Tennessee Defined-Benefit Pension Plan and Trust Agreement is a comprehensive retirement benefit program established by the state of Tennessee to provide financial security to eligible workers upon retirement. This pension plan is designed to offer a stable source of income to retired employees, offering them peace of mind and economic support during their later years. The Tennessee Defined-Benefit Pension Plan and Trust Agreement is a legally binding contract between the state government and participating employees. It outlines the terms and conditions of the pension plan, including the eligibility criteria and retirement benefits calculations. It is important to note that there may be variations in the plan based on the date of hire, specific job classifications, and employee contributions. Some different types or variations of the Tennessee Defined-Benefit Pension Plan and Trust Agreement may include: 1. State Employee Pension Plan: This variation of the pension plan is specifically tailored for employees working within various state agencies, departments, and institutions across Tennessee. It encompasses a broad range of job classifications and offers retirement benefits based on years of service and average final compensation. 2. Teacher Retirement System: This specific branch of the pension plan is designed to cater to the retirement needs of educators and school personnel in Tennessee. It provides retirement benefits based on years of service, average final compensation, and contributions from both the employee and their employer. 3. Municipal Pension Plan: This type of pension plan is created for employees working within city or municipal governments in Tennessee. It offers retirement benefits similar to the state employee plan but may have variations in terms of contribution rates and eligibility requirements specific to each municipality. 4. Police and Firefighter Pension Plan: Primarily aimed at police officers and firefighters, this variation of the pension plan is tailored to meet the retirement needs and risks associated with these public safety occupations. It often allows for early retirement options and provides additional benefits to acknowledge the physical demands and inherent dangers of the job. In summary, the Tennessee Defined-Benefit Pension Plan and Trust Agreement is a state-sponsored retirement benefit program offered to different sectors of public-sector workers, including state employees, teachers, municipal employees, and public safety personnel. It provides a reliable income source during retirement, based on factors like years of service and average final compensation. The plan helps ensure a financially secure future for eligible employees who have dedicated their careers to serving the state of Tennessee.

Tennessee Defined-Benefit Pension Plan and Trust Agreement

Description

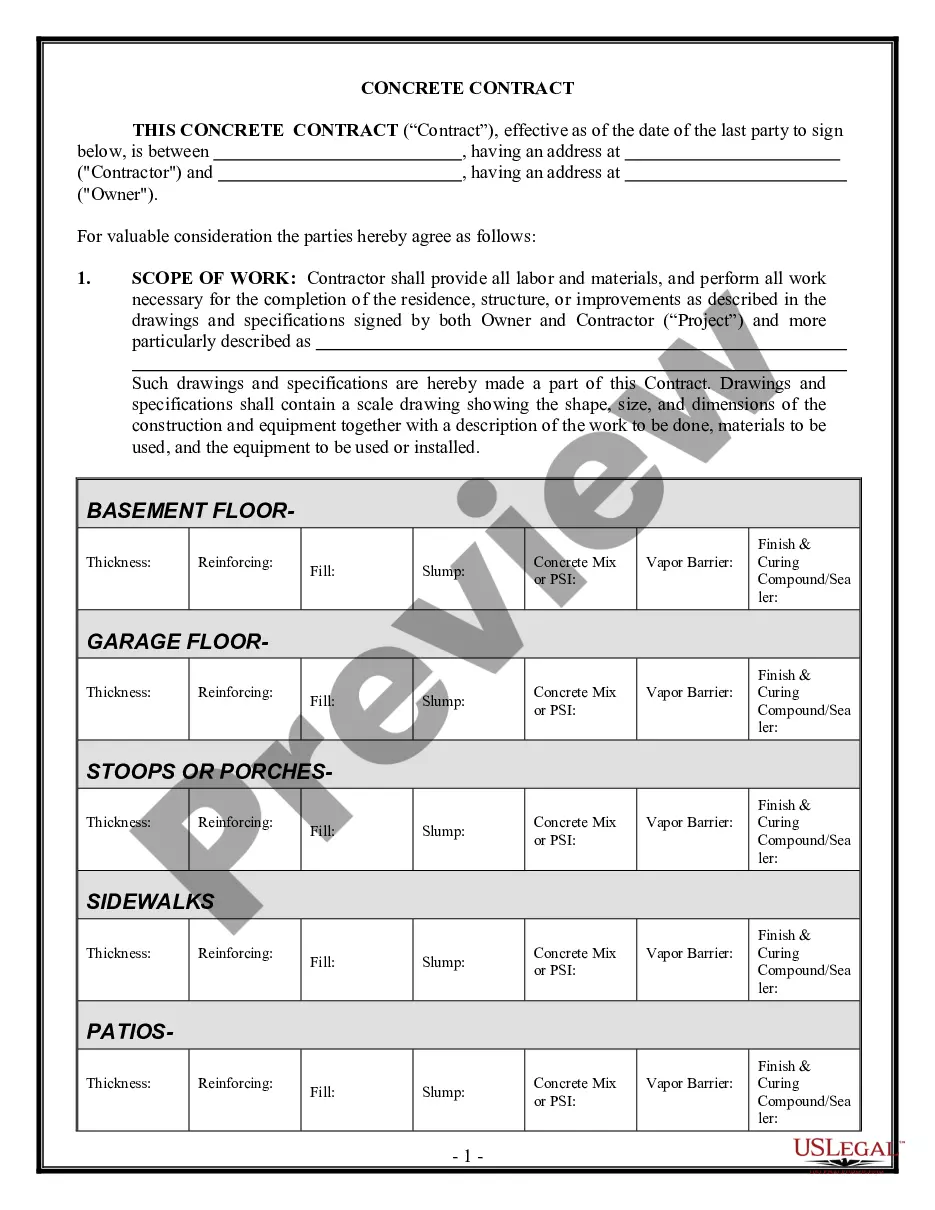

How to fill out Tennessee Defined-Benefit Pension Plan And Trust Agreement?

You can devote hours on the web searching for the legal papers design that suits the federal and state requirements you require. US Legal Forms supplies a large number of legal kinds that are reviewed by specialists. You can actually download or print out the Tennessee Defined-Benefit Pension Plan and Trust Agreement from your service.

If you have a US Legal Forms bank account, it is possible to log in and click the Download key. After that, it is possible to comprehensive, revise, print out, or sign the Tennessee Defined-Benefit Pension Plan and Trust Agreement. Each and every legal papers design you acquire is yours eternally. To have an additional backup for any purchased develop, go to the My Forms tab and click the related key.

If you work with the US Legal Forms web site the very first time, adhere to the straightforward recommendations under:

- Initial, make sure that you have chosen the right papers design to the state/area of your choosing. Look at the develop outline to make sure you have selected the correct develop. If offered, take advantage of the Preview key to appear with the papers design as well.

- If you would like get an additional edition of the develop, take advantage of the Search field to find the design that fits your needs and requirements.

- Upon having found the design you want, simply click Buy now to carry on.

- Choose the rates prepare you want, type your references, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You can utilize your credit card or PayPal bank account to cover the legal develop.

- Choose the structure of the papers and download it to the product.

- Make adjustments to the papers if needed. You can comprehensive, revise and sign and print out Tennessee Defined-Benefit Pension Plan and Trust Agreement.

Download and print out a large number of papers templates making use of the US Legal Forms Internet site, that provides the largest assortment of legal kinds. Use specialist and state-specific templates to tackle your organization or person demands.

Form popularity

FAQ

The Teacher Retirement System (TRS) is a network of state and city-level organizations that collectively administer pensions and retirement accounts for public education employees within their states.

The state makes all contributions to your retirement account. Vested members of TCRS become eligible for service retirement upon completion of 30 years of creditable service or upon attainment of age 60. You must make a beneficiary designation.

Consolidated Retirement Plan is a multi-employer defined benefit union pension based in White Plains, New York. Established in 1946, the plan was formed to provide eligible employees of UNITE HERE and Workers United with pension benefits upon retirement. The assets of the plan are managed by the board of trustees.

TCRS is a well-funded, secure pension plan with plan assets totaling over $43 billion. Retirement benefits are based on a formula that includes salary and service. Five-year vesting requirement for state employees and teachers.

4 Types Of Pension Plans Most Preferred For Retirement PlanningNPS. Regulated by Pension Fund Regulatory and Development Authority (PFRDA), the National Pension Scheme or NPS is a popular option if you want to receive a regular pension after retirement.Pension Funds.Annuity Plans.Pension Plans with Life Cover.

Tennessee Consolidated Retirement System (TCRS) TCRS provides lifetime retirement, survivor, and disability benefits for its members. After meeting the five-year vesting requirement, a member becomes eligible to receive a monthly retirement benefit upon reaching the age and/or service requirement to begin benefits.

TCRS is a well-funded, secure pension plan with plan assets totaling over $43 billion. Retirement benefits are based on a formula that includes salary and service. Five-year vesting requirement for state employees and teachers.

Your Tennessee Consolidated Retirement System (TCRS) is recognized as one of the top 5 strongest pension funds in the United States by Standard & Poor's (S&P).

Retirees to receive 3% COLA beginning July 2022. Retired teachers and state employees who have been on the TCRS retired payroll for at least 12 consecutive months as of July 1, 2022 will receive a 3% cost-of-living adjustment, the highest increase available under laws governing TCRS.

The MTRS is a defined benefit retirement plan intended to provide a meaningful retirement benefit to the employee who has chosen a career in public service. It operates as a qualified plan under section 401(a) of the Internal Revenue Code.