The Tennessee Renunciation of Legacy in Favor of Other Family Members is a legal process that allows an individual to voluntarily relinquish their right to receive an inheritance or legacy from a deceased family member. This action is taken with the intention of benefiting other family members who may be in greater need of the assets or who may be better equipped to manage and utilize the inheritance. By filing a Renunciation of Legacy in Tennessee, an individual effectively disclaims their legal entitlement to inherit any assets from the deceased family member's estate. This process is governed by the Tennessee Probate Code and must be done in accordance with the state's specific laws and regulations. There are a few different types of Renunciation of Legacy in the state of Tennessee. The most common is a straightforward renunciation, where an individual willingly and explicitly refuses their right to a bequest or legacy. This renunciation can be made for various reasons, such as a desire to prevent potential conflicts among family members or to redirect assets to those with greater financial need. Another type of Tennessee Renunciation of Legacy is conditional renunciation. In this scenario, an individual may relinquish their right to inheritance on the condition that certain requirements are met. For instance, they may stipulate that the assets should be used for a specific purpose or to benefit a specific family member, such as a minor child or a financially dependent relative. It is important to note that a Renunciation of Legacy in Tennessee is typically irrevocable once it has been filed, meaning that the individual cannot later change their mind and claim the inheritance. Therefore, anyone considering renunciation should carefully consider the potential implications and seek legal counsel to ensure they fully understand the ramifications of their decision. Overall, the Tennessee Renunciation of Legacy in Favor of Other Family Members provides individuals with a legal avenue to forfeit their inheritance in order to benefit other family members. This process allows for the equitable distribution of assets and can help prevent disputes or financial strain within families.

Tennessee Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Tennessee Renunciation Of Legacy In Favor Of Other Family Members?

It is possible to devote time on the web trying to find the legal record web template that meets the state and federal demands you need. US Legal Forms offers 1000s of legal types which can be evaluated by experts. It is possible to download or print the Tennessee Renunciation of Legacy in Favor of Other Family Members from your assistance.

If you already possess a US Legal Forms profile, you may log in and then click the Obtain key. Next, you may comprehensive, edit, print, or indicator the Tennessee Renunciation of Legacy in Favor of Other Family Members. Each and every legal record web template you buy is yours for a long time. To get another copy of any obtained develop, visit the My Forms tab and then click the related key.

If you use the US Legal Forms site initially, keep to the straightforward directions listed below:

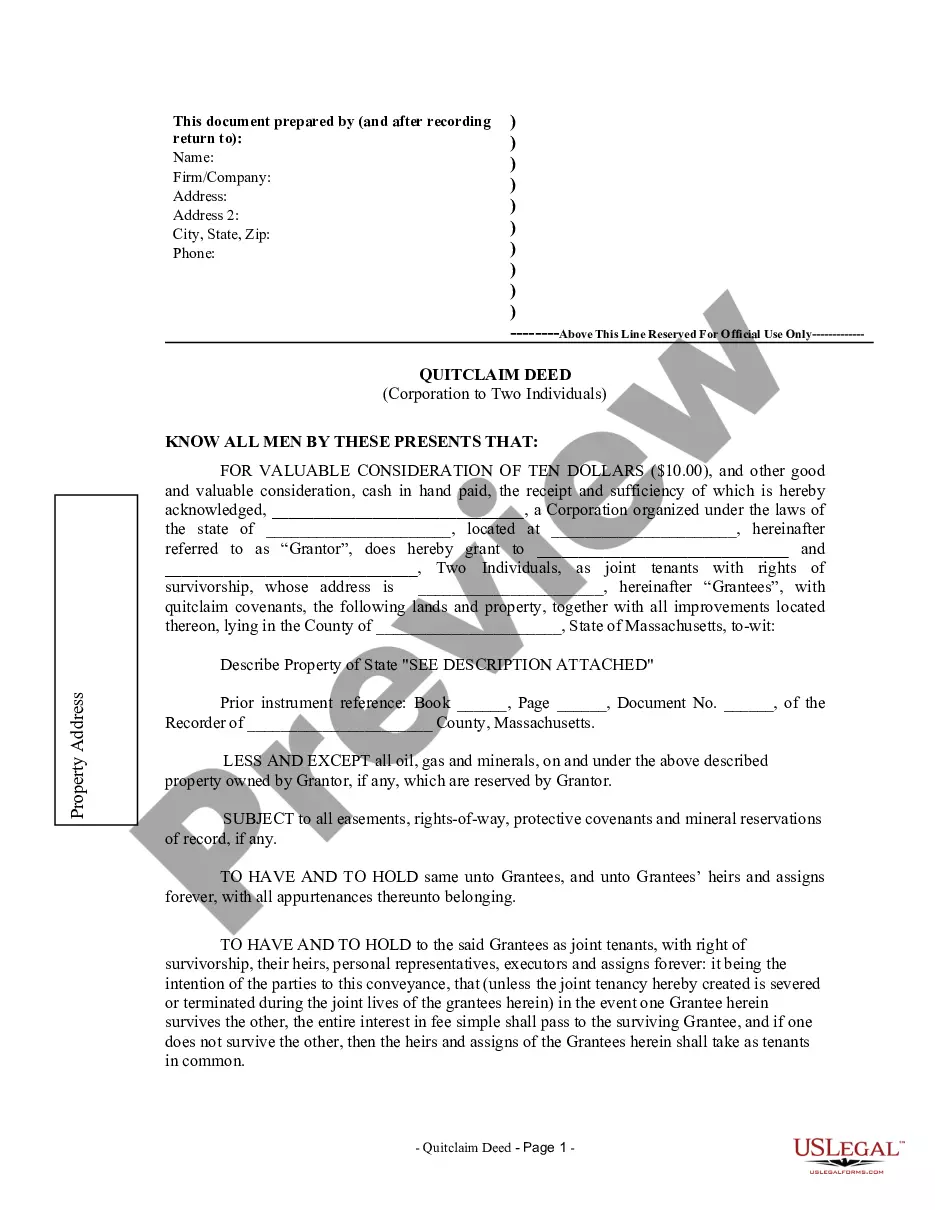

- First, make certain you have chosen the proper record web template for that county/area of your choosing. See the develop information to ensure you have picked the appropriate develop. If readily available, make use of the Review key to appear from the record web template at the same time.

- If you wish to find another variation in the develop, make use of the Search industry to obtain the web template that fits your needs and demands.

- Upon having located the web template you would like, click on Buy now to move forward.

- Pick the pricing prepare you would like, type in your qualifications, and sign up for a free account on US Legal Forms.

- Full the purchase. You may use your charge card or PayPal profile to cover the legal develop.

- Pick the formatting in the record and download it in your gadget.

- Make alterations in your record if necessary. It is possible to comprehensive, edit and indicator and print Tennessee Renunciation of Legacy in Favor of Other Family Members.

Obtain and print 1000s of record web templates utilizing the US Legal Forms site, which provides the most important collection of legal types. Use expert and status-distinct web templates to deal with your small business or individual requires.