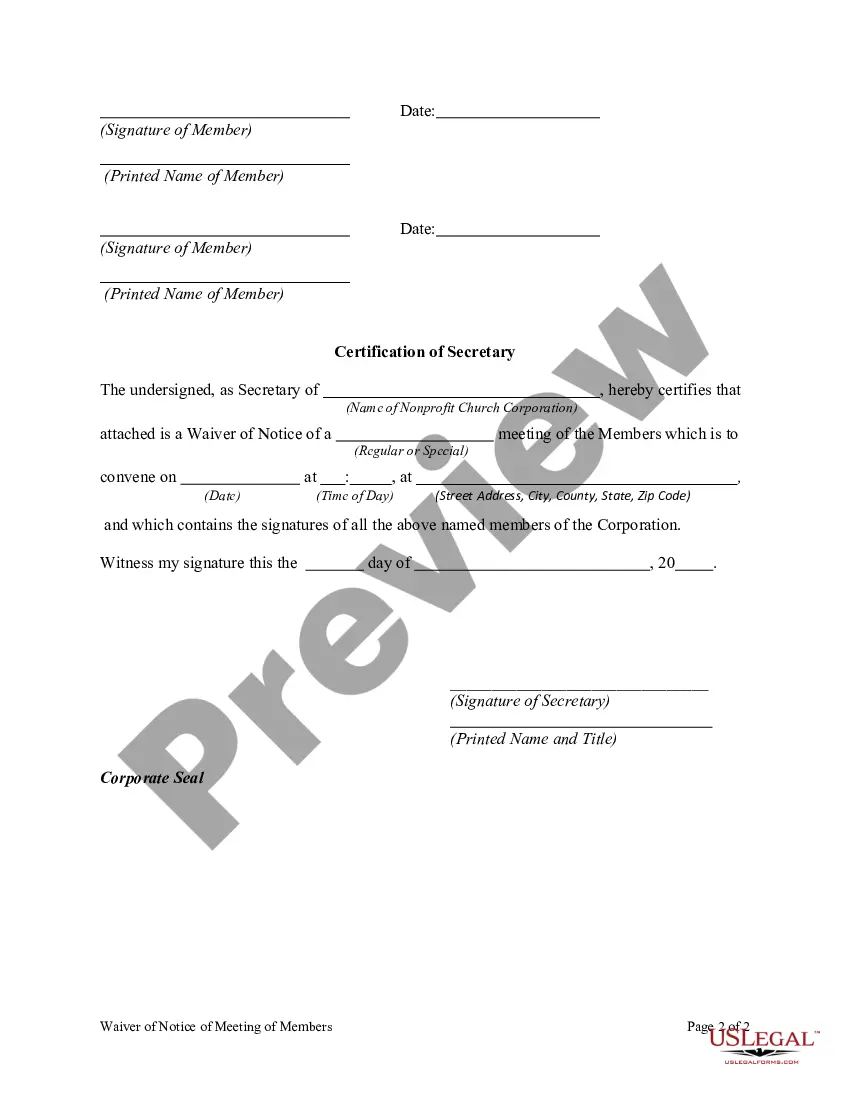

A member of a Nonprofit Church Corporation may waive any notice required by the Model Nonprofit Corporation Act, the articles of incorporation, or bylaws before or after the date and time stated in the notice. The waiver must be in writing, be signed by the member entitled to the notice, and be delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Tennessee Waiver of Notice of Meeting of members of a Nonprofit Church Corporation

Description

How to fill out Waiver Of Notice Of Meeting Of Members Of A Nonprofit Church Corporation?

If you require thorough, obtain, or print legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Make use of the site's straightforward and convenient search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. After locating the form you want, click the Order Now button. Select the payment plan you prefer and provide your details to create an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Use US Legal Forms to obtain the Tennessee Waiver of Notice of Meeting of members of a Nonprofit Church Corporation with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Tennessee Waiver of Notice of Meeting of members of a Nonprofit Church Corporation.

- You can also view forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

So can an LLC be a nonprofit in Tennessee? Yes, absolutely. Tennessee is one of the states where an LLC can be run as a nonprofit and enjoy all the perks that come with such.

Step 1: Know Why Your Club Exists.Step 2: Structure Your Club & Governance.Step 3: How to Get New Members.Step 4: Outline the Financial Structure.Step 5: Create a Club Website.Step 6: Hold Your First Club Meeting.Step 7: Attract & Engage Your Members.

The simple answer is that most authors agree that a typical nonprofit board of directors should comprise not less than 8-9 members and not more than 11-14 members. Some authors focusing on healthcare organizations indicate a board size up to 19 members is acceptable, though not optimal.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

The rulebook usually states that the authority to close the club and cease trading is the decision of the members at a duly convened members meeting, thus the first step should be to call a General Meeting of the members. 2. It is far easier to wind up a solvent club than an insolvent club.

According to a study by Bain Capital Private Equity, the optimal number of directors for boards to make a decision is seven. Every added board member after that decreases decision-making by 10%. Nonprofits can use that as a starting metric before considering the organization's life cycle, mission and fundraising needs.

Tennessee nonprofit corporations must have at least three board members. We recommend at least seven directors, when possible. Tennessee nonprofit corporations must have o cers, including a president and secretary, who must be different persons.

A sole member structure is really appealing when an individual or corporation creates a new nonprofit and wants to retain long term control over the nonprofit's mission and activities. By making themselves the sole member, the founder can give themselves the power to appoint or remove board members.

Steps to Dissolving a NonprofitFile a final form. In this type of dissolution, the IRS mandates that the board of directors of the nonprofit organization complete certain requirements to "dissolve," or shut down, the 501(c)(3).Vote for dissolution.File Form 990.File the paperwork.

(a) Unless chapters 51-68 of this title or the charter or bylaws provide for a higher or lower quorum, ten percent (10%) of the votes entitled to be cast on a matter must be represented at a meeting of members to constitute a quorum on that matter.