A receipt is an acknowledgment in writing that something of value, or cash, has been placed into the possession of an individual or organization. It is a written confirmation of payment.

Tennessee Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift

Description

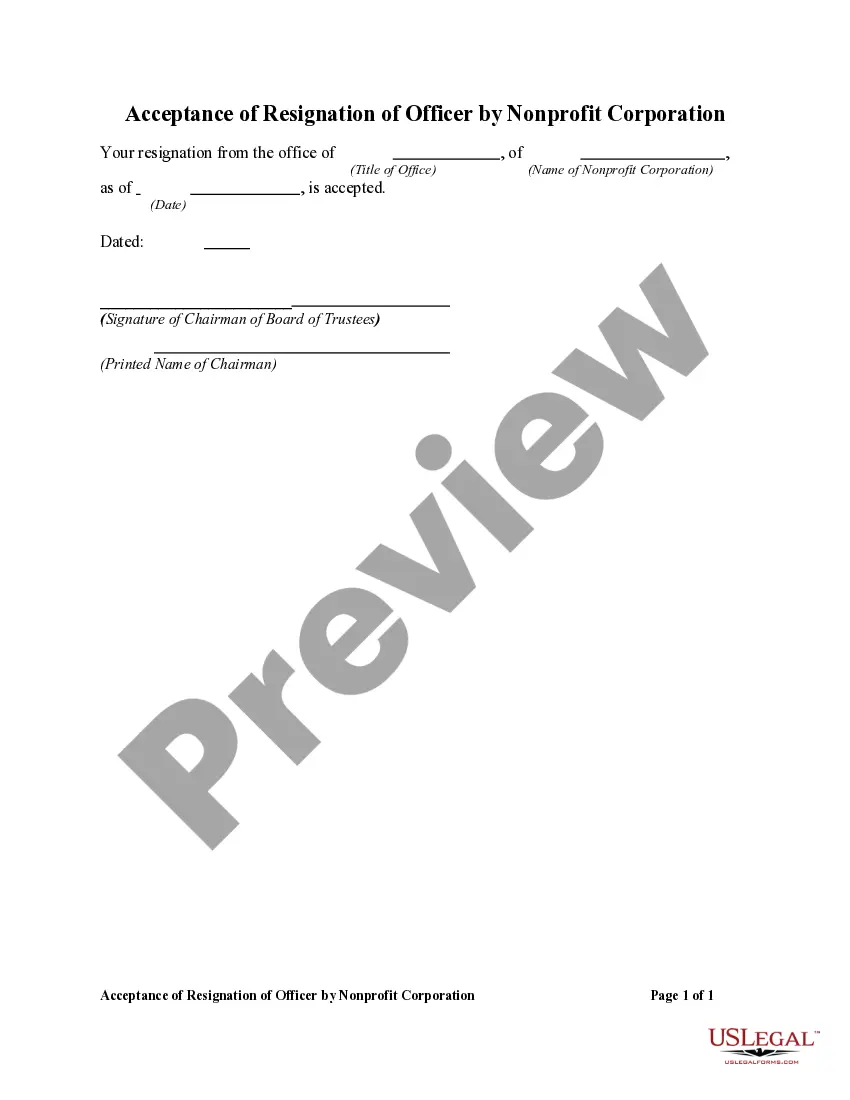

How to fill out Acknowledgment By A Nonprofit Church Corporation Of Receipt Of Gift?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a diverse selection of legal document templates that you can download or create.

By utilizing the platform, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can access the most up-to-date forms such as the Tennessee Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift in just minutes.

If you already possess an account, Log In and acquire the Tennessee Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift from the US Legal Forms database. The Download button will be available on every template you view. You can access all previously obtained forms in the My documents section of your account.

Process the transaction. Use a Visa or MasterCard or PayPal account to complete the transaction.

Select the format and download the form onto your device. Make modifications. Fill in, edit, print, and sign the downloaded Tennessee Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you need to download or print another copy, simply go to the My documents area and click on the form you need.

- Ensure you have selected the correct form for your city/county.

- Click on the Preview button to review the form's details.

- Read the form description to confirm that you have chosen the appropriate document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy Now button.

- Then, select the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

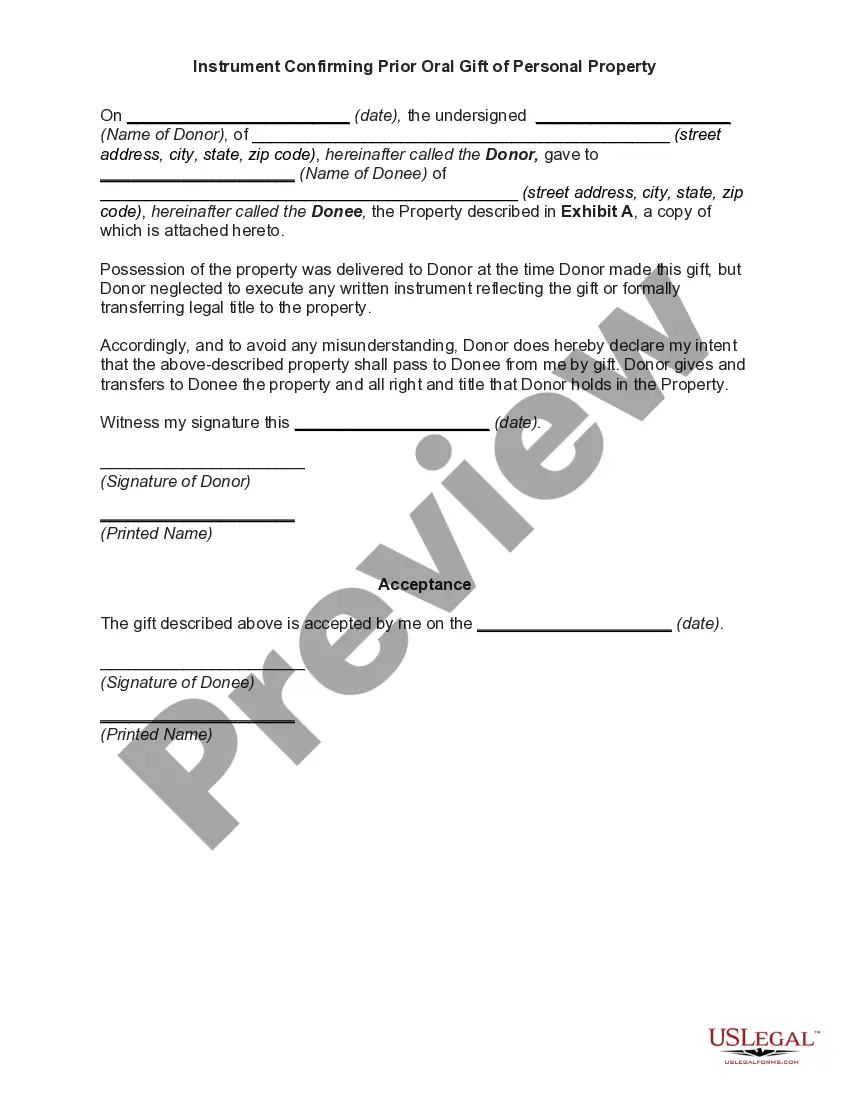

A gift acknowledgment is a formal statement provided to donors, confirming the receipt of their contributions. It should outline the amount or the value of the gift, as well as the organization’s tax-exempt status. For organizations seeking a Tennessee Acknowledgment by a Nonprofit Church Corporation of Receipt of Gift, this document serves as proof for the donor, aiding in their tax deductions.

How Do I Write Donation Receipts?The name of the donor.The name of your organization.Your organization's federal tax ID number, and a statement indication your organization is a registered 501(c)(3)The date of the donation.The amount given OR a description of items donated, if any.

How do you acknowledge a donation?The name of your donor.The full legal name of your organization.A declaration of your organization's tax-exempt status.Your organization's employer identification number.The date the gift was received.A description of the gift and the amount received.More items...

A donor or donation acknowledgment letter, or charitable contribution acknowledgment letter, is a letter nonprofits send to thanking their donors for their gift. As we'll discuss below, it's also an opportunity for you to provide the official documentation required by the IRS to donors who have given a gift over $250.

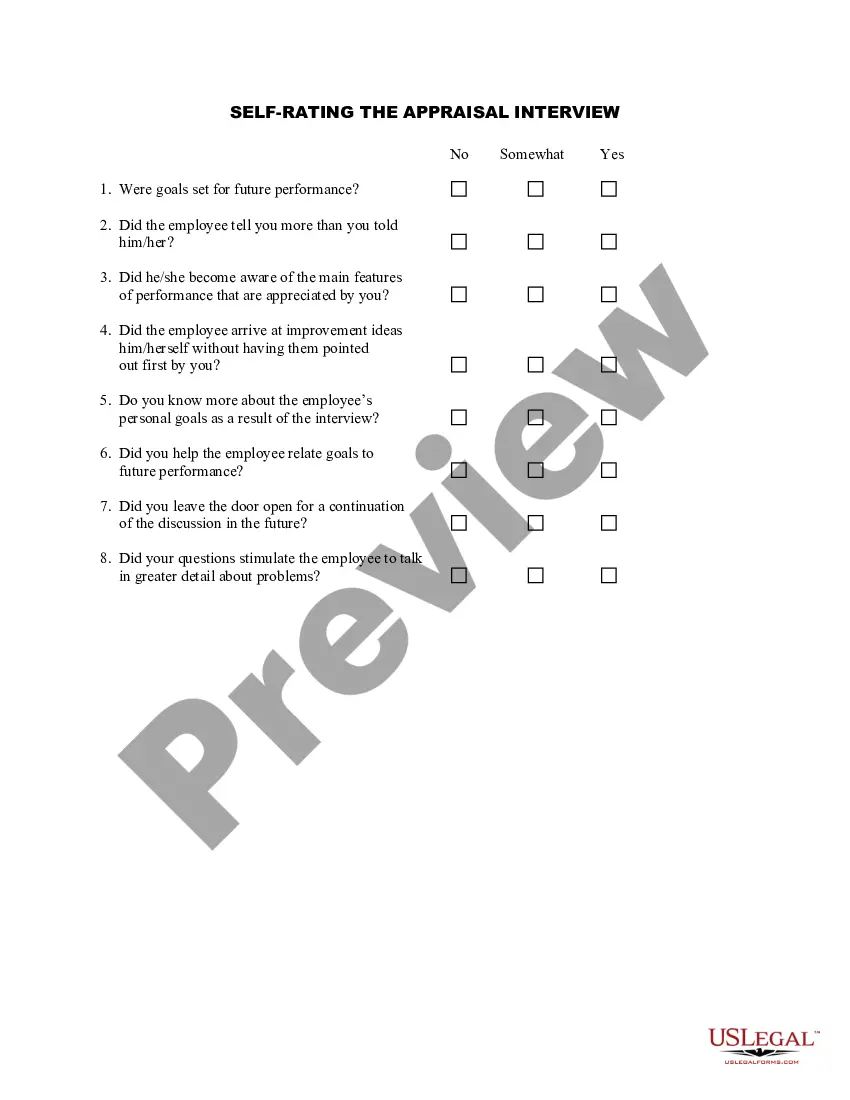

In order to maintain non-profit status, your church does not need to fill out a contribution statement at the end of the year. It is not a legal requirement, and there are no penalties for skipping this process. However, in lieu of community and tax deductions, you would be ill-advised not to.

1. How to write an Acknowledgment Letter?Name and details of the person who is sending the letter.Name and details of the recipient to whom the letter is been sent.Date of sending the acknowledgment letter.Subject stating the reason for writing it.Statement of confirmation of receipt of the item.More items...?

The accepted way to record in-kind donations is to set up a separate revenue account but the expense side of the transaction should be recorded in its functional expense account. For example, revenue would be recorded as Gifts In-Kind Services, and the expense would be recorded as Professional Services.

Any donations worth $250 or more must be recognized with a receipt. The charity receiving this donation must automatically provide the donor with a receipt. As a general rule a nonprofit organization should NOT place a value on what is donated (that is the responsibility of the donor).

Thank you for your great generosity! We, at charitable organization, greatly appreciate your donation, and your sacrifice. Your support helps to further our mission through general projects, including specific project or recipient. Your support is invaluable to us, thank you again!

A Contribution Statement is a listing of a contact's donations within a certain time-period (most commonly at year end). These statements would then be sent to the donor for tax purposes. You might also call this a tax receipt or a giving statement.