgages, making it an attractive option for borrowers expecting interest rates to decrease. 3. Balloon Mortgage: A balloon mortgage is a loan agreement with a fixed interest rate for a set period, usually five to seven years. At the end of the fixed term, the remaining loan balance becomes due in full, requiring the borrower to either pay off the debt or refinance the loan. Conclusion: The Tennessee Sample Letter for Note and Deed of Trust is an essential document for real estate financing transactions in Tennessee. It outlines the borrower's promise to repay the loan and provides a legal mechanism to secure the lender's interest in the property. Understanding the different types of Note and Deed of Trust, such as fixed-rate mortgages, adjustable-rate mortgages, and balloon mortgages, allows borrowers to select the option that aligns with their financial goals and comfort levels. Please review the attached Tennessee Sample Letter for Note and Deed of Trust and contact me should you have any questions or require further clarification. Thank you for your attention. Sincerely, [Your Name]

Tennessee Sample Letter for Note and Deed of Trust

Description

How to fill out Tennessee Sample Letter For Note And Deed Of Trust?

US Legal Forms - one of several greatest libraries of lawful forms in the States - delivers an array of lawful file layouts you are able to down load or print. Making use of the website, you will get a large number of forms for business and personal reasons, sorted by types, states, or keywords and phrases.You can get the most recent types of forms much like the Tennessee Sample Letter for Note and Deed of Trust in seconds.

If you have a membership, log in and down load Tennessee Sample Letter for Note and Deed of Trust from your US Legal Forms catalogue. The Down load key will appear on each and every kind you see. You have access to all formerly saved forms in the My Forms tab of the account.

If you wish to use US Legal Forms the very first time, listed here are straightforward recommendations to help you get started out:

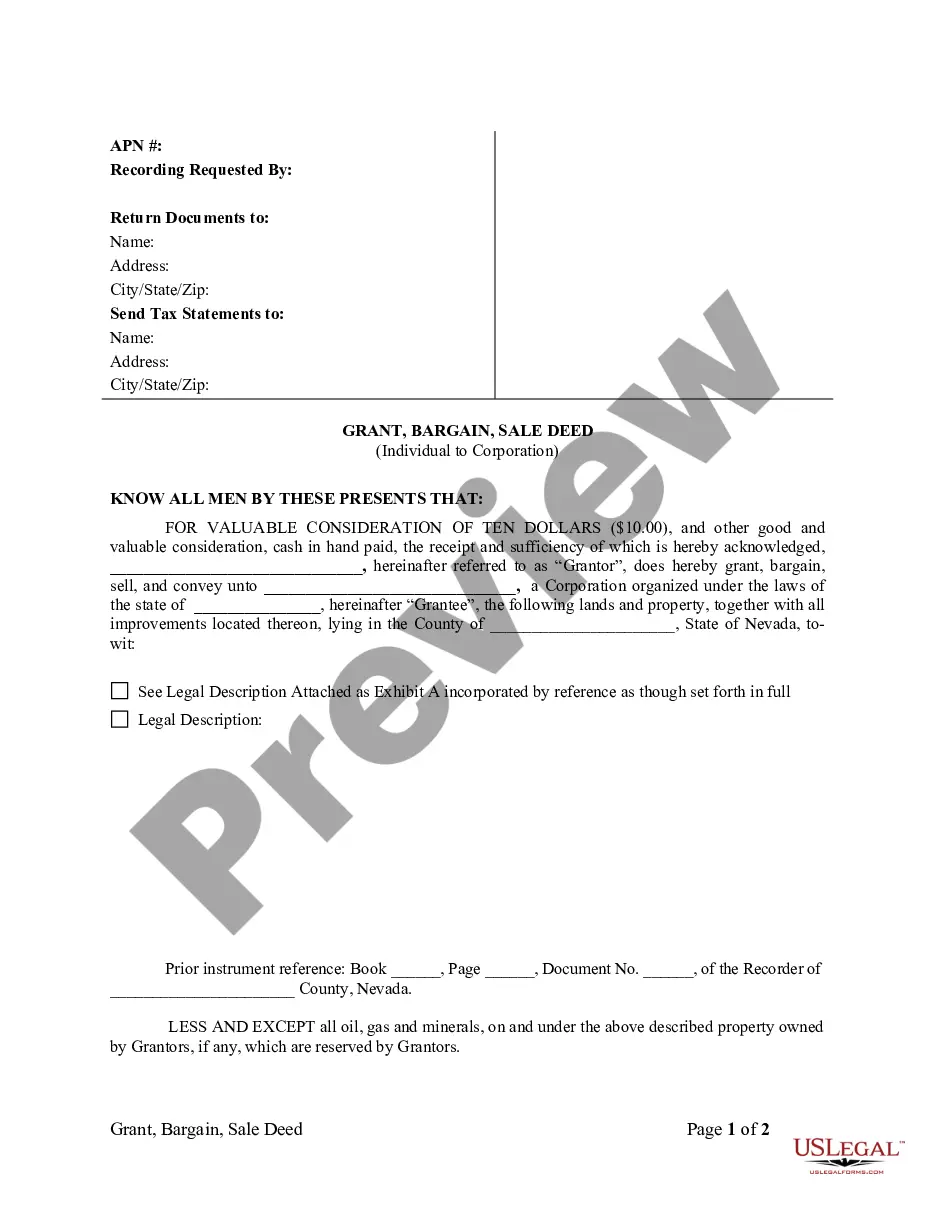

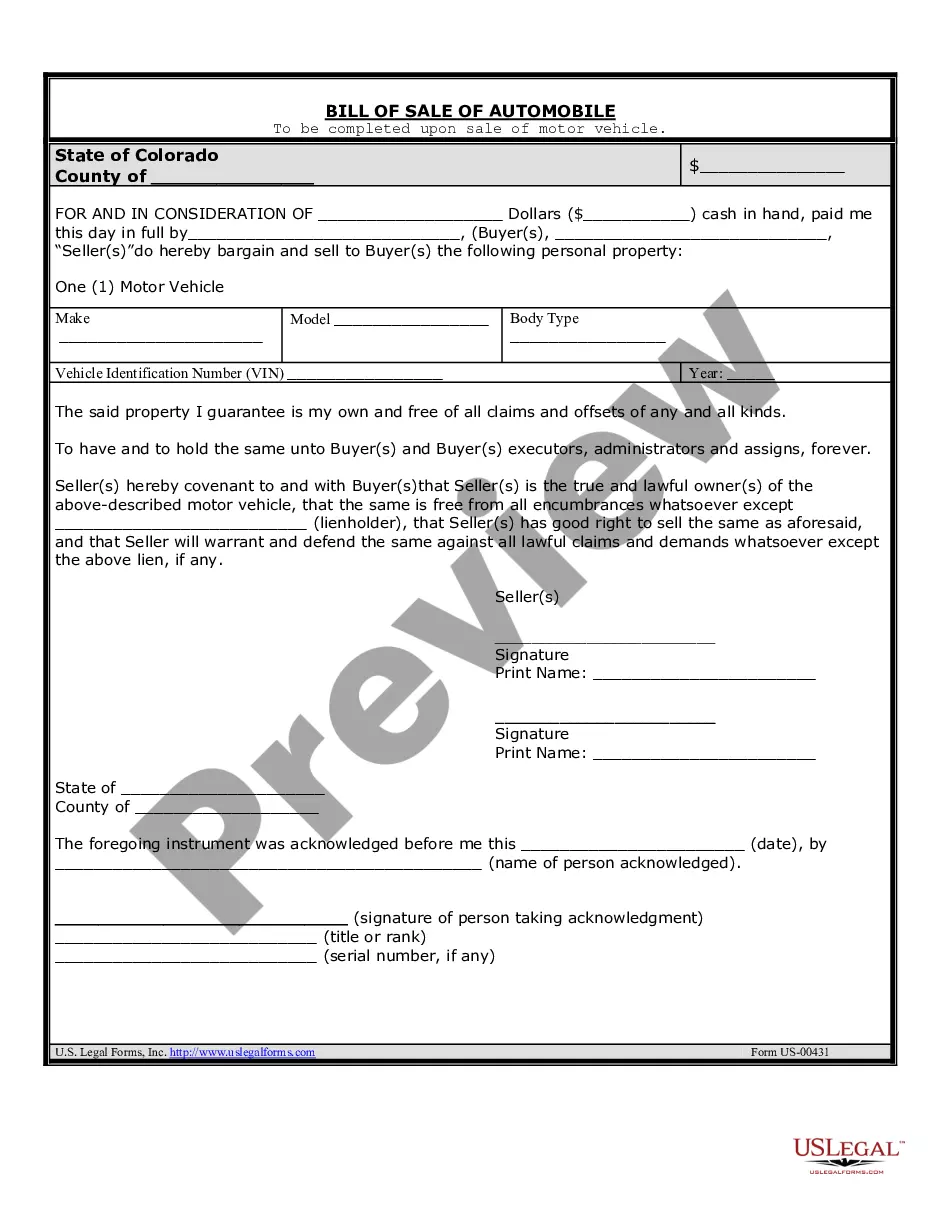

- Be sure to have selected the correct kind for your personal city/state. Click the Preview key to analyze the form`s information. See the kind description to actually have chosen the proper kind.

- In the event the kind doesn`t fit your requirements, use the Look for field on top of the monitor to find the one that does.

- If you are happy with the shape, verify your option by clicking on the Buy now key. Then, opt for the costs plan you prefer and supply your accreditations to sign up on an account.

- Procedure the transaction. Make use of charge card or PayPal account to accomplish the transaction.

- Select the structure and down load the shape in your system.

- Make alterations. Load, modify and print and indication the saved Tennessee Sample Letter for Note and Deed of Trust.

Each and every design you included in your account lacks an expiration particular date and is also your own forever. So, if you want to down load or print one more duplicate, just visit the My Forms portion and then click in the kind you require.

Gain access to the Tennessee Sample Letter for Note and Deed of Trust with US Legal Forms, probably the most considerable catalogue of lawful file layouts. Use a large number of expert and status-specific layouts that meet up with your business or personal requirements and requirements.

Form popularity

FAQ

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.

The promissory note is held by the lender until the loan is paid in full, and generally is not recorded with the county recorder or registrar of titles (sometimes also referred to as the county clerk, register of deeds, or land registry) whereas a deed of trust is recorded.

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.

Over to the Trustees mentioned hereunder, is hereby acknowledged by the Trustees, who hereby accept the appointment as such Trustees of the said Trust, under the terms and conditions, set out hereunder for the fulfillment of the objects of the Trust, more fully and particularly described and set out hereunder.

A deed of trust involves three parties: (1) the trustor, who is the person who received the loan, (2) the beneficiary, who is the person who loaned the money to the trustor, and (3) the trustee, who is the person that released the loan once it has been paid off.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

Tennessee is a deed of trust state. However, a mortgage is enforceable. The trustee must be a resident of Tennessee or a corporation domiciled in Tennessee.

The property owner signs the note, which is a written promise to repay the borrowed money. A trust deed gives the third-party ?trustee? (usually a title company or real estate broker) legal ownership of the property.