Tennessee Stop Annuity Request

Description

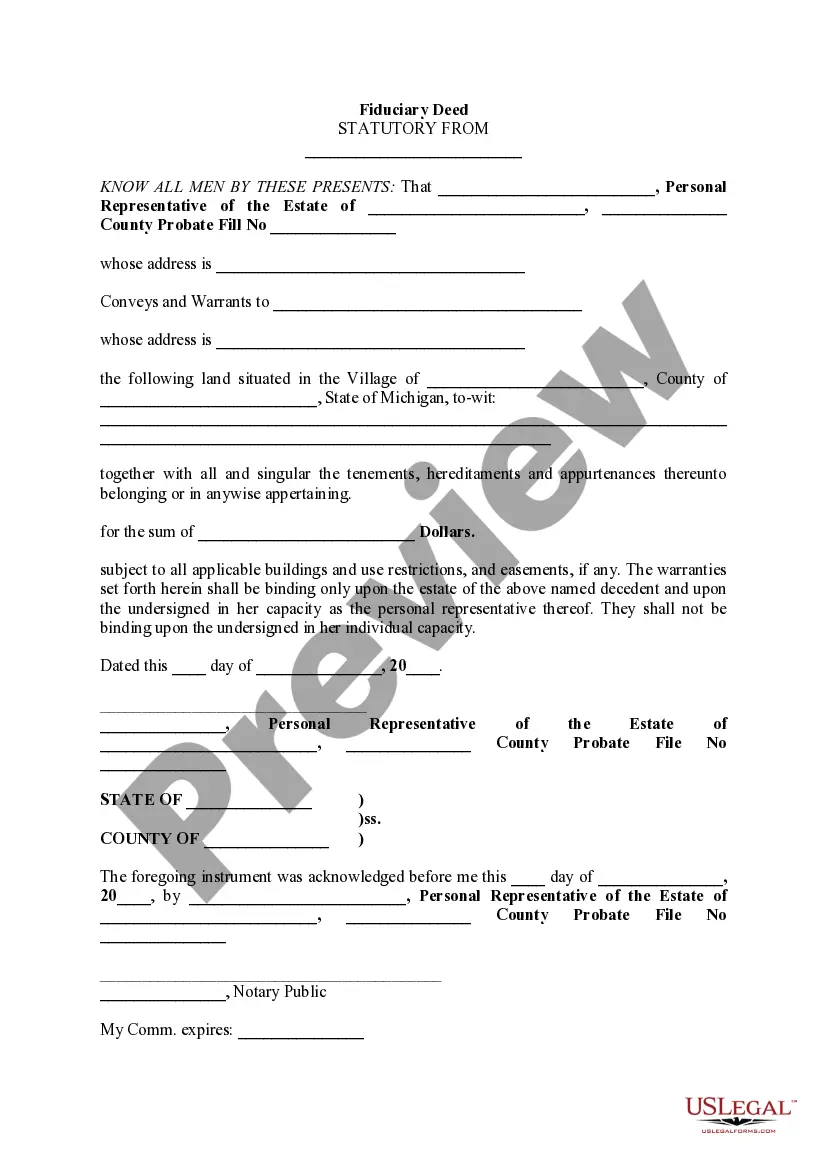

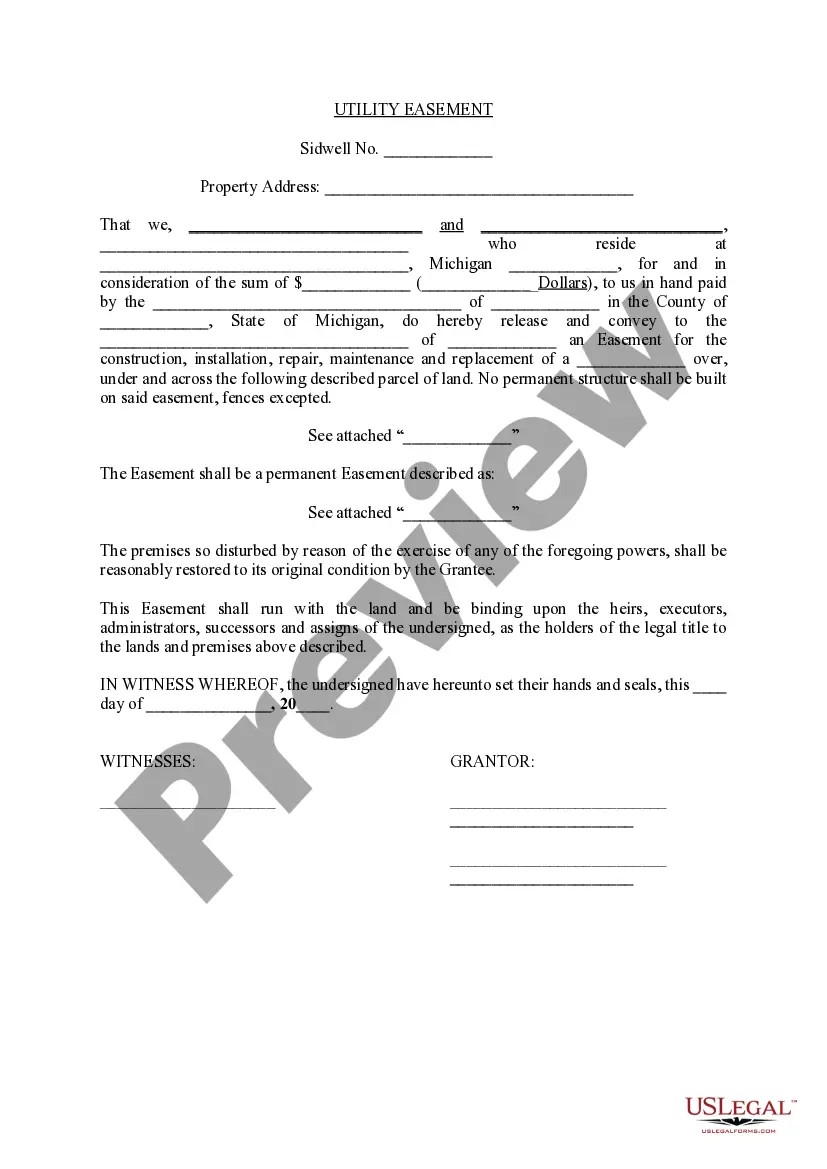

How to fill out Stop Annuity Request?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can download or print.

By using the website, you will access thousands of forms for business and personal purposes, categorized by classifications, states, or keywords.

You can find the latest versions of forms like the Tennessee Stop Annuity Request in mere moments.

Read the form summary to confirm that you have selected the proper form.

If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you possess a membership, Log In and retrieve the Tennessee Stop Annuity Request from the US Legal Forms repository.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you intend to use US Legal Forms for the first time, here are simple steps to get you started.

- Ensure you have chosen the correct form for the area/county.

- Click the Preview option to review the form's details.

Form popularity

FAQ

METLIFE TO ACQUIRE AMERICAN LIFE INSURANCE COMPANY FROM AMERICAN INTERNATIONAL GROUP FOR APPROXIMATELY $15.5 BILLION.

What Is the Free Look Period? The free look period is the required time period in which a new life insurance policy owner can terminate the policy without any penalties, such as surrender charges. A free look period often lasts 10 or more days depending on the insurer.

Steps to find out if someone has life insuranceObtain the death certificate.Talk to family and friends.Search personal belongings.Check mail/email.Online search.Review the death certificate.Talk to bankers, financial advisors or insurers.

Are Life Insurance Policies Public Record? Because life insurance death benefits are typically paid to designated beneficiaries, they aren't public record.

Generally, direct individual or direct group life and health insurance policies as well as individual annuity contracts issued by the guaranty association's member insurers are covered by the association. Such coverage is limited by the terms of the Tennessee Life and Health Insurance Guaranty Association Act (Tenn.

Casualty insurance is a problematically defined term which broadly encompasses insurance not directly concerned with life insurance, health insurance, or property insurance. Casualty insurance is mainly liability coverage of an individual or organization for negligent acts or omissions.

One of the oldest midsize life insurers in the United States is buying a smaller life insurer. Manhattan Life Group Inc. announced earlier this week that it is acquiring Standard Life and Casualty Insurance Company.

Telephone (615) 862-5880.

While annuities are not insured by the federal government, guaranty associations in all 50 states cover at least $250,000 in annuity benefits for customers if the insurance company that issued the contract goes belly up.

Use NAIC, MIB Group, or NAUPA Life Policy Locators The National Association of Insurance Commissioners (NAIC) offers a free Life Policy Locator tool to help you find out if someone had life insurance. To use the tool, you'll need to provide the following information for the deceased: Social Security Number (SSN)