Title: Tennessee Business Reducibility Checklist: Ensuring Optimal Tax Benefits for Your Business Introduction: The Tennessee Business Reducibility Checklist serves as a comprehensive guide for business owners in Tennessee to maximize tax deductions and optimize their financial benefits. By adhering to the checklist's guidelines, businesses can ensure compliance with tax laws while reducing their tax burden and maximizing profits. Below, we discuss the various types of Tennessee Business Reducibility Checklists available and provide insights into their key aspects. Keywords: Tennessee, Business Reducibility Checklist, tax benefits, tax deductions, compliance, tax laws, tax burden, profits. 1. Standard Tennessee Business Reducibility Checklist: — This checklist outlines the standard deduction categories applicable to businesses in Tennessee. — It encompasses deductions related to business expenses, salaries, employee benefits, advertising costs, office supplies, rent, utilities, and more. — By following this checklist, businesses can identify and track deductible expenses, ensuring that they can claim all eligible deductions at tax time. 2. Industry-Specific Tennessee Business Reducibility Checklists: — Many industries have specific deductions that they can claim based on the nature of their business. These industry-specific checklists help business owners identify tax deductions unique to their sector. — Examples may include manufacturing deductions, research and development expenses, healthcare industry-specific deductions, construction industry deductions, and more. — These checklists save time by providing industry-specific expense categories and allowing businesses to capture deductions that might otherwise be overlooked. 3. Tennessee Start-Up Business Reducibility Checklist: — Start-ups face unique challenges when it comes to tax planning. This checklist is tailored specifically for new businesses in Tennessee. — It includes deductions related to initial start-up costs, such as legal fees, licensing costs, market research expenses, incorporation fees, and more. — Following this checklist helps start-ups claim all eligible deductions, reducing their tax liability during the crucial early stages of their operations. 4. Tennessee Home-Based Business Reducibility Checklist: — Businesses operating from home can benefit from various tax deductions. This checklist focuses on deductions specifically available for businesses operating out of a residential property. — It covers deductions related to home office expenses, mortgage interest, property taxes, utilities, insurance, and other relevant costs. — Employing this checklist helps home-based businesses maximize their deductions and ensure compliance with regulations concerning the home office deduction. Conclusion: The Tennessee Business Reducibility Checklist empowers businesses to take advantage of eligible tax deductions, reduce their tax burden, and maximize profits. Whether it's the standard checklist, industry-specific checklists, start-up business checklist, or home-based business checklist, these tools provide comprehensive guidance tailored to different business scenarios. By diligently following the checklists, businesses in Tennessee can optimize their tax planning strategies and make the most of available deductions to foster growth and success. Keywords: Tennessee Business Reducibility Checklist, tax deductions, maximize profits, compliance, industry-specific deductions, start-up business deductions, home-based business deductions.

Tennessee Business Deductibility Checklist

Description

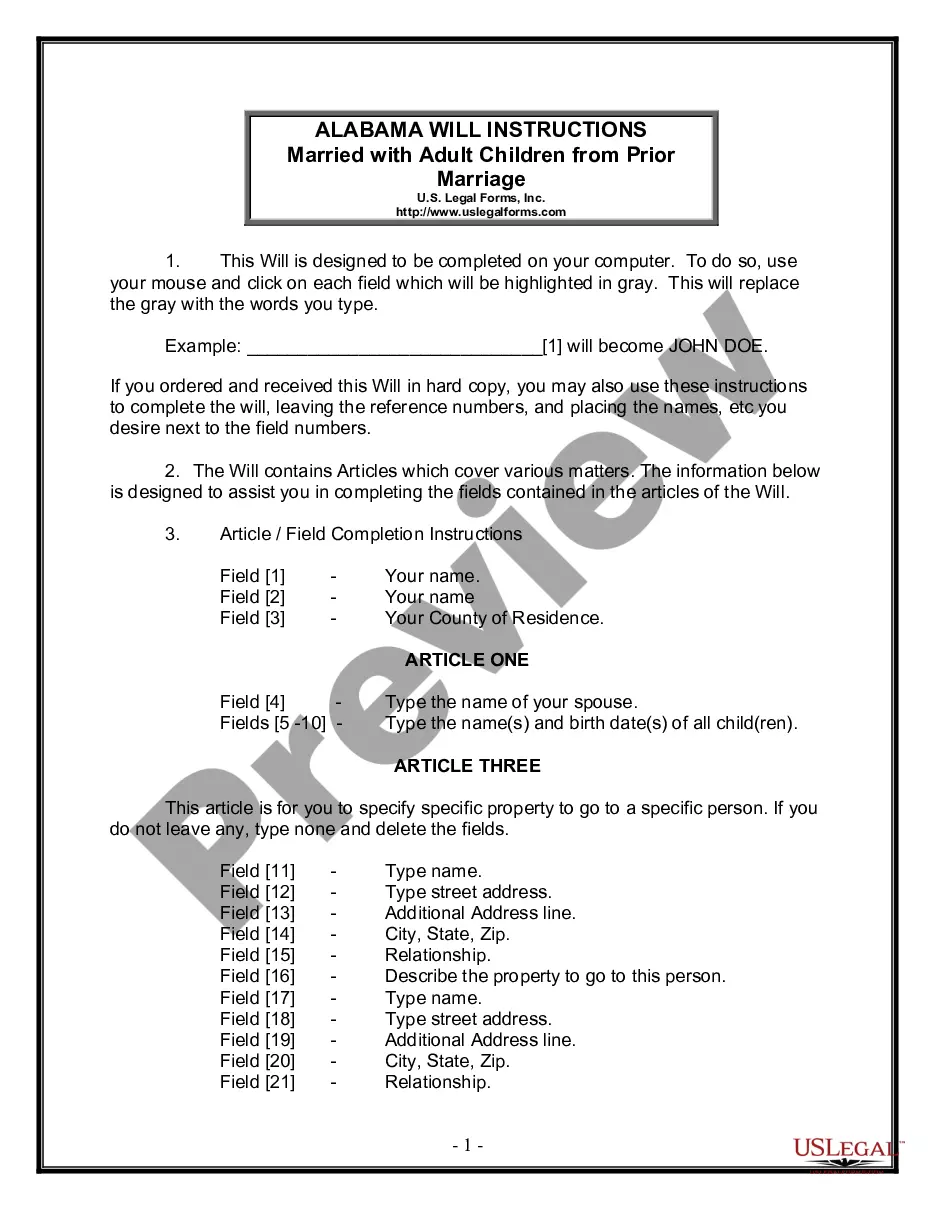

How to fill out Tennessee Business Deductibility Checklist?

You may commit several hours on-line attempting to find the lawful document web template that suits the federal and state specifications you want. US Legal Forms gives thousands of lawful types that happen to be analyzed by experts. It is simple to obtain or printing the Tennessee Business Deductibility Checklist from our support.

If you already possess a US Legal Forms profile, you are able to log in and then click the Obtain key. After that, you are able to full, modify, printing, or signal the Tennessee Business Deductibility Checklist. Each and every lawful document web template you purchase is your own property permanently. To have one more version of any bought develop, go to the My Forms tab and then click the related key.

Should you use the US Legal Forms website for the first time, adhere to the easy guidelines listed below:

- Initially, ensure that you have chosen the proper document web template for that county/town that you pick. Look at the develop description to ensure you have chosen the appropriate develop. If readily available, utilize the Preview key to check through the document web template too.

- In order to get one more version of the develop, utilize the Search discipline to discover the web template that meets your requirements and specifications.

- When you have identified the web template you need, simply click Purchase now to carry on.

- Choose the rates prepare you need, key in your credentials, and sign up for your account on US Legal Forms.

- Complete the financial transaction. You can use your bank card or PayPal profile to purchase the lawful develop.

- Choose the formatting of the document and obtain it to the gadget.

- Make adjustments to the document if required. You may full, modify and signal and printing Tennessee Business Deductibility Checklist.

Obtain and printing thousands of document templates utilizing the US Legal Forms website, which offers the largest variety of lawful types. Use skilled and express-certain templates to handle your business or individual requirements.

Form popularity

FAQ

Services in Tennessee are generally not taxable.

Businesses with less than $10,000 in taxable sales sourced to a county are exempt from the state business tax in that county, and businesses with less than $10,000 in taxable sales sourced to a municipality are exempt from the municipality business tax in that municipality.

The excise tax is based on net earnings or income for the tax year. The minimum franchise tax of $100 is payable if you are incorporated, domesticated, qualified, or otherwise registered through the Secretary of State to do business in Tennessee, regardless of whether the company is active or inactive.

Family-owned, noncorporate entities (FONCEs) that own commercial or industrial real estate, and. Limited liability companies (LLCs) and limited partnerships (LPs) that have been exempt from Tennessee franchise and excise tax.

There are some exemptions to filing franchise and excise tax. For example, certain limited liability companies, limited partnerships and limited liability partnerships whose activities are at least 66% farming or holding personal residences where one or more of its partners or members reside are exempt.

21 Small-business tax deductionsStartup and organizational costs. Our first small-business tax deduction comes with a caveat it's not actually a tax deduction.Inventory.Utilities.Insurance.Business property rent.Auto expenses.Rent and depreciation on equipment and machinery.Office supplies.More items...

What Businesses Are Subject to the Business Tax? The business tax is imposed generally on anyone delivering goods or services to Tennessee customers, but a number of activities and entities are specifically exempted. For example, taxpayers are exempt from the business tax if they generate less than $10,000 in sales.

Service Business Exemption State law exempts gross receipts from services provided by medical, dental, legal, and educational providers and certain services provided by nonprofit membership organizations. Services by religious and charitable organizations and veterinary services are also exempt from business tax.

In Tennessee, services that are generally not subjected to either sales or use taxes include data processing, information services, and management consulting services. Businesses that offer management consulting or management services are required to pay a local gross receipts tax.