A Tennessee LLC Operating Agreement for S Corp is a legal document that outlines the rules, regulations, and management structure of a Limited Liability Company (LLC) operating as an S Corporation in the state of Tennessee. This agreement is important as it provides a framework for how the LLC should be operated and helps establish the rights and responsibilities of its members. Key elements typically covered in a Tennessee LLC Operating Agreement for S Corp include: 1. Formation: The agreement will specify the name and address of the LLC, the purpose for which it is being formed, and the duration of its existence. 2. Ownership and Membership: It will outline the ownership interests held by each member, their initial capital contributions, and any additional contributions they may make. This section may also include provisions for admitting new members or transferring membership interests. 3. Management and Decision-making: The agreement will define whether the LLC will be member-managed or manager-managed, outlining the powers and duties of managers (if applicable). It will also detail the decision-making processes, such as voting rights and procedures for member meetings. 4. Profits, Losses, and Distributions: The agreement will specify how profits and losses will be allocated among the members, typically based on their ownership percentages. It will also outline the distribution of assets upon dissolution or withdrawal of a member. 5. Taxation: As an S Corporation, the LLC operating agreement will address the specific tax treatment and requirements for the company, including the ability to pass profits and losses through to the members' personal tax returns. 6. Dissolution and Dispute Resolution: The agreement will outline the procedures for dissolving the LLC and provide guidance on resolving disputes among members, including provisions for mediation or arbitration. Types of Tennessee LLC Operating Agreements for S Corp: 1. Single-Member LLC Operating Agreement: This type of agreement is designed for LCS with only one member or owner. It outlines the rights and responsibilities of the sole owner, and may differ from agreements involving multiple members. 2. Multi-Member LLC Operating Agreement: This agreement is tailored for LCS with two or more members. It addresses the interaction and governance of multiple owners, their respective roles, and the decision-making process. In conclusion, a Tennessee LLC Operating Agreement for S Corp is a comprehensive legal document that establishes the structure, management, and operation of an LLC operating as an S Corporation in the state of Tennessee. Whether it is a single-member or multi-member agreement, having a well-drafted and customized operating agreement is crucial to ensure smooth and compliant business operations.

Tennessee LLC Operating Agreement for S Corp

Description

How to fill out Tennessee LLC Operating Agreement For S Corp?

You are able to invest hrs online attempting to find the authorized record design that meets the state and federal needs you require. US Legal Forms supplies a large number of authorized forms that happen to be examined by professionals. You can actually download or print out the Tennessee LLC Operating Agreement for S Corp from your assistance.

If you already possess a US Legal Forms profile, you can log in and click the Download button. Following that, you can total, edit, print out, or sign the Tennessee LLC Operating Agreement for S Corp. Every authorized record design you get is your own permanently. To get an additional copy for any purchased develop, proceed to the My Forms tab and click the corresponding button.

If you use the US Legal Forms site the very first time, stick to the straightforward guidelines beneath:

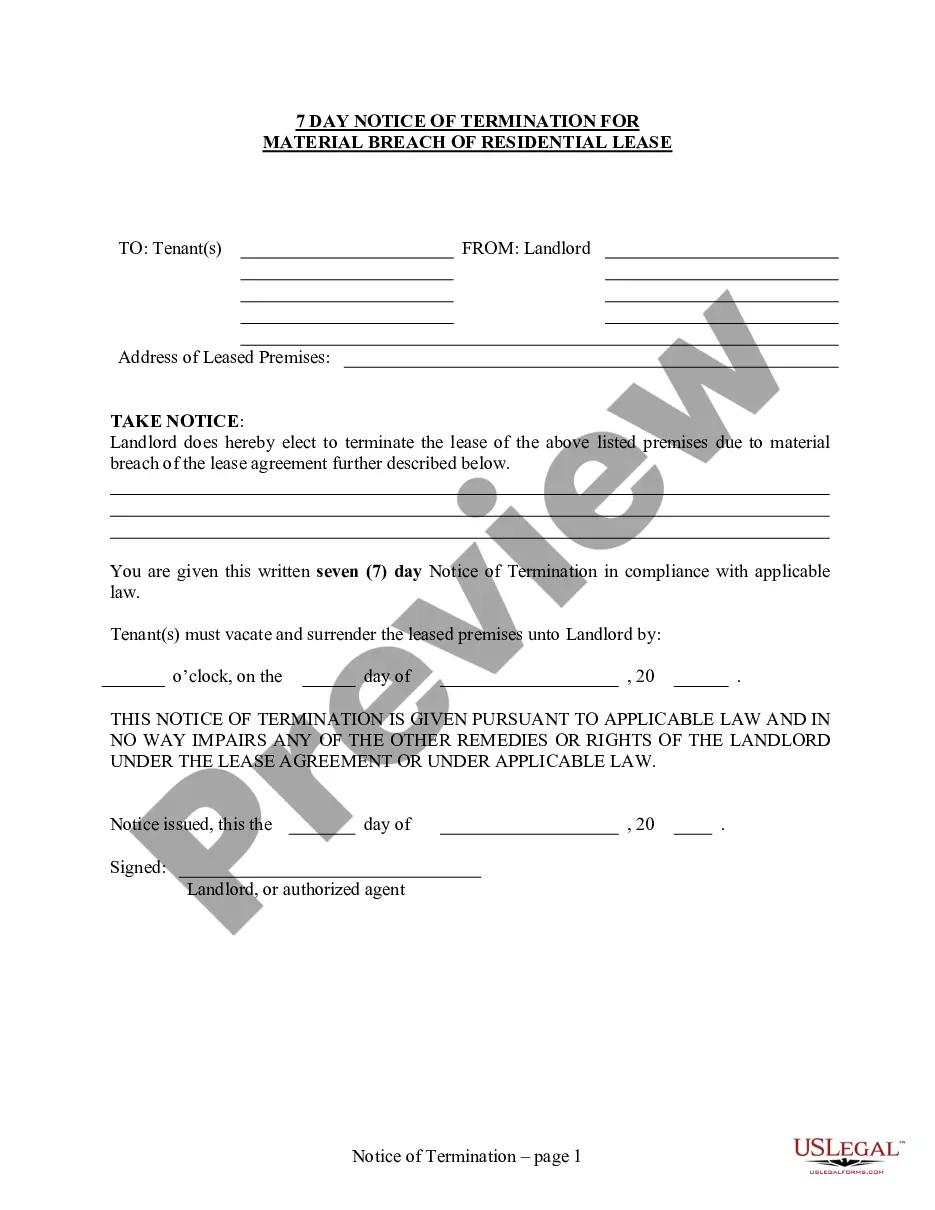

- Very first, make certain you have selected the proper record design for that region/city of your choosing. Browse the develop explanation to make sure you have selected the appropriate develop. If accessible, take advantage of the Preview button to appear throughout the record design at the same time.

- If you wish to find an additional variation of the develop, take advantage of the Look for area to obtain the design that suits you and needs.

- Upon having found the design you would like, simply click Acquire now to continue.

- Find the rates prepare you would like, key in your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You may use your charge card or PayPal profile to purchase the authorized develop.

- Find the formatting of the record and download it in your product.

- Make alterations in your record if possible. You are able to total, edit and sign and print out Tennessee LLC Operating Agreement for S Corp.

Download and print out a large number of record layouts while using US Legal Forms website, that offers the greatest selection of authorized forms. Use skilled and state-specific layouts to deal with your business or specific requirements.