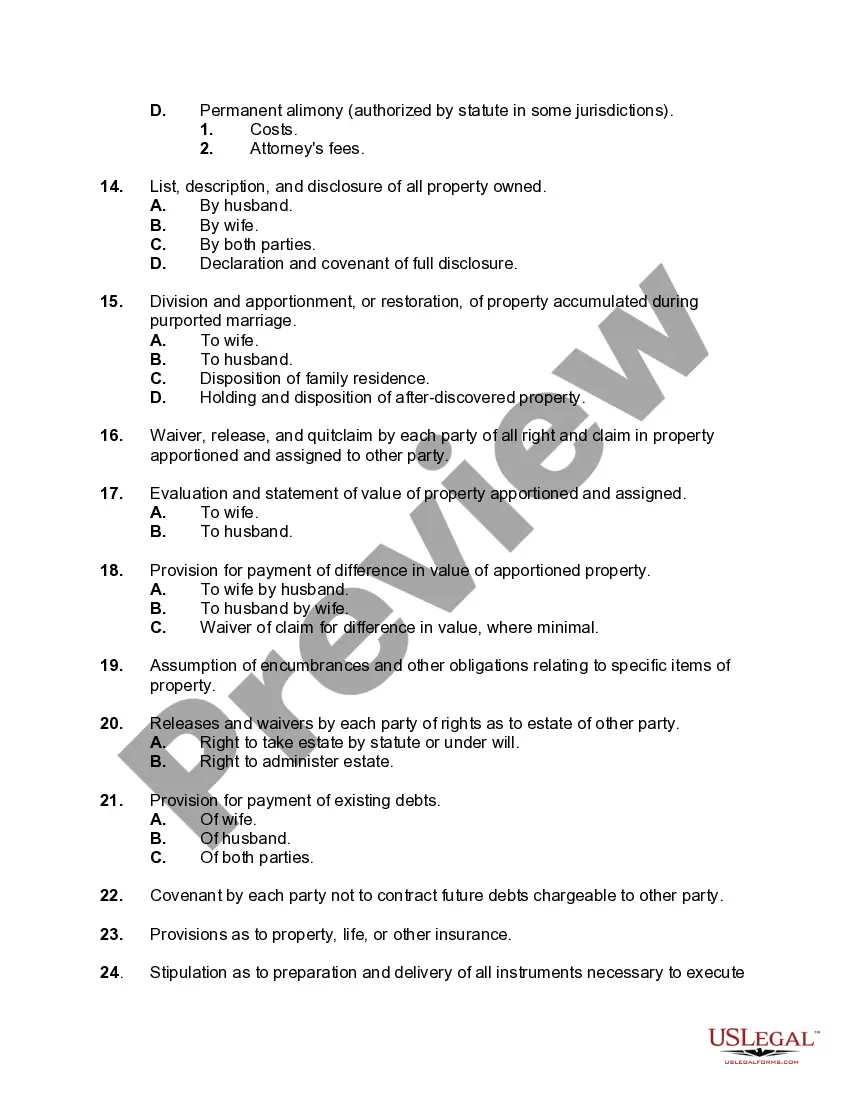

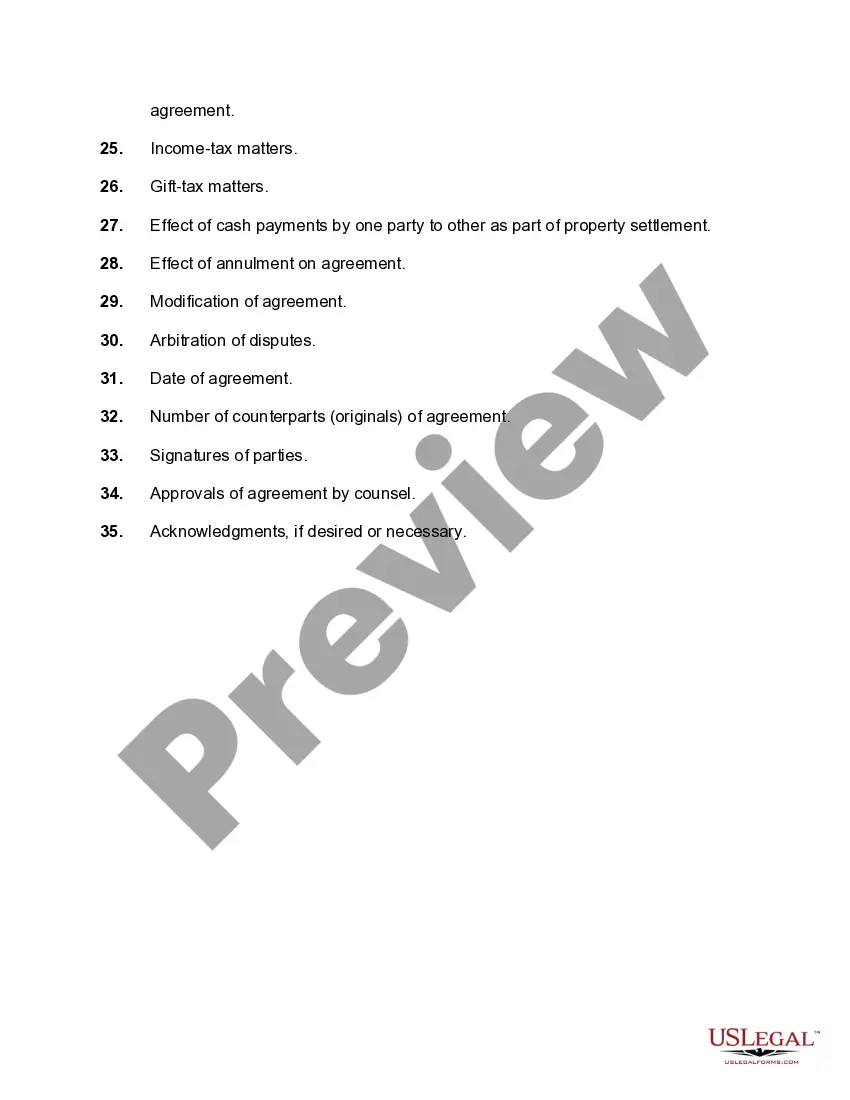

Tennessee Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage can vary depending on the specific circumstances of the case. However, there are some common factors that should be considered when drafting such an agreement. Here are some key aspects to include: 1. Marital Property: Identify and list all the assets and debts acquired during the marriage that need to be divided or restored. This includes real estate, personal property, bank accounts, investments, retirement plans, and any liabilities or debts. 2. Separate Property: Differentiate between marital and separate property. Separate property usually refers to assets acquired by each spouse before the marriage or through inheritance or gifts during the marriage. Determine how the division or restoration of separate property will be handled. 3. Property Valuation: Determine the value of each asset and debt at the time of the marriage and at the time of the annulment proceeding. This could involve obtaining professional appraisals or expert opinions, especially for complex or high-value assets like businesses or real estate. 4. Division of Assets and Debts: Decide how the marital property and debts will be divided between the spouses. This may involve an equal division, proportional distribution based on financial contributions, or a different arrangement agreed upon by both parties. 5. Spousal Support: Address the issue of alimony or spousal support if applicable. Determine whether any support will be provided, its duration, and the amount to be paid. 6. Child Custody and Support: If there are children involved, address custody, visitation rights, and child support obligations. This includes outlining a parenting plan that ensures the best interests of the child are met. 7. Insurance and Benefits: Determine the impact of the annulment on health insurance coverage, life insurance policies, retirement plans, and other related benefits. Consider whether any necessary changes or adjustments need to be made to ensure appropriate coverage. 8. Tax Implications: Consider the tax implications of the property division or restoration agreement. Consult with a tax professional to understand any potential tax consequences, such as capital gains or losses, that may arise from the transfer of assets. 9. Legal Assistance: It is advisable for both parties to seek independent legal representation to ensure their interests are protected throughout the drafting and negotiation process. Consider including a clause for attorney's fees and costs. Different types of Tennessee Checklists for Division or Restoration of Property in Annulling a Marriage may exist based on the unique needs of specific cases or if there are additional factors to consider.

Tennessee Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage

Description

How to fill out Tennessee Checklist Of Matters To Be Considered In Drafting An Agreement For Division Or Restoration Of Property In Connection With A Proceeding For Annulment Of A Marriage?

You can spend hours on the web trying to find the legitimate papers format which fits the federal and state demands you need. US Legal Forms gives 1000s of legitimate types that are analyzed by experts. It is possible to down load or print the Tennessee Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage from our support.

If you currently have a US Legal Forms bank account, you may log in and click on the Down load button. Afterward, you may complete, modify, print, or signal the Tennessee Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage. Each legitimate papers format you purchase is your own permanently. To get another copy for any obtained kind, proceed to the My Forms tab and click on the related button.

If you are using the US Legal Forms site initially, keep to the easy guidelines below:

- Very first, make certain you have selected the right papers format to the state/area of your liking. Read the kind information to make sure you have picked out the correct kind. If offered, utilize the Preview button to search with the papers format at the same time.

- If you want to locate another variation in the kind, utilize the Research area to discover the format that meets your requirements and demands.

- When you have found the format you want, just click Buy now to continue.

- Choose the pricing prepare you want, type your accreditations, and sign up for a merchant account on US Legal Forms.

- Full the transaction. You can utilize your bank card or PayPal bank account to cover the legitimate kind.

- Choose the formatting in the papers and down load it for your gadget.

- Make modifications for your papers if needed. You can complete, modify and signal and print Tennessee Checklist of Matters to be Considered in Drafting an Agreement for Division or Restoration of Property in Connection with a Proceeding for Annulment of a Marriage.

Down load and print 1000s of papers templates utilizing the US Legal Forms Internet site, that provides the greatest variety of legitimate types. Use skilled and status-distinct templates to take on your organization or personal requires.