Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund

Description

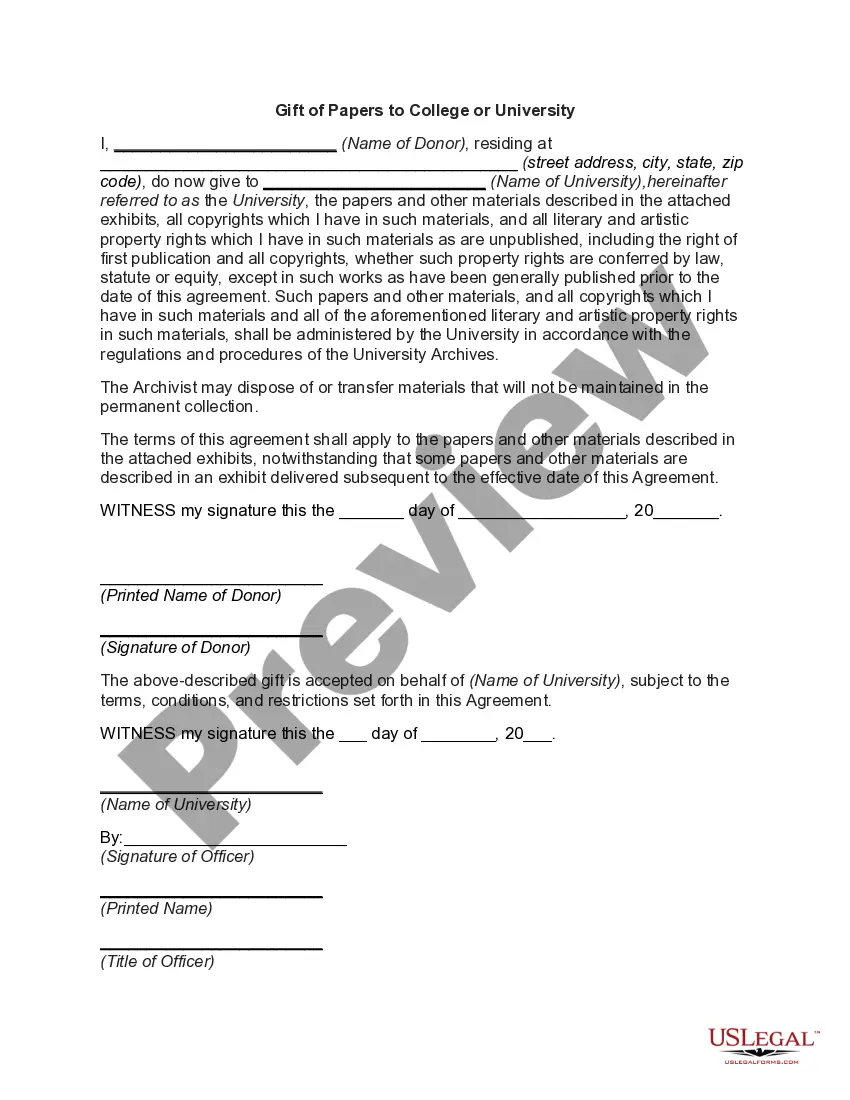

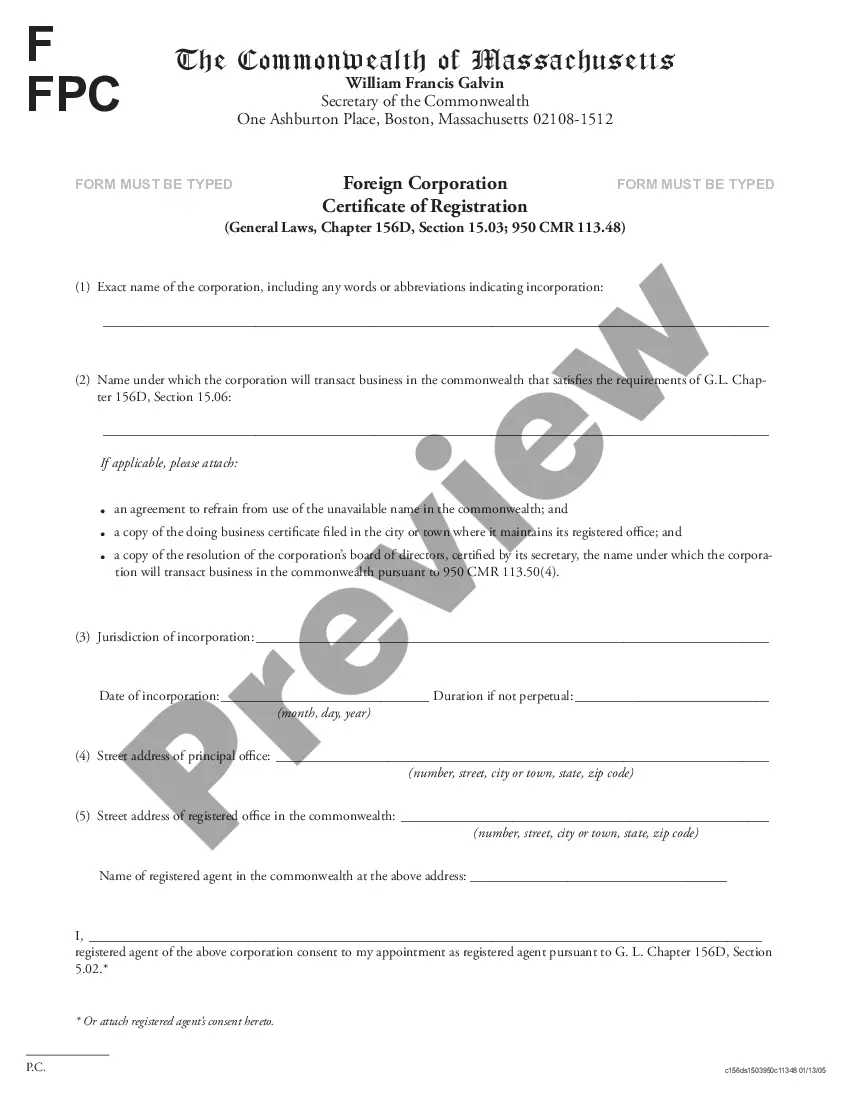

How to fill out Charitable Pledge Agreement - Gift To University To Establish Scholarship Fund?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal form templates that you can obtain or create.

While utilizing the site, you can access thousands of forms for commercial and personal uses, organized by categories, claims, or keywords.

You can download the latest versions of forms such as the Tennessee Charitable Pledge Agreement - Donation to University for Scholarship Fund in a matter of minutes.

In case the form doesn’t meet your needs, utilize the Search field at the top of the screen to find one that does.

Once satisfied with the form, confirm your choice by clicking on the Get now button. Then, choose your preferred pricing plan and provide your details to register for an account.

- If you hold a subscription, Log In and retrieve the Tennessee Charitable Pledge Agreement - Donation to University for Scholarship Fund from the US Legal Forms archive.

- The Download button will be visible on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some basic tips to help you get started.

- Ensure you have selected the correct form for your city/state.

- Review the Review button to examine the form’s information.

Form popularity

FAQ

Yes, gifts made to a 501(c)(3) organization are generally tax-deductible for the donor, as long as the organization is recognized by the IRS. By establishing a Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, donors can maximize their tax benefits while supporting education. This deduction serves as an incentive, encouraging more people to contribute to meaningful causes.

Nonprofits can offer prizes as part of fundraising efforts, such as raffles or contests. These prizes can create excitement and encourage participation in campaigns like the Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. It's critical to understand the legal requirements and guidelines for conducting such activities, ensuring compliance while boosting fundraising results.

Nonprofits may provide gifts to donors as a token of appreciation, strengthening their relationship with supporters. This practice is often part of a broader strategy, such as a Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, designed to encourage ongoing commitment. Nonetheless, it is essential to follow the rules set forth by the IRS regarding such gifts.

Yes, nonprofits can offer gifts in return for donations, commonly known as donor incentives. These gifts encourage individuals to contribute more generously, especially in the context of a Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. However, organizations need to ensure these gifts comply with IRS regulations and enhance the overall mission of the nonprofit.

A nonprofit gift acceptance policy outlines how an organization accepts and manages gifts, ensuring that donations align with its mission and legal guidelines. When considering a Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, this policy helps clarify the types of gifts the nonprofit can accept. It also provides transparency and confidence to donors, ensuring that their contributions are used effectively.

To politely ask for contributions, frame your request around the community's needs and the positive change contributions can create. You could say, 'We invite you to consider contributing to our Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund, as your support can change lives.' It’s essential to personalize your request. Thank them for their time and willingness to support a worthy cause.

When asking for donations instead of gifts, it is important to explain your intentions clearly. You might say, 'Your donations will have a lasting impact by helping us establish scholarships through the Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund.' This approach not only conveys your needs but also illustrates the tangible benefits of their contributions. Always express your gratitude for their consideration and support.

You can simply say, 'We would greatly appreciate your support through donations rather than gifts.' Make sure to clarify that contributions will help fund scholarships via the Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. This clear communication shows your intentions and emphasizes the positive outcome of their support. Showing genuine appreciation for their help encourages a favorable response.

To politely request donations instead of gifts, focus on the impact of contributions. You can express how their support helps establish scholarships through the Tennessee Charitable Pledge Agreement - Gift to University to Establish Scholarship Fund. Highlight the benefits for students and the community. Providing clear examples of how the funds will be used makes the ask more meaningful.