The Tennessee Private Annuity Agreement is a legal contract that allows individuals to transfer property or assets to another party in exchange for regular annuity payments. This arrangement provides a means for individuals to efficiently transfer wealth while potentially reducing estate taxes. One type of Tennessee Private Annuity Agreement is the "Straight Annuity." Under this arrangement, an individual (known as the "annuitant") transfers ownership of assets, such as real estate, a business, or investments, to another party (known as the "obliged" or "purchaser"). The purchaser then agrees to make regular annuity payments to the annuitant for a specified period, usually until the annuitant's death. Another type is the "Deferred Annuity." In this case, the annuitant transfers assets to the purchaser, but the annuity payments are delayed until a future date specified in the agreement. This allows the annuitant to defer income recognition and potentially enjoy tax advantages. It's worth mentioning that the Tennessee Private Annuity Agreement is subject to specific guidelines and regulations set forth by the Internal Revenue Service (IRS) and the state of Tennessee. These agreements must adhere to the rules outlined in the Tennessee Uniform Exempt Trust Act (THETA). The Tennessee Private Annuity Agreement offers several benefits. Firstly, it allows individuals to transfer assets while potentially reducing estate tax liability. By transferring ownership, the annuitant removes the asset's value from their taxable estate, which can help protect family wealth from excessive taxation. Additionally, annuitants can enjoy a regular stream of income through annuity payments, which can provide financial stability and security. The agreement also allows for flexibility in tailoring the terms, such as payment frequency and duration, to meet the annuitant's specific needs and goals. However, it's crucial to seek professional advice from an attorney or financial advisor when considering a Tennessee Private Annuity Agreement. The complex nature of these arrangements necessitates careful planning and consideration of tax implications, legal requirements, and the individual's long-term goals. In summary, the Tennessee Private Annuity Agreement is a legal tool that facilitates the transfer of assets in exchange for regular annuity payments. Different types include the Straight Annuity and the Deferred Annuity. These agreements offer opportunities for individuals to transfer wealth efficiently and potentially reduce estate taxes while ensuring a stable income stream. However, expert guidance should be sought to ensure compliance with regulations and optimize the benefits of this arrangement.

Tennessee Private Annuity Agreement

Description

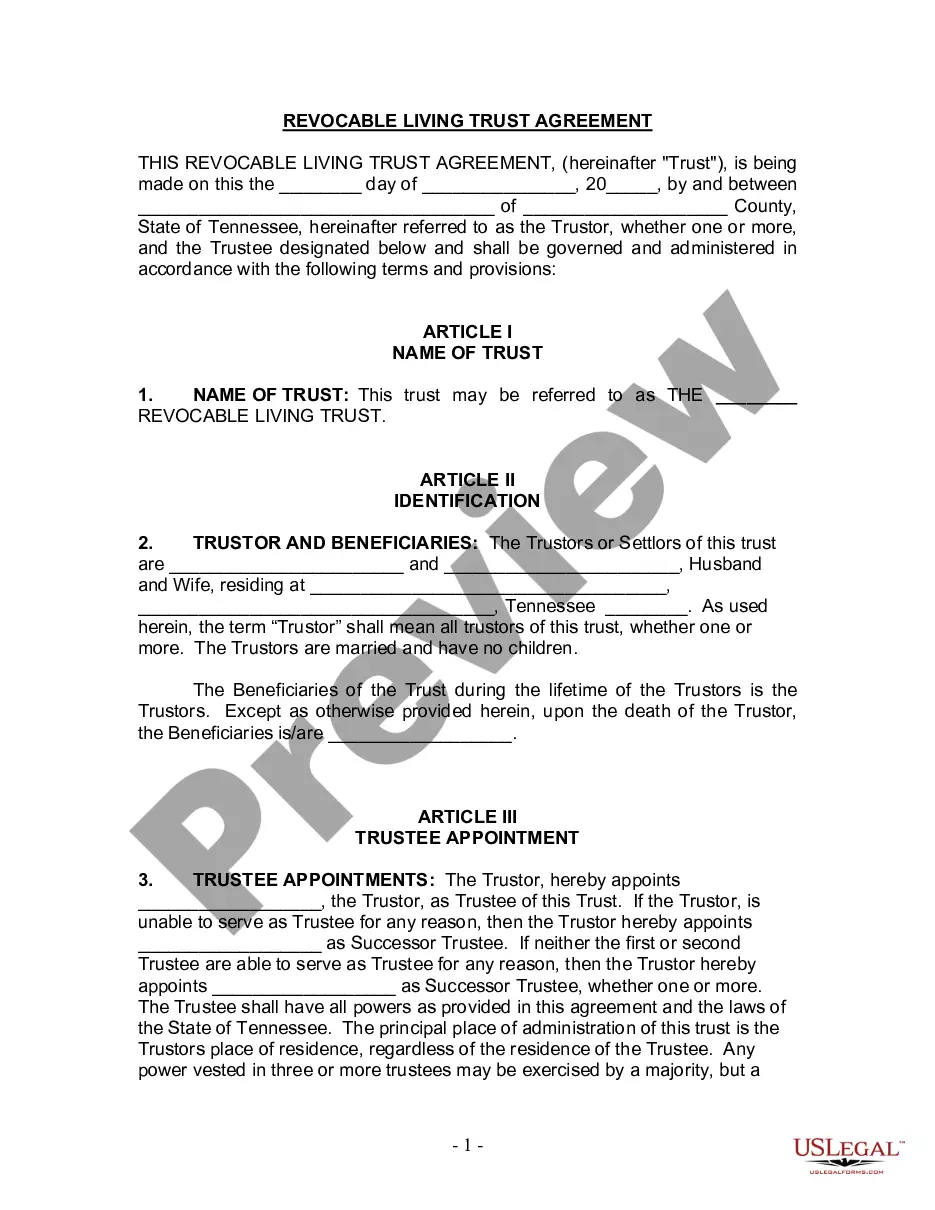

How to fill out Tennessee Private Annuity Agreement?

Are you presently inside a position in which you require files for either business or specific purposes nearly every time? There are plenty of lawful papers layouts accessible on the Internet, but getting versions you can trust isn`t straightforward. US Legal Forms gives a huge number of kind layouts, like the Tennessee Private Annuity Agreement, that are created in order to meet federal and state requirements.

Should you be presently knowledgeable about US Legal Forms website and get a free account, merely log in. Next, you may acquire the Tennessee Private Annuity Agreement template.

Should you not have an account and want to start using US Legal Forms, abide by these steps:

- Find the kind you need and make sure it is for that correct town/area.

- Make use of the Review option to review the shape.

- See the explanation to ensure that you have selected the appropriate kind.

- If the kind isn`t what you are looking for, utilize the Research industry to obtain the kind that fits your needs and requirements.

- Whenever you discover the correct kind, just click Get now.

- Choose the costs plan you would like, complete the desired details to make your money, and pay for the order with your PayPal or Visa or Mastercard.

- Pick a hassle-free paper file format and acquire your backup.

Discover every one of the papers layouts you have bought in the My Forms food selection. You can obtain a more backup of Tennessee Private Annuity Agreement whenever, if possible. Just click on the needed kind to acquire or produce the papers template.

Use US Legal Forms, one of the most comprehensive variety of lawful kinds, to conserve efforts and steer clear of faults. The service gives skillfully manufactured lawful papers layouts that you can use for an array of purposes. Create a free account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.

There are four parties to an annuity contract: the annuity issuer, the owner, the annuitant, and the beneficiary. The annuity issuer is the company (e.g., an insurance company) that issues the annuity.

The owner of the annuity is the person who pays the initial premium to the insurance company and has the authority to make withdrawals, change the beneficiaries named in the contract and terminate the annuity. The annuitant is the person whose life determines the annuity payouts.

Thus, annuity payments to an annuitant who was outliving his life expectancy is taxed as ordinary income. Additionally, the annuity payment must be based on IRS actuarial tables and cannot be related in any way to the amount of income earned by the asset; otherwise, the asset will be included in the annuitant's estate.

As long as you do not withdraw your investment gains and keep them in the annuity, they are not taxed. A variable annuity is linked to market performance. If you do not withdraw your earnings from the investments in the annuity, they are tax-deferred until you withdraw them.