Tennessee Recommended Spending Percentages is a set of guidelines designed to assist individuals and households in managing their finances effectively. These recommendations allocate specific percentages of income to various spending categories to help individuals achieve financial stability and meet their financial goals. One significant aspect of Tennessee Recommended Spending Percentages is allocating a portion of income towards housing expenses. The recommended percentage for housing expenses is typically around 30% of monthly income. This includes rent or mortgage payments, property taxes, and homeowner's insurance. Another crucial spending category outlined by the recommendations is transportation. Tennessee Recommended Spending Percentages suggest that individuals allocate approximately 15% of their income towards transportation expenses. This includes car payments, fuel costs, insurance premiums, and maintenance expenses. In addition to housing and transportation, the recommended percentages also focus on necessities like groceries and healthcare. The guidelines recommend that individuals spend around 10-15% of their income on food, while 5-10% should be allocated for healthcare expenses. Furthermore, Tennessee Recommended Spending Percentages suggest budgeting approximately 10% of income for saving and investing purposes. This percentage aims to help individuals build an emergency fund, save for retirement, or invest in long-term financial instruments. Other categories included in the guidelines are debt repayment, personal spending, entertainment, and education. Debt repayment, such as credit cards or student loans, should ideally be limited to around 10-15% of income. Personal spending, including clothing, personal care, and hobbies, is recommended to be around 10-15% as well. Entertainment expenses should be controlled to about 5-10%, while education expenses may vary depending on personal circumstances. It is important to note that these Tennessee Recommended Spending Percentages are flexible and can be adjusted based on individual financial situations. These recommendations aim to provide individuals with a clear framework for managing their finances effectively, but personal circumstances and priorities may necessitate deviations from the percentages. By adhering to the Tennessee Recommended Spending Percentages and tailoring them to their specific needs, individuals in Tennessee can strive towards achieving financial stability and securing their long-term financial well-being.

Tennessee Recommended Spending Percentages

Description

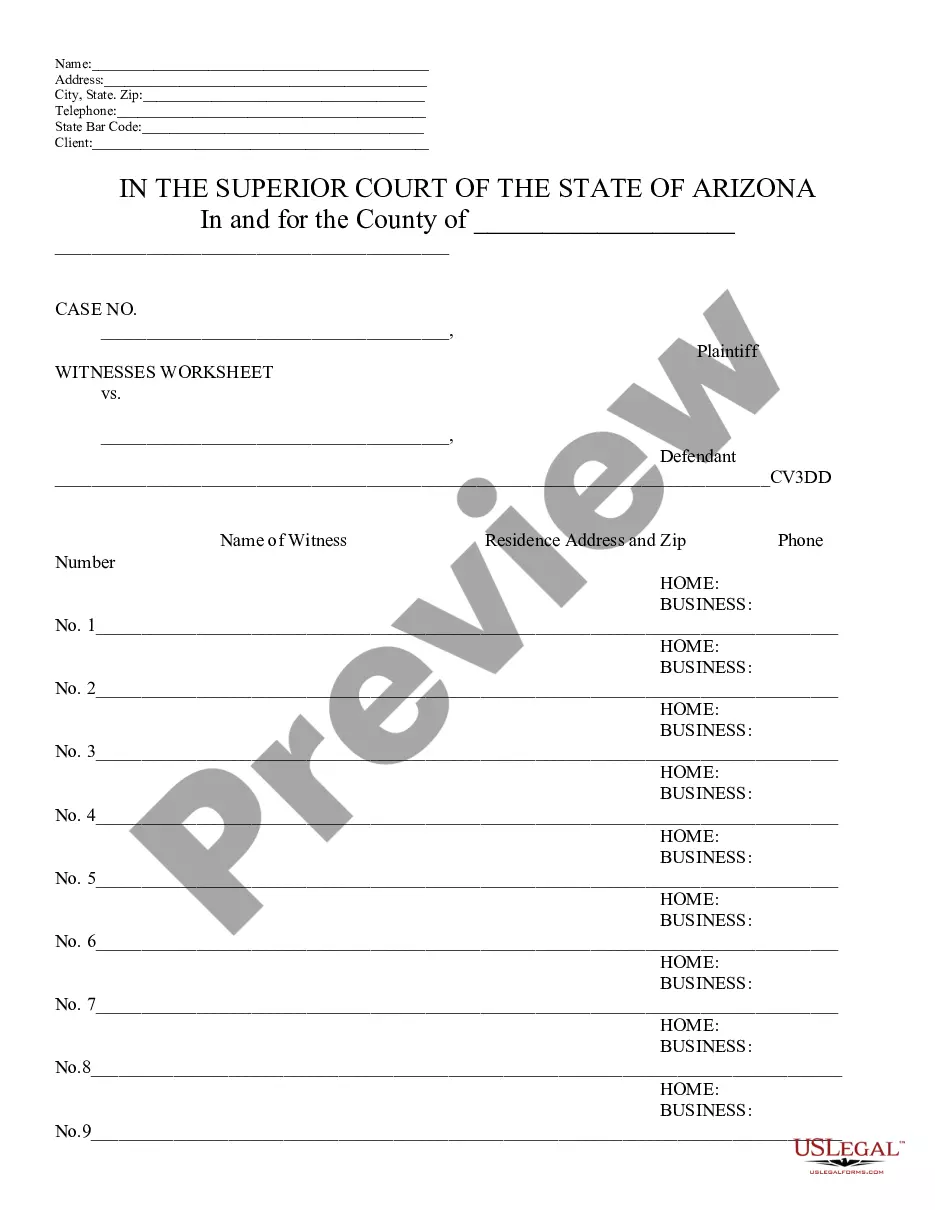

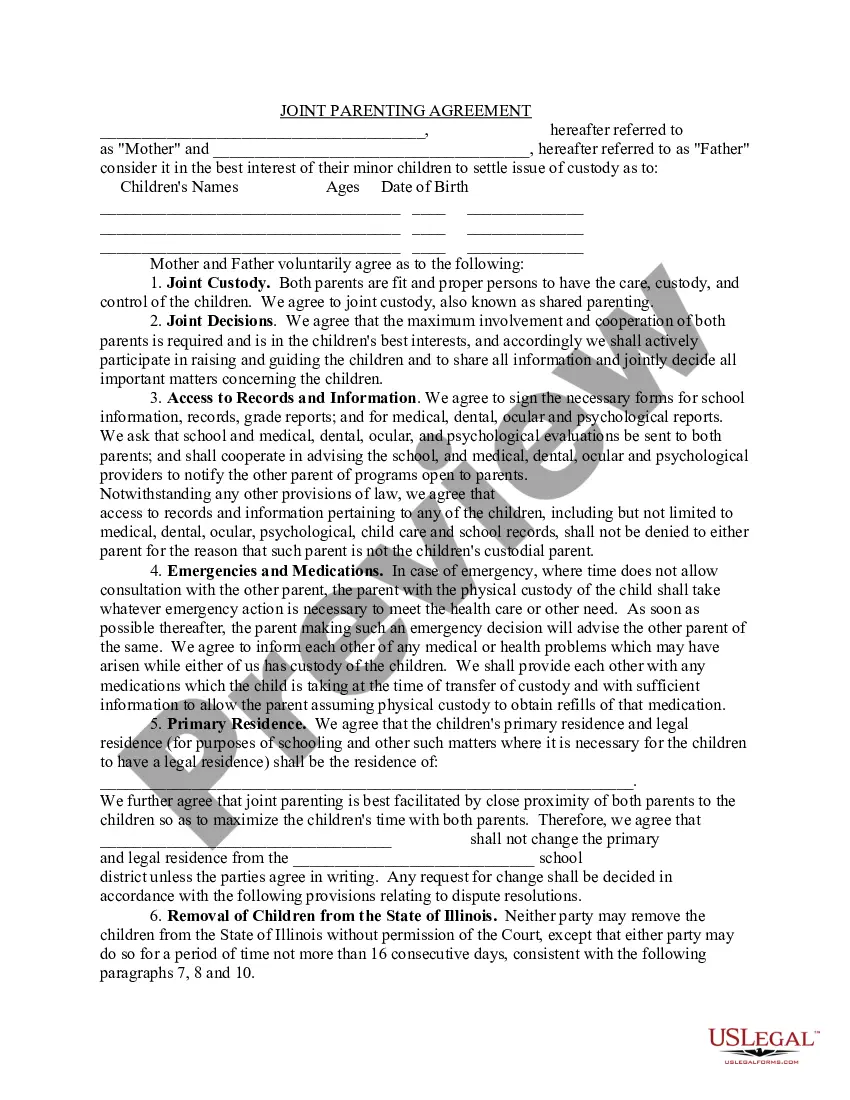

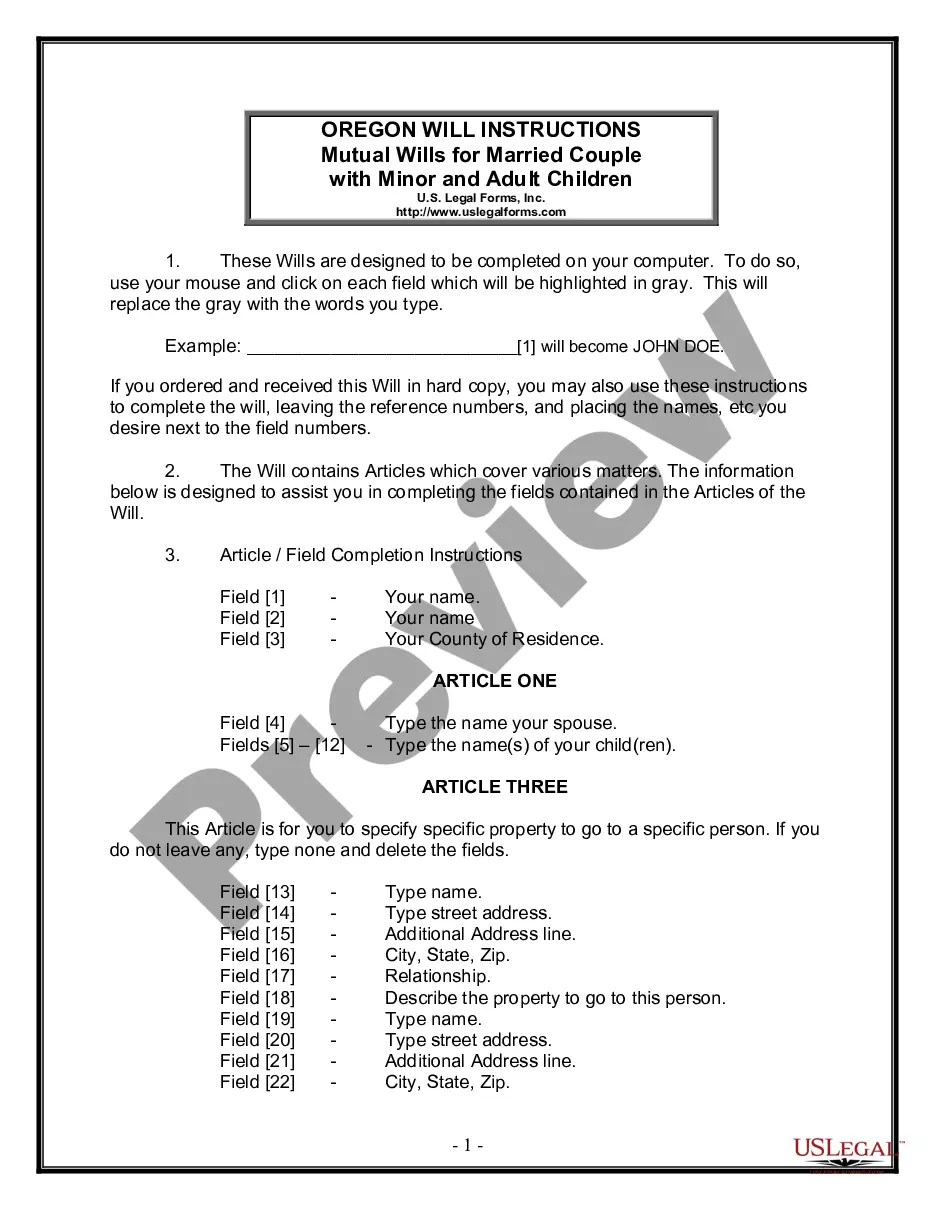

How to fill out Tennessee Recommended Spending Percentages?

US Legal Forms - one of the greatest libraries of legal types in the States - provides a wide range of legal papers web templates you are able to obtain or print. Utilizing the web site, you can get thousands of types for organization and specific reasons, categorized by types, suggests, or search phrases.You will find the newest versions of types like the Tennessee Recommended Spending Percentages within minutes.

If you already possess a monthly subscription, log in and obtain Tennessee Recommended Spending Percentages from your US Legal Forms library. The Obtain switch will appear on every type you see. You have accessibility to all earlier saved types in the My Forms tab of the accounts.

If you would like use US Legal Forms the very first time, listed here are simple guidelines to help you get started off:

- Make sure you have picked the correct type for the area/area. Select the Review switch to check the form`s information. Browse the type outline to ensure that you have selected the correct type.

- If the type doesn`t fit your demands, take advantage of the Search industry near the top of the screen to find the one which does.

- When you are pleased with the form, validate your decision by clicking the Get now switch. Then, choose the prices prepare you favor and provide your accreditations to register to have an accounts.

- Approach the deal. Make use of Visa or Mastercard or PayPal accounts to finish the deal.

- Pick the format and obtain the form on your gadget.

- Make modifications. Fill up, modify and print and sign the saved Tennessee Recommended Spending Percentages.

Each web template you added to your money lacks an expiry particular date which is your own for a long time. So, if you want to obtain or print yet another copy, just go to the My Forms area and click around the type you want.

Gain access to the Tennessee Recommended Spending Percentages with US Legal Forms, one of the most comprehensive library of legal papers web templates. Use thousands of skilled and state-specific web templates that meet up with your organization or specific requirements and demands.

Form popularity

FAQ

Explainer: How far does a $4B surplus really go for a state like Tennessee? Tennessee collected $4 billion more than budget From August of 2020 through October of 2021. Tennessee officials have underestimated their tax revenues to the tune of $4 billion since August of 2020.

Explainer: How far does a $4B surplus really go for a state like Tennessee? Tennessee collected $4 billion more than budget From August of 2020 through October of 2021. Tennessee officials have underestimated their tax revenues to the tune of $4 billion since August of 2020.

A budget surplus can be used to reduce taxes, start new programs or fund existing programs such as Social Security or Medicare. A budget surplus can occur when growth in revenue exceeds growth in expenditures, or following a reduction in costs or spending or both. An increase in taxes can also result in a surplus.

The primary source of funding for state expenditures is appropriation from general revenues. General revenues are proceeds from taxes, licenses, fees, fines, forfeitures, and other imposts laid specifically by law.

Using numbers that included data from the fiscal year that ended in June 2020, Tennessee had $8.7 billion more than it owed in obligations, amounting to a $4,400 surplus per taxpayer and earning a grade of B in the report, which was released Tuesday. The state had a $3,400 surplus per taxpayer the year before.

Tennessee has the lowest debt per capita of any state.

Tennessee collected 21% more tax revenue in FY 2021 than lawmakers initially budgeted, giving the state a $2.1 billion unbudgeted surplus.

Using numbers that included data from the fiscal year that ended in June 2020, Tennessee had $8.7 billion more than it owed in obligations, amounting to a $4,400 surplus per taxpayer and earning a grade of B in the report, which was released Tuesday. The state had a $3,400 surplus per taxpayer the year before.

Balanced Budget Requirement: Tennessee's constitution requires the budget to balance. This means in any given fiscal year, spending cannot exceed revenue collections plus reserves.

Depending on the size of a state's budget that might not be very much but in at least 29 of those states, the surplus was actually more than $1 billion. The total for those 29 states is more than $173.9 billion in additional funds. In many cases, the surplus is from state tax revenue that went far beyond projections.