Subject: Tennessee Sample Letter to Beneficiaries Regarding Trust Money Disbursement Dear [Beneficiary's Name], We hope this letter finds you well. We are writing to provide you with important information regarding the disbursement of funds from the trust established by [Settler's Name] for the benefit of the beneficiaries, as governed by the laws of the state of Tennessee. First and foremost, we would like to inform you about the purpose of this trust and its objectives. The trust was created to secure financial stability and support for the beneficiaries, empowering them to pursue their dreams, educational endeavors, healthcare needs, and overall well-being. The trustee has diligently managed the trust's assets in accordance with the trust terms and applicable Tennessee laws. After a comprehensive review, it has been determined that the trust has successfully accumulated sufficient funds for distribution to the beneficiaries, including yourself. In compliance with trust guidelines, the trustee has prepared a detailed financial statement outlining the trust's current assets, expenses incurred and taxes paid, investment performance, and any disbursements made thus far. We encourage you to review this statement carefully, as it reflects the transparent handling of funds to date. Types of Tennessee Sample Letters to Beneficiaries regarding Trust Money: 1. Trust Fund Distribution Notification: If this is the first distribution from the trust, this letter serves as an official notification to inform you that the trustee has approved the disbursement of trust funds. Detailed instructions regarding the disbursement process, payment methods, tax implications, and any required paperwork will be provided to facilitate a smooth transaction. 2. Periodic Account Statement and Fund Update: This letter aims to keep beneficiaries informed about the trust's financial status, investment performance, and any changes in assets or liabilities. It will serve as a periodic update to ensure transparency and accountability in managing the trust. Moreover, it provides an opportunity for beneficiaries to request additional information, ask relevant questions, or address any concerns they may have. 3. Annual Tax reporting and K-1 Statement: This type of letter is issued annually to beneficiaries, explaining the trust's taxable income, deductions, credits, and distribution information. The letter will include a Schedule K-1 form, which outlines each beneficiary's share of taxable income and deductions for filing their individual tax returns. We understand that you may have specific questions or concerns about the trust or the disbursement process. In that regard, we encourage you to contact our office directly to schedule a meeting or speak with one of our trust officers. Please refer to the contact information provided below. Your financial well-being remains our priority, and we are committed to providing you with the utmost assistance and support throughout this process. The trust's success is a testament to the Settler's intentions, and we aim to ensure that our actions align with their vision. Thank you for your trust and cooperation. We look forward to serving you further and contributing to your financial security and personal growth. Sincerely, [Your Name] [Your Title/Position] [Contact Information]

Tennessee Sample Letter to Beneficiaries regarding Trust Money

Description

How to fill out Tennessee Sample Letter To Beneficiaries Regarding Trust Money?

Finding the right lawful record format can be a have a problem. Needless to say, there are tons of themes available on the Internet, but how do you discover the lawful type you will need? Use the US Legal Forms site. The service provides thousands of themes, including the Tennessee Sample Letter to Beneficiaries regarding Trust Money, which can be used for organization and personal requirements. Every one of the types are examined by professionals and meet up with state and federal requirements.

In case you are presently authorized, log in to your bank account and click on the Acquire switch to have the Tennessee Sample Letter to Beneficiaries regarding Trust Money. Make use of your bank account to look with the lawful types you possess acquired in the past. Visit the My Forms tab of your respective bank account and get yet another backup from the record you will need.

In case you are a new end user of US Legal Forms, listed here are straightforward directions so that you can comply with:

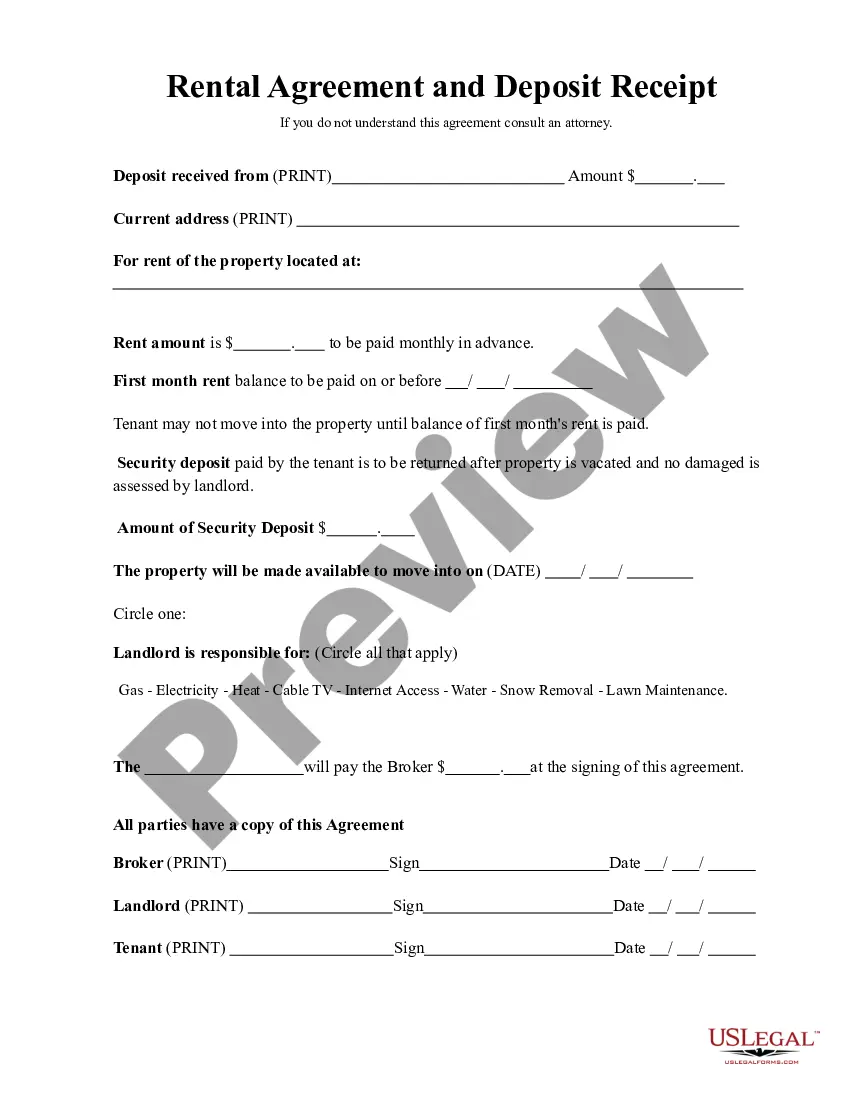

- Initially, ensure you have selected the proper type for your metropolis/area. You may look over the form while using Review switch and read the form description to make sure it will be the right one for you.

- In the event the type is not going to meet up with your needs, make use of the Seach discipline to get the appropriate type.

- When you are positive that the form is acceptable, go through the Acquire now switch to have the type.

- Pick the costs program you want and enter the essential details. Design your bank account and buy your order using your PayPal bank account or Visa or Mastercard.

- Opt for the data file structure and obtain the lawful record format to your system.

- Comprehensive, change and print and indicator the received Tennessee Sample Letter to Beneficiaries regarding Trust Money.

US Legal Forms is the largest catalogue of lawful types for which you can see various record themes. Use the company to obtain professionally-manufactured documents that comply with state requirements.

Form popularity

FAQ

Write the names of the first beneficiary(ies) you would like to receive your benefit after you die. You may name an individual(s), entity (such as a charity, business, religious organization, funeral home, etc.), trust, or estate. You may name more than one.

Examples of BENEFICIARY'S SIGNATURE in a sentence UNDERSIGNED PRINCIPAL(S) & BENEFICIARIES AGREE TO HOLD HARMLESS INSURER, ENTITY, FN OR ANY PERSON FROM ALL LIABILITY BY HONORING THIS POWER OF ATTORNEY, DISCLOSING INFORMATION & PAYING ASSIGNED AMOUNT TO FN.

The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Here are the essentials, in most states: Explain that the trust exists. ... Provide your name and contact information. ... Tell beneficiaries that they have the right to see a copy of the trust document and that you will send them one if they request it. ... Give the deadline for court challenges.

How to write a beneficiary letter List important contact information. ... Give specific and clear instructions. ... Address your beneficiary personally. ... Keep multiple copies. ... Check the letter annually and update as needed.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.

A good first step for the beneficiary is to meet with the trustee who is tasked with executing the terms of the trust. It may be an individual, such as a CPA or lawyer, family member, or potentially a corporate trustee such as Wells Fargo Bank.

Start by addressing the letter correctly, including the recipient's name, address, and contact information. Clearly state the purpose of the letter, which is to designate a beneficiary or beneficiaries for a specific matter, such as a life insurance policy or retirement account.