A lactation consultant is a healthcare provider recognized as having expertise in the fields of human lactation and breastfeeding

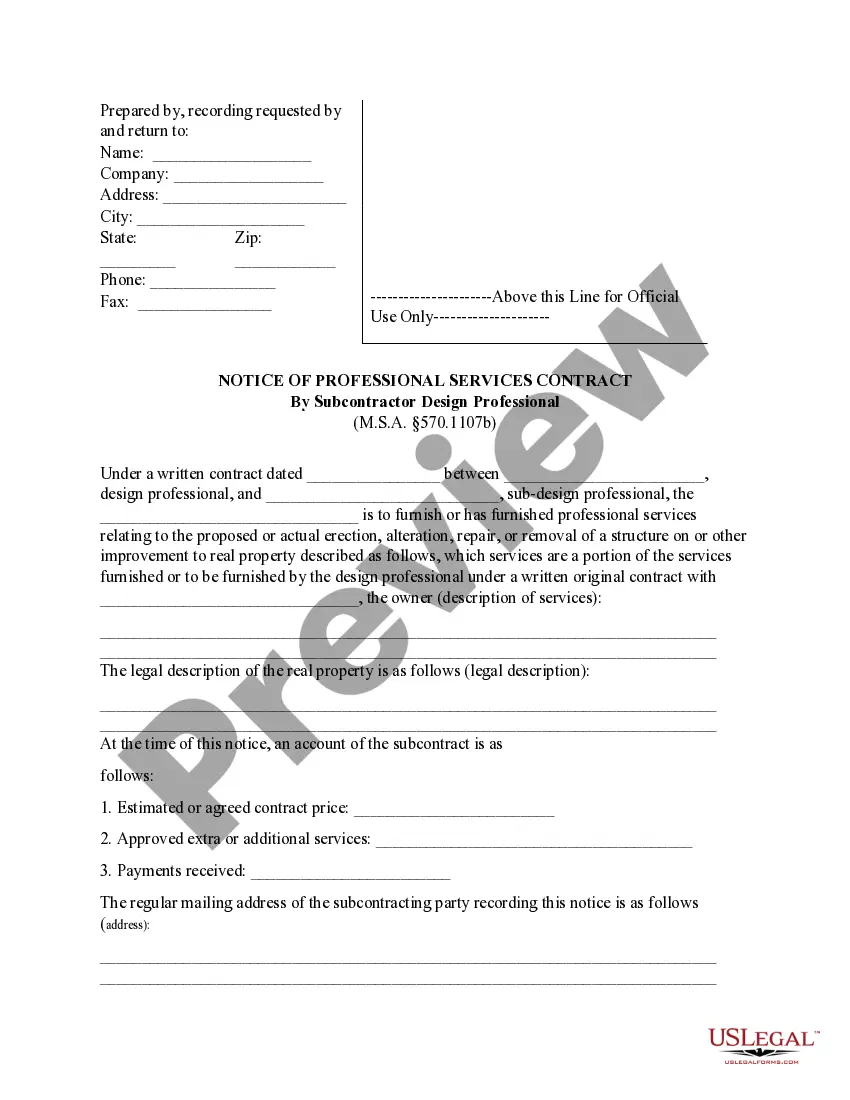

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Tennessee Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legal document that establishes a trust fund to provide financial protection and support for the designated beneficiaries. This type of trust agreement is designed to protect and preserve the assets of the granter (the creator of the trust) for the benefit of their loved ones, namely their spouse, children, and grandchildren. One of the main features of this trust agreement is its irrevocable nature. Once the trust is established and assets are transferred into it, the granter relinquishes control over those assets. This means that the granter cannot modify, amend, or revoke the trust agreement without the unanimous consent of all named beneficiaries. The irrevocable aspect of this trust ensures that the assets are safely managed and distributed according to the granter's wishes, without being subject to any potential changes or challenges in the future. In Tennessee, there may be different types of Irrevocable Trust Agreements for the Benefit of Spouse, Children, and Grandchildren, based on specific circumstances and objectives. These may include: 1. Irrevocable Life Insurance Trust (IIT): This type of trust agreement is commonly used to hold life insurance policies outside the granter's estate. By transferring the policies into the trust, the proceeds can be distributed to the spouse, children, and grandchildren, providing financial support and security upon the granter's passing. 2. Generation-Skipping Trust: This trust agreement allows the granter to provide for the long-term financial needs of their grandchildren and future generations. By "skipping" a generation (the granter's children), the assets are protected and can grow for the benefit of the grandchildren, reducing potential estate taxes. 3. Charitable Remainder Trust (CRT): This type of trust agreement allows the granter to provide for their spouse, children, and grandchildren, while also supporting charitable causes. The trust assets are first distributed to the beneficiaries for a specific period, after which the remaining balance is donated to one or more charitable organizations. 4. Qualified Personnel Residence Trust (PRT): A PRT enables the granter to transfer their primary residence or vacation home into the trust while retaining the right to live in it for a specified period. After this period, the property is transferred to the beneficiaries, minimizing estate taxes. In conclusion, the Tennessee Irrevocable Trust Agreement for the Benefit of Spouse, Children, and Grandchildren is a legal instrument that allows individuals to safeguard and manage their assets for the financial security and benefit of their loved ones. With different types of irrevocable trust agreements available in Tennessee, individuals can tailor their estate planning strategies to meet their specific needs and goals.