Tennessee Notice of Disputed Account

Description

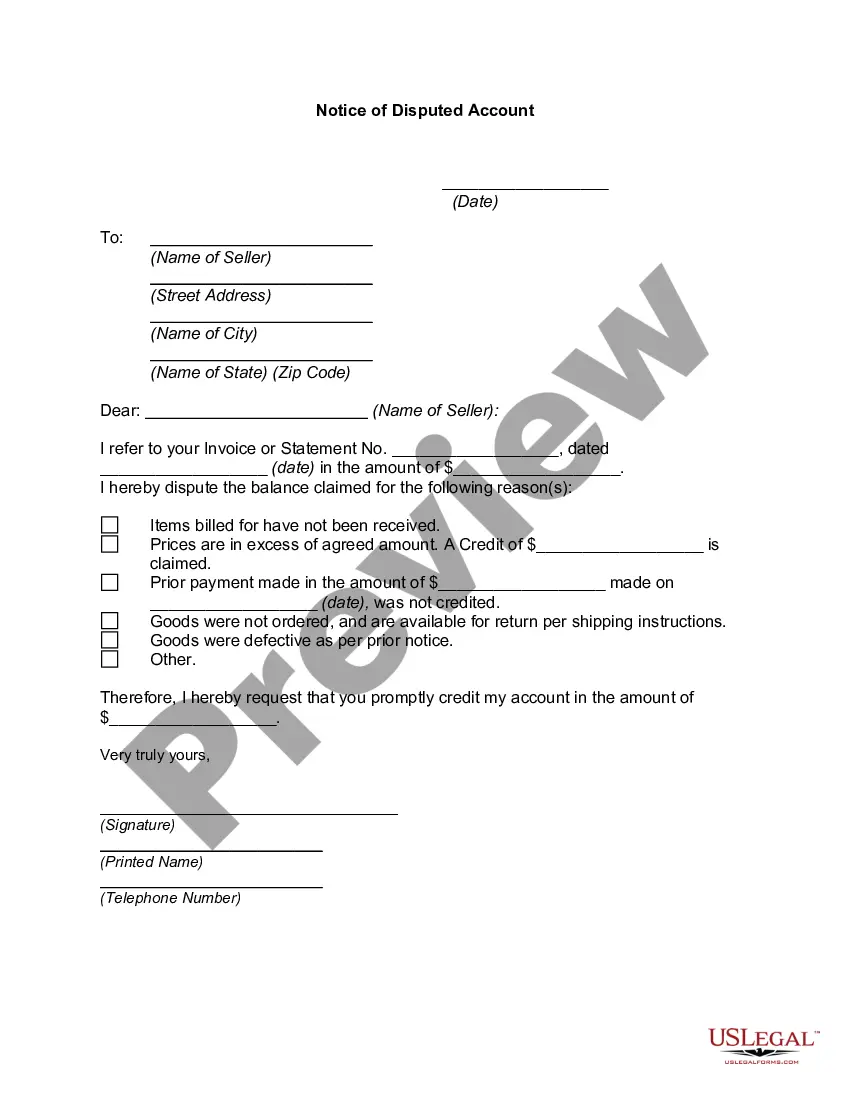

How to fill out Notice Of Disputed Account?

Locating the appropriate legal documents template may pose a challenge.

Of course, there are numerous templates accessible online, but how can you acquire the legal form you require.

Use the US Legal Forms website. This service offers a vast array of templates, such as the Tennessee Notice of Disputed Account, suitable for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If the form does not meet your requirements, utilize the Search area to locate the appropriate form. Once you are certain that the form is suitable, click the Buy now button to obtain the form. Select the pricing plan you desire and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, modify, and print and sign the acquired Tennessee Notice of Disputed Account. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to download professionally crafted documents that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Acquire button to obtain the Tennessee Notice of Disputed Account.

- Utilize your account to review the legal forms you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your city/state.

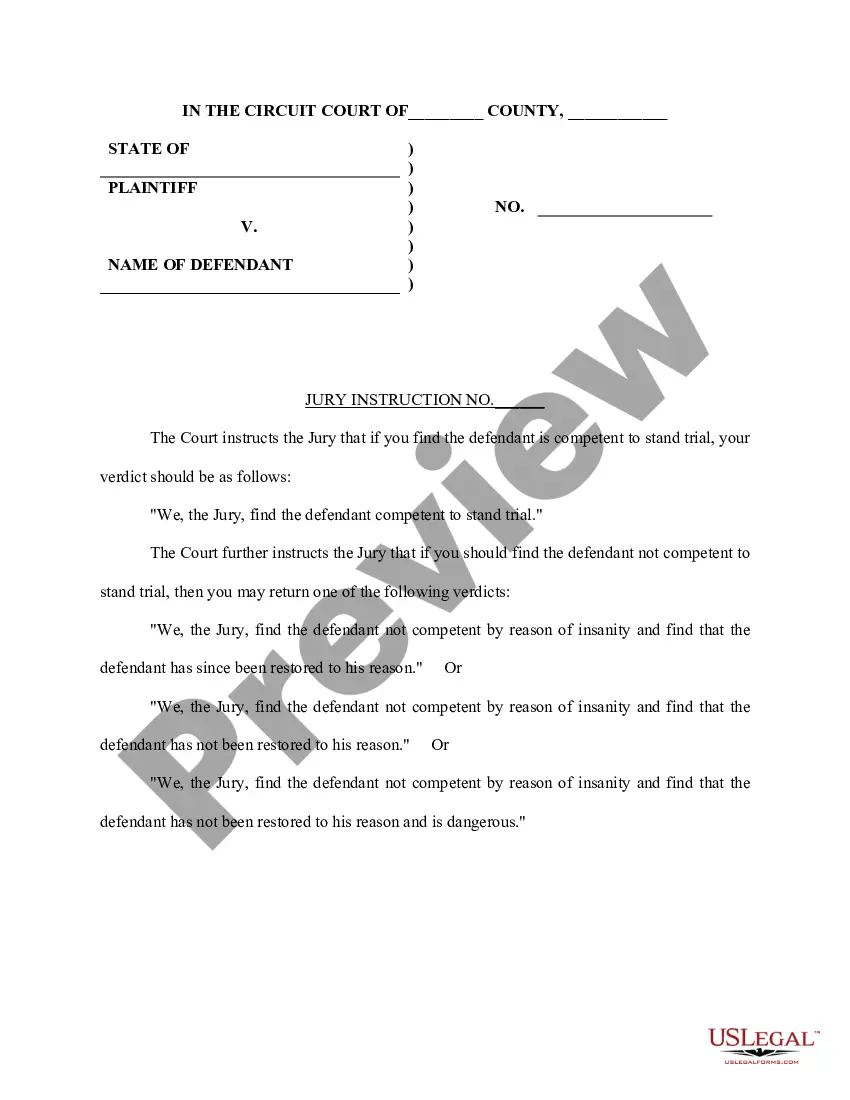

- You can examine the form using the Preview button and review the form description to confirm that it is the right one for you.

Form popularity

FAQ

Yes, creditors can take your house in Tennessee under certain conditions, particularly if the debt is secured and you fail to meet repayment terms. However, various exemptions allow you to keep your home under specific circumstances, mainly if it's your primary residence. If you receive a Tennessee Notice of Disputed Account, consider consulting a legal expert to explore your options before taking any action.

You may lose your house in a lawsuit in Tennessee if a court rules against you and the debt is not protected by state laws. However, if the property qualifies for homestead exemption, you may retain your home. A Tennessee Notice of Disputed Account can provide a starting point for addressing the lawsuit and discussing potential defenses.

Tennessee law protects various assets from creditors, including your primary residence up to a certain value, retirement accounts, and personal property like clothes and household goods. Understanding these protections can help you navigate financial challenges more effectively. If you receive a Tennessee Notice of Disputed Account, it’s wise to evaluate which of your assets may be at risk.

Creditors can potentially take your house in Tennessee if they obtain a judgement against you and the debt is secured. However, certain protections exist under state homestead laws that can provide some security for your home. A Tennessee Notice of Disputed Account may serve as a foundation for negotiating or disputing claims that could affect your property.

Yes, medical bills can impact your credit score in Tennessee if they remain unpaid and are sent to collections. When an account goes to collections, it can appear on your credit report, potentially lowering your score. Receiving a Tennessee Notice of Disputed Account related to medical bills gives you the opportunity to address inaccuracies before they affect your credit history.

In Tennessee, a judgement can result in the seizure of various personal properties, including bank accounts, vehicles, and valuable personal items. However, exemptions apply to certain assets, like essentials for living and certain retirement accounts. Understanding these exemptions is crucial if you receive a Tennessee Notice of Disputed Account, as they can impact what creditors may take.

Filling out a credit dispute form is straightforward. Provide your contact information, account details, and identify the specific errors. Use the space provided to explain your reasoning and mention the Tennessee Notice of Disputed Account for context. If you need assistance, consider using tools from platforms like uslegalforms, which can guide you through the process effectively.

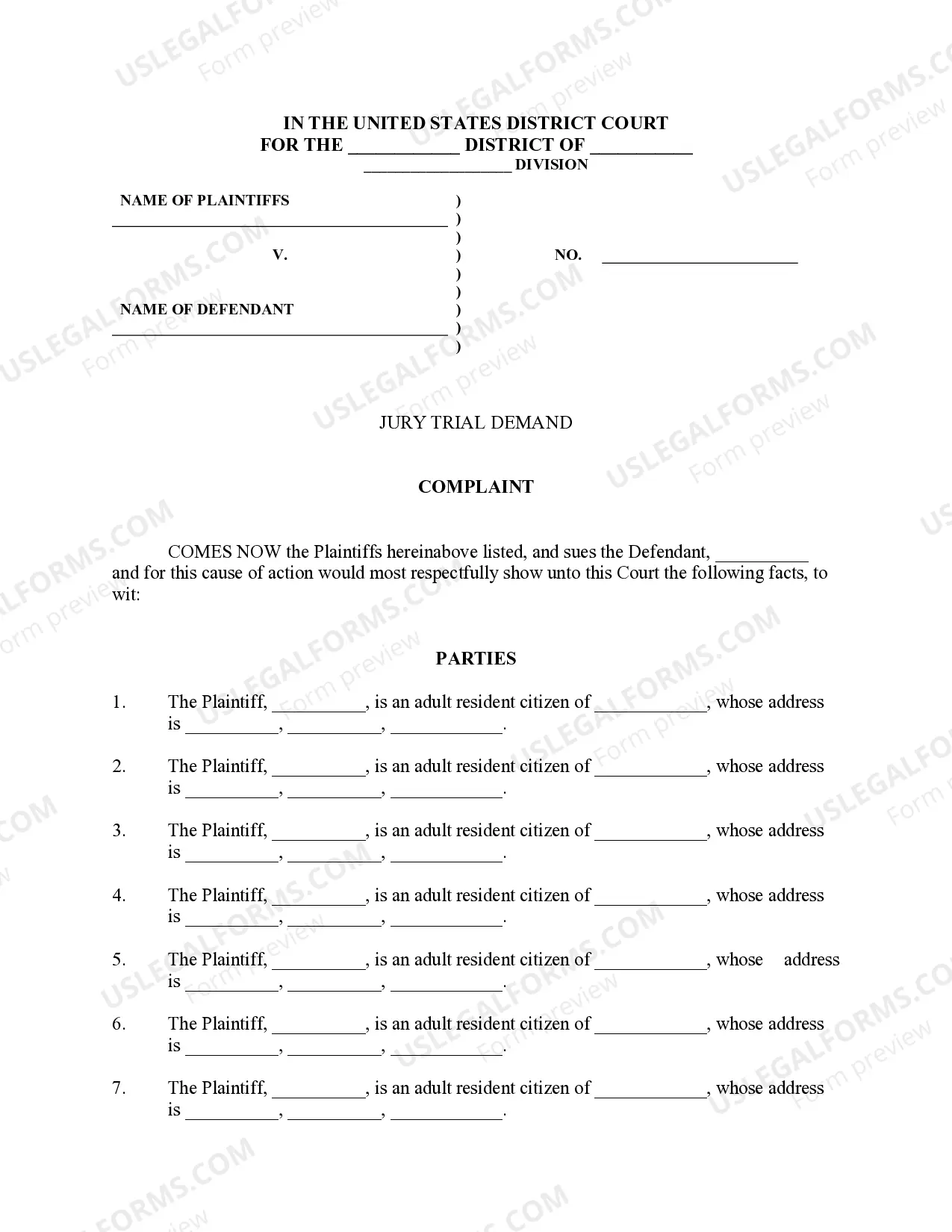

To properly dispute a credit report, gather all relevant information, such as your credit report and supporting documents. Write a clear letter to the credit bureau, detailing your disputes and referencing the Tennessee Notice of Disputed Account. Submit your dispute using certified mail to ensure you have proof of sending. This method enhances your chances of a timely response.

crafted credit dispute letter begins with your personal information and details of the disputed account. Clearly outline the inaccuracies and cite any relevant evidence, such as credit reports or statements. Use the Tennessee Notice of Disputed Account to reference your claims legally. This structured approach increases the likelihood of a favorable outcome.

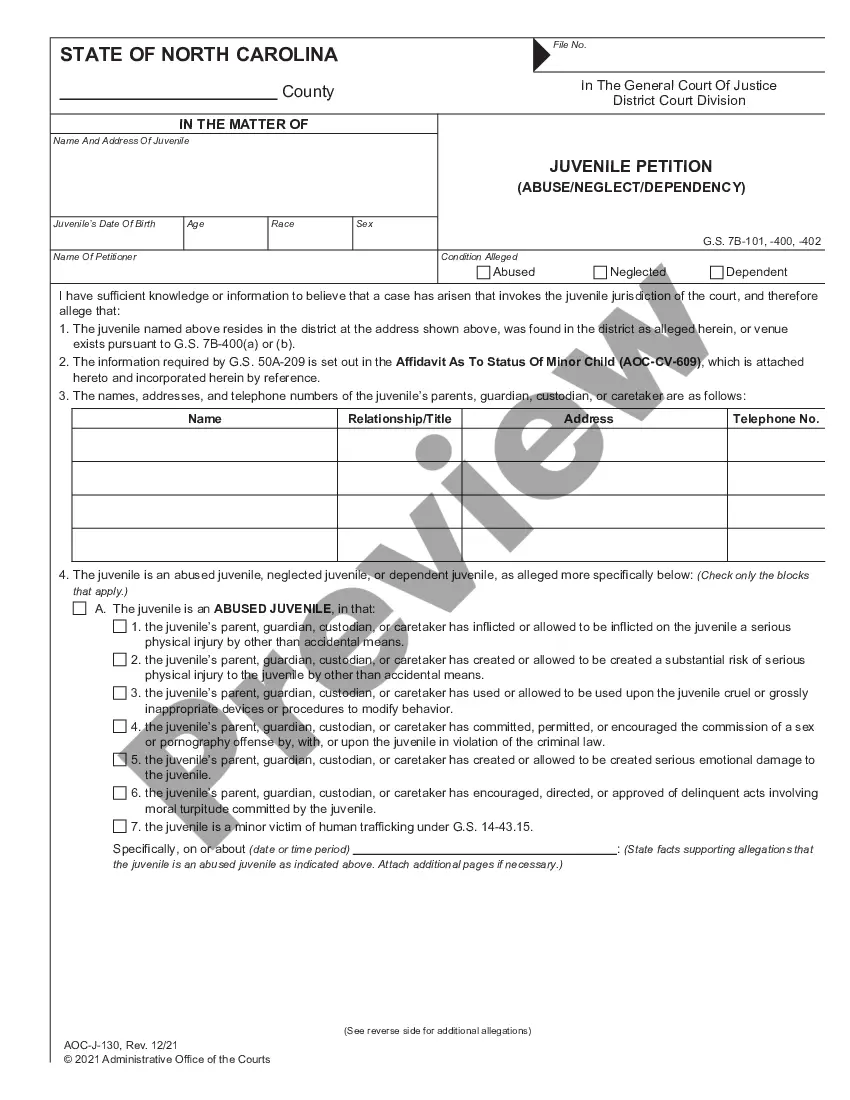

To write a dispute form related to your Tennessee Notice of Disputed Account, start by clearly stating your account details at the top. Include the transactions you are disputing, along with specific reasons for your dispute. Use precise language and provide any supporting documentation to strengthen your case. This helps ensure a smoother resolution process.