Tennessee Sample Letter for Complaint to Close Estate and Judgment Closing Estate

Description

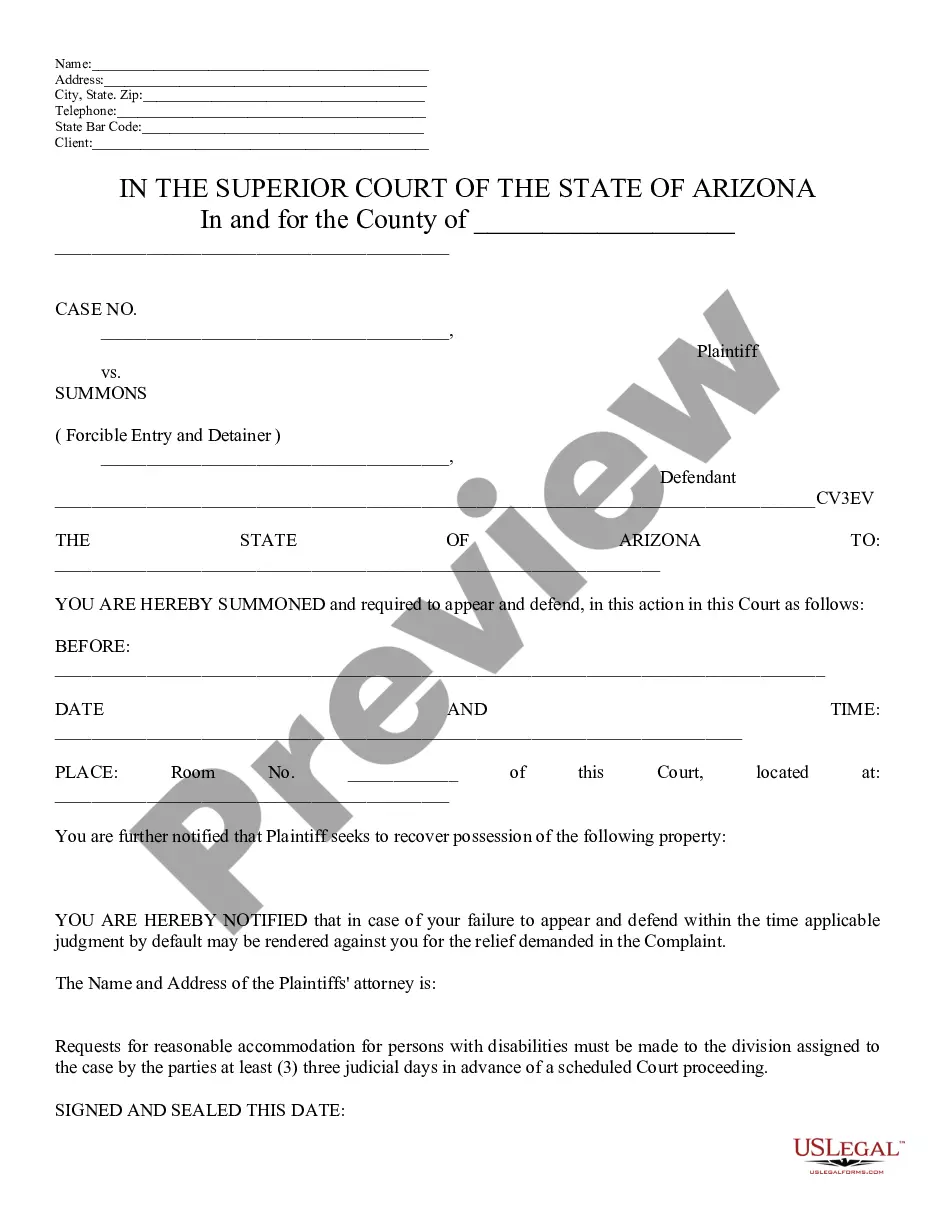

How to fill out Sample Letter For Complaint To Close Estate And Judgment Closing Estate?

You are able to invest hrs online looking for the lawful record template that meets the state and federal requirements you require. US Legal Forms provides thousands of lawful forms that are evaluated by pros. It is simple to down load or printing the Tennessee Sample Letter for Complaint to Close Estate and Judgment Closing Estate from my assistance.

If you already possess a US Legal Forms bank account, you may log in and click on the Down load key. Next, you may total, modify, printing, or signal the Tennessee Sample Letter for Complaint to Close Estate and Judgment Closing Estate. Each and every lawful record template you get is your own property forever. To acquire another copy of any purchased kind, proceed to the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms website the first time, stick to the straightforward guidelines beneath:

- Very first, make certain you have selected the best record template for your county/area that you pick. Read the kind description to make sure you have chosen the appropriate kind. If offered, take advantage of the Review key to appear with the record template too.

- If you wish to locate another model from the kind, take advantage of the Research area to discover the template that meets your needs and requirements.

- When you have identified the template you want, click Purchase now to move forward.

- Choose the costs strategy you want, key in your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal bank account to cover the lawful kind.

- Choose the formatting from the record and down load it to your gadget.

- Make modifications to your record if required. You are able to total, modify and signal and printing Tennessee Sample Letter for Complaint to Close Estate and Judgment Closing Estate.

Down load and printing thousands of record templates utilizing the US Legal Forms web site, that offers the greatest collection of lawful forms. Use professional and condition-certain templates to deal with your company or personal needs.

Form popularity

FAQ

Tennessee Executor's Deed. An executor's deed is a legal document used to transfer real estate from an estate to an heir or beneficiary after the death of the former owner. The executor prepares the deed and submits it to the probate court for approval.

Unfortunately, Tennessee does not allow transfer-on-death deeds, a popular tool used to efficiently distribute real property in other states.

To close the estate, the executor must fill out and sign a final accounting form, documenting all payments from the estate. The accounting form is sent to all the beneficiaries named in the will, and if they agree that the information it contains is correct, they must also sign the form.

An affidavit of heirship is the simplest way of transferring real property after a person has passed away. When a person dies in Tennessee without a will, real estate immediately vests in the heirs of the decedent.

(B) If a creditor receives actual notice less than sixty (60) days before the date that is twelve (12) months from the decedent's date of death or receives no notice, the creditor's claim shall be barred unless filed within twelve (12) months from the decedent's date of death.

If a person passes away without leaving a will in Tennessee, the real property they owned is immediately transferred to their heirs.

Once the executor receives authority to manage the estate, they have 60 days to file an inventory of the estate with the probate court. Creditors then have up to 12 months to enter their claims on the record.