A Tennessee Personal Guaranty — Guarantee of Lease to Corporation is a legal agreement that acts as a form of security for a lease agreement between a landlord and a corporation. This guarantee is provided by an individual, known as the guarantor, who agrees to assume responsibility for the lease obligations in the event that the corporation fails to fulfill its rental obligations. Keywords: Tennessee Personal Guaranty, Guarantee of Lease, Corporation, Landlord, Legal Agreement, Lease Obligations, Guarantor, Rental Obligations. There are several types of Tennessee Personal Guaranty — Guarantee of Lease to Corporation, each catering to various circumstances and requirements. These types include: 1. Unlimited Personal Guaranty: This type offers the broadest form of security for a lease agreement. In case the corporation defaults on rental payments or breaches other lease terms, the guarantor becomes fully liable for all rental obligations, penalties, and any other costs specified in the lease. 2. Limited Personal Guaranty: This version of the guarantee imposes restrictions on the guarantor's liability. The limited guarantor is typically only responsible for certain specified obligations or a predetermined amount, providing some protection against excessive liability. 3. Financial Statement Guaranty: This type of guarantee requires the guarantor to submit their financial statement to assess their creditworthiness and ability to fulfill the lease obligations. The landlord can evaluate the guarantor's financial stability and determine their risk level before entering into the lease agreement. 4. Conditional Personal Guaranty: In this scenario, the guarantor's liability is conditional upon certain events or circumstances. For example, the guarantor may only become liable if the corporation defaults on rental payments for a certain period or fails to comply with specific provisions outlined in the lease agreement. 5. Joint and Several Personal guaranties: With this type of guarantee, multiple individuals or entities act as guarantors simultaneously, each sharing the full responsibility for the lease obligations. Any of the guarantors may be held fully liable for the entire lease amount if the corporation defaults on its obligations. Tennessee Personal Guaranty — Guarantee of Lease to Corporation protects the landlord's interests by providing an additional layer of security. It ensures that if the corporation fails to fulfill its lease obligations, the guarantor(s) will take financial responsibility, mitigating potential losses for the landlord.

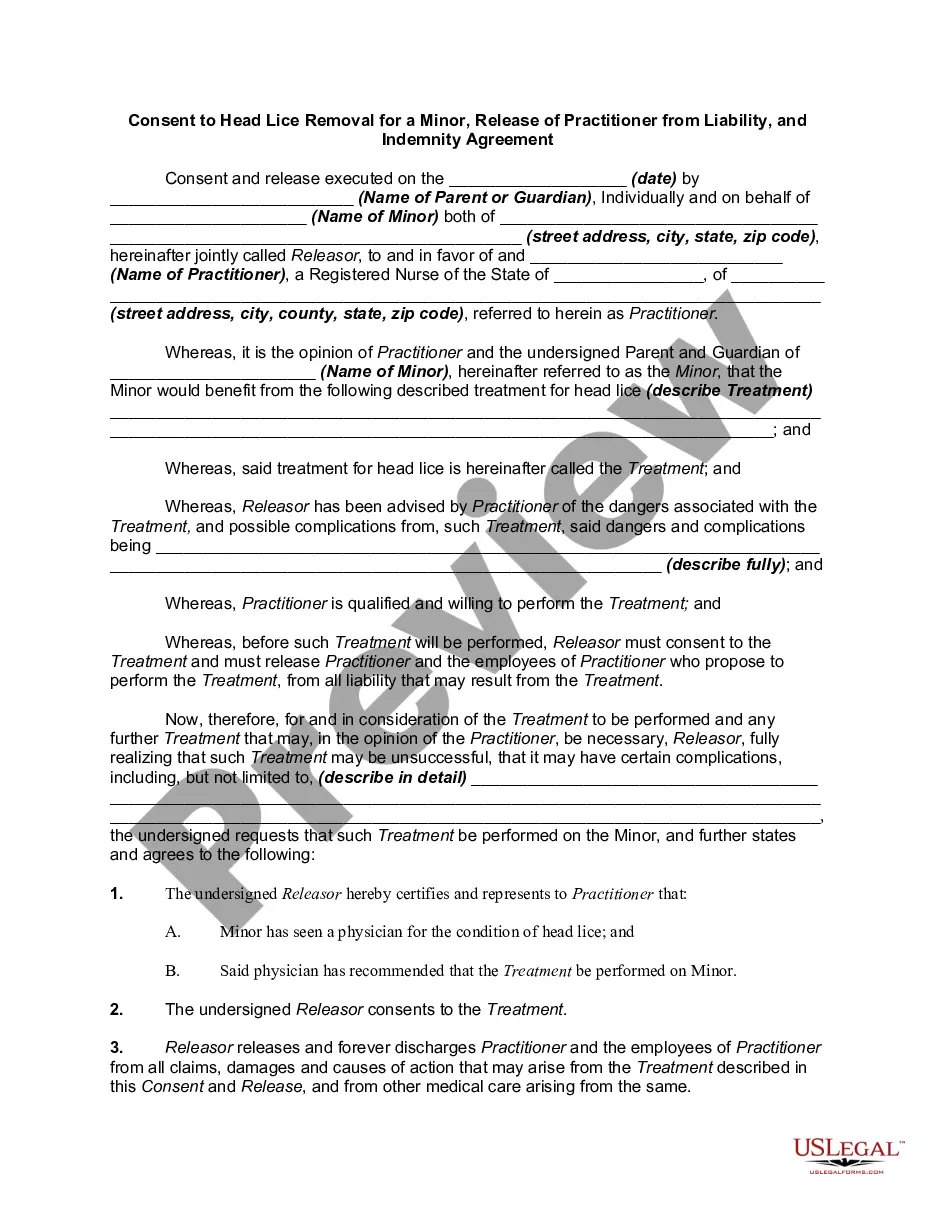

Tennessee Personal Guaranty - Guarantee of Lease to Corporation

Description

How to fill out Tennessee Personal Guaranty - Guarantee Of Lease To Corporation?

Are you currently in the placement where you will need documents for sometimes organization or specific purposes nearly every day? There are tons of legal document themes available on the net, but discovering types you can depend on isn`t simple. US Legal Forms delivers a huge number of form themes, like the Tennessee Personal Guaranty - Guarantee of Lease to Corporation, that are created to meet federal and state demands.

Should you be currently knowledgeable about US Legal Forms website and possess a free account, simply log in. Following that, you are able to down load the Tennessee Personal Guaranty - Guarantee of Lease to Corporation design.

If you do not have an profile and want to begin to use US Legal Forms, follow these steps:

- Discover the form you want and make sure it is for your proper town/region.

- Take advantage of the Preview option to review the shape.

- Browse the outline to ensure that you have selected the right form.

- If the form isn`t what you are searching for, make use of the Lookup area to obtain the form that suits you and demands.

- Once you get the proper form, just click Purchase now.

- Opt for the rates plan you desire, submit the necessary info to generate your money, and pay money for your order utilizing your PayPal or Visa or Mastercard.

- Choose a practical file file format and down load your duplicate.

Find all the document themes you have bought in the My Forms food list. You may get a extra duplicate of Tennessee Personal Guaranty - Guarantee of Lease to Corporation at any time, if required. Just click the essential form to down load or printing the document design.

Use US Legal Forms, by far the most extensive selection of legal types, to conserve some time and stay away from mistakes. The assistance delivers professionally made legal document themes that you can use for a variety of purposes. Generate a free account on US Legal Forms and commence producing your life easier.