Tennessee Statement for Vietnam Era Veterans and / or the Disabled

Description

How to fill out Statement For Vietnam Era Veterans And / Or The Disabled?

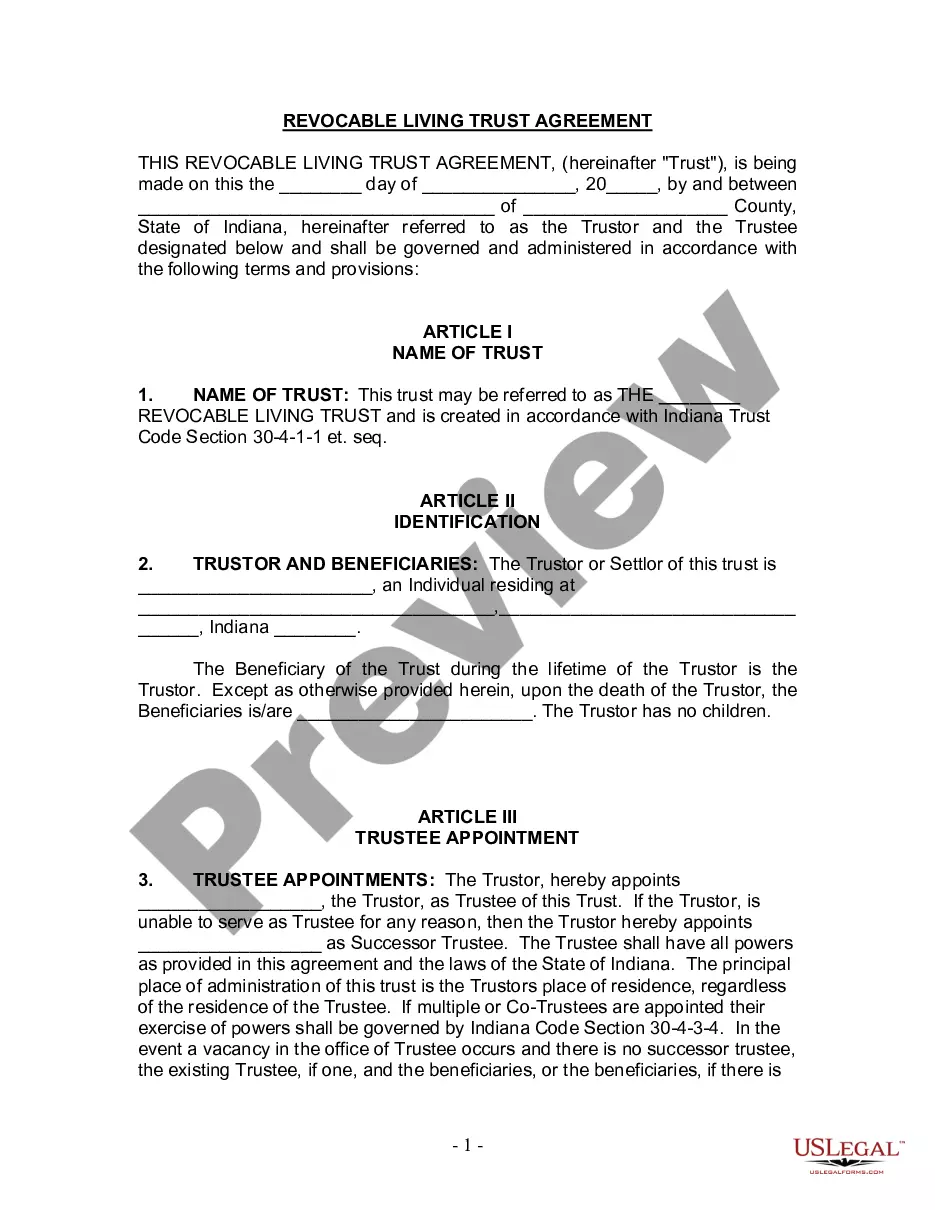

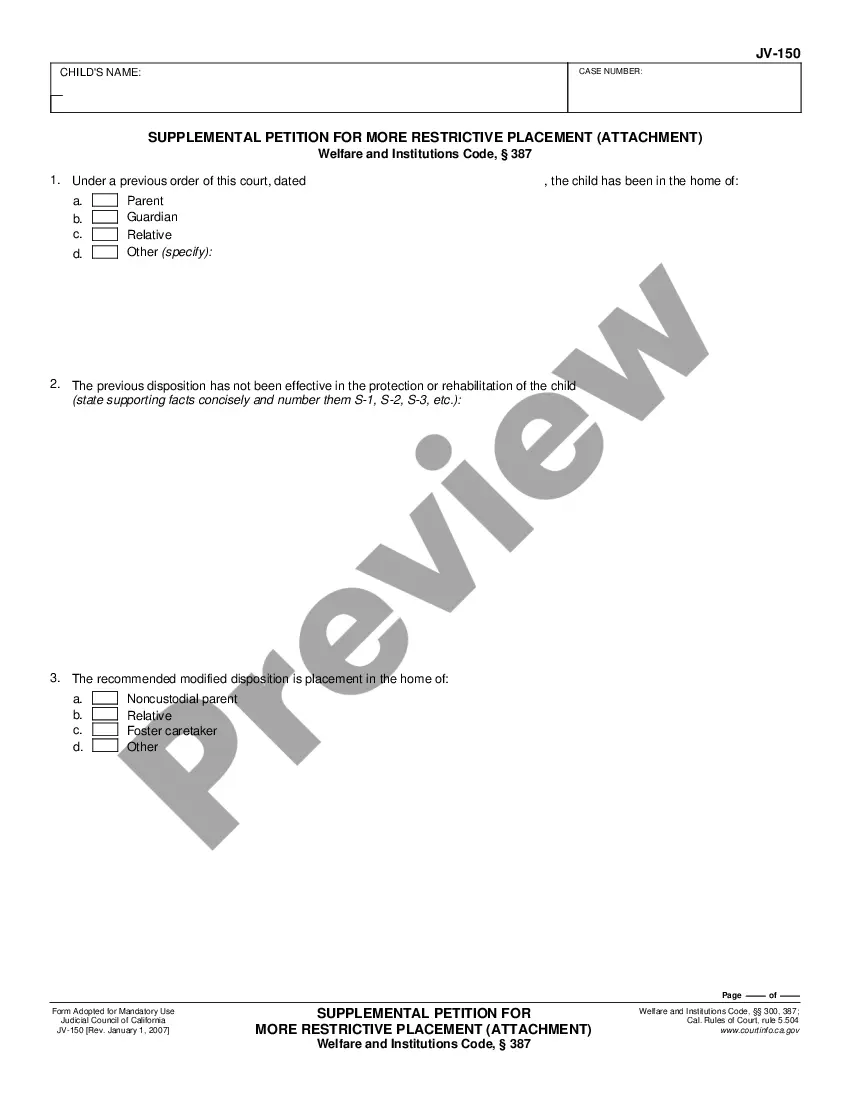

Choosing the best lawful file web template can be a have a problem. Obviously, there are tons of templates accessible on the Internet, but how do you find the lawful form you want? Make use of the US Legal Forms internet site. The service provides thousands of templates, such as the Tennessee Statement for Vietnam Era Veterans and / or the Disabled, that can be used for enterprise and private requirements. Every one of the types are checked by experts and meet federal and state demands.

If you are already registered, log in to the bank account and click the Download option to obtain the Tennessee Statement for Vietnam Era Veterans and / or the Disabled. Utilize your bank account to check with the lawful types you possess ordered earlier. Go to the My Forms tab of your bank account and get an additional copy of the file you want.

If you are a new user of US Legal Forms, allow me to share basic directions that you can adhere to:

- Initial, be sure you have chosen the right form for your personal metropolis/state. You can look through the form utilizing the Review option and study the form explanation to guarantee it is the right one for you.

- When the form will not meet your expectations, take advantage of the Seach industry to discover the correct form.

- When you are positive that the form is suitable, click on the Acquire now option to obtain the form.

- Opt for the pricing prepare you want and type in the needed information. Design your bank account and pay for the transaction utilizing your PayPal bank account or bank card.

- Choose the file format and down load the lawful file web template to the gadget.

- Comprehensive, revise and print and sign the acquired Tennessee Statement for Vietnam Era Veterans and / or the Disabled.

US Legal Forms may be the greatest library of lawful types that you can find various file templates. Make use of the service to down load skillfully-produced documents that adhere to status demands.

Form popularity

FAQ

Other VA benefits and servicesDisability housing grants for Veterans.Fiduciary services.VA nursing homes, assisted living, and home health care.Veteran Readiness and Employment (VR&E)Aid and Attendance benefits and Housebound allowance.

Tennessee Disabled Veteran and Surviving Spouse State Property Tax Benefits: Disabled Veterans and their Surviving Spouse may qualify for a rebate or exemption of taxes on a portion of the value of their property The Veteran or Surviving Spouse must own and use the property as their primary residence.

Effective March 5, 2018, new or used vehicles sold, given, or donated to disabled veterans or active-duty service members who have a service-connected disability and who receive a Veterans Affairs automobile grant, are exempt from sales tax, registration fee, and local motor vehicle privilege tax.

A disabled veteran in Tennessee may receive a property tax exemption on the first $175,000 of his/her primary residence if the veteran is 100 percent disabled and has lost the use of two or more limbs or is blind in both eyes as a result of service. The exemption amount varies by county.

Tennessee Veteran Recreation BenefitsFree hunting and fishing licenses for 100% permanently disabled veterans or those with a 30% disability due to war service.

Tenn. Code Ann. § 67-6-303 exempts from sales and use tax the sale of motor vehicles to members of the armed forces who fall into any one of the following five categories: 1.

A disabled veteran in Tennessee may receive a property tax exemption on the first $175,000 of his/her primary residence if the veteran is 100 percent disabled and has lost the use of two or more limbs or is blind in both eyes as a result of service. The exemption amount varies by county.

Any veteran with a VA-rated 100% permanent and total disability from a service-connected cause, or any former prisoner-of-war, is exempt from Tennessee's County Motor Vehicle Privilege Tax.

Tennessee 100 Disabled Veteran BenefitsHealth care benefits.Special Monthly Compensation.Property Tax Waiver.Income Tax Exemption on Retirement Pay.Education Assistance (Chapter 35)Service-Disabled Veterans Life Insurance Waiver.Recreational Benefits.