Tennessee Model COBRA Continuation Coverage Election Notice

Description

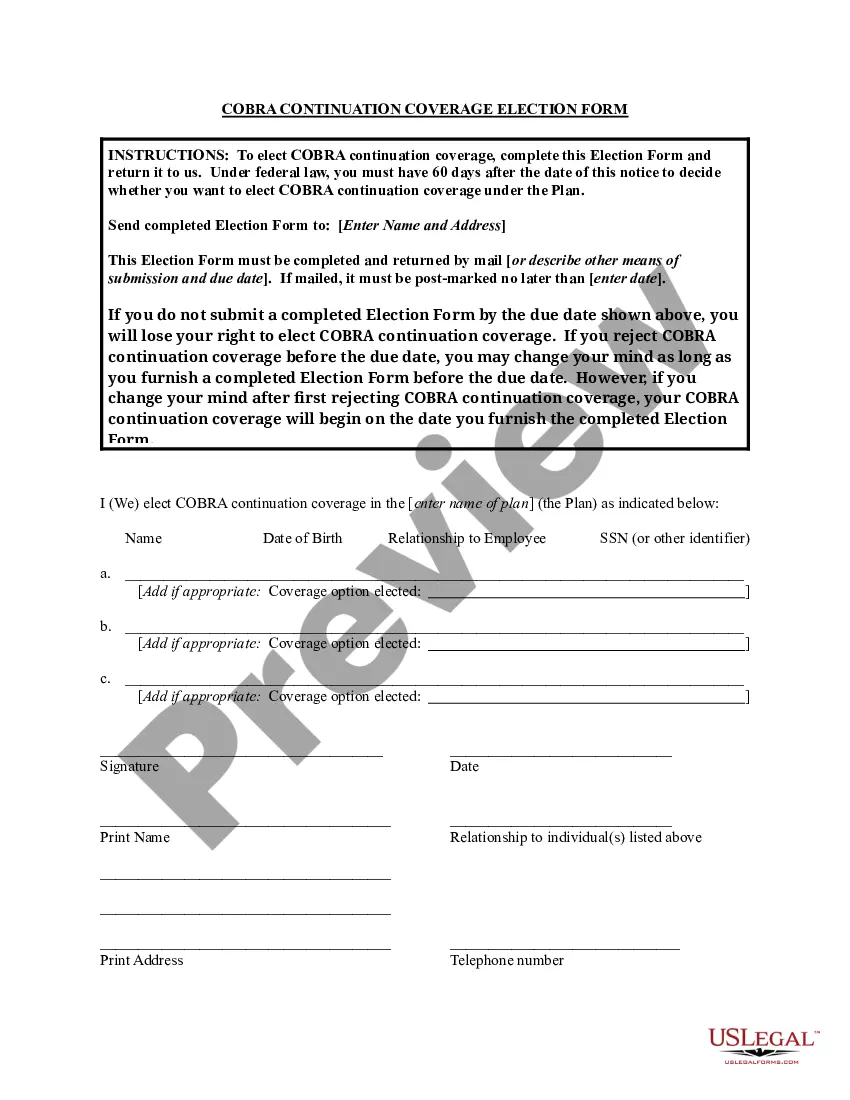

How to fill out Model COBRA Continuation Coverage Election Notice?

Selecting the most suitable legitimate document template can be quite a challenge. Naturally, there are numerous designs accessible online, but how do you find the legitimate form you need? Utilize the US Legal Forms website. The service provides a vast array of templates, such as the Tennessee Model COBRA Continuation Coverage Election Notice, which you can utilize for both professional and personal purposes. All of the forms are vetted by specialists and adhere to federal and state regulations.

If you are already a member, Log In to your account and click on the Download option to retrieve the Tennessee Model COBRA Continuation Coverage Election Notice. Use your account to browse the legitimate forms you have previously purchased. Navigate to the My documents tab in your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you can follow: Initially, ensure you have selected the correct form for your locality/state. You can review the form using the Preview option and read the form description to confirm this is indeed the right one for you.

US Legal Forms is the premier library of legitimate forms where you can explore various document layouts. Take advantage of the service to download properly crafted documents that comply with state regulations.

- If the form does not meet your expectations, utilize the Search feature to find the appropriate form.

- Once you are convinced that the form is acceptable, click the Purchase now option to acquire the form.

- Choose the pricing plan you desire and input the required information.

- Create your account and process your payment using your PayPal account or Visa or Mastercard.

- Select the file format and download the legitimate document template onto your device.

- Complete, modify, print, and sign the acquired Tennessee Model COBRA Continuation Coverage Election Notice.

Form popularity

FAQ

The general notice describes general COBRA rights and employee obligations. This notice must be provided to each covered employee and each covered spouse of an employee who becomes covered under the plan. The notice must be provided within the first 90 days of coverage under the group health plan.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

COBRA is not an insurance company. COBRA is simply the continuation of the same coverage you had through a previous employer. To get proof of insurance, you would need to contact the COBRA Administrator at your previous employer. Typically, the COBRA Administrator is in the HR department.

Under COBRA, a group health plan is any arrangement that an employer establishes or maintains to provide employees or their families with medical care, whether it is provided through insurance, by a health maintenance organization, out of the employer's assets, or through any other means.

There are several other scenarios that may explain why you received a COBRA continuation notice even if you've been in your current position for a long time: You may be enrolled in a new plan annually and, therefore, receive a notice each year. Your employer may have just begun offering a health insurance plan.

Federal law requires that most group health plans (including this Plan) give employees and their families the opportunity to continue their health care coverage through COBRA continuation coverage when there's a qualifying event that would result in a loss of coverage under an employer's plan.

Election Procedures. If you are entitled to elect COBRA continuation coverage, you must be given an election period of at least 60 days (starting on the later of the date you are furnished the election notice or the date you would lose coverage) to choose whether or not to elect continuation coverage.

COBRA the Consolidated Omnibus Budget Reconciliation Act -- requires group health plans to offer continuation coverage to covered employees, former employees, spouses, former spouses, and dependent children when group health coverage would otherwise be lost due to certain events.

The general notice describes general COBRA rights and employee obligations. This notice must be provided to each covered employee and each covered spouse of an employee who becomes covered under the plan. The notice must be provided within the first 90 days of coverage under the group health plan.

Federal law requires that most group health plans (including this Plan) give employees and their families the opportunity to continue their health care coverage through COBRA continuation coverage when there's a qualifying event that would result in a loss of coverage under an employer's plan.