Title: Tennessee Notice of Special Stockholders' Meeting to Consider Recapitalization — A Comprehensive Overview Keywords: Tennessee, Notice, Special Stockholders' Meeting, Recapitalization, Details, Agenda, Proxy, Vote, Shareholders, Types Introduction: The Tennessee Notice of Special Stockholders' Meeting to Consider Recapitalization is a formal communication sent to shareholders, informing them about the upcoming meeting discussing the possibility of recapitalizing the company. This detailed description will provide a comprehensive overview of what this notice entails, its significance, and the different types it may come in. 1. Purpose of the Notice: The primary purpose of the Tennessee Notice of Special Stockholders' Meeting is to notify shareholders of the upcoming gathering. Specifically, this particular notice focuses on discussing the potential recapitalization of the company. Recapitalization involves altering the financial structure of a company, often aiming to optimize its capital base, debt structure, or equity distribution. 2. Detailed Agenda for the Meeting: The notice will provide a comprehensive agenda detailing the topics that will be discussed during the Special Stockholders' Meeting. Some potential agenda items may include: a) Presentation of recapitalization proposal: This section will outline the specific recapitalization plan being considered by the company. b) Rationale behind recapitalization: The notice may explain the reasons and benefits driving the proposed recapitalization, such as creating a more favorable capital structure, enhancing financial flexibility, or facilitating growth opportunities. c) Potential impacts and risks: Shareholders will be informed about the potential effects, both positive and negative, that recapitalization might have on various aspects of the company, such as taxation, financial ratios, or existing shareholder rights. d) Voting procedures: The notice will detail the procedures for voting during the meeting, including any requirements for proxy voting or attending in person. 3. Proxy Voting Information: If applicable, the notice will emphasize the importance of shareholders' active participation. It may provide instructions on how to appoint a proxy to vote on their behalf if they are unable to attend the meeting. Shareholders will be informed of the deadline for submitting proxy forms and the process for revoking or changing proxy instructions. 4. Shareholder Engagement: The notice might outline opportunities for shareholders to engage with the board of directors or management. It may indicate relevant contact information or specify the availability of additional materials, such as an investor presentation or a Q&A session, to address any concerns or queries about the proposed recapitalization. Different Types of Tennessee Notice of Special Stockholders' Meeting to Consider Recapitalization: — Initial notice: This type of notice is the first communication sent to shareholders, informing them of the upcoming Special Stockholders' Meeting to discuss recapitalization. — Amendment notice: In case of any changes or updates to the meeting's agenda or logistics, an amendment notice is issued with the modified information. — Final notice: This notice is sent as a final reminder to ensure shareholders are aware of the meeting, its date, time, and location, and to encourage attendance or proxy voting. In conclusion, the Tennessee Notice of Special Stockholders' Meeting to Consider Recapitalization serves as an essential communication tool for companies to notify shareholders about an upcoming meeting focused on discussing the potential recapitalization of the company. It outlines the meeting's agenda, provides voting instructions, and highlights the importance of active shareholder engagement.

Tennessee Notice of Special Stockholders' Meeting to Consider Recapitalization

Description

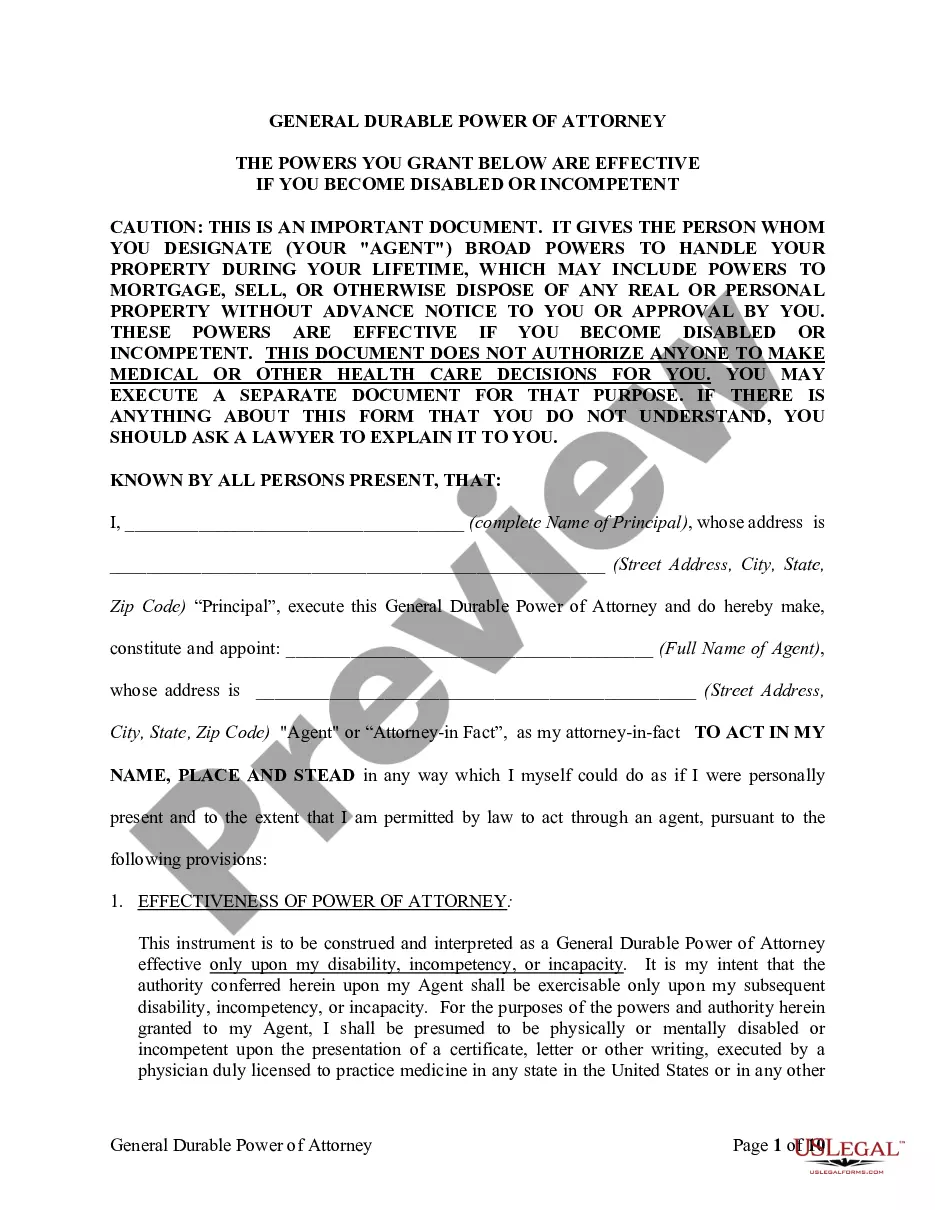

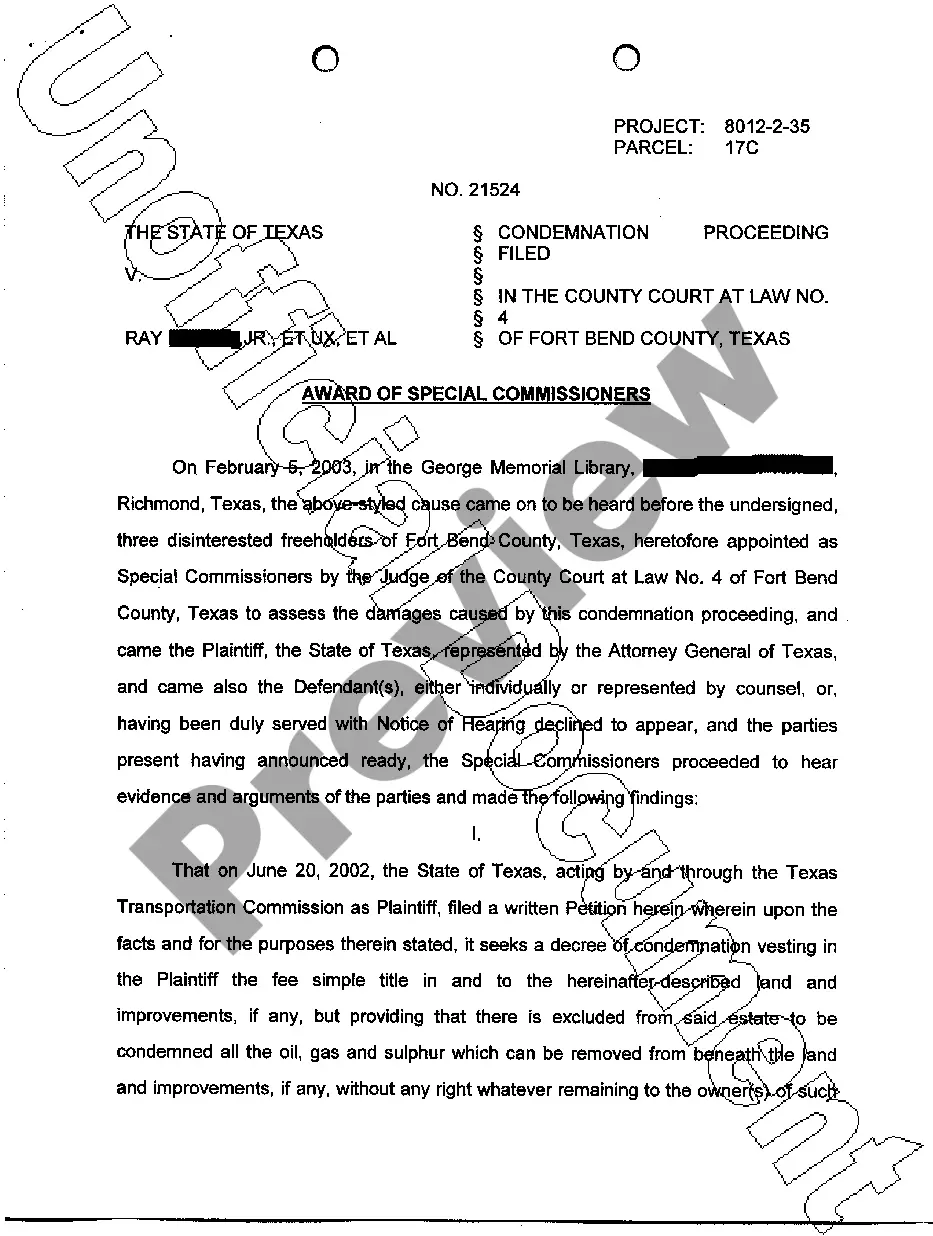

How to fill out Tennessee Notice Of Special Stockholders' Meeting To Consider Recapitalization?

Finding the right lawful papers format can be quite a have a problem. Obviously, there are a variety of web templates available online, but how do you get the lawful type you want? Make use of the US Legal Forms web site. The services provides a large number of web templates, including the Tennessee Notice of Special Stockholders' Meeting to Consider Recapitalization, which can be used for enterprise and personal needs. Every one of the kinds are checked out by specialists and meet state and federal demands.

If you are already authorized, log in to the profile and click on the Acquire switch to obtain the Tennessee Notice of Special Stockholders' Meeting to Consider Recapitalization. Make use of your profile to appear with the lawful kinds you possess purchased earlier. Proceed to the My Forms tab of your profile and get one more duplicate of the papers you want.

If you are a brand new user of US Legal Forms, here are easy guidelines for you to comply with:

- Initial, ensure you have selected the right type to your metropolis/county. You may look over the shape while using Review switch and study the shape description to make certain this is basically the right one for you.

- When the type will not meet your needs, take advantage of the Seach industry to discover the proper type.

- Once you are sure that the shape is proper, click the Buy now switch to obtain the type.

- Pick the rates program you desire and type in the needed details. Create your profile and purchase the order with your PayPal profile or Visa or Mastercard.

- Select the document file format and obtain the lawful papers format to the device.

- Comprehensive, edit and printing and signal the obtained Tennessee Notice of Special Stockholders' Meeting to Consider Recapitalization.

US Legal Forms will be the largest local library of lawful kinds for which you can find numerous papers web templates. Make use of the company to obtain appropriately-manufactured paperwork that comply with condition demands.

Form popularity

FAQ

Proxy statements must disclose the company's voting procedure, nominated candidates for its board of directors, and compensation of directors and executives. The proxy statement must disclose executives' and directors' compensation, including salaries, bonuses, equity awards, and any deferred compensation.

A proxy statement is a document that provides shareholders information and details on matters that will be brought up and voted on at an annual or special meeting. A merger occurs when two existing companies agree to combine to form one new company.

These rules get their name from the common practice of management asking shareholders to provide them with a document called a proxy card granting authority to vote the shareholders' shares at the meeting.

Special meetings of directors or members shall be held at any time deemed necessary or as provided in the bylaws: Provided, however, That at least one (1) week written notice shall be sent to all stockholders or members, unless a different period is provided in the bylaws, law or regulation.

Issues covered in a proxy statement can include proposals for new additions to the board of directors, information on directors' salaries, information on bonus and options plans for directors, corporate actions like proposed mergers or acquisitions, dividend payouts, and any other declarations made by the company's

A proxy is an SEC filing (called the 14A) that is required when a public company does something that its shareholders have to vote on, such as getting acquired. For a vote on a proposed merger, the proxy is called a merger proxy (or a merger prospectus if the proceeds include acquirer stock) and is filed as a DEFM14A.

A proxy statement is a document containing information that the Securities and Exchange Commission requires public companies to disclose to shareholders when requesting votes ahead of an annual meeting.

Definition. A person designated by another to attend a shareholders' meeting and vote on their behalf. A proxy can be revoked at any time by the grantor, unless it has been coupled with an interest.

Proxy materials are provided by companies to all shareholders before the annual shareholder meeting. These materials allow shareholders to make an informed decision about how they should allocate their voting rights to a proxy if they cannot attend the meeting.

Proxy is defined by supreme courts as "an authority or power to do a certain thing." A person can confer on his proxy any power which he himself possesses. He may also give him secret instructions as to voting upon particular questions. But a proxy is ineffectual when it is contrary to law or public policy.