Tennessee Form Letters - Notice of Default

Description

How to fill out Form Letters - Notice Of Default?

You can commit time on-line trying to find the authorized papers web template which fits the state and federal specifications you will need. US Legal Forms supplies a huge number of authorized kinds that are examined by experts. It is simple to download or print the Tennessee Form Letters - Notice of Default from the services.

If you have a US Legal Forms bank account, you may log in and then click the Download option. Next, you may full, change, print, or sign the Tennessee Form Letters - Notice of Default. Each authorized papers web template you get is the one you have eternally. To acquire yet another copy of the purchased type, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms site for the first time, follow the easy directions below:

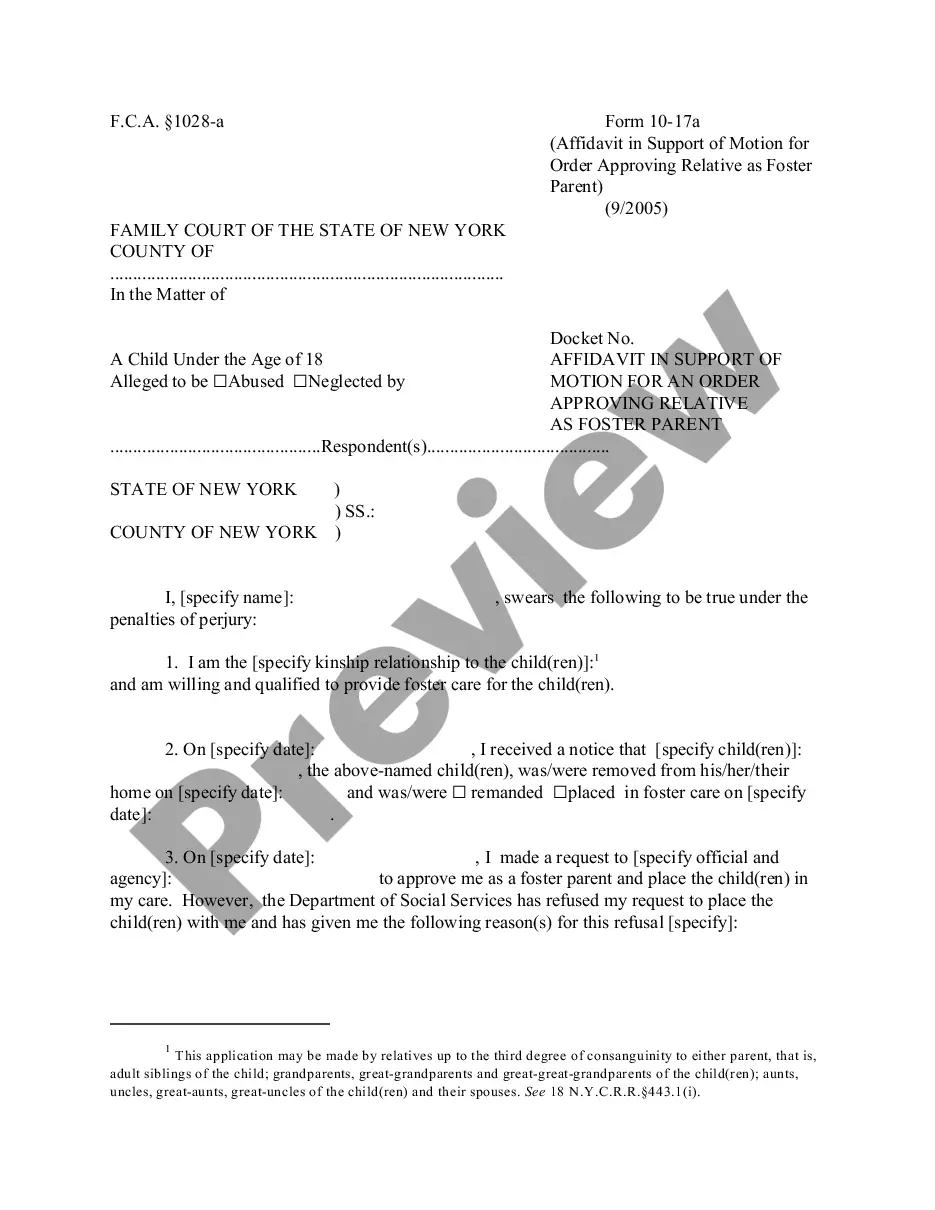

- First, make certain you have chosen the best papers web template for your state/city of your choosing. Look at the type outline to make sure you have picked the appropriate type. If readily available, utilize the Preview option to look with the papers web template at the same time.

- If you would like find yet another edition of the type, utilize the Look for area to discover the web template that meets your needs and specifications.

- Upon having found the web template you would like, click Get now to continue.

- Find the costs program you would like, type in your qualifications, and register for a free account on US Legal Forms.

- Total the financial transaction. You can use your credit card or PayPal bank account to cover the authorized type.

- Find the formatting of the papers and download it to the gadget.

- Make alterations to the papers if required. You can full, change and sign and print Tennessee Form Letters - Notice of Default.

Download and print a huge number of papers templates making use of the US Legal Forms web site, which provides the largest collection of authorized kinds. Use skilled and express-particular templates to handle your company or specific requirements.

Form popularity

FAQ

Hear this out loud PauseRight to Written Notice. If a landlord wants to evict a tenant, he must first provide the tenant 30 days written notice of the termination of the lease. If there is no lease, the tenant can ask the renter to move at any time, as long as he provides written notice.

For month-to-month leases (see the Tennessee rental agreement for tenancies at will) most states will require at least a 30 Day Notice to Vacate. The Tennessee Notice to Vacate could be given in the form of a 30 Day Notice to Vacate, 60 Day Notice to Vacate, or a 90 Day Notice to Vacate, depending on the circumstances.

Hear this out loud PauseThe cost of an eviction in Tennessee for all filing, court, and service fees can vary on service fees. For cases filed in Circuit Court (for claims less than $25,000), the average cost is $351. Cases can also be filed in General Sessions Court (for claims up to $25,000), the average cost of an eviction is $187.

A loan enters default when it is 30 days late, and a second notice is sent at that time. This default date will have a negative impact on your credit score. When a loan is 90 days past due, the lender may initiate acceleration procedures by sending a letter notifying the borrower that foreclosure is the next step.

Hear this out loud PauseMonth-to-Month Tenancies If the landlord wants to end a month-to-month tenancy, the landlord must give the tenant a 30-day notice that specifies the date on which the tenancy will end. If the tenant does not move out by that date, the landlord can file an eviction lawsuit against the tenant. (Tenn.

Hear this out loud PauseTennessee Landlord Notice to Vacate notifies tenants that they should vacate the rental property and remove all of their personal possessions. Tennessee Tenant Notice to Vacate notifies landlords and property managers that the tenant intends to vacate the property.

Foreclosure in Tennessee In the State of Tennessee, the minimum time a debt on a property has to be unpaid in order for the mortgage holder to enter foreclosure proceedings is six months. Foreclosure also cannot be initiated over any debt less than 200 dollars.

When Can a Tennessee Foreclosure Start? Under federal law, the servicer usually can't officially begin a foreclosure until you're more than 120 days past due on payments, subject to a few exceptions. (12 C.F.R.

Yes, there is a right of redemption for Tennessee borrowers whose property has been foreclosed. The time for redemption can be as long as two years but may be shortened depending on the circumstances of the foreclosure. The redemption period may also be waived in the mortgage documents.

Ways to Stop Foreclosure in Tennessee Declare Bankruptcy. Yes, bankruptcy is a way through which foreclosure can be stopped. ... Applying for Loan Modification. ... Reinstating Your Loan. ... Plan for Repayment. ... Refinancing. ... Sell Out Your Home. ... Short Sale. ... Deed In Lieu of Foreclosure.