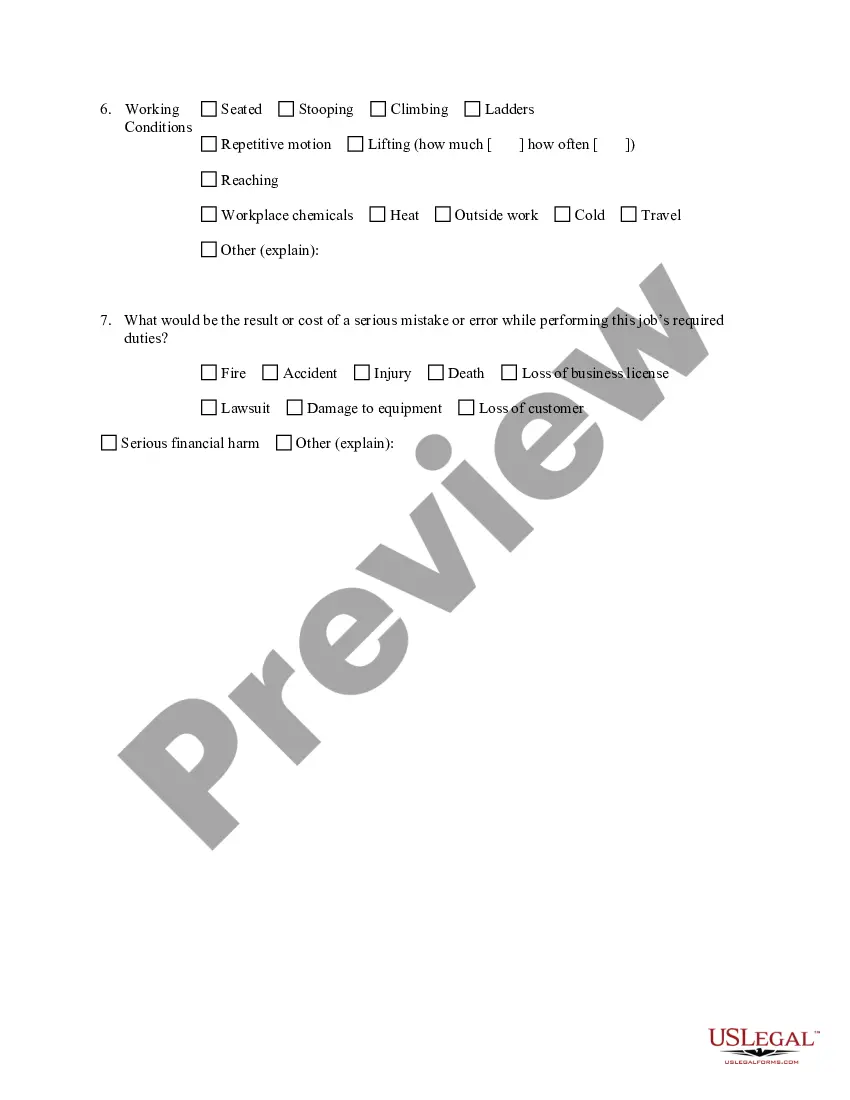

Tennessee Job Description Worksheet is a comprehensive document used by employers or hiring managers to define the roles and responsibilities associated with a particular job position in the state of Tennessee. This worksheet serves as a template or guide to describe the essential tasks, skills, qualifications, and physical requirements necessary for the successful performance of a specific job. Keywords: 1. Tennessee: The job description worksheet is specific to the state of Tennessee and aligns with its unique employment laws, regulations, and practices. 2. Job Description: It outlines the attributes and duties associated with a particular job position, providing a detailed account of what the role entails. 3. Worksheet: The job description worksheet employs a structured format to categorize different elements of a job, making it easier for employers to organize and communicate job requirements. 4. Roles and Responsibilities: It describes the primary responsibilities, tasks, and functions that an employee is expected to fulfill in their designated role. 5. Essential Tasks: The worksheet identifies the core duties and tasks that must be completed on a regular basis for optimal job performance. 6. Skills: This section highlights the specific skills, both technical and soft, that are necessary for the job role and should be possessed by potential candidates. 7. Qualifications: It lists the minimum requirements, such as education level, certifications, or professional experience, that an individual must meet to be considered for the position. 8. Physical Requirements: If applicable, the job description worksheet may outline any physical demands necessary for performing the job, such as lifting heavy objects or standing for long periods. 9. Different Types: While specific types of Tennessee Job Description Worksheet may vary across industries and organizations, they essentially serve the same purpose. However, variations may arise based on the complexity or uniqueness of certain job roles. Overall, the Tennessee Job Description Worksheet plays a crucial role in standardizing job descriptions, ensuring that employers accurately communicate the expectations and requirements of various positions within their organization while adhering to Tennessee employment standards.

Tennessee Job Description Worksheet

Description

How to fill out Tennessee Job Description Worksheet?

If you need to full, download, or print out legitimate document templates, use US Legal Forms, the biggest variety of legitimate kinds, which can be found online. Utilize the site`s basic and handy search to find the files you want. Various templates for business and person functions are sorted by groups and claims, or keywords. Use US Legal Forms to find the Tennessee Job Description Worksheet with a few mouse clicks.

Should you be currently a US Legal Forms buyer, log in to your account and click the Down load option to obtain the Tennessee Job Description Worksheet. You may also gain access to kinds you formerly downloaded from the My Forms tab of your account.

If you are using US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form for the appropriate town/country.

- Step 2. Use the Review solution to look through the form`s content material. Never forget to see the explanation.

- Step 3. Should you be not happy using the form, utilize the Look for industry on top of the display to find other models of the legitimate form design.

- Step 4. Upon having found the form you want, click on the Buy now option. Pick the pricing strategy you choose and include your credentials to sign up for the account.

- Step 5. Procedure the deal. You can use your bank card or PayPal account to accomplish the deal.

- Step 6. Find the formatting of the legitimate form and download it on your own system.

- Step 7. Full, change and print out or sign the Tennessee Job Description Worksheet.

Each and every legitimate document design you buy is the one you have eternally. You have acces to every form you downloaded within your acccount. Go through the My Forms segment and decide on a form to print out or download once again.

Compete and download, and print out the Tennessee Job Description Worksheet with US Legal Forms. There are millions of expert and status-distinct kinds you can utilize to your business or person needs.

Form popularity

FAQ

Excess wages are the portion of wages paid in a quarter that are above the yearly taxable wage base.

Steingold, Contributing Author. If your small business has employees working in Tennessee, you'll need to pay Tennessee unemployment insurance (UI) tax. The UI tax funds unemployment compensation programs for eligible employees. In Tennessee, state UI tax is one of the primary taxes that employers must pay.

Under Tennessee law, you can request a modification whenever there is a 15% difference between the current child support order and the proposed child support. This is called a significant variance.

The Premium Report contains fields for reporting the number of workers who were on an employer's payroll during the first, second, and third months of the quarter. Employers must report all full-time and part-time employees who worked during or received pay for the payroll period that included the 12th of the month.

The Premium Report contains fields for reporting the number of workers who were on an employer's payroll during the first, second, and third months of the quarter. Employers must report all full-time and part-time employees who worked during or received pay for the payroll period that included the 12th of the month.

Your weekly benefit amount is determined by averaging your wages from the two highest quarters in your base period and plugging that number into a Benefits Table to determine your weekly amount. There is a minimum weekly amount of $30, and a maximum weekly amount of $275. Benefits are available for up to 26 weeks.

The calculation of Excess Wages is based on the first $7000 paid to each employee during the calendar year (the Tennessee Taxable Wage Base applicable to the quarter being reported). Modifying the Prior Wage amount in this system does not actually modify your prior quarterly reports.

One child: 6.81 percent. Two children: 7.22 percent. Three children: 7.77 percent. Four children: 8.05 percent.