Tennessee Letter Requesting Transfer of Property to Trust

Description

How to fill out Letter Requesting Transfer Of Property To Trust?

Finding the right legitimate papers format can be a battle. Of course, there are plenty of themes available on the net, but how would you obtain the legitimate develop you will need? Utilize the US Legal Forms website. The support offers a huge number of themes, including the Tennessee Letter Requesting Transfer of Property to Trust, that can be used for company and private requires. Every one of the varieties are checked by professionals and satisfy state and federal demands.

When you are currently listed, log in in your accounts and then click the Down load switch to obtain the Tennessee Letter Requesting Transfer of Property to Trust. Utilize your accounts to look throughout the legitimate varieties you may have purchased earlier. Check out the My Forms tab of the accounts and get an additional duplicate from the papers you will need.

When you are a new consumer of US Legal Forms, here are basic instructions that you can stick to:

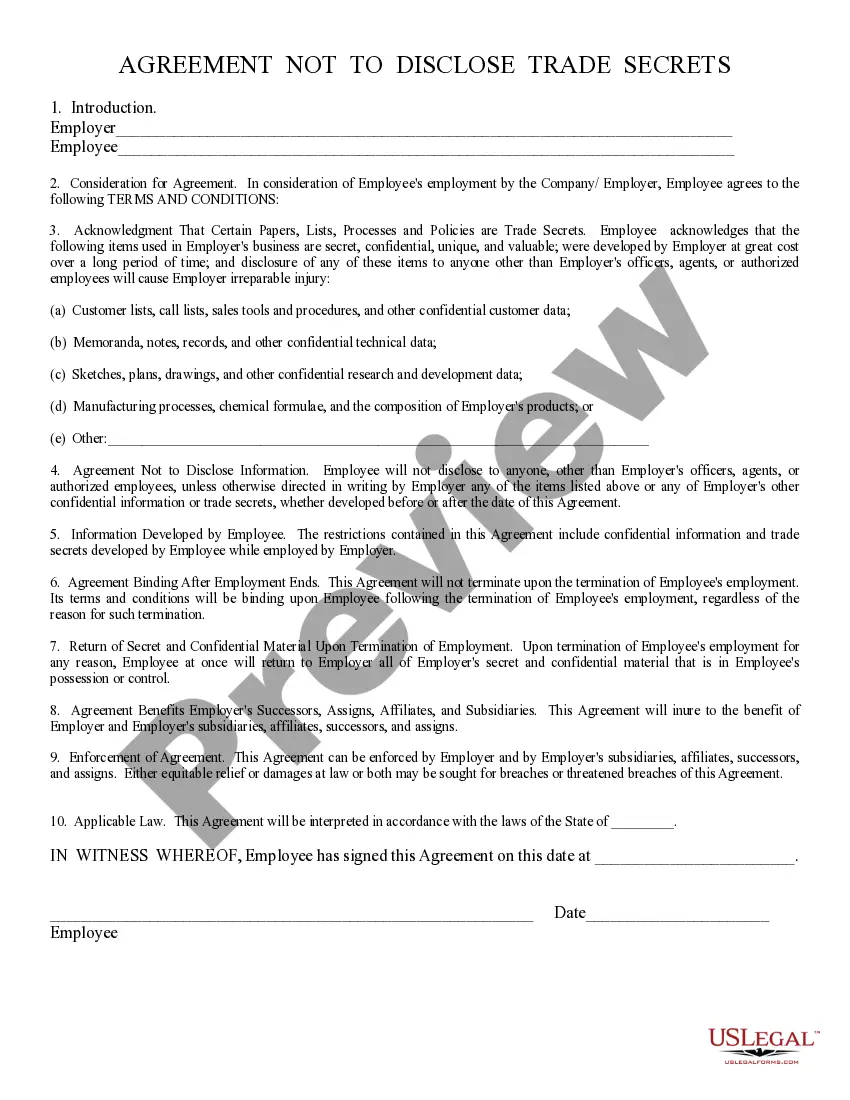

- Initial, make sure you have chosen the correct develop for your personal area/area. You are able to look over the shape while using Review switch and study the shape description to ensure this is basically the best for you.

- In the event the develop fails to satisfy your needs, take advantage of the Seach discipline to find the right develop.

- When you are certain the shape is suitable, select the Get now switch to obtain the develop.

- Opt for the costs plan you want and type in the required info. Design your accounts and pay money for the transaction using your PayPal accounts or bank card.

- Pick the data file file format and download the legitimate papers format in your system.

- Total, edit and produce and indicator the acquired Tennessee Letter Requesting Transfer of Property to Trust.

US Legal Forms will be the most significant collection of legitimate varieties in which you can see various papers themes. Utilize the company to download appropriately-manufactured paperwork that stick to status demands.

Form popularity

FAQ

What Assets Should Go Into a Trust?Bank Accounts. You should always check with your bank before attempting to transfer an account or saving certificate.Corporate Stocks.Bonds.Tangible Investment Assets.Partnership Assets.Real Estate.Life Insurance.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Assets That Can And Cannot Go Into Revocable TrustsReal estate.Financial accounts.Retirement accounts.Medical savings accounts.Life insurance.Questionable assets.

How to Transfer Assets Into an Irrevocable TrustIdentify Your Assets. Review your assets and determine which ones you would like to place in your trust.Obtain a Trust Tax Identification Number.Transfer Ownership of Your Assets.Purchase a Life Insurance Policy.

Moving your house or other assets into a trust (specifically an irrevocable trust) can decrease your taxable estate. For a wealthy estate that could otherwise be subject to a state or federal estate tax, putting assets into a trust can help avoid or minimize the estate taxes.

Transfers to an irrevocable trust are generally subject to gift tax. This means that even though assets transferred to an irrevocable trust will not be subject to estate tax, they will generally be subject to gift tax.

Irrevocable Trust DisadvantagesInflexible structure. You don't have any wiggle room if you're the grantor of an irrevocable trust, compared to a revocable trust.Loss of control over assets. You have no control to retrieve or even manage your former assets that you assign to an irrevocable trust.Unforeseen changes.

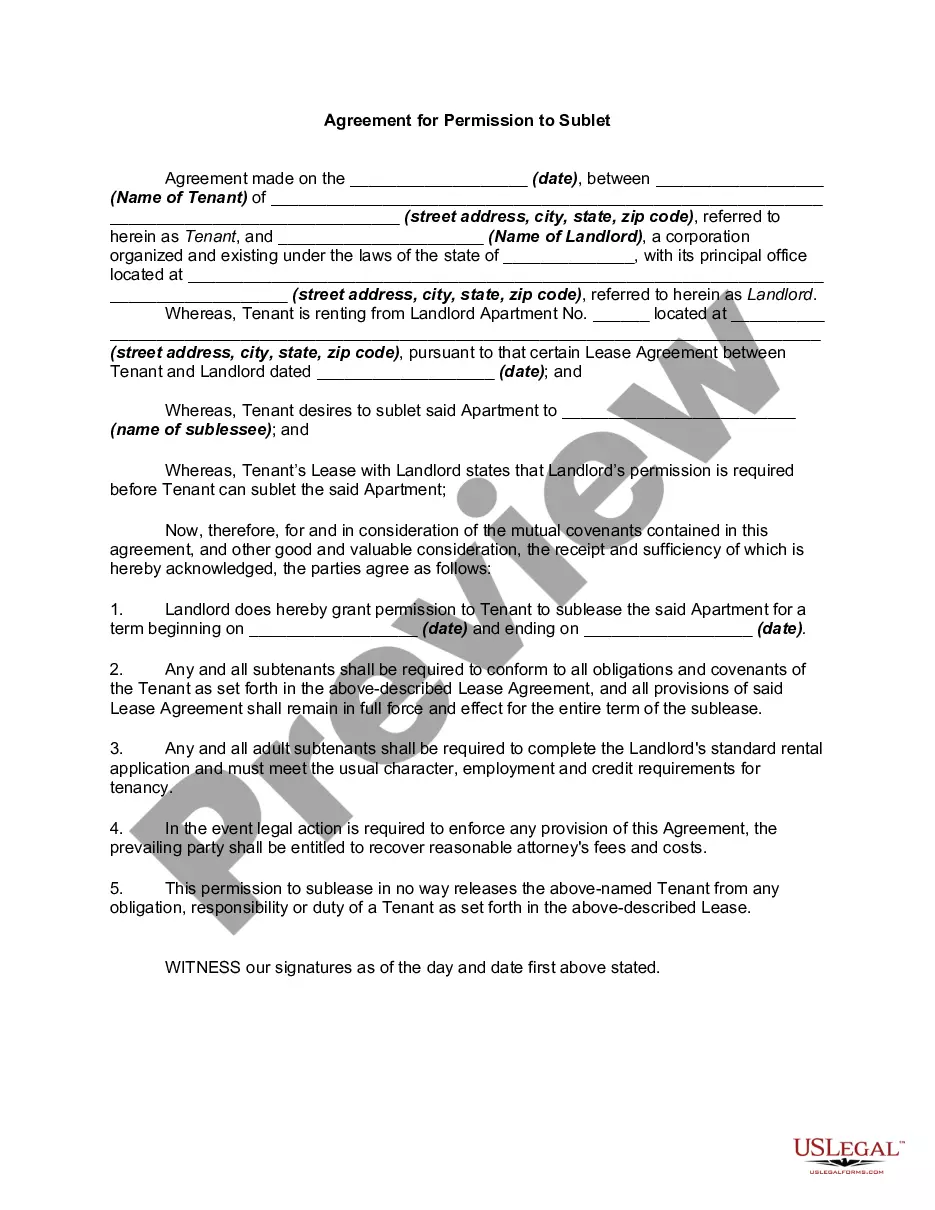

To transfer real property into your Trust, a new deed reflecting the name of the Trust must be executed, notarized and recorded with the County Recorder in the County where the property is located. Care must be taken that the exact legal description in the existing deed appears on the new deed.