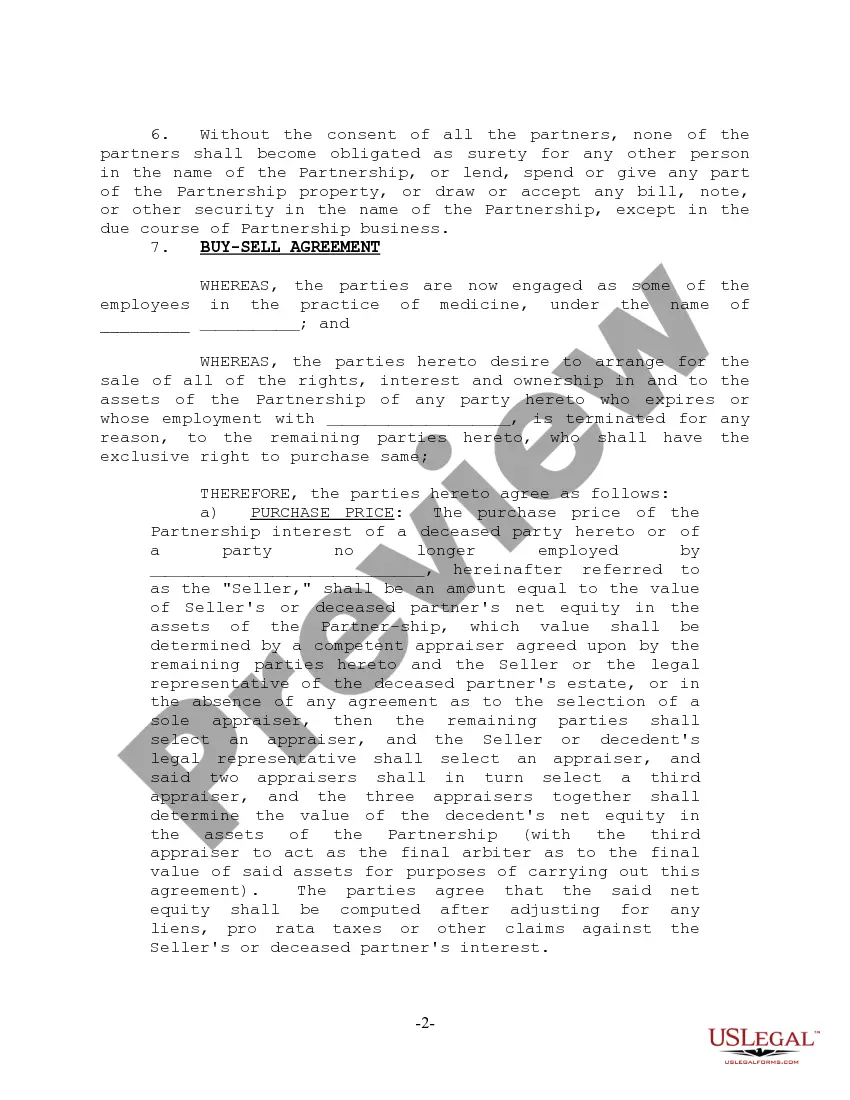

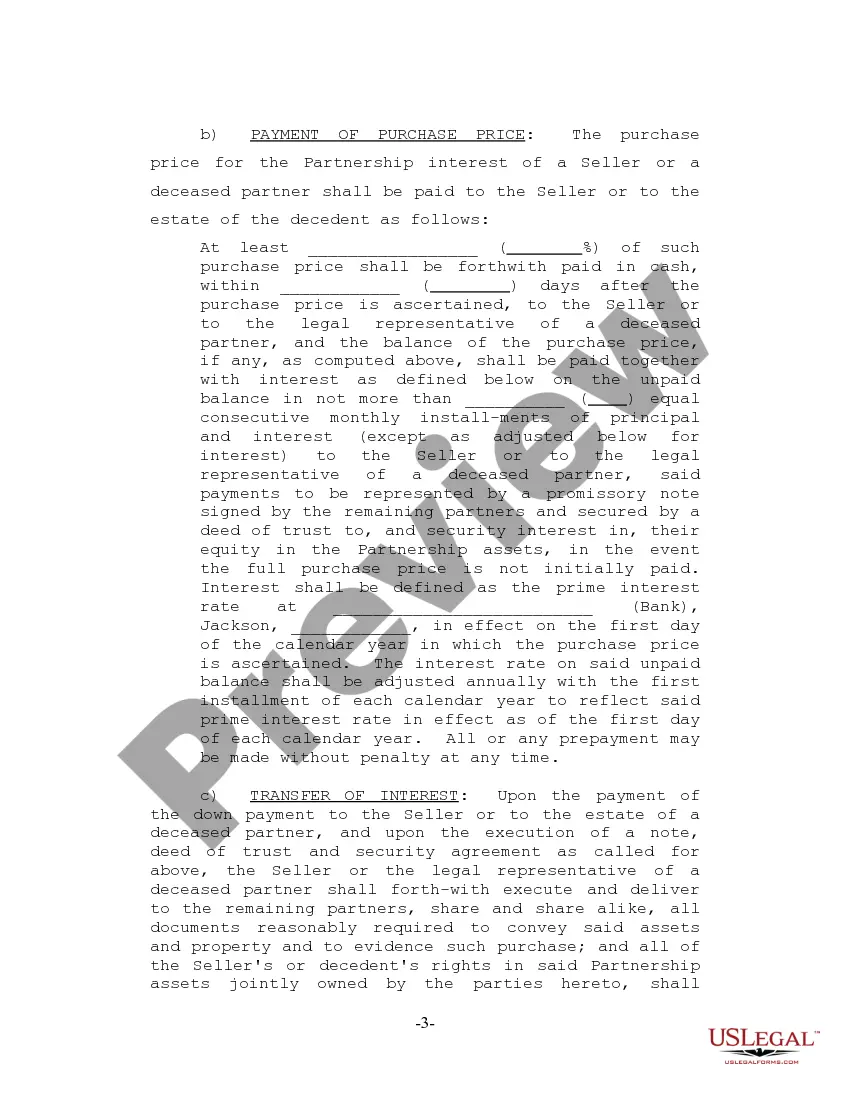

The Tennessee Partnership Agreement for Home Purchase is a legally binding contract between two or more parties who have decided to join forces to purchase a home together in the state of Tennessee. This agreement outlines the terms and conditions under which the partnership will operate, defining each party's rights, responsibilities, and obligations. One type of Tennessee Partnership Agreement for Home Purchase is the Co-Ownership Agreement. This agreement is typically used when multiple individuals want to jointly own a property but do not necessarily wish to form a long-term partnership or share financial responsibilities outside the home purchase. Another type of Tennessee Partnership Agreement for Home Purchase is the Joint Venture Agreement. This type of agreement is commonly used when investors or real estate developers come together to pool resources and expertise for the purpose of purchasing a property with the intention of generating profits through either rental income or property appreciation. The Tennessee Partnership Agreement for Home Purchase covers various important details and provisions related to the partnership, including: 1. Identification of the Parties: The partnership agreement clearly identifies all parties involved in the transaction, including their names, addresses, and contact information. 2. Financial Contributions: The agreement specifies the amount of money each party will contribute towards the purchase of the property, including down payments, mortgage payments, and closing costs. 3. Property Ownership: The agreement outlines how ownership percentages will be divided among the parties, outlining their respective shares in the property. 4. Decision-Making Process: The partnership agreement establishes a decision-making process, stipulating how major decisions such as property management, improvements, or potential sale will be made. It may include voting rights, alternative dispute resolution methods, or appointing a managing partner to make decisions on behalf of the partnership. 5. Financial Responsibilities: The agreement details the parties' financial responsibilities, including mortgage payments, property taxes, insurance, maintenance, repairs, and utilities. It may also establish a system for collecting and distributing rental income or sharing profits in case of a sale. 6. Insurance and Liability: This part of the agreement addresses insurance coverage for the property and outlines liability protections for each party, ensuring that potential risks are properly allocated and managed. 7. Exit Strategy: The partnership agreement may include provisions for the termination or dissolution of the partnership, including procedures for selling the property, buyout options for one party, or transferring ownership to another party. It is vital for anyone considering entering into a Tennessee Partnership Agreement for Home Purchase to consult with a qualified attorney to ensure the agreement effectively meets their specific needs and protects their interests.

Tennessee Partnership Agreement for Home Purchase

Description

How to fill out Partnership Agreement For Home Purchase?

Finding the right lawful document template could be a struggle. Obviously, there are tons of themes available on the Internet, but how would you obtain the lawful type you will need? Make use of the US Legal Forms internet site. The assistance provides a huge number of themes, such as the Tennessee Partnership Agreement for Home Purchase, that you can use for business and personal demands. Each of the kinds are inspected by pros and fulfill federal and state needs.

If you are currently listed, log in for your profile and click on the Acquire button to have the Tennessee Partnership Agreement for Home Purchase. Make use of your profile to look from the lawful kinds you might have purchased in the past. Visit the My Forms tab of the profile and have an additional duplicate in the document you will need.

If you are a fresh end user of US Legal Forms, listed below are easy directions for you to adhere to:

- Initially, make certain you have selected the right type for your city/county. You are able to look over the form while using Preview button and browse the form description to make sure this is the right one for you.

- In case the type does not fulfill your expectations, make use of the Seach industry to obtain the proper type.

- When you are certain the form is acceptable, click on the Acquire now button to have the type.

- Select the pricing prepare you desire and enter in the essential info. Build your profile and purchase the order with your PayPal profile or bank card.

- Choose the submit structure and down load the lawful document template for your system.

- Full, modify and print and signal the received Tennessee Partnership Agreement for Home Purchase.

US Legal Forms is definitely the most significant local library of lawful kinds in which you can find various document themes. Make use of the service to down load professionally-manufactured documents that adhere to express needs.

Form popularity

FAQ

Tennessee: Real estate attorneys are not essential for closing but may be advised by your real estate agent. Texas: Real estate attorneys are not essential for closing but may be advised by your real estate agent. Utah: Real estate attorneys are not essential for closing but may be advised by your real estate agent.

An Tennessee general partnership is an association of two or more persons to carry on as co-owners of a business for profit, with such associates sharing in the management and control of its activities, and dividing its profits among themselves.

Tennessee does not require a licensed attorney to conduct closings, in many title companies across the state of Tennessee, closings are performed by non-attorney staff members, and an attorney may not even be located in the office.

You can get out of a real estate contract in Tennessee during several stages of the buying process. First, the offer must be accepted to make it binding. If the seller rejects the offer, the buyer can make a counter-offer or leave the deal.

Partnership: To create a general partnership in Tennessee, you don't need to file any organizational documents with the state. Although not legally required, all partnerships should have a written partnership agreement. The partnership agreement can be very helpful if there is ever a dispute among the partners.

Unlike some states, Tennessee does not require buyers to involve a lawyer in the house-buying transaction.

An attorney is legally authorized to review any documents and contracts involved in selling or purchasing property. Although Tennessee does not hiring require a real estate lawyer for a commercial or home closing, it is strongly recommended.

It is not mandatory to register a partnership firm as per the provisions of the Partnership Act, 1932. However, it is better to register a partnership firm. If the firm is not registered it cannot avail any legal benefits provided to the firm under the Partnership Act, 1932.

All business types, except sole-proprietors and general partnerships, must also register for the payment of franchise and excise taxes.

The state of Tennessee does not have a general business license that all general partnerships are required to obtain. However, depending on what industry you operate in, your business may need licenses or permits to enable you to run your company in a compliant fashion.