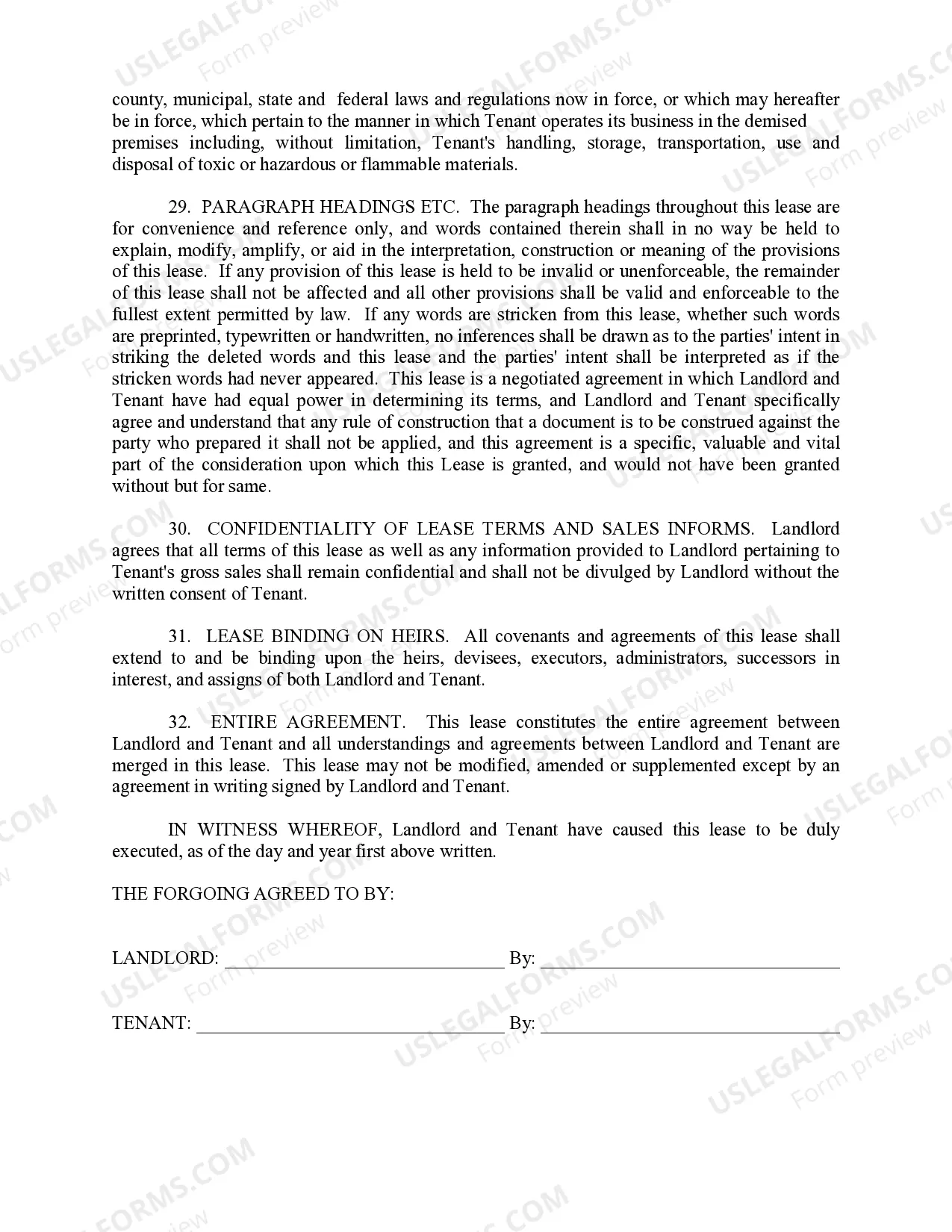

Tennessee Shopping Center Lease Agreement — Percentage Rent Option: A Comprehensive Overview In Tennessee, shopping center lease agreements often incorporate a percentage rent option, a vital component that determines tenants' rental obligations based on a percentage of their gross sales. This arrangement ensures that both the landlord and tenant can benefit from the success of the retail business. By exploring the features, benefits, and variations of this option, tenants and landlords can make informed decisions when structuring lease agreements. Definition and Key Considerations: The Tennessee shopping center lease agreement's percentage rent option enables landlords to receive a base rent amount plus an additional percentage of a tenant's sales above a predetermined threshold. This threshold is known as the "natural breakpoint" and is determined during lease negotiations. It is crucial to accurately define what constitutes gross sales to avoid any potential disputes or misunderstandings. Benefits for Tenants: 1. Cost-sharing and Risk Mitigation: Tenants can benefit from reduced upfront costs as the percentage rent structure allows for a lower base rent or the elimination of one. This enables smaller or startup businesses to establish themselves without excessive financial strain. 2. Incentivization: Tenants are motivated to drive sales, improve marketing efforts, and enhance customer experiences since their rental costs are directly connected to gross sales. As sales increase, tenants can enjoy the flexibility of lower fixed costs and even higher profit margins. Types of Tennessee Shopping Center Lease Agreement — Percentage Rent Options: 1. Graduated Percentage Rent: This option involves a tiered structure where the percentage of gross sales gradually increases as the tenant's sales rise above different predetermined breakpoints. The graduated scale ensures fairness and aligns rental obligations with the tenant's success. 2. Percentage Rent Only: In some cases, a lease agreement may exclude a base rent, and tenants are solely responsible for paying a percentage of their gross sales to the landlord. This arrangement is more common in high-demand shopping centers or when tenants negotiate advantageous terms. 3. Minimum Guarantee: Some lease agreements provide tenants with a minimum rent guarantee, establishing a floor amount that must be paid regardless of sales performance. If the percentage rent falls below the minimum, the tenant is obliged to pay the shortfall. This option strikes a balance between incentivization and risk mitigation for both parties. Considerations for Landlords: 1. Subleasing Considerations: Landlords may need to address how percentage rent applies to sublease arrangements, determining whether the original tenant or subtenant is responsible for reporting and paying the percentage rent. Careful drafting and clarity on these provisions are essential. 2. Reporting and Audit Rights: Lease agreements should outline detailed reporting requirements, clarifying the frequency and transparency of financial reporting from tenants. Landlords may also include provisions allowing for audit rights to ensure accurate reporting. 3. Exclusions and Calculations: Certain exclusions, such as returns, allowances, or sales tax, require explicit mention in the lease agreement. Clearly defining how these factors affect the percentage rent calculation ensures fairness and prevents disputes. In conclusion, the Tennessee Shopping Center Lease Agreement — Percentage Rent Option is an effective tool that benefits both tenants and landlords. By understanding the various types, including graduated percentage rent, percentage rent only, and minimum guarantee, stakeholders can establish fair and mutually beneficial lease agreements. Adequate attention to reporting, exclusions, calculations, and sublease considerations ensures transparency and mitigates potential issues, fostering fruitful landlord-tenant relationships.

Tennessee Shopping Center Lease Agreement - percentage rent option

Description

How to fill out Tennessee Shopping Center Lease Agreement - Percentage Rent Option?

If you wish to total, obtain, or produce lawful file templates, use US Legal Forms, the largest variety of lawful forms, that can be found on the Internet. Utilize the site`s simple and convenient research to obtain the documents you need. A variety of templates for organization and specific purposes are categorized by categories and claims, or key phrases. Use US Legal Forms to obtain the Tennessee Shopping Center Lease Agreement - percentage rent option in just a number of click throughs.

In case you are previously a US Legal Forms buyer, log in to the accounts and click the Down load button to obtain the Tennessee Shopping Center Lease Agreement - percentage rent option. Also you can entry forms you previously saved from the My Forms tab of your own accounts.

Should you use US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the form for your proper area/land.

- Step 2. Take advantage of the Preview solution to look over the form`s content. Do not overlook to see the information.

- Step 3. In case you are unsatisfied with the form, utilize the Research industry on top of the display screen to discover other types of your lawful form web template.

- Step 4. Upon having discovered the form you need, select the Purchase now button. Pick the costs prepare you like and include your accreditations to sign up for an accounts.

- Step 5. Procedure the financial transaction. You may use your credit card or PayPal accounts to complete the financial transaction.

- Step 6. Pick the structure of your lawful form and obtain it on your own gadget.

- Step 7. Total, modify and produce or indication the Tennessee Shopping Center Lease Agreement - percentage rent option.

Every single lawful file web template you get is yours eternally. You possess acces to each form you saved inside your acccount. Click the My Forms area and choose a form to produce or obtain yet again.

Compete and obtain, and produce the Tennessee Shopping Center Lease Agreement - percentage rent option with US Legal Forms. There are thousands of specialist and status-certain forms you can use for your personal organization or specific requirements.