Tennessee Order Confirming Plan - Form 15 - Pre and Post 2005 Act

Description

How to fill out Order Confirming Plan - Form 15 - Pre And Post 2005 Act?

Choosing the right authorized file template can be a have difficulties. Naturally, there are tons of layouts available on the net, but how would you get the authorized type you want? Take advantage of the US Legal Forms site. The assistance provides 1000s of layouts, such as the Tennessee Order Confirming Plan - Form 15 - Pre and Post 2005 Act, which can be used for organization and personal requirements. All of the varieties are examined by experts and fulfill federal and state requirements.

When you are presently listed, log in for your profile and click on the Acquire switch to find the Tennessee Order Confirming Plan - Form 15 - Pre and Post 2005 Act. Use your profile to check throughout the authorized varieties you may have acquired earlier. Proceed to the My Forms tab of your profile and obtain one more copy of your file you want.

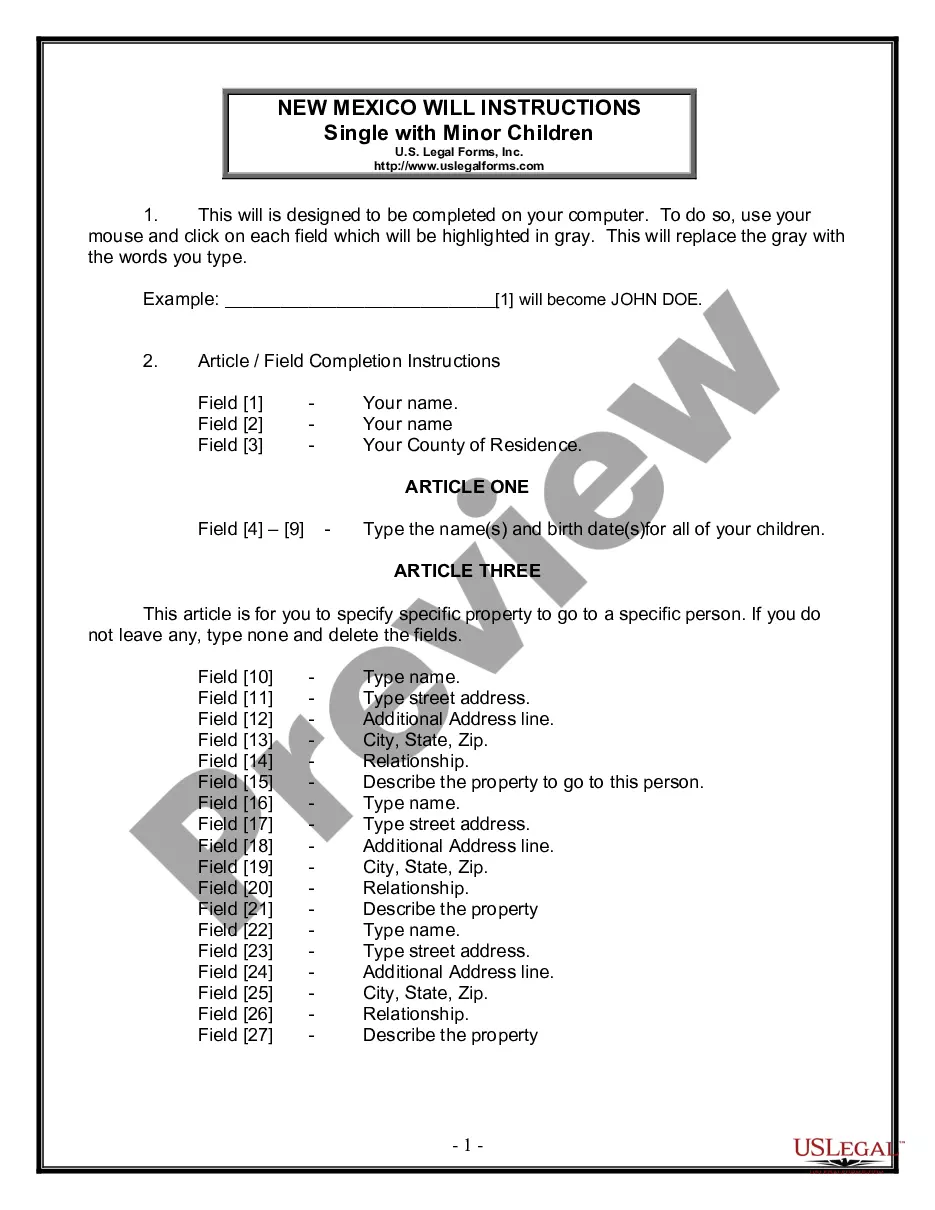

When you are a fresh consumer of US Legal Forms, listed below are simple directions that you should comply with:

- First, be sure you have selected the correct type for your city/area. You may examine the shape utilizing the Preview switch and browse the shape outline to make sure this is basically the best for you.

- If the type fails to fulfill your needs, use the Seach industry to discover the proper type.

- When you are positive that the shape is suitable, click on the Get now switch to find the type.

- Opt for the rates strategy you need and enter in the required details. Build your profile and pay for the transaction utilizing your PayPal profile or charge card.

- Pick the data file file format and acquire the authorized file template for your gadget.

- Comprehensive, change and print out and indicator the obtained Tennessee Order Confirming Plan - Form 15 - Pre and Post 2005 Act.

US Legal Forms will be the biggest library of authorized varieties that you can find different file layouts. Take advantage of the service to acquire expertly-created files that comply with state requirements.