Tennessee Receipt for Balance of Account is a legal document that serves as proof of payment for the remaining balance on an account. It outlines the details of the transaction, including the amount paid, the date of payment, and the account holder's information. This receipt is crucial for both the creditor and the debtor as it helps maintain accurate financial records and settles any outstanding debts. When creating a Tennessee Receipt for Balance of Account, certain keywords should be included to maintain relevance and accuracy. These keywords may include "Tennessee," "receipt," "balance of account," "payment," "transaction," and "debt settlement." By incorporating these relevant keywords, it becomes easier for individuals to search and identify the specific type of receipt needed. In Tennessee, there are various types of receipts for balance of account based on the nature of the transaction or industry involved. Some common types include: 1. Tennessee Receipt for Balance of Account — Business: This type of receipt is typically used in business transactions, such as settling outstanding payments between a supplier and a retailer. It includes details specific to the business transaction, such as account numbers, invoice references, and tax information. 2. Tennessee Receipt for Balance of Account — Rental Property: In cases where an individual rents a property in Tennessee, this receipt variant is used to confirm the payment of any remaining balance owed to the landlord. It may include details like the rental period, rental amount, and any other applicable charges. 3. Tennessee Receipt for Balance of Account — Loans or Credit: This receipt is employed when settling outstanding loan or credit balance between a lender and a borrower. It contains specific loan details such as the principal amount, interest rate, payment schedule, and the calculation of remaining balance. 4. Tennessee Receipt for Balance of Account — Personal Transactions: For personal transactions, such as repaying friends or family, this type of receipt verifies the payment made towards a personal balance. It typically includes the names of both parties involved, the payment method, and any additional remarks agreed upon. These various types of Tennessee Receipts for Balance of Account cater to diverse situations, ensuring accurate documentation and providing legal protection for both parties involved in the transaction. Remember, it is essential to consult with legal professionals or utilize standardized templates to ensure all necessary information is included and the receipt complies with Tennessee's legal requirements.

Tennessee Receipt for Balance of Account

Description

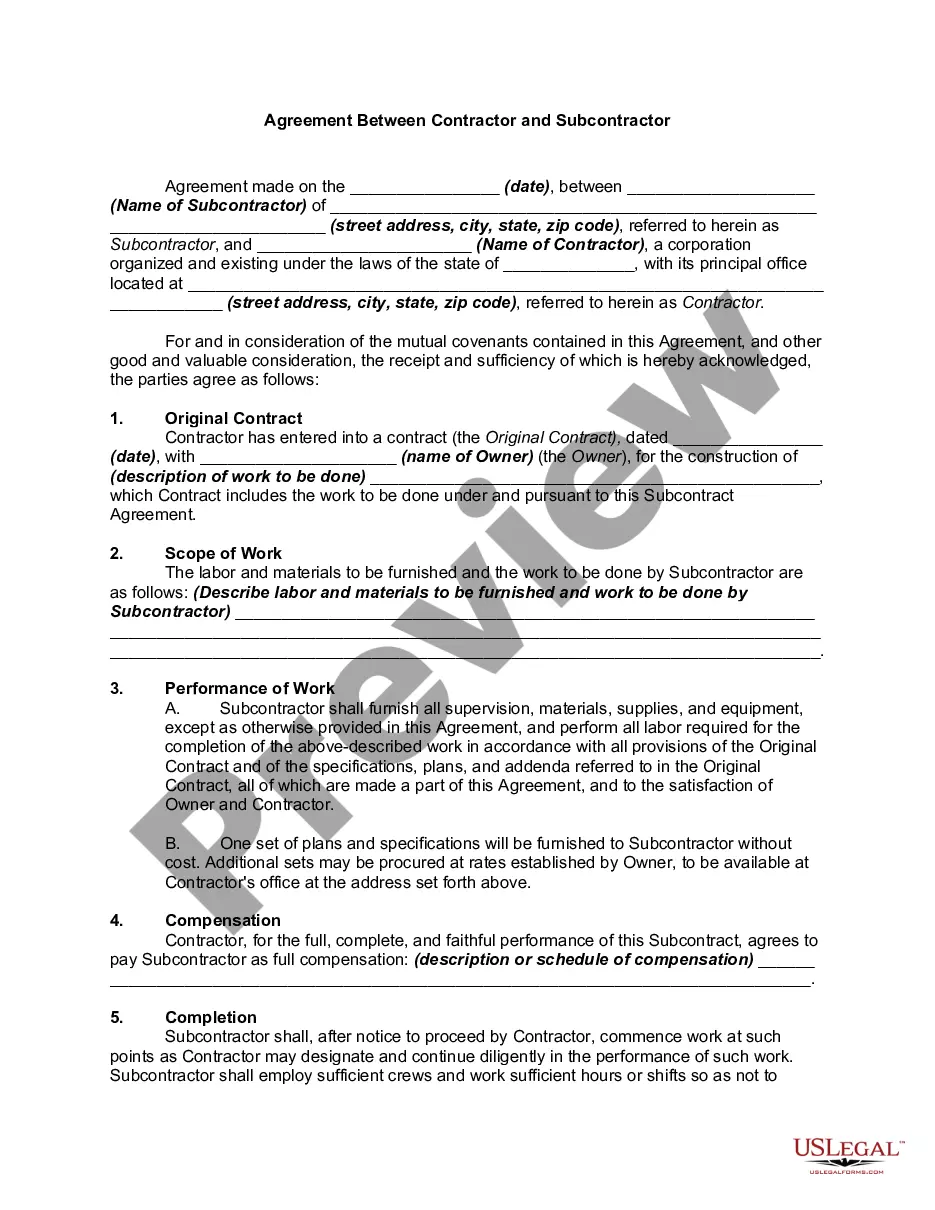

How to fill out Tennessee Receipt For Balance Of Account?

US Legal Forms - one of many most significant libraries of legal forms in the States - offers a variety of legal document web templates you are able to download or printing. While using web site, you can find a large number of forms for enterprise and person reasons, categorized by classes, suggests, or key phrases.You can get the most up-to-date types of forms just like the Tennessee Receipt for Balance of Account in seconds.

If you already possess a registration, log in and download Tennessee Receipt for Balance of Account from your US Legal Forms library. The Acquire option will show up on every develop you view. You have access to all formerly acquired forms in the My Forms tab of your respective profile.

If you want to use US Legal Forms the very first time, listed here are straightforward guidelines to help you get started:

- Make sure you have chosen the correct develop for the metropolis/region. Click the Review option to examine the form`s content. Browse the develop outline to actually have selected the appropriate develop.

- If the develop doesn`t satisfy your requirements, utilize the Lookup field near the top of the display screen to obtain the one that does.

- When you are satisfied with the shape, verify your decision by visiting the Purchase now option. Then, select the costs strategy you prefer and give your qualifications to sign up for the profile.

- Approach the financial transaction. Make use of charge card or PayPal profile to complete the financial transaction.

- Choose the file format and download the shape on the system.

- Make modifications. Fill out, modify and printing and sign the acquired Tennessee Receipt for Balance of Account.

Each design you added to your bank account lacks an expiry date and it is yours permanently. So, if you wish to download or printing another copy, just go to the My Forms portion and then click on the develop you will need.

Gain access to the Tennessee Receipt for Balance of Account with US Legal Forms, one of the most comprehensive library of legal document web templates. Use a large number of professional and express-distinct web templates that meet up with your business or person demands and requirements.