Tennessee Sample Letter for Exemption of Ad Valorem Taxes

Description

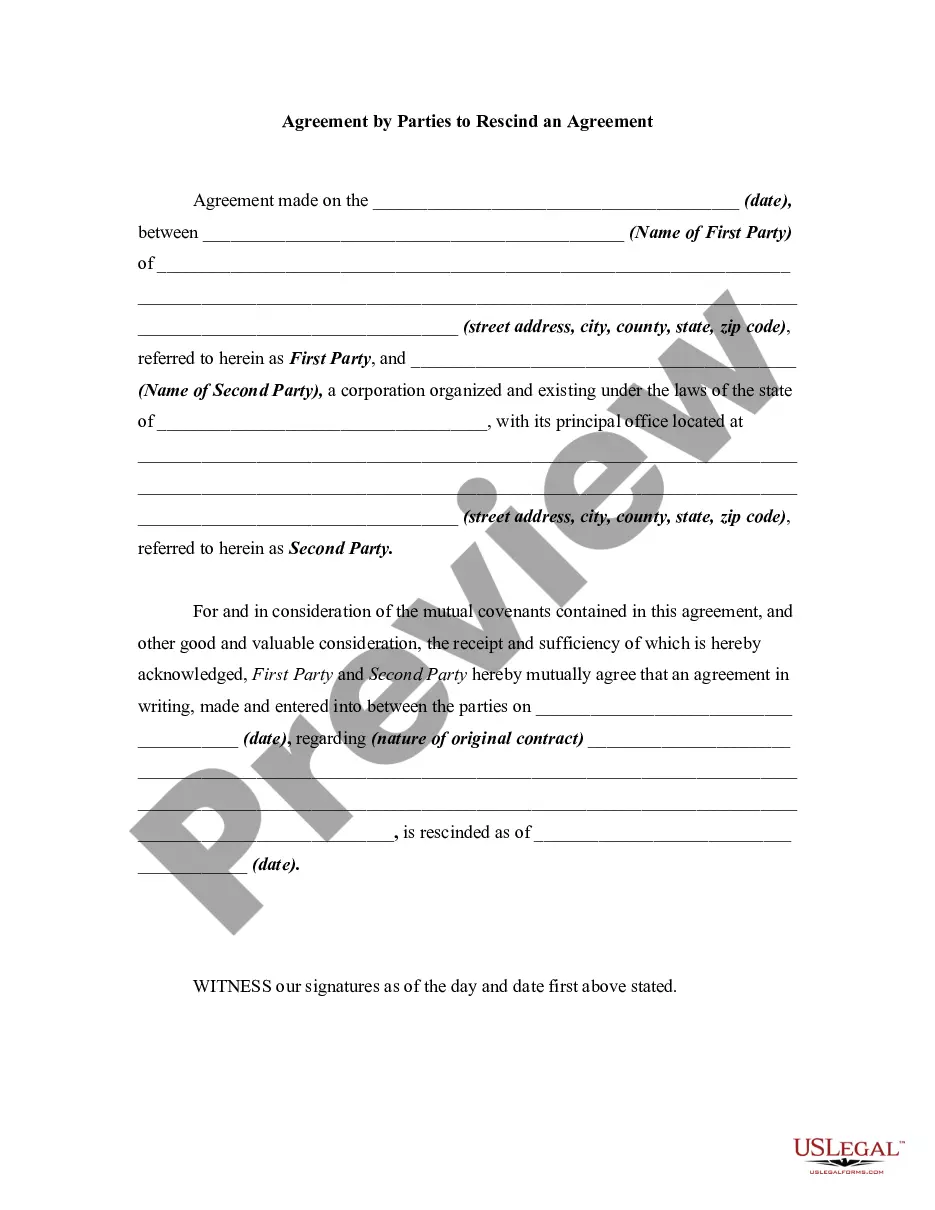

How to fill out Sample Letter For Exemption Of Ad Valorem Taxes?

Are you presently within a place that you need files for both organization or specific reasons just about every working day? There are a lot of lawful file themes accessible on the Internet, but discovering ones you can rely isn`t easy. US Legal Forms provides thousands of form themes, such as the Tennessee Sample Letter for Exemption of Ad Valorem Taxes, that are written to meet state and federal requirements.

When you are presently acquainted with US Legal Forms website and also have your account, basically log in. Next, you are able to acquire the Tennessee Sample Letter for Exemption of Ad Valorem Taxes web template.

If you do not offer an profile and wish to begin using US Legal Forms, follow these steps:

- Find the form you need and make sure it is to the correct city/state.

- Utilize the Review key to analyze the shape.

- Browse the description to ensure that you have selected the appropriate form.

- When the form isn`t what you`re trying to find, take advantage of the Look for industry to obtain the form that meets your requirements and requirements.

- When you discover the correct form, click on Get now.

- Opt for the rates plan you want, submit the specified information to make your money, and purchase the transaction with your PayPal or Visa or Mastercard.

- Decide on a handy data file structure and acquire your backup.

Locate each of the file themes you have purchased in the My Forms food selection. You can get a additional backup of Tennessee Sample Letter for Exemption of Ad Valorem Taxes whenever, if required. Just click on the needed form to acquire or printing the file web template.

Use US Legal Forms, the most extensive assortment of lawful kinds, in order to save time as well as prevent faults. The service provides appropriately manufactured lawful file themes which can be used for a selection of reasons. Create your account on US Legal Forms and start creating your lifestyle a little easier.

Form popularity

FAQ

Under case law, co-owners may each claim a $25,000 homestead exemption. This bill increases the individual homestead exemption to $35,000, increases the joint exemption to $52,500, and eliminates the enhanced exemptions based on age and parental status.

To qualify, the individual must use the property as his or her principle place of residence. The homeowner can take an exemption of up to $20,000 if married to someone younger than 62, and $25,000 if both are over 62.

You can file for an exemption using the Tennessee Taxpayer Access Point (TNTAP), without creating a logon. Read more about exempt entities at the link on the left. Family Owned Non-corporate Entity (FONCE): Entities that meet specific criteria can file for the FONCE exemption.

There are two types of exemptions-personal and dependency. Each exemption reduces the income subject to tax.

You likely received a Tennessee resale certificate when you registered for your Tennessee sales tax permit. If you don't have this document, you can contact the Tennessee Department of Revenue to request a new copy by calling 615-253-0600 or submitting a request on their website.

You can file for an exemption using the Tennessee Taxpayer Access Point (TNTAP), without creating a logon. Read more about exempt entities at the link on the left. Family Owned Non-corporate Entity (FONCE): Entities that meet specific criteria can file for the FONCE exemption.

Under the program, qualifying homeowners age 65 or older, disabled homeowners, as well as disabled veteran homeowners or their surviving spouses receive tax relief from the taxes due on their property. Homeowners must have been 65 by December 31 of the tax year for which they are applying.