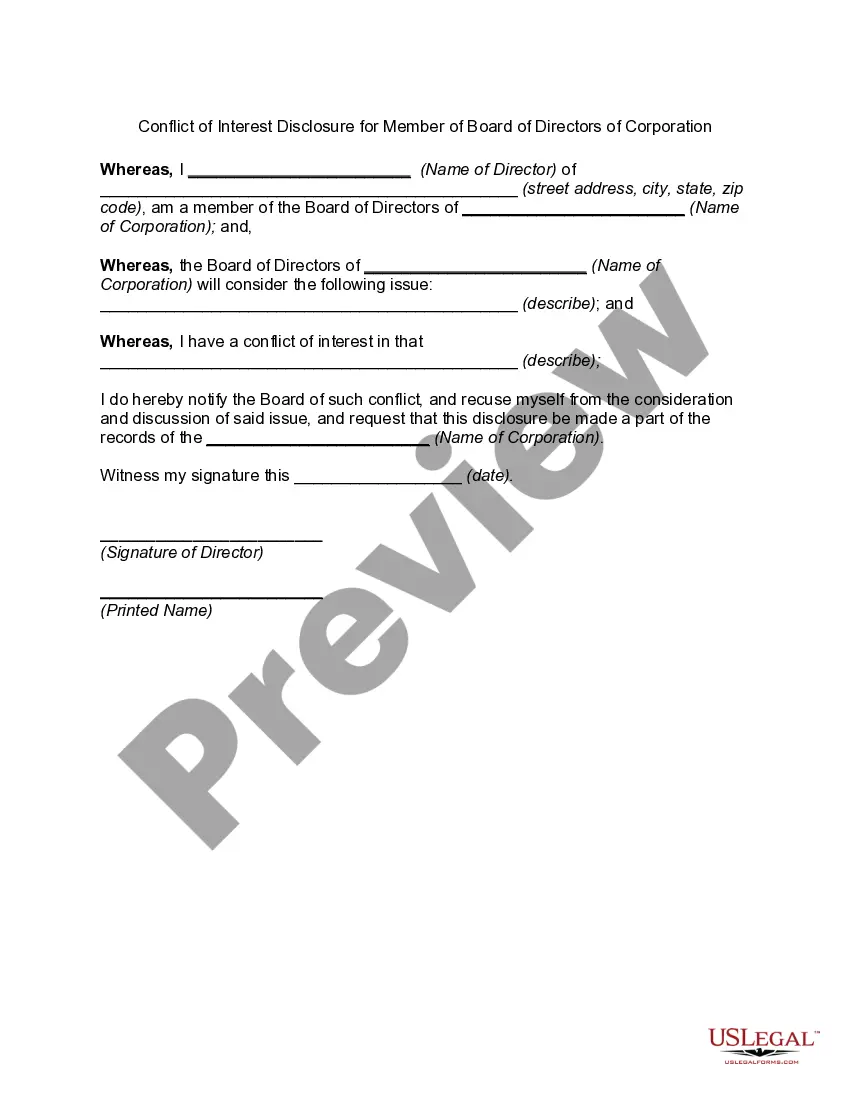

Tennessee Conflict of Interest Disclosure for Member of Board of Directors of Corporation

Description

How to fill out Conflict Of Interest Disclosure For Member Of Board Of Directors Of Corporation?

You can spend hours online searching for the legal document template that meets your state and federal requirements.

US Legal Forms offers a vast array of legal documents that are assessed by experts.

You can obtain or create the Tennessee Conflict of Interest Disclosure for Board of Directors Members of a Corporation through the service.

If available, utilize the Review button to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can complete, edit, print, or sign the Tennessee Conflict of Interest Disclosure for Member of Board of Directors of Corporation.

- Every legal document template you purchase is permanently yours.

- To get another copy of the purchased form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/region of choice.

- Review the form description to verify that you have chosen the right document.

Form popularity

FAQ

If a board member has a conflict of interest, it is crucial to address the situation promptly to prevent any compromise in decision-making. The board member should disclose the conflict fully and may need to recuse themselves from discussions or votes related to that issue. Utilizing a Tennessee Conflict of Interest Disclosure for Member of Board of Directors of Corporation ensures that the board maintains ethical standards and adheres to legal requirements. By managing these conflicts actively, the board can preserve its integrity and public trust.

A conflict of interest on a board occurs when a board member's personal interests may compromise their ability to make objective decisions for the corporation. This might include situations where a board member has a financial stake in a decision being made, or when a board member has relationships that could improperly influence their judgments. In the framework of Tennessee Conflict of Interest Disclosure for Member of Board of Directors of Corporation, recognizing these conflicts is vital for maintaining ethical governance and transparency.

A declaration of conflict of interest is a formal statement made by board members indicating any potential conflicts that may affect their responsibilities. This declaration is essential for maintaining transparency, particularly in a Tennessee Conflict of Interest Disclosure for Member of Board of Directors of Corporation. By declaring conflicts, members uphold the integrity of the board and ensure that all decisions are made in the organization's best interests. This proactive approach helps prevent misinformation and trust issues.

The four types of conflict of interest typically include personal, financial, managerial, and professional conflicts. In the context of a Tennessee Conflict of Interest Disclosure for Member of Board of Directors of Corporation, personal conflicts arise when board members prioritize personal relationships over corporate interests. Financial conflicts occur when board members stand to gain financially. Managerial conflicts happen when personal stakes interfere with decision-making, while professional conflicts involve competing professional obligations.

To disclose a conflict of interest, a board member should inform the board promptly, ideally through a formal conflict of interest disclosure form. Providing a clear account of the potential conflict will help the board evaluate the situation appropriately. In Tennessee, utilizing the Conflict of Interest Disclosure for Member of Board of Directors of Corporation is essential for maintaining ethical governance and trust within your organization.

A board member conflict of interest form is a document that captures the disclosures made by board members regarding any potential conflicts they may have. This form helps maintain transparency and accountability within the board's operations. In the context of Tennessee, using a Conflict of Interest Disclosure for Member of Board of Directors of Corporation can streamline this process and ensure compliance with state regulations.

A board declaration of conflict of interest is a formal statement made by a board member disclosing any personal, professional, or financial interests that could influence their responsibilities. This declaration is crucial in maintaining ethical standards and accountability. For organizations in Tennessee, ensuring that board members complete a Conflict of Interest Disclosure for Member of Board of Directors of Corporation is a vital step for good governance.

To effectively deal with conflict of interest on a board, establish clear policies and procedures for identifying and managing such conflicts. Utilizing a Tennessee Conflict of Interest Disclosure for Member of Board of Directors of Corporation can facilitate transparent discussions and decision-making. Regular training and open communication foster a culture where board members feel comfortable disclosing potential conflicts.

A Form 990 conflict of interest refers to any situation where an individual involved with a nonprofit organization holds a financial interest that could affect their decision-making. For organizations in Tennessee, the Conflict of Interest Disclosure for Member of Board of Directors of Corporation must be clearly outlined to ensure transparency. Understanding this can help protect the integrity of your board and maintain public trust.

The four unethical practices of the board of directors include self-dealing, neglecting fiduciary duties, failing to disclose conflicts of interest, and misusing company resources for personal gain. These actions can severely damage an organization's reputation and trust. To combat these unethical practices, having a clear understanding of the Tennessee Conflict of Interest Disclosure for Member of Board of Directors of Corporation is essential for all board members.