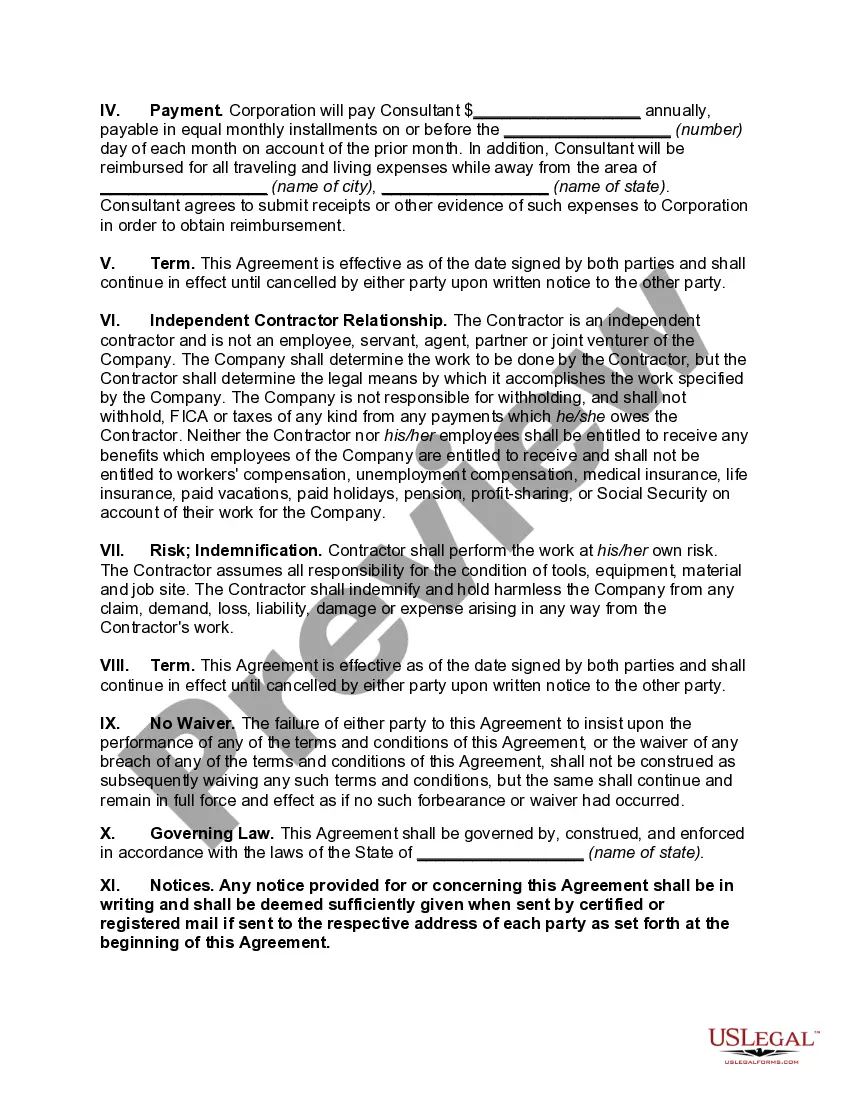

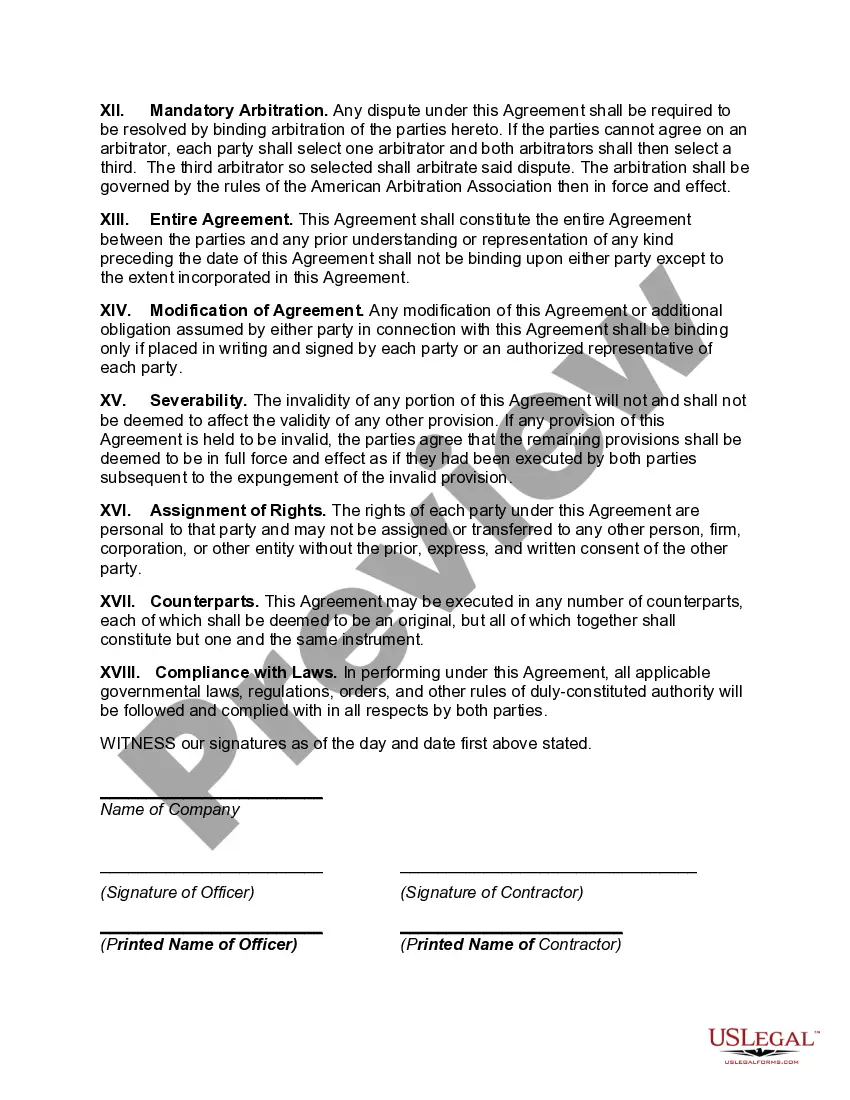

Tennessee Consulting Agreement with Independent Contractor

Description

How to fill out Consulting Agreement With Independent Contractor?

You can invest hours on the web attempting to locate the legal document template that fits the state and federal requirements you need.

US Legal Forms offers a vast array of legal forms that have been reviewed by experts.

You can easily download or print the Tennessee Consulting Agreement with Independent Contractor from the service.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Obtain button.

- After that, you can complete, modify, print, or sign the Tennessee Consulting Agreement with Independent Contractor.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your desired region/area.

- Review the document details to confirm that you have chosen the appropriate form.

Form popularity

FAQ

By Practical Law Employment. A contract for services between an independent contractor (a self-employed individual) and the client company for the provision of consultancy services.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The contractor isn't an employee of the company but works independently. The contractor provides services to the client under an Independent Contractor Agreement.

What is the difference between a Consultant and a Contractor? The short answer is that the Consultants role is evaluate a client's needs and provide expert advice and opinion on what needs to be done while the Contractors role is generally to evaluate the client's needs and actually perform the work.

Consultants Are Usually Self-Employed According to the IRS, you're self-employed if you're a business owner or contractor who provides services to other businesses. To remain a contractor rather than an employee, you must: Have the right to direct or control the work you perform.

In general, the difference is that the consultant's role is to evaluate a client's needs and provide expert advice and opinions on what needs to be done, while the contractors role is generally to evaluate the client's needs and actually perform the work.

You may have noticed already that consulting is a type of service. So, put simply, a consultancy agreement is a type of services agreement, specifically tailored between an outside consultant who provides business strategy advice to a client (the business owner).

Freelancers and consultants are known as "independent contractors" in legal terms. An independent contractor (IC) is a person who contracts to perform services for others without having the legal status of an employee.

What is a contractor contract? At the very basic level, a contract is a legally binding agreement between the client's organisation and the contractor or agency.