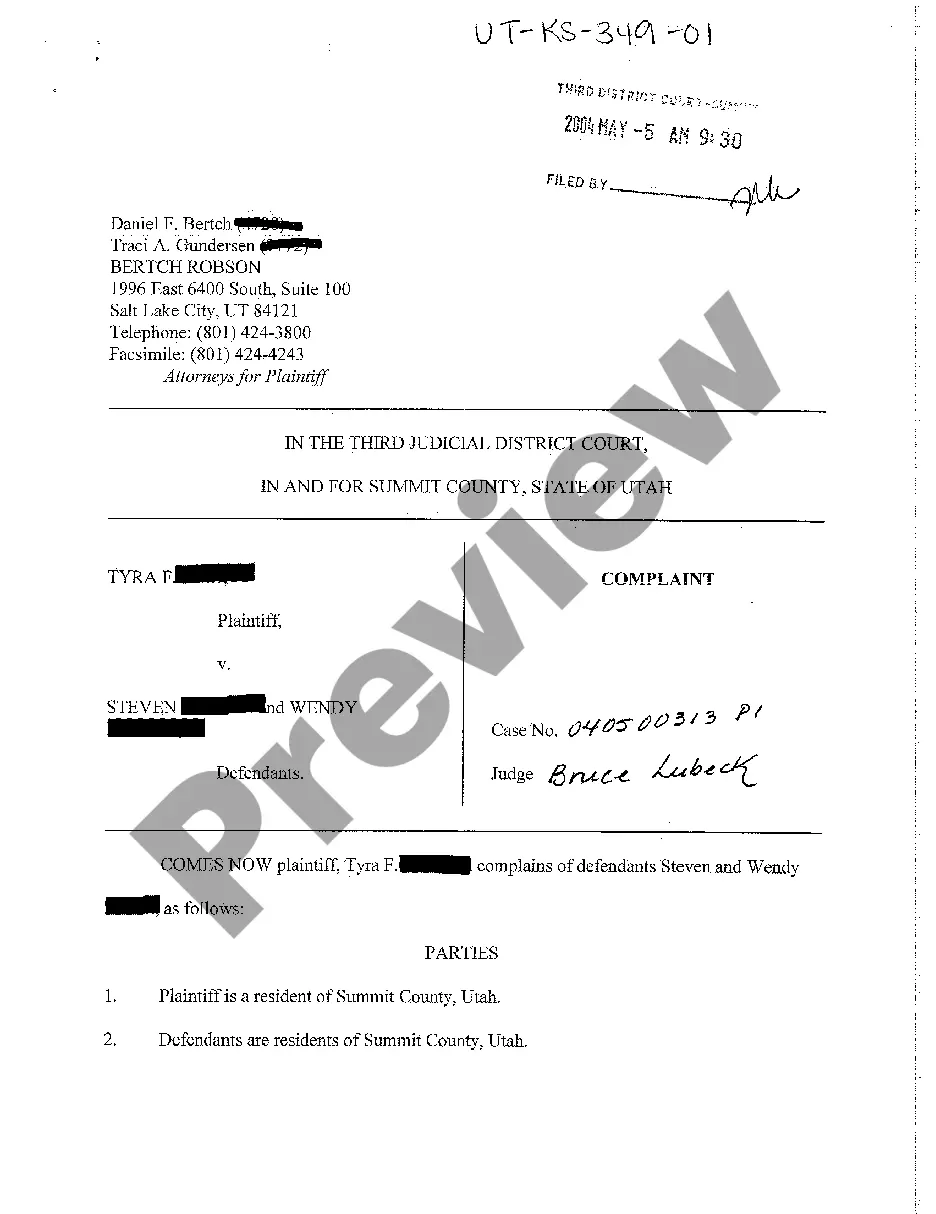

The Tennessee Assignment of Profits of Business is a legal document that allows individuals or entities to transfer their right to receive profits from a business to another party. This assignment is often used in situations where a business owner wants to sell or transfer the profit-generating aspect of their business, such as the income from a specific project or division, without relinquishing ownership of the entire business. This assignment can be beneficial for various parties involved, including entrepreneurs looking to raise capital, investors seeking a passive income stream, or individuals wanting to mitigate financial risks. By assigning the profits, business owners can secure funding or attract investors by sharing the potential returns on investment while still maintaining control over the daily operations and decision-making processes of the business. There are different types of Tennessee Assignment of Profits of Business that can be utilized depending on the specific needs and circumstances: 1. Partial Assignment: This type of assignment involves transferring only a portion of the business profits. It allows the assignor to retain control over a part of the business while sharing the benefits with the assignee. This can be particularly useful for businesses that have multiple profit-generating activities or revenue streams. 2. Total Assignment: In a total assignment of profits, the assignor transfers the entire profit generated from the business. This implies that the assignee assumes full responsibility for managing and operating the business while enjoying all the associated profits. Total assignments are often found in cases where business owners want to exit their ventures entirely or retire. 3. Specific Project Assignment: This type of assignment focuses on transferring the profits from a specific project or undertaking within a business. It allows the assignor to isolate particular revenue-generating activities and assign them to a separate entity or individual. This arrangement can be beneficial in cases where businesses have ongoing projects or ventures that require specialized attention or financial support. When drafting a Tennessee Assignment of Profits of Business, it is crucial to include specific clauses and provisions that outline the terms and conditions of the assignment. These may include details about the assigned profits, any limitations, payment schedules, dispute resolution mechanisms, and confidentiality agreements. Seek the assistance of a knowledgeable attorney to ensure that the document is tailored to your unique business needs and complies with relevant Tennessee laws and regulations. In conclusion, the Tennessee Assignment of Profits of Business is a valuable legal instrument for facilitating the transfer of profit rights from one party to another within a business setting. It grants business owners' flexibility, promotes financial growth, and attracts investment opportunities while allowing them to retain control over their business operations.

Tennessee Assignment of Profits of Business

Description

How to fill out Tennessee Assignment Of Profits Of Business?

If you have to comprehensive, download, or produce legitimate papers themes, use US Legal Forms, the most important selection of legitimate kinds, which can be found on the Internet. Utilize the site`s basic and hassle-free look for to discover the documents you require. A variety of themes for enterprise and individual reasons are categorized by groups and suggests, or search phrases. Use US Legal Forms to discover the Tennessee Assignment of Profits of Business within a few click throughs.

In case you are already a US Legal Forms buyer, log in for your account and then click the Acquire key to have the Tennessee Assignment of Profits of Business. You can even accessibility kinds you formerly downloaded in the My Forms tab of the account.

Should you use US Legal Forms initially, follow the instructions listed below:

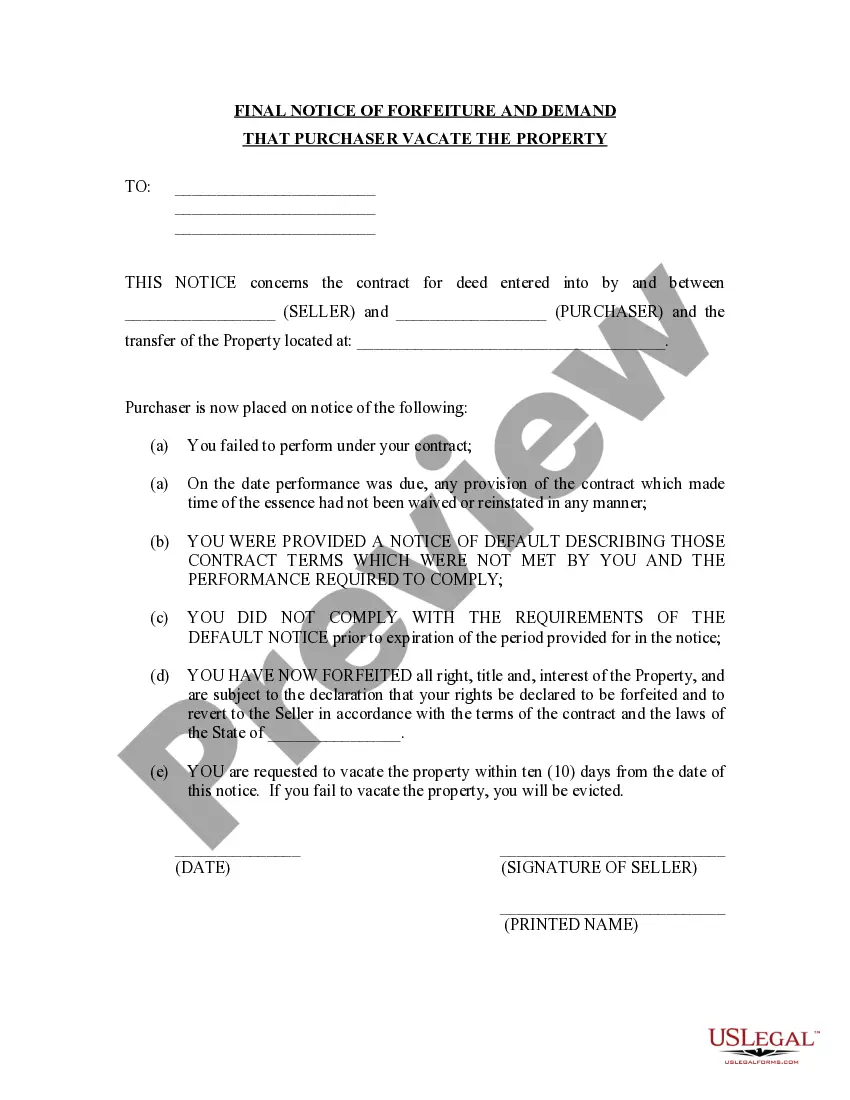

- Step 1. Be sure you have chosen the shape for the appropriate metropolis/country.

- Step 2. Use the Review solution to examine the form`s articles. Do not overlook to read through the description.

- Step 3. In case you are not happy with the kind, make use of the Look for discipline at the top of the display screen to get other models of the legitimate kind template.

- Step 4. Upon having discovered the shape you require, go through the Purchase now key. Pick the prices strategy you favor and include your accreditations to sign up for an account.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal account to complete the financial transaction.

- Step 6. Pick the file format of the legitimate kind and download it on the gadget.

- Step 7. Complete, revise and produce or indication the Tennessee Assignment of Profits of Business.

Every single legitimate papers template you purchase is the one you have for a long time. You possess acces to every single kind you downloaded inside your acccount. Go through the My Forms section and choose a kind to produce or download again.

Contend and download, and produce the Tennessee Assignment of Profits of Business with US Legal Forms. There are millions of skilled and condition-distinct kinds you may use to your enterprise or individual needs.