Tennessee Substituted Agreement

Description

How to fill out Substituted Agreement?

It is feasible to spend hours online searching for the appropriate legal document format that meets the state and federal requirements you will need.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You can easily download or print the Tennessee Substituted Agreement from the service.

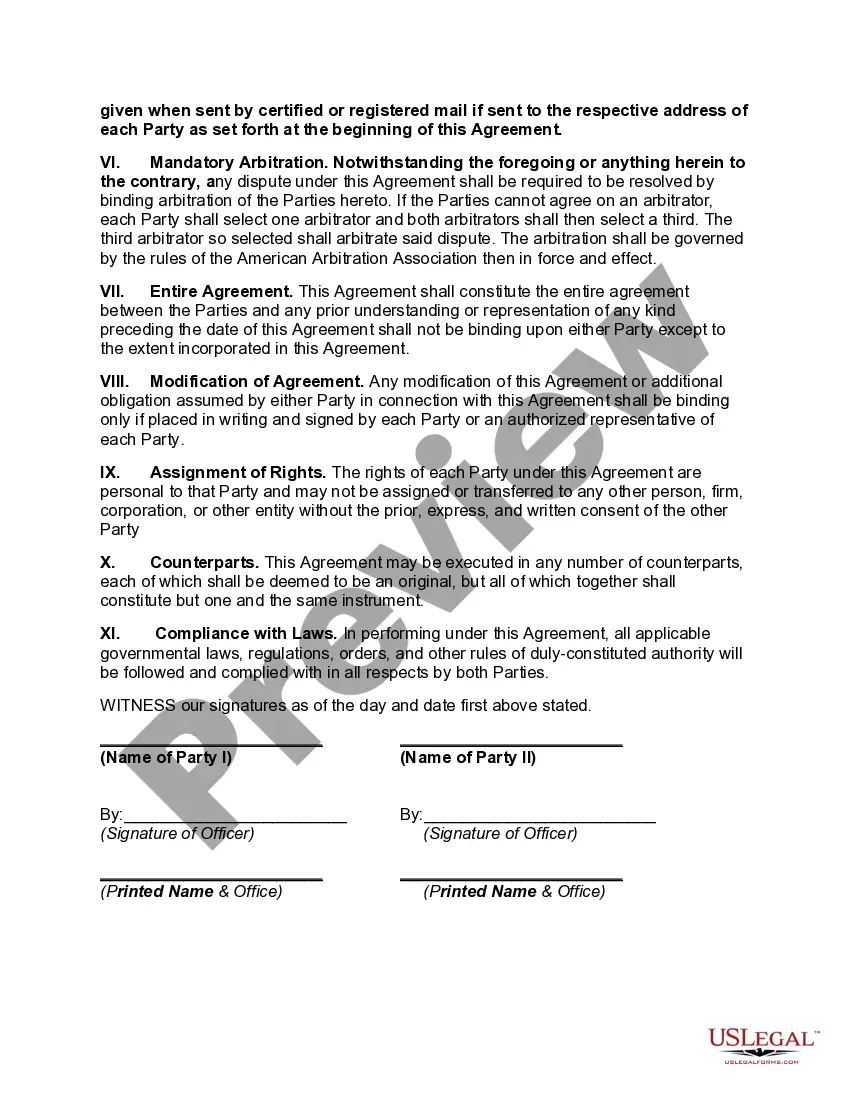

If available, use the Review option to examine the document format as well.

- If you already have a US Legal Forms account, you may Log In and select the Download option.

- Subsequently, you can fill out, modify, print, or sign the Tennessee Substituted Agreement.

- Each legal document format you acquire is yours indefinitely.

- To obtain another copy of the downloaded form, navigate to the My documents tab and select the corresponding option.

- If this is your first time using the US Legal Forms site, follow the simple instructions provided below.

- First, verify that you have chosen the correct document format for the county/area of your choice. Check the form description to ensure you have selected the right form.

Form popularity

FAQ

The primary difference lies in the fact that a substituted contract replaces an original agreement, often due to changes in circumstances. In contrast, a regular contract is established without such alterations. Understanding this distinction is essential, especially when employing tools like the Tennessee Substituted Agreement to manage obligations effectively.