Tennessee Equipment Lease with Lessor to Purchase Equipment Specified by Lessee is a contractual agreement between a lessor (the equipment owner) and a lessee (the individual or business needing the equipment) in Tennessee. This lease type is commonly used when the lessee wants to acquire specific equipment but doesn't have the immediate financial means to purchase it outright. Instead, they opt for this lease with a predetermined purchase option at the end of the lease term. Different types of Tennessee Equipment Lease with Lessor to Purchase Equipment Specified by Lessee can be categorized based on the specific industries they serve, the duration of the lease, and the equipment involved. Some common variants include: 1. Construction Equipment Lease: This type of lease is designed for lessees in the construction industry who require heavy machinery and equipment such as excavators, bulldozers, cranes, or loaders. It allows construction companies to use advanced equipment without the burdensome upfront costs. 2. Medical Equipment Lease: Designed for healthcare providers, medical equipment leases provide access to crucial equipment like MRI machines, X-ray systems, ultrasound devices, or diagnostic tools. This lease enables medical facilities to offer state-of-the-art services without breaking their budgets. 3. Office Equipment Lease: Intended for businesses in need of office-related equipment, such as computers, printers, copiers, or phone systems. This lease allows companies to stay technologically updated and efficiently run their operations. 4. Automotive Equipment Lease: Catering to automotive businesses, this lease involves equipment like car lifts, tire changers, wheel balancers, or diagnostic scanners. Automotive shops can lease these tools to enhance their service capabilities while avoiding substantial upfront expenses. 5. Agriculture Equipment Lease: Tailored to farmers and agricultural businesses, this lease accommodates essential tools like tractors, combines, irrigation systems, or grain storage equipment. It assists farmers in accessing modern equipment to maximize their productivity and yields. Regardless of the specific industry or equipment, Tennessee Equipment Lease with Lessor to Purchase Equipment Specified by Lessee typically follows a similar structure. The agreement outlines the lease term, monthly payments, terms and conditions, responsibilities of both parties, insurance requirements, maintenance obligations, and the purchase price if the lessee decides to acquire the equipment at the end of the lease. Overall, Tennessee Equipment Lease with Lessor to Purchase Equipment Specified by Lessee provides a flexible solution for lessees seeking equipment while minimizing upfront costs, allowing businesses in various industries to access the necessary tools for their operations and growth.

Tennessee Equipment Lease with Lessor to Purchase Equipment Specified by Lessee

Description

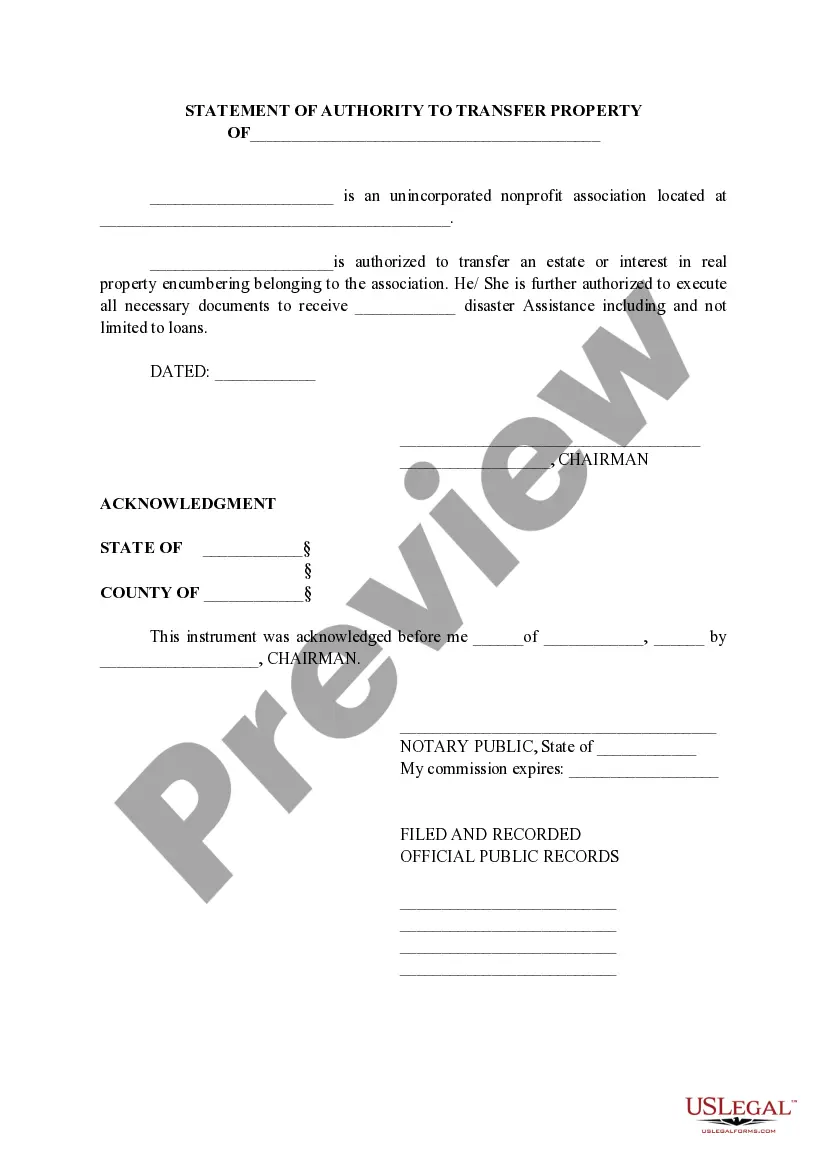

How to fill out Equipment Lease With Lessor To Purchase Equipment Specified By Lessee?

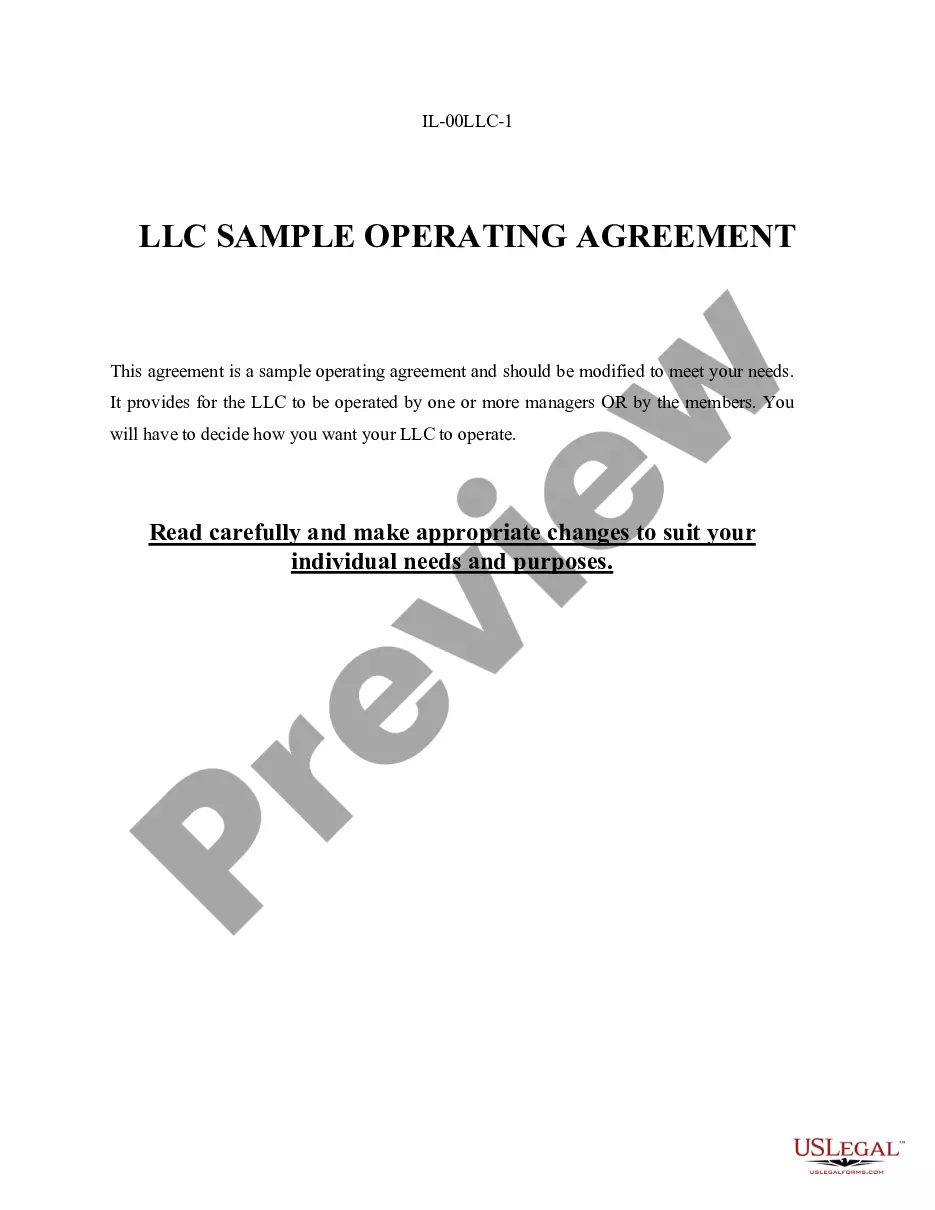

Have you been within a position where you require files for possibly business or person uses nearly every day time? There are tons of legal file layouts available on the Internet, but discovering versions you can rely on is not simple. US Legal Forms gives thousands of kind layouts, such as the Tennessee Equipment Lease with Lessor to Purchase Equipment Specified by Lessee, which can be written to fulfill state and federal demands.

When you are currently informed about US Legal Forms web site and have an account, just log in. Afterward, you are able to download the Tennessee Equipment Lease with Lessor to Purchase Equipment Specified by Lessee web template.

If you do not have an profile and would like to begin using US Legal Forms, abide by these steps:

- Find the kind you want and ensure it is for that right area/state.

- Make use of the Preview switch to analyze the form.

- Look at the explanation to ensure that you have selected the correct kind.

- When the kind is not what you`re looking for, use the Look for discipline to find the kind that suits you and demands.

- Whenever you find the right kind, simply click Purchase now.

- Choose the pricing strategy you want, complete the necessary information and facts to make your money, and pay for the transaction with your PayPal or credit card.

- Decide on a handy data file structure and download your duplicate.

Locate each of the file layouts you may have bought in the My Forms menu. You may get a additional duplicate of Tennessee Equipment Lease with Lessor to Purchase Equipment Specified by Lessee whenever, if needed. Just click the needed kind to download or print out the file web template.

Use US Legal Forms, probably the most comprehensive assortment of legal types, to save efforts and steer clear of mistakes. The services gives professionally created legal file layouts that can be used for a variety of uses. Produce an account on US Legal Forms and begin producing your daily life easier.

Form popularity

FAQ

A lease agreement, as we know, is a contract between two parties, (a lessee and the lessor here, the lessee being the one who is renting/leasing the property, and the lessor, the owner), wherein, specific conditions are mentioned about renting or leasing the property.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

Compared to a loan which typically requires 5-20% down, a TRAC lease does not require a large down payment. The TRAC lease has a lower barrier of entry. You get the equipment needed for your business and keep more money in your pocket.

A lease is a contract outlining the terms under which one party agrees to rent an assetin this case, propertyowned by another party. It guarantees the lessee, also known as the tenant, use of the property and guarantees the lessor (the property owner or landlord) regular payments for a specified period in exchange.

A TRAC (Terminal Rental Adjustment Clause) is a lease on vehicles intended for commercial use more than half of the time. TRAC leases reduce the high cost of equipment to low monthly payments, thus allowing you to get access to the equipment you need at the lowest possible rate.

How to Record "Lease to Own" Computer assetCreate Other Current Liability account for the loan/lease payable.Create Fixed Asset account for Computer Equipment.You must use a General Journal Entry, as taxes cannot be entered from the register.

The lease agreement is a contract between the lessor vs lessee for the use of the asset or property. It outlines the terms of the contract and sets the legal obligations associated with the use of the asset. Both parties are signatories to the agreement and are required to abide by its rules.

What is equipment leasing? Equipment leasing is a type of financing in which you rent equipment rather than purchase it outright. You can lease expensive equipment for your business, such as machinery, vehicles or computers.

A $1 Buyout Lease, also called a capital lease, is similar to purchasing equipment with a loan. With this type of lease, there is a higher monthly payment compared with an FMV lease, but at the end of the lease term, the lessee purchases the equipment for $1.