Tennessee Subrogation Agreement between Insurer and Insured is a legally binding contract that outlines the rights and obligations of both parties regarding the reimbursement of an insured party for damages or losses incurred. This agreement is commonly used in insurance claims when the insured party suffers losses that are covered by the insurance policy and the insurer seeks to recover the paid-out amount from a third party responsible for the damages. In Tennessee, there are different types of Subrogation Agreements that can be established between the insurer and insured depending on the specific circumstances of the claim. Some of these variations include: 1. Auto Insurance Subrogation Agreement: This type of agreement is typically applicable in cases where the insured's vehicle is involved in an accident caused by another party's negligence. The insurer, after paying the insured party for the damages, reserves the right to surrogate against the at-fault party to recover the paid-out amount. 2. Property Insurance Subrogation Agreement: When an insured property suffers damage due to events such as fire, theft, or natural disasters, this agreement becomes relevant. The insurer, upon compensating the insured, can surrogate against any responsible party, such as contractors, manufacturers, or other parties whose actions or products led to the loss. 3. Workers' Compensation Subrogation Agreement: In cases where an employee sustains injuries in the workplace, receives workers' compensation benefits, and another party is liable for the incident, a subrogation agreement may be used. The insurer, having compensated the injured worker, can then seek reimbursement from the accountable party. These subrogation agreements typically contain various essential provisions, including: — Parties involved: Clearly identifies the insurer and the insured party, establishing their legal relationship in the agreement. — Purpose: Outlines the intention of the agreement, highlighting that it enables the insurer to recover any amounts paid to the insured from third parties responsible for the damages. — Notice requirement: Specifies the obligations of both parties to notify each other promptly in case of any developments related to subrogation claims. — Cooperation: Requires the insured party to cooperate fully with the insurer during the subrogation process, including providing necessary information or testimony to support the claim. — Reimbursement and repayment terms: Details the conditions under which the insured party is obligated to reimburse the insurer if they recover funds from third-party sources. — Legal actions and rights: Outlines the insurer's authority to pursue legal actions on behalf of the insured and clarifies the insured party's right to intervene or be represented independently in such cases. It is essential to note that a Tennessee Subrogation Agreement may have additional provisions specific to the type of insurance policy being surrogate, and it should always be carefully reviewed and tailored to the individual circumstances of each case. Seeking legal advice and expertise is strongly recommended ensuring compliance with Tennessee laws and regulations.

Tennessee Subrogation Agreement between Insurer and Insured

Description

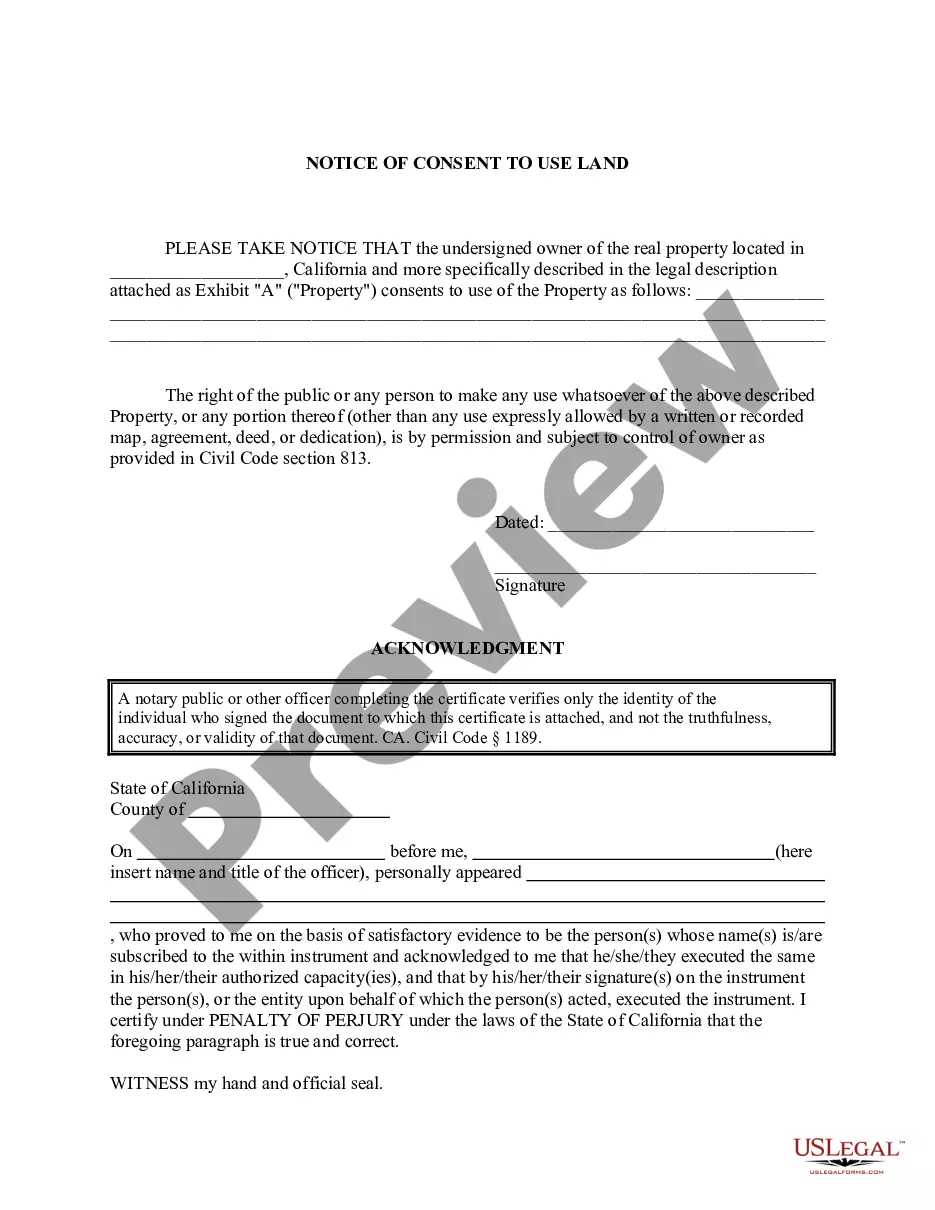

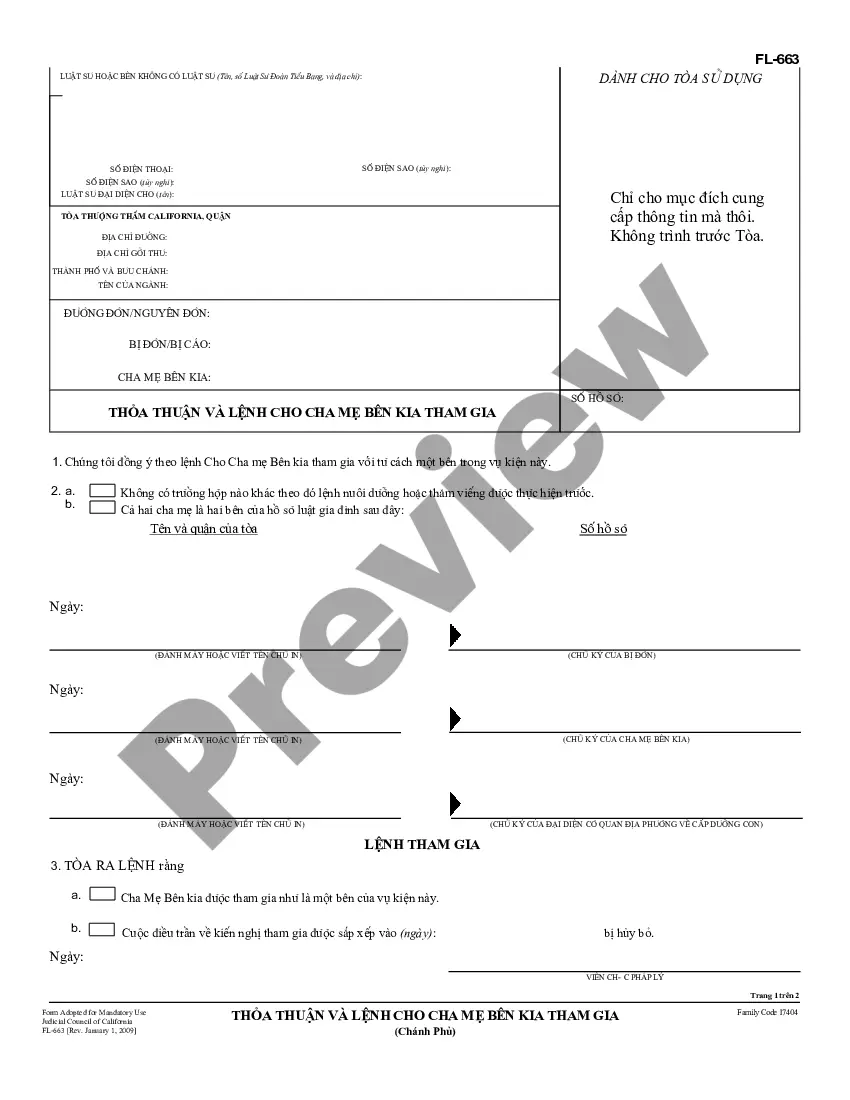

How to fill out Tennessee Subrogation Agreement Between Insurer And Insured?

Are you currently in the place the place you require files for possibly enterprise or person functions almost every day? There are a variety of legal papers layouts available online, but getting kinds you can rely isn`t straightforward. US Legal Forms offers 1000s of develop layouts, just like the Tennessee Subrogation Agreement between Insurer and Insured, which can be written to meet state and federal needs.

When you are currently informed about US Legal Forms web site and also have an account, just log in. Afterward, you may download the Tennessee Subrogation Agreement between Insurer and Insured web template.

Should you not have an account and want to begin using US Legal Forms, abide by these steps:

- Obtain the develop you will need and ensure it is for the appropriate metropolis/county.

- Make use of the Review button to review the form.

- Read the outline to actually have chosen the correct develop.

- In the event the develop isn`t what you`re seeking, make use of the Search area to obtain the develop that fits your needs and needs.

- Whenever you find the appropriate develop, click on Get now.

- Pick the rates strategy you would like, fill out the necessary info to generate your bank account, and pay for the order using your PayPal or bank card.

- Decide on a practical paper structure and download your copy.

Discover each of the papers layouts you might have bought in the My Forms menu. You may get a more copy of Tennessee Subrogation Agreement between Insurer and Insured any time, if necessary. Just click on the required develop to download or printing the papers web template.

Use US Legal Forms, the most comprehensive assortment of legal forms, to save efforts and stay away from blunders. The assistance offers appropriately produced legal papers layouts that can be used for a variety of functions. Make an account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

An insurance company may not subrogate against its own insured or a co-insured. However, when a party claiming to be a co-insured is merely a loss payee to which no liability coverage is afforded, subrogation is permissible.

When you file a claim, your insurer can try to recover costs from the person responsible for your injury or property damage. This is known as subrogation. For example: Your insurance company pays your doctor for your treatment following an auto accident that someone else caused.

Medical assistance paid to, or on behalf of, any recipient cannot be recovered from a beneficiary unless such assistance has been incorrectly paid, or, unless the recipient or beneficiary recovers or is entitled to recover from a third party reimbursement for all or part of the costs of care or treatment for the injury ...

An insurer may attempt to subrogate against an additional insured for completed operations injuries caused by the insured if the additional insured endorsement provides coverage only for ongoing operations injuries.

"Subrogation," or "subro" for short, refers to the right your insurance company holds under your policy ? after they've paid a covered claim ? to request reimbursement from the at-fault party. This reimbursement often comes from the at-fault party's insurance company.

Generally, in most subrogation cases, an individual's insurance company pays its client's claim for losses directly, then seeks reimbursement from the other party's insurance company. Subrogation is most common in an auto insurance policy but also occurs in property/casualty and healthcare policy claims.

In the event of payment to any person under the coverage required by this part, and subject to the terms and conditions of the coverage, the insurer making payment shall, to the extent of the coverage, be subrogated to all of the rights of the person to whom payment has been made, and shall be entitled to the proceeds ...

Subrogation refers to the right of an insurance company to recover money it paid to or on behalf of its insureds due to the actions of at-fault third parties.