Tennessee Assignment of Leases and Rents as Collateral Security for a Commercial Loan is a legal document used to secure a loan by granting the lender the rights to collect rental income generated from leased properties. This arrangement offers added protection to commercial lenders, ensuring they have a source of repayment in case of default. In Tennessee, there are two primary types of Assignment of Leases and Rents as Collateral Security for a Commercial Loan: 1. Absolute Assignment of Leases and Rents: Under this type of assignment, the borrower transfers the ownership rights of the leased properties and their rental income to the lender as collateral. It gives the lender full authority to collect rents directly from tenants in case of loan default. The lender assumes the role of landlord and may even exercise other landlord rights, including eviction and lease modification, if necessary. 2. Conditional Assignment of Leases and Rents: This type of assignment grants the lender conditional ownership rights over the leased properties and their rental income. The lender can only step in to collect rents if the borrower defaults on the loan. Until then, the borrower retains all landlord rights and responsibilities. This form of assignment provides some level of control to the borrower while offering the lender the assurance of repayment. Keywords: Tennessee Assignment of Leases and Rents, Collateral Security, Commercial Loan, Rental Income, Source of Repayment, Default, Absolute Assignment, Conditional Assignment, Lender, Borrower, Lease Agreement, Rental Property, Eviction, Lease Modification.

Tennessee Assignment of Leases and Rents as Collateral Security for a Commercial Loan

Description

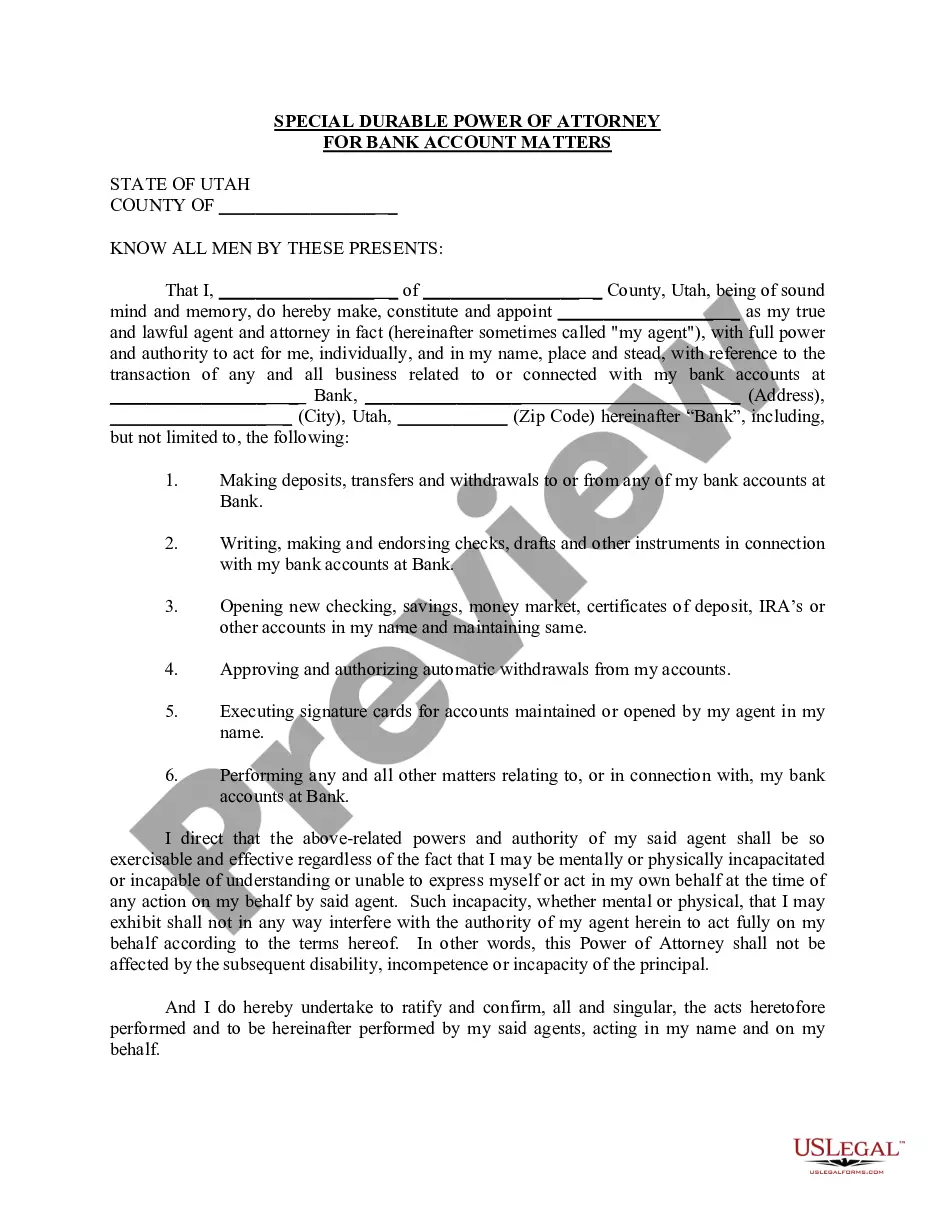

How to fill out Tennessee Assignment Of Leases And Rents As Collateral Security For A Commercial Loan?

US Legal Forms - among the biggest libraries of lawful kinds in the States - delivers a wide array of lawful record themes you may obtain or produce. Making use of the website, you can find thousands of kinds for enterprise and specific uses, sorted by types, says, or key phrases.You can get the newest versions of kinds such as the Tennessee Assignment of Leases and Rents as Collateral Security for a Commercial Loan within minutes.

If you already have a registration, log in and obtain Tennessee Assignment of Leases and Rents as Collateral Security for a Commercial Loan from the US Legal Forms library. The Obtain button will show up on each and every type you see. You get access to all formerly downloaded kinds within the My Forms tab of your profile.

In order to use US Legal Forms the first time, here are basic guidelines to obtain started off:

- Be sure you have chosen the right type for your personal area/region. Go through the Preview button to examine the form`s articles. See the type outline to ensure that you have selected the proper type.

- When the type does not suit your requirements, utilize the Search industry on top of the monitor to obtain the the one that does.

- When you are pleased with the shape, verify your selection by visiting the Buy now button. Then, opt for the prices plan you want and provide your accreditations to register to have an profile.

- Approach the transaction. Make use of your bank card or PayPal profile to accomplish the transaction.

- Choose the formatting and obtain the shape in your device.

- Make adjustments. Fill out, edit and produce and indication the downloaded Tennessee Assignment of Leases and Rents as Collateral Security for a Commercial Loan.

Each template you included in your account does not have an expiry date and it is yours permanently. So, in order to obtain or produce yet another duplicate, just check out the My Forms section and click in the type you need.

Obtain access to the Tennessee Assignment of Leases and Rents as Collateral Security for a Commercial Loan with US Legal Forms, one of the most substantial library of lawful record themes. Use thousands of professional and status-specific themes that satisfy your small business or specific requires and requirements.