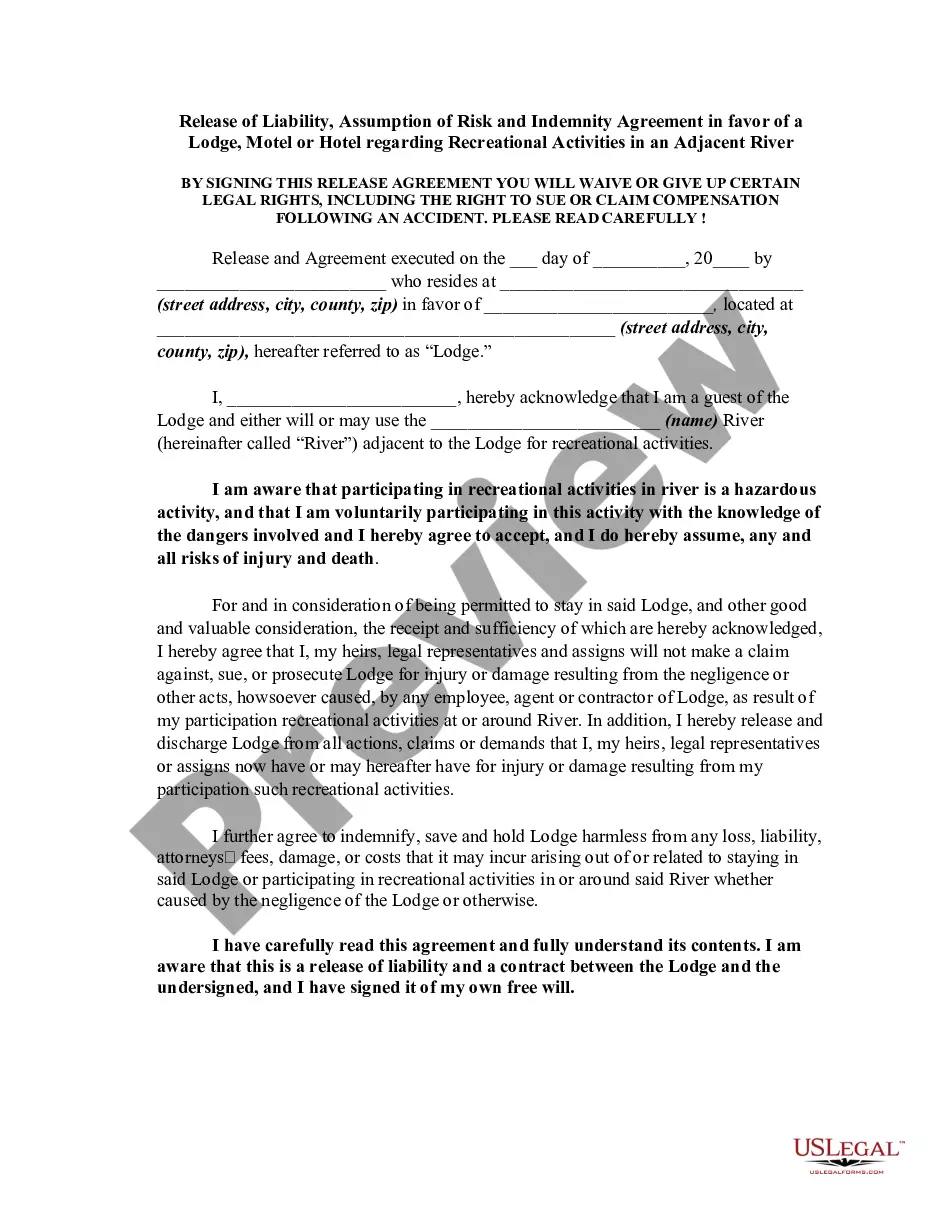

The Tennessee Indemnification Agreement for a Trust is a legal document that provides protection and indemnification to trustees in the state of Tennessee. It outlines the terms and conditions under which trustees can be reimbursed and protected from any liability or loss incurred while carrying out their duties. An indemnification agreement is a crucial component of establishing a trust as it ensures that trustees can perform their fiduciary responsibilities without fear of personal financial loss. This agreement serves as a form of insurance for trustees, safeguarding them against potential legal actions, disputes, or financial risks that may arise during the administration of the trust. Key elements included in a Tennessee Indemnification Agreement may encompass the scope of indemnification, the conditions under which indemnification is provided, procedures for making claims, and the limits of indemnification. The agreement typically specifies that trustees are entitled to indemnification for any expenses incurred, including but not limited to legal fees, court costs, and settlements or judgments resulting from lawsuits or legal actions related to the trust. It is important to note that there are various types of Tennessee Indemnification Agreements for a Trust, each tailored to different types of trusts. Some notable types include: 1. Revocable Living Trust Indemnification Agreement: This agreement applies to trusts that can be altered, amended, or revoked during the granter's lifetime. It offers protection and reimbursement for the trustee while they oversee and manage the assets held within the trust. 2. Irrevocable Trust Indemnification Agreement: Irrevocable trusts cannot be modified or terminated without the consent of the beneficiaries. The indemnification agreement for an irrevocable trust provides similar protections as the revocable living trust agreement, but with a focus on ensuring the trustee's liability is minimized in light of the irrevocable nature of the trust. 3. Charitable Trust Indemnification Agreement: This agreement is specific to trusts created for charitable purposes, such as foundations or charitable organizations. Trustees of charitable trusts face unique challenges and risks, thus requiring a tailored indemnification agreement to protect them during their tenure. In summary, the Tennessee Indemnification Agreement for a Trust is a vital legal document that safeguards trustees from personal financial loss and liability while fulfilling their fiduciary duties. Through this agreement, trustees can confidently administer trusts in Tennessee knowing they have legal support and reimbursement for any expenses incurred.

Tennessee Indemnification Agreement for a Trust

Description

How to fill out Tennessee Indemnification Agreement For A Trust?

Have you been within a situation where you will need papers for both enterprise or specific functions virtually every day time? There are plenty of legal document themes available on the net, but discovering versions you can depend on is not effortless. US Legal Forms provides a huge number of type themes, much like the Tennessee Indemnification Agreement for a Trust, that are composed in order to meet state and federal needs.

If you are already acquainted with US Legal Forms web site and have your account, simply log in. Next, it is possible to obtain the Tennessee Indemnification Agreement for a Trust web template.

Should you not provide an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Obtain the type you require and ensure it is for your right area/state.

- Use the Review switch to review the form.

- Read the description to actually have chosen the right type.

- In the event the type is not what you`re trying to find, utilize the Search discipline to discover the type that meets your needs and needs.

- Whenever you find the right type, click Buy now.

- Choose the costs program you desire, complete the desired details to create your account, and purchase an order with your PayPal or bank card.

- Select a handy data file format and obtain your copy.

Find all of the document themes you may have purchased in the My Forms menus. You can obtain a further copy of Tennessee Indemnification Agreement for a Trust anytime, if necessary. Just select the necessary type to obtain or print out the document web template.

Use US Legal Forms, the most comprehensive collection of legal types, to save time as well as avoid mistakes. The services provides expertly made legal document themes which you can use for a variety of functions. Produce your account on US Legal Forms and initiate producing your life a little easier.