Tennessee Resolution of Meeting of LLC Members to Borrow Money

Description

How to fill out Resolution Of Meeting Of LLC Members To Borrow Money?

Are you in a situation where you need to have documents for both corporate or personal activities nearly every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn’t simple.

US Legal Forms provides a vast collection of form templates, including the Tennessee Resolution of Meeting of LLC Members to Borrow Money, designed to meet federal and state requirements.

Once you locate the appropriate document, click Acquire now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and process your payment with PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Tennessee Resolution of Meeting of LLC Members to Borrow Money template.

- If you don’t have an account and wish to begin using US Legal Forms, follow these instructions.

- Find the document you require and confirm it is for the correct city/state.

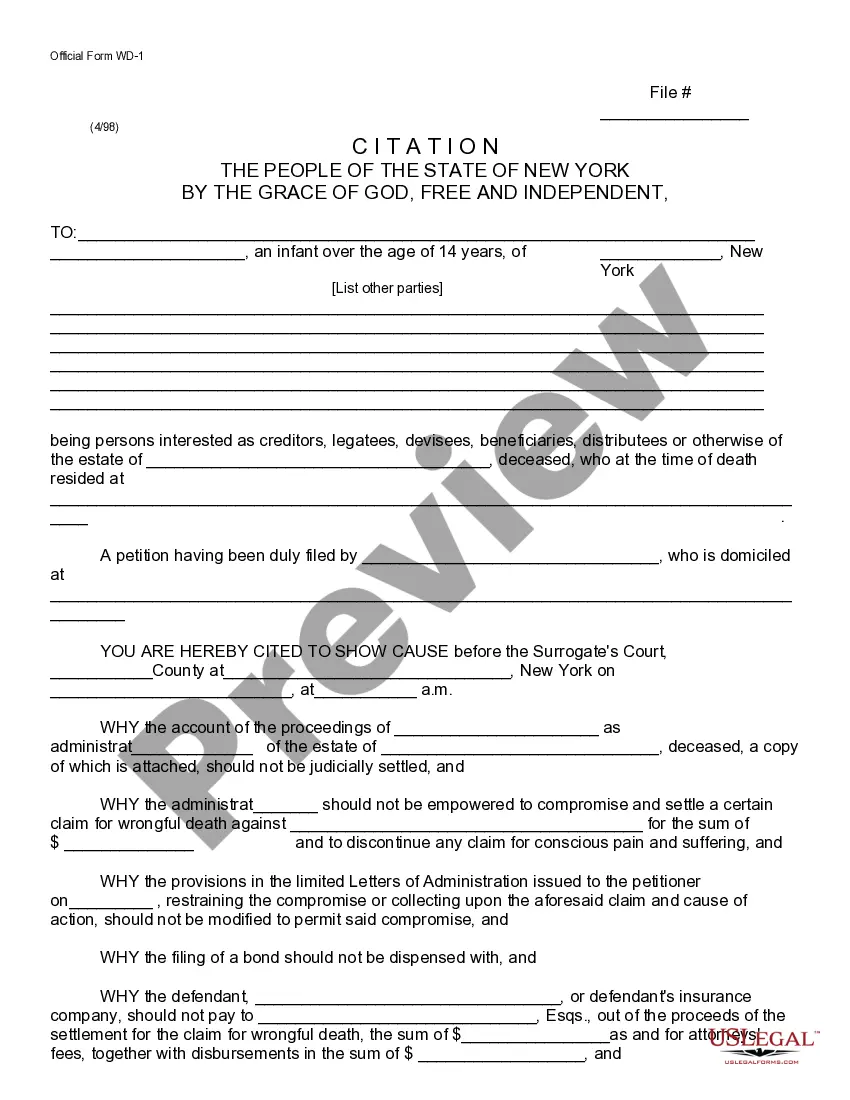

- Use the Review option to inspect the form.

- Read the description to ensure you have selected the correct document.

- If the document isn’t what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

A resolution for an LLC manager outlines the duties and powers granted to the manager by the members of the LLC. This document is essential for establishing clear expectations and accountability among the management team. It aligns with the principles in the Tennessee Resolution of Meeting of LLC Members to Borrow Money, ensuring that all managerial actions are officially recognized.

A resolution for an LLC in Florida serves a similar purpose as those in Tennessee, allowing members to document their decisions. It can include authorizing borrowing, appointing managers, or other important actions. To ensure your resolution meets all legal requirements, consider utilizing the Tennessee Resolution of Meeting of LLC Members to Borrow Money as a model.

A resolution letter for a company is a document that communicates the decisions made by the company's members or directors. This letter often accompanies formal agreements, such as loans or contracts, and serves as a confirmation of authorized actions. Utilizing the Tennessee Resolution of Meeting of LLC Members to Borrow Money can ensure that your resolution letter is properly structured and legally sound.

The resolution of members of an LLC is a written record that reflects the decisions made by the members during a meeting. This document can cover various topics, including borrowing money, changes to management, or modifications to operating agreements. By formally documenting these decisions, the resolution aligns with the Tennessee Resolution of Meeting of LLC Members to Borrow Money, providing clarity and legal validity.

A resolution to borrow from an LLC allows the organization to secure financing, either from members or external lenders. This document ensures that all members agree on the borrowing terms and responsibilities, supporting transparency and accountability. This process is highlighted in the Tennessee Resolution of Meeting of LLC Members to Borrow Money and is essential for legal protection.

A banking resolution is a necessary business document for corporations, both for-profit and nonprofit. While resolutions for LLCs are not legally required, they may still be needed in order to document the company decisions.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

Elements of a Certified Board ResolutionExplanation of the action being taken by the board of directors and the reason for doing so. Name of the secretary. Legal name of the corporation and state of incorporation. Names of the board of directors voting for approval of the resolution.

A resolution can be made by a corporation's board of directors, shareholders on behalf of a corporation, a non-profit board of directors, or a government entity.

When you create a resolution to open a bank account, you need to include the following information:The legal name of the corporation.The name of the bank where the account will be created.The state where the business is formed.Information about the directors/members.More items...