Tennessee Depreciation Schedule

Description

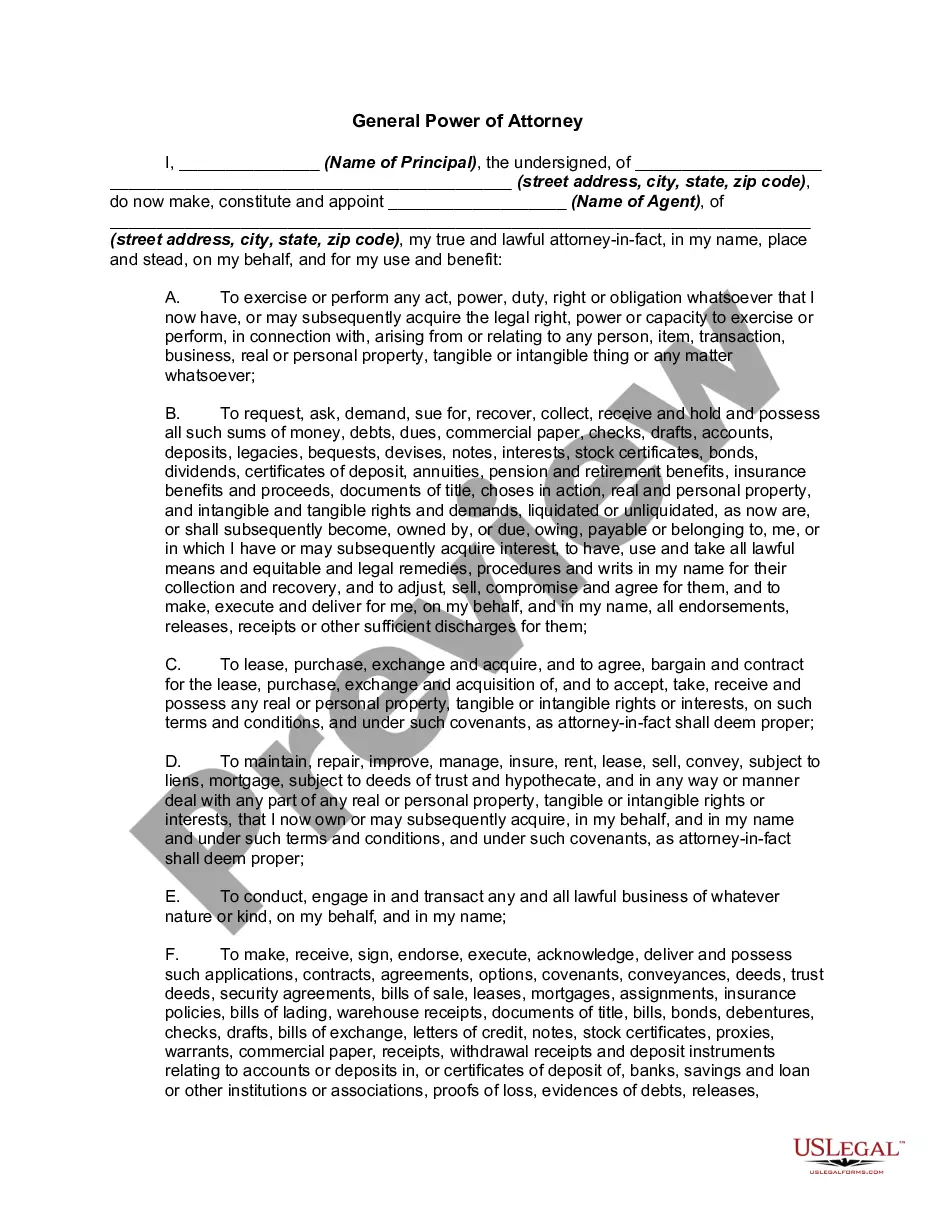

How to fill out Depreciation Schedule?

Are you presently in a role that necessitates documents for either business or personal purposes almost every day.

There are numerous reputable document formats accessible online, but locating ones you can rely on isn't straightforward.

US Legal Forms provides thousands of form templates, including the Tennessee Depreciation Schedule, which are designed to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Tennessee Depreciation Schedule at any time, if necessary. Click on the required form to download or print the document template. Use US Legal Forms, the most extensive collection of valid forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Tennessee Depreciation Schedule template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Identify the form you need and ensure it's for the correct city/county.

- Utilize the Preview button to review the document.

- Check the description to confirm you have selected the right form.

- If the document isn't what you're looking for, use the Search field to find the form that meets your needs.

- Once you find the correct form, click Purchase now.

- Select the pricing plan you prefer, enter the necessary information to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

The ASSESSMENT RATIO for the different classes of property is established by state law (residential and farm @ 25% of appraised value, commercial/industrial @ 40% of appraised value and personalty @ 30% of appraised value). The ASSESSED VALUE is calculated by multiplying the appraised value by the assessment ratio.

Under Tennessee sales and use tax law, sales of motor vehicles, trailers, and off-highway vehicles are sales of tangible personal property subject to sales or use tax.

If the Assessor's record of a property's market value does not change with the market, some people could pay too much in property taxes, while others could pay too little. That's why the Davidson County Assessor is required to conduct reappraisals every four years.

Reappraisal of property for tax purposes is required on a periodic basis to maintain appraisals at market value and to ensure equity of appraisals throughout the jurisdiction. Every county in Tennessee operates on either a four-, five-, or six-year cycle of reappraisal.

In Tennessee, personal property is assessed at 30% of its value for commercial and industrial property and 55% of its value for public utility property. One of the most common components used to differentiate personal property from real property is whether it is moveable (personal) or affixed (real).

Tax assessment: An evaluation of your property, often conducted by a county or city assessor, to determine the property's assessed value. Property taxes: What you pay based on the assessed value of your property and the property tax rate.

Calculating Property Tax To calculate your property tax, multiply the appraised value by the assessment ratio for the property's classification. Then, multiply the product by the tax rate. Property is classified based on how the property is used.

Tangible Personal Property is all property owned or held by a business to operate that business, including but not limited to, furniture, fixtures, vehicles, tools, machinery, equipment, raw materials, and supplies.

This occurs every four years, as required by state law. The property tax rate is automatically adjusted so city can't take in more tax revenue after after a reappraisal, even if the the combined value of all property in Davidson County rose or fell.

Assessors reappraise property in Tennessee in four to six year cycles. The purpose of the reappraisal is to determine the current market value, on which taxes will be based until the next reappraisal in four, five or six years.